Pasture, Rangeland, Forage Insurance Program (PRF)

The Pasture, Rangeland, Forage Insurance Program (PRF) is a pilot federal crop insurance program that provides insurance protection for perennial forage produced for grazing or harvested for hay. The program is administered by the USDA Risk Management Agency (RMA) and sold through private crop insurance companies. Federal crop insurance is only available through private companies, known as approved insurance providers (AIP). Private crop insurance companies directly insure producers and their crops, and then RMA reinsures the companies against a portion of the losses they may suffer. Due to difficulties quantifying price and yield for forage crops, particularly for grazing, standard crop insurance products are generally not an option for insuring forage production. The PRF program is similar to group risk insurance and provides area-wide coverage. For Oklahoma and the majority of the United States, the program is based on a rainfall index (Figure 1). PRF insures producers based on the average rainfall in their geographic area instead of the producers’ individual farm. Producers receive an indemnity payment when rainfall in their area falls below the normal historical level. Details of the rainfall index program will be discussed next.

Figure 1. 2013 and Succeeding Crop Years – Pasture, Rangeland, Forage Availability.

Source: Risk Management Agency

Rainfall Index

The Rainfall Index uses National Oceanic and Atmospheric Administration Climate Prediction Center (NOAA CPC) data. The areas where the Rainfall Index is available have been divided into grids. Each grid covers an area equal to .25 degrees in latitude by .25 degrees in longitude. These grids do not follow county lines or township boundaries. This data does not directly reflect the rainfall amounts measured at a specific weather station within a particular grid. Instead, it reflects a smoothed result of nearby weather station estimates in order to obtain an estimate for the grid. Most group risk insurance provides coverage at the county level, but this product provides coverage at the grid level, which is likely to provide a more accurate estimate of rainfall for a particular acreage than a county level measure.

Grid locations can be found by using the Grid Locator feature on RMA’s website. The Grid Locator tool can be accessed directly through the following website: http://agforceusa.com/rma/ri/prf/maps or through the following RMA website: https://www.rma.usda.gov/en/Fact-Sheets/National-Fact-Sheets/Pasture-Rangeland-Forage-Pilot-Insurance-Program Open the RMA website and click on the Grid ID Locator, Decision Support Tool, and Historical Indices link as shown in Figure 2.

Enter the location of the acreage on the grid locator screen (as shown in Figure 3) to find the appropriate grid. Click on the Zoom to Grids button and it will show all of the grids in the area.

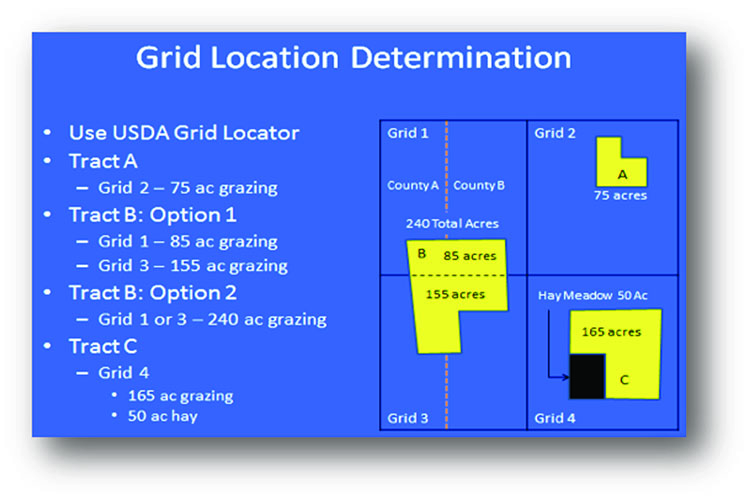

Producers must use the grid where the acreage is physically located or use a point of reference for contiguous acreage. If a producer has acreage that is contiguous in two adjacent grids, the producer has three options to choose from. An example of this is shown in Figure 4. Tract B has 85 acres in Grid 1 and 155 acres in Grid 3. To insure this acreage, a producer may choose one of the following three options: 1) Insure 85 acres using Grid 1 and 155 acres using Grid 3; 2) Insure 240 acres using Grid 1; or 3) Insure 240 acres using Grid 3.

Producers are not required to insure all acres in the PRF program and can choose to insure the acres most important to the operation. However, producers cannot insure more than the total number of grazing or haying acres in the operation. To obtain coverage, producers will be asked to make several choices regarding the Intended Use, Productivity Factor, Coverage Level, Insurable Interest, Insured Acres, and Index Intervals.

Figure 2. RMA Grid Locator, Decision Tool, and Historical Indices Website.

Figure 3. Grid Locator Website.

Figure 4. Grid Location Determination.

Intended Use – Producers must choose between insuring their acreage for either grazing or hay. The insurable value for grazing acreage is considerably lower than the value for hay, therefore the insurance premiums are also lower. To be insured as hay acreage, the acreage must be hayable.

Coverage Level – A county base value (per acre) has been established. These values are different for grazing and hay acreages. Producers must choose a level of 70, 75, 80, 85, or 90 percent of the baseline county value. The premium cost will increase with higher coverage levels.

Productivity Factor – A productivity value (per acre) has been established for each county based on income received for haying and grazing operations under normal rainfall conditions. Producers can choose a protection factor between 60 and 150 percent of the county value. Producers will want to select the amount of protection based on the forage value that best represents his/her specific grazing or hay operation, as well as the productivity of his/her land. The premium cost will increase or decrease, depending on the protection factor selected. Producers can only select one productivity factor for each crop type and county.

Insurable Interest – Producers must choose the appropriate insurable interest for the acreage. Producers can insure both owned and leased acres. Insurable interest is the insured’s (person purchasing the insurance policy) percentage of the insured crop at financial risk. Insurable interest in grazing or haying acreage owned by the insured will typically be 100 percent. When the insured crop is leased pasture, rangeland, or forage acres with an intended use of grazing, the insured’s percentage of the insured crop at financial risk will be based on the insured’s percentage:

- Interest in the livestock to be grazed on the insured acres, if the acres are cash leased; or

- The value gained of the livestock being grazed on the insured acres if the acres are share leased.

Lessors under a cash lease are not considered to have a share in the insured crop.

Insured Acres – The same acreage cannot be insured for both haying and grazing in the same crop year. No more than 60 percent of the insured acreage can be put into one Index Interval (this applies separately to acres insured for haying or grazing). In addition, the same acres cannot be insured in more than one grid ID or county. If acreage is located in more than one grid, producers can choose to put all acreage in one grid or divide the acreage into separate grids (see Figure 5).

Figure 5. PRF Example 1.

Index Intervals: Percent of Value – Producers must select at least two, 2-month time periods, called index intervals, when rain is important to the operation. Producers must choose the percent of value for each interval (i.e. the percentage of acreage to insure in each interval). Each index interval must include a minimum of 10 percent of the insured acreage, with no more than 60 percent of the insured acreage can be put into one index interval. The total percentage of acres insured in the intervals must equal 100 percent. Producers cannot choose more than one index interval that includes the same month for the same grid ID, intended use and share (i.e. if the April-May interval is selected, the March-April and May-June intervals cannot be selected).

Insurance payments are calculated using NOAA CPC data for the grid(s) and the chosen index interval(s). If the final grid index is less than the trigger grid index, which is the coverage level times the expected grid index; a loss payment may be issued. This insurance product only provides coverage for a lack of rainfall and is based on rainfall for the entire grid, not individual farms or ranches or specific weather stations. It is possible that producers may have low rainfall on their own farm and not receive a payment under the PRF policy. The rainfall indices do not measure direct production or loss. Additional information on the rainfall index can be obtained at the NOAA Web site.

A decision tool is available allowing producers to estimate premiums and indemnities from 1948 to the current year to see how the program would have performed if they were enrolled in previous years. Producers can also view the historical rainfall indices for an area using the tool. PRF insurance is best suited for producers whose production tends to follow and correlate to the historical average rainfall patterns for the grid so it is important for producers to look at the historical indices.

Decision Tool

Producers will need to answer the same questions when using the decision tool or when enrolling with a crop insurance agent. This section will explain how to use the decision tool to estimate premiums and indemnities under the PRF program and will help producers understand which data they need to provide to a crop insurance agent (even if they choose not to use the decision tool). Producers must visit their local crop insurance agent to obtain current rates and coverage for the crop year in which they are enrolling. It is not necessary to use the decision tool to obtain PRF coverage. The crop insurance agent will provide the necessary assistance. However, the decision tool is extremely useful to understand how the program works, estimate premiums and indemnities for prior years, and view historical rainfall indices.

Example – Producer Smith owns 100 acres of Bermudagrass pasture located four miles south of Stillwater, OK that he wants to insure against drought (Figure 5).

Go to the RMA’s grid locator website. Enter “Stillwater, OK” in the Find a Location box. Find the location of the acreage on the map and click on the Decision Support Tool or on Historical Rainfall Indices to see rainfall indices from 1948 to the current year for the grid. Once the Decision Support Tool is open (Figure 5), fill in the information. If a grid was selected on the first screen, the location and grid should automatically be filled in. If not, enter it at the top of this screen.

At the top of the screen (Box #1), enter the state, county, and grid number (or use the Grid Locator tool). On the left of the screen (Box #2), enter the intended use, coverage level, productivity factor, insurable interest, insured acres, and sample year (remember, this tool can only be used to evaluate payments in previous years – visit a crop insurance agent to calculate the premium for the current insurable year). Enter the percentage of acres to insure in each chosen interval (Box #3) and then click on the calculate button (Box #4). The results show that Producer Smith would have paid an insurance premium of $87 and received an indemnity of $408 (Box #5). Try different options to evaluate the change in premiums and indemnities under various scenarios.

For the example in Figure 5, the following information would be entered:

Intended Use: Grazing

The acreage that is going to be insured is pasture land. If the acreage was a hay field the entry would be hay.

Coverage Level percent: 90

This can be 70, 75, 80, 85, or 90.

Productivity Factor percent: 100

This is used to either raise or lower the value of the insured coverage. This number can be from 60 to 150.

Insurable Interest percent: 100

Producer Smith owns the acreage.

Insured Acreage: 100

Total number of acreage being insured.

Sample Year: 2011

Choose any year from 1948 to the current year. However, recent data from the current year will likely be missing.

Index Intervals: 50 percent in Jun-Jul, 50 percent in Aug-Sep

Enter the percentage of acreage to insure in each interval and (minimum of 10 percent maximum of 60 percent in each).

Sign-Up Deadline

To participate in PRF, producers must submit an application and an acreage report to their crop insurance agent no later than November 15th of the previous crop year. In addition, perennial crops must be planted by July 1 of the previous year (i.e. alfalfa planted on July 15, 2013 would not be eligible for 2014 PRF coverage, but would be eligible for 2015 PRF coverage). Producers must certify all insurable and uninsurable acreage of the crop type and the general location within a specified grid, but they are not required to insure all eligible acreage or specify which acres are insured.

Producers should visit a crop insurance agent to enroll in PRF or to obtain more information. To find a crop insurance agent, use the RMA agent locator tool at the following website: http://www.rma.usda.gov/tools/agent.html.

Eligibility & Additional Rules

Any pasture, rangeland, and perennial forage crops produced for haying or grazing by livestock are eligible for PRF coverage. However, producers can be ineligible to participate in PRF if they have enrolled the particular acreage in other Government programs, especially conservation programs that prohibit them from grazing or haying the land. For example, producers who enroll land in the Farm Service Agency’s (FSA) Conservation Reserve Program agree to plant resource-conserving vegetative covers that would generally preclude grazing. Producers can enroll in both PRF and the Non-Insured Disaster Assistance Program (NAP) since PRF does not provide multi-peril coverage.

Producers may select only one coverage level and dollar amount of protection per acre for each of the insured crop types in the county. The dollar amount of protection per acre selected will be applied to each Grid ID and crop type. Producers are not required to report yield history or maintain production records for the PRF policy. However, producers should continue to maintain production records in case an Actual Production History (APH) plan of multiple peril crop insurance becomes available in future years.

Acreage Reporting

An acreage report must be submitted for each growing season and should include: share, intended use, grid ID, FSA farm number, FSA tract number, and FSA field number.

Annual Premium

The annual premium is due when the insured crop is reported on the acreage report.

PRF Indemnities

Producers do not need to file a claim or submit any documentation for a loss under the PRF policy. Payments will be made after rainfall data is collected for each 2-month index interval and provided to RMA and crop insurance companies, which means that payments may be issued multiple times in a year.

Additional Information

Producers may contact a local crop insurance agent to obtain more information about PRF or to enroll in the program. Producers may also contact Jody Campiche (jody.campiche@okstate.edu) for additional assistance. Producers can also obtain more information about PRF at the following website: http://www.rma.usda.gov/policies/pasturerangeforage/.

Jody Campiche

Assistant Professor & Extension Economist

JJ Jones

Southeast Area Extension Agriculture Economist