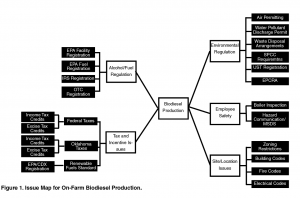

On-Farm Biodiesel Production Regulatory Guide

- Jump To:

- Introduction

- Assumptions Made in this Guide

- Biodiesel Production Facility Registration

- EPA Registration

- IRS Registration

- OTC Registration

- Tax and Incentive Issues

- Income Tax Issues

- Excise Tax Issues

- Renewable Fuels Standard

- Environmental Permitting

- Tank Storage Issues

- Community Right-To-Know Issues

- Boilers

- Building and Zoning Restrictions

- Conclusion

- APPENDIX 1

- Web References for Additional Information

Note: This publication is intended to provide general information about legal issues. It should not be cited or relied upon as legal authority. State laws vary and no attempt is made to discuss laws of states other than Oklahoma. For advice about how these issues might apply to your individual situation, please consult an attorney.

Introduction

More and more agricultural producers are not only being asked to produce the world’s food and fiber, but also to produce the world’s fuel. Recent years have seen tremendous increases in the amount of biofuels, such as ethanol and biodiesel, that are being produced from agricultural sources such as corn, sorghum and oilseed crops. Some agricultural producers are adapting the technologies used on an industrial scale to produce the fuels to the farm level and for their own use. While on-farm production of biofuels can have significant advantages for agricultural producers, the production of fuels also triggers many regulatory requirements. Many of these regulations do not carry exemptions for small-scale production of fuels, and, as a result, those who produce fuel simply for their own use may often face the same regulations as a large, commercial refinery.

Assumptions Made in this Guide

This guide will present a number of the regulations that may apply to the on-farm

production of biodiesel, and is targeted to readers who are producing fuel primarily

for their own use and not for sale to others. It is assumed that the reader is producing

less than 10,000 gallons of biodiesel per year.1

It is also assumed that all fuel produced is used for “off-road” purposes and is not

used in any vehicle for highway travel. The use of any biodiesel produced in any vehicle

for highway travel would trigger the application of a host of additional fuel regulations

at both the state and federal level. Please also note that this guide will focus solely

on the regulations that govern the production of fuel. It will not address issues

such as liability for injuries on the premises where the fuel is produced or damage

to vehicles in which the fuel is used, nor will it discuss legal structures for the

entity producing the fuels (such as organizing a limited liability company or cooperative

for the fuel production).

Finally, it is important for the reader to consult with the agencies listed, as well

as any county or municipal governments, to be sure all requirements have been satisfied.

Always consult with a licensed attorney with experience in your type of issue should

legal concerns arise.

Biodiesel Production Facility Registration

The production of biodiesel triggers the jurisdiction of a number of agencies at both the federal and state level. At the federal level, the Environmental Protection Agency (EPA) and the Internal Revenue Service (IRS) may require the registration of a biodiesel production facility. At the state level, the Oklahoma Tax Commission (OTC) also requires facility registration. Each of these registrations will be addressed in turn.

EPA Registration

EPA regulations require the registration of “refineries” that produce gasoline or

diesel fuels.2 For the purposes of EPA regulations, biodiesel is defined as diesel.3 Since biodiesel is required to meet many of the same regulatory requirements as petroleum-based

diesel, and since this guide assumes that the biodiesel produced will be used in tractors

and other off-road equipment, an on-farm biodiesel facility will likely be required

to register with EPA.4

Registering a diesel refinery requires filing EPA Forms 3520-20A (Fuels Program Company/Entity

Registration) and 3520-20B1 (Diesel Programs Facility Registration), available at

http://www.epa.gov/oms/regs/fuels/rfgforms.htm. These forms require general information

about the location of the facility, contact persons, recordkeeping for the facility

and a certification that the information submitted is correct.

In addition to registering the facility producing biodiesel, the producer must also

determine whether it must register the fuel it produces. Assuming that none of the

fuel produced by a biodiesel facility is used for an on-road vehicle, the facility

is not required to register its fuel.5 If, on the other hand, any of the biodiesel fuel was used for on-road applications,

fuel registration would be required by using EPA Form 3520-12, which requires information

regarding the composition of the fuel and its physical characteristics, additives

to be used in the fuel. This form and more information on the registration process

can be found at http://www.epa.gov/oms/regs/fuels/ffarsfrms.htm. Additional information about the EPA registration processes relevant to biodiesel

producers can be found in EPA’s “Guidance for Biodiesel Producers and Biodiesel Blenders/Users,”

available at http://www.epa.gov/otaq/renewablefuels/420b07019.pdf.

IRS Registration

Regardless of whether the biodiesel produced by a facility is used on-road or off-road,

or even as heating fuel or fuel for the generation of electricity, the biodiesel facility

is required to register with IRS for the purpose of fuel excise taxes.6 To register, use IRS form 637, “Application for Registration (For Certain Excise

Tax Activities),” available at http://www.irs.gov/pub/irs-pdf/f637.pdf. For additional

information about excise tax issues, consult IRS Publication 510, “Excise Taxes,”

available at http://www.irs.gov/pub/irs-pdf/p510.pdf.

OTC Registration

The statutes governing Oklahoma’s excise taxes for motor vehicle fuels defines “diesel” to include “biodiesel” and does not distinguish between on-road and off-road uses.7 Given this, a biodiesel producer may need to register as a “supplier”8 of biodiesel fuel pursuant to OTC regulations for entities that may have to collect excise taxes.9 There are, however, several potential exemptions from excise taxes including exemptions for fuel used for farm tractors or stationary engines used exclusively for agricultural purposes,10 and biodiesel “produced by an individual with crops grown on property owned by the same individual and used in a vehicle owned by the same individual on the public roads and highways of this state.”11 For help in determining whether a supplier registration is needed for your operation, contact the OTC at 405-522-5658 or via email at otcmaser@tax.ok.gov.

Tax and Incentive Issues

Important note: While many of the regulations affecting biodiesel production are complex, those governing

biodiesel taxation and tax credits are even more so. Consult with a qualified tax

expert for assistance in determining your tax liability and tax credit eligibility.

While there are several income tax credits available for biofuels production, most

of them are conditioned on the sale of the biofuels to another party. To take full

advantage of these credits for fuels that are used on the producer’s own operation,

the producer may need to restructure their operation and place ethanol production

into a separate legal entity, such as an LLC or corporation, that can then sell the

fuel to the farming operation. As always, consult the appropriate tax and legal experts

for more information.

At the federal level, three important incentive programs are targeted at biofuels

production: income tax credits, excise tax credits and programs under the Federal

Renewable Fuels Standard. Each program takes a slightly different approach to encouraging

biofuels development.

Feed Grain Identification

Income Tax Issues

Important note: The income tax credits created by 26 U.S.C. § 40A expired as of December 31, 2009.

There are currently a number of legislative proposals that would re-enact these credits

and potentially make them retroactive back to December 31, 2009. Nevertheless, as

this guide goes to press, these credits are currently expired. Biodiesel producers

should continue to monitor for further legislative developments. The National Biodiesel

Board posts updates on such legislative developments at http://www.biodiesel.org/news/taxcredit/default.shtm.

The structure of the biodiesel income tax credit basically parallels that of the ethanol

credit (albeit with more generous amounts) and provides a “biodiesel fuels credit”

that consists of a “biodiesel mixture credit,” a “biodiesel credit,” and a “small

agri-biodiesel producer credit.”12 The biodiesel mixture credit provides a credit of $1.00 per gallon for each gallon

of biodiesel used by the facility in producing a “qualified biodiesel mixture” (a

mixture of biodiesel and diesel sold by the facility for use as a fuel). The biodiesel

credit equals $1.00 per gallon of biodiesel (if the biodiesel is not mixed with petroleum-based

diesel) that is sold by the facility “at retail to a person [using the alcohol as

fuel] and placed in the fuel tank of such person’s vehicle.” Finally, the small agri-biodiesel

producer credit provides $0.10 per gallon of biodiesel sold to another party and is

limited to the first 15 million gallons of production per year from a facility with

a capacity of no more than 60 million gallons from the biodiesel facility. The difference

between this credit and its ethanol counterpart is the term “agri-biodiesel.” “Agri-biodiesel”

means “biodiesel derived solely from virgin oils, including esters derived from virgin

vegetable oils from corn, soybeans, sunflower seeds, cottonseeds, canola, crambe,

rapeseeds, safflowers, flaxseeds, rice bran, mustard seeds and camelina and from animal

fats.”13

As emphasized above, many of these credits are conditioned on the sale of the fuel

to another party. To take full advantage of these credits for fuels that are used

on the producer’s own operation, the producer may need to restructure their operation

and place biodiesel production into a separate legal entity, such as an LLC or corporation,

that can then sell the fuel to the farming operation. As always, consult the appropriate

tax and legal experts for more information.

Excise Tax Issues

Excise taxes are typically imposed on gasoline and diesel fuels either when the fuels

leave the refinery or terminal, or upon their arrival to the United States if they

are imported. As a result, given the assumptions stated at the beginning of this guide,

these taxes will likely not apply to the reader. However, if you intend to sell your

fuel to another entity, these taxes may be triggered.

The federal excise tax is $0.243 per gallon for diesel.14 Biofuels are not immune from these taxes, as 26 U.S.C. § 4041 also imposes the diesel

tax rates on biodiesel. These taxes can be offset with the credits created by 26 U.S.C.

§ 6426, which creates the “biodiesel mixture credit.” This credit amounts to $1.00

per gallon for biodiesel mixed with petroleum-based diesel. Claiming these credits

requires registration with the IRS.15

Additionally, there are several exemptions available for fuels that are used on a

farming operation for farming purposes. Consult IRS Publication 510, “Exise Taxes,”

for more information (Publication 510 is available at http://www.irs.gov/pub/irs-pdf/p510.pdf.

Also note that the excise and income tax credits are linked via 26 U.S.C § 40(c) so

that the income tax credit will be “reduced to take into account any benefit provided

with respect to such alcohol solely by reason of the application of” the excise credit

provisions—in other words, producers are not allowed to “double dip” from both the

income tax credits and the excise tax credits.16

At the state level, an excise tax of $0.13 per gallon is imposed on diesel and diesel-blend.17 As mentioned above, there are several potential exemptions from excise taxes including

exemptions for fuel used for farm tractors or stationary engines used exclusively

for agricultural purposes,18 and biofuels “produced by an individual with crops grown on property owned by the

same individual and used in a vehicle owned by the same individual on the public roads

and highways of this state.”19

Renewable Fuels Standard

The federal Energy Policy Act of 2005 (often called EPAct)20 established a Renewable Fuels Standard (RFS) that mandates the inclusion of certain levels of biofuels into the U.S. fuel supply.21 For more information on the RFS, consult the “Basic Biofuels Information Guide” available at http://agecon.okstate.edu/faculty/publications/3393.pdf. Under this rule, fuel importers and refiners are required to demonstrate compliance with the requirements of the RFS by purchasing credits called “Renewable Identification Numbers” (RINs).22Thus, if a biodiesel producer wants to take advantage of the programs under the RFS, they need to register with EPA so the fuel they produce can be assigned RINs.23 Participants also need to register with EPA’s Central Data Exchange (CDX). For more information on these registration requirements, visit the EPA’s Renewable Fuels Reporting Forms Web site http://www.epa.gov/otaq/regs/fuels/rfsforms.htm.

Environmental Permitting

In Oklahoma, most environmental programs that are handled at the federal level by the EPA are delegated to the Oklahoma Department of Environmental Quality (DEQ). Thus, DEQ will be the agency that will handle environmental permitting for most biofuels facilities within the state. Although most on-farm biodiesel production projects will be too small to require permits under many environmental programs, producers should still examine whether their operations do qualify. If it is determined that a facility was operating without a required permit, substantial penalties may be enforced.

Air Permitting

The federal Clean Air Act (CAA)24 requires air permits for facilities that emit more than specified amounts of certain air pollutants. These permits are often called “Title V” permits and facilities required to have such permits are called “Title V” (from the title of the CAA that contains the permit requirements) and/or “Major Sources.” Facilities emitting more than the following amounts are considered to be major stationary sources of air pollution and must have a Title V permit:

- Ten (10) tons per year of any individual hazardous air pollutant (HAP) or 25 tons per year of any combination of HAPs (note, a hazardous air pollutant is a substance found on EPA’s list of particularly dangerous air pollutants; this list is found at 42 U.S.C. § 7412(b)); OR 100 tons of any “regulated” air pollutant (these pollutants include volatile organic compounds, certain classes of airborne particles or “particulate matter,” carbon monoxide, nitrogen oxides, sulfur dioxide and lead).25

- A facility’s “potential to emit” must be compared against the emission threshold for each respective regulated air pollutant. “Potential to emit” is a calculation of a facility’s theoretical ability to emit regulated pollutant(s), i.e., the worst case air emissions scenario. That calculation is based on an assumption that the facility will operate at its maximum capacity 24 hours a day, 365 days per year, even if it would not do so in reality.26 As a result, you need to calculate the atmospheric emissions of your facility on this basis. Major sources must receive construction approval from the DEQ prior to construction of the pollutant emitting equipment. As a result, large biofuels facilities need to begin the major source application process well before they anticipate starting facility construction or operations.

Most on-farm biofuel production facilities will not approach the major source permit

thresholds. However, the DEQ also permits smaller sources of air emissions under their

“minor facility” permit program that applies to facilities emitting more than 40 tons

per year of a certain regulated air pollutant, but less than Major Source thresholds.27 Note that facilities that emit 40 tons per year or less of actual emissions of each

regulated pollutant are exempted from Title V and minor source permitting requirements.28 Also note that the calculation of the “permit exempt” limits is based on actual emissions,

rather than potential to emit.

If there is a question as to whether your facility would require a minor facility

permit, you can request an “applicability determination” from DEQ.29 A request for an applicability determination must be in writing, contain all information

necessary for DEQ to determine whether a permit is required, and must be accompanied

by the necessary permit fee (in the case of a minor facility, this fee is $250).30 It is also possible to request evaluation of potential facility air permitting requirements

through engagement of a qualified environmental consultant. Utilizing this approach

can preserve the ability to self-report any compliance issues discovered during the

evaluation process.

Another alternative for facilities whose potential to emit triggers the need for a

major source permit is to ask DEQ for legally enforceable limits on their operations

that would reduce their emissions below the major source limits.31 These facilities are called “synthetic minor” sources. Where possible, synthetic

minor source permitting can provide significant relief from the resources and expense

needed to comply with a major source permit.

For more information on DEQ’s air permitting programs, visit http://www.deq.state.ok.us/aqdnew/permitting/index.htm.

Water Issues

Generally, the federal Clean Water Act32 (CWA) requires a permit for the discharge of any “pollutant” into a body of water

from a discrete point (such as a pipe, conduit, ditch or channel). The CWA’s definition

of pollutant encompasses an immense range of possible substances.33 If your biofuels facility will discharge only to a septic system or to a city sewage

system, no discharge permit is required.34If, however, you will be discharging to such a system, you must ensure that your discharges

will not cause that system to malfunction.

On the other hand, if you will need to discharge pollutants to a water body, you will

need an Oklahoma Pollutant Discharge Elimination System (OPDES) permit. Such permits

must take into account the nature of the pollutants emitted by the facility, the existing

quality of the water receiving the discharge from the facility, the uses of the receiving

water, and the technology that could be used to treat the discharge.35 Given that many biofuels facilities have the opportunity to use different strategies

for handling the water they generate (such as irrigating nearby fields and using evaporation

ponds), facility developers should consult the permitting agency early in their planning

process to determine if such alternatives may be approved. Generally, an applicant

must submit their materials no later than 180 days prior to commencing a discharge,

but in some circumstances the application must be submitted 90 days prior to construction

of the discharge equipment.36

If your biofuels facility will be located outdoors, it may also need a permit for

discharges of pollutants that occur from industrial storm water runoff (rainfall that

runs off from the facility carrying potential pollutants with it). Usually, this is

handled by a “general permit.”37 If applicable to the facility, a general permit often provides coverage at a lower

cost and with less needed “lead time” than other permits. If you are building a large

biofuels facility outdoors, “construction storm water” regulations may also come into

play. These regulations require permit coverage for potential runoff discharges from

construction sites that will disturb more than one acre of land.38 As with industrial storm water permits, Oklahoma frequently handles construction

storm water issues with general permits, making such permits much easier and much

less expensive to obtain.

For more information on DEQ water permits, visit http://www.deq.state.ok.us/wqdnew/wqprogrms.html.

Figure 3. Co-products from seed crushing oilseeds for biodiesel production can include seed meals that can be used as livestock feeds.

Waste

The production of biofuels from agricultural materials generates a number of by-products

and co-products, some of which may fit the definition of “solid waste” under the Resource

Conservation and Recovery Act (RCRA).39 In Oklahoma, enforcement of RCRA has been delegated to DEQ. As with the definition

of pollutant previously discussed, the definition of “solid waste” encompasses almost

every waste material generated by an industrial process. Such wastes must be disposed

of at a RCRA-compliant landfill or by another RCRA-permitted method. Additionally,

RCRA defines some solid wastes as “hazardous wastes” by both listing specific substances

always considered hazardous and by setting forth chemical characteristics deemed “hazardous.”40 That is to say, a substance may be hazardous if either (A) it is listed on one of

the RCRA “hazardous” lists, or (B) if the substance has a “hazardous” characteristic.

Depending on the inputs and processes used for your biodiesel production facility,

you may generate some quantities of these materials. While all hazardous wastes require

special storage and disposal procedures, the facility itself may face additional registration

and reporting requirements if it generates more than 1,000 kilograms of hazardous

waste in one month.41

One of the most common co-products of the biodiesel production process is glycerine

combined with methanol.42 Methanol, at concentrations of 24 percent or greater by weight, meets the definition

of an RCRA hazardous waste and may meet the definition at lower concentrations depending

on environmental conditions.43 Generally, glycerine, in and of itself, will not be classified as a hazardous waste.44 If, however, the glycerine produced contains methanol at sufficient concentrations

for the methanol to be considered a hazardous waste, the entire volume of material

— both glycerine and methanol — may deemed hazardous by virtue of RCRA’s “mixture

rule.”45 Because hazardous waste determinations are very fact-specific, you should consult

your local waste management agency for help in determining proper handling for your

process wastes.

Importantly, using co-products or by-products (for example, applying them as fertilizers

or making other products out of them) can exclude those materials from the definition

of “solid waste.” Since this may significantly reduce the costs of waste management

and/or provide additional cash flows, you should carefully review your fuel production

processes to determine how all the facility’s resources can be used or reused for

maximum efficiency.

More information on DEQ’s waste programs is available at http://www.deq.state.ok.us/lpdnew/index.htm.

Tank Storage Issues

Generally, the regulation of chemical storage tanks in Oklahoma is overseen by the

Oklahoma Corporation Commission (OCC) and DEQ.46 The tank storage of chemicals is regulated through two main programs. First, the

“Spill Prevention, Containment, and Countermeasure” (SPCC) program applies to aboveground

storage tank (AST) facilities containing 1,320 gallons or more of “oil and oil products.47 For the purposes of the SPCC program, however, “oil and oil products” is defined

as “oil of any kind or in any form including, but not limited to: fats, oils, or greases

of animal, fish, or marine mammal origin; vegetable oils, including oils from seeds,

nuts, fruits, or kernels; and, other oils and greases, including petroleum…”48 While biodiesel itself might not fall into this definition, storage of many biodiesel

feedstocks, including plant oils (such as soybean or canola oils) and animal greases,

would meet this definition. If a large tank is used to store petroleum diesel for

blending, that tank may trigger SPCC requirements. Facilities subject to the SPCC

regulations must prepare a spill prevention, containment, and countermeasure plan

that may include requirements to build “secondary containment” structures (such as

curbs or berms) around tanks and must provide contingency plans for responding to

a spill of regulated materials.49 For more information on the SPCC program, visit EPA’s Web site at http://www.epa.gov/emergencies/content/spcc/index.htm.

In Oklahoma, SPCC plans for ASTs with regulated substances are overseen by the OCC.

You can find more information regarding OCC’s storage tank programs at http://www.occ.state.ok.us/Divisions/PST/pst.htm.

You can also get more information about spill and pollution prevention from DEQ’s

Land Protection Division by visiting their website at http://www.deq.state.ok.us/lpdnew/index.htm.

The second tank storage program, the Underground Storage Tank (UST) program, regulates

tank systems containing “regulated substances” constructed with 10 percent or more

of their volume underground.50 “Regulated substances” represents yet another broadly encompassing definition and

includes substances regulated under a number of other regulatory programs including

“hazardous substances”51 and petroleum products.52 Although biodiesel itself does not fit within this definition, it does include many

substances commonly stored at biofuels facilities. Owners of regulated tank systems

must register with either OCC or DEQ (depending on the stored substance as discussed

above), install and maintain leak detection and corrosion protection systems, and

keep records of material inventories and maintenance operations.53 More information about storage tank regulations can be found on the OCC’s Petroleum

Storage Tank division’s Web site at http://www.occ.state.ok.us/Divisions/PST/pst.htm

Canola in bloom at the Oklahoma Experiment Station in Stillwater Oklahoma. Test plot

at the Efal farm west of the main campus on McElroy Street.

Dr. Tom Peeper research in alternative crops for Oklahoma farmers.

Community Right-To-Know Issues

Another potentially applicable regulatory system is the Emergency Planning and Community

Right-to-know Act (EPCRA), also known as “SARA Title III” (because EPCRA formed Title

III of the Superfund Amendments and Reauthorization Act). EPCRA requires communication

between a facility storing specified amounts of potentially dangerous substances and

local emergency response agencies and establishes reporting requirements to help local

emergency officials understand the inventories of such substances in their areas.

One can find a list of substances that may trigger EPCRA applicability by consulting

EPA’s “List of Lists,” available at http://www.epa.gov/ceppo/pubs/title3.pdf. Any prospective biofuels project should review its process design

to determine if it will hold inventories of any EPCRA-covered substances. Generally,

you should communicate with your local emergency services (firefighters, emergency

medical, and local sheriff’s and police departments) so that emergency responders

are aware of any potential hazards present at your biofuels operation. This will provide

greater safety for both you and them.

Table 1 presents a list of typical biodiesel production inputs and outputs, with notes

of substances that may trigger EPCRA reporting requirements.

You can learn more about EPCRA from the DEQ’s Risk Communication page at http://www.deq.state.ok.us/CSDnew/saratitleiii/index.htm.

Boilers

Some biodiesel facilities will use one or more boilers as part of the production process. Boilers (other than those used for household or commercial hot water applications) generally must be approved and routinely inspected by the Oklahoma Department of Labor (DOL) pursuant to the Oklahoma Boiler and Pressure Vessel Safety Act.54 However, there are several exemptions from these requirements. The following types of boilers are exempt from the act:

- Pressure vessels having an internal or external operating pressure not exceeding fifteen (15) pounds per square inch gauge [one hundred three (103) kilopascals gauge] with no limit on size;

- Pressure vessels having an inside diameter not exceeding six (6) inches (152mm) with no limitation on pressure;

- Pressure vessels containing water heated by steam or other indirect means when none of the following limitations is exceeded:

- A heat input of two hundred thousand (200,000) British thermal units per hour, fifty-eight thousand six hundred (58,600) watts,

- A water temperature of two hundred ten degrees Fahrenheit (210 F), or

- A water containing capacity of one hundred twenty (120) gallons, four hundred fifty (450) liters. 55

Unless your boiler falls under one of the Act’s exemptions, an annual inspection of the boiler by a DOL inspector will be necessary.56 More information on DOL’s boiler safety programs is available at http://www.ok.gov/odol/Safety_Standards/index.html.

Building and Zoning Restrictions

The first step in addressing building and zoning restrictions that may apply to your

biofuels facility is to determine whether your facility lies within the jurisdiction

of a city or town that has an enforceable code (other than rural areas in Oklahoma

County and Tulsa County, very few areas outside the boundaries of a municipality are

under any zoning or building code authority).57 Even if your facility is in a rural area, that area may be within the annexed limits

of a nearby city or town. Thus, always confirm the zoning status of your operation

with the city engineering office of your nearby towns and cities.

If your facility will be within the jurisdiction of a city or town with an enforceable

code, several different ordinances may apply to your operation. Zoning restrictions

may apply to fuel production operations. For example, fuel production operations may

be restricted to “commercial” or “industrial” areas and may not be allowed in “residential”

or “agricultural” areas. However, read these regulations carefully; often, code enforcement

officials may simply assume that a zoning restriction applies to your operation without

understanding the scale of your operation. Meet with code enforcement officials and

be prepared to fully explain the scope and operation of your fuel production system.

In addition to zoning restrictions, fire codes, electrical codes, and building codes

may also apply to the construction and operation of your fuel production system. Again,

these codes may vary from jurisdiction to jurisdiction. Consult your city or town’s

municipal office to determine the local code provisions that apply to your operation.

Many times, local jurisdictions will adopt national codes, either outright or with

modifications. Copies of these codes are sometimes kept at your local library. You

can also get more information about these codes at the following Web sites:

National Fire Code: www.nfpa.org (contains information regarding both the National Fire Code and the National Electrical

Code).

International Code Council: www.iccsafe.org.

Conclusion

On-farm biodiesel production provides an opportunity to agricultural producers by enabling them to produce their own fuels from their own products. This can potentially provide an important fuel cost management tool to the producer. However, many of the regulations that apply to large refineries do not carry exemptions for small-scale production of fuels, and as a result, those who produce fuel simply for their own use may often face the same regulations as a large, commercial refinery. As a result, you should conduct a careful evaluation of your planned biofuels production facility and determine the applicability of these regulations before proceeding. In the case of fuel production, it is definitely “easier to ask permission than forgiveness.”

APPENDIX 1

On-Farm Biodiesel Production Applicability and Approval Checklist

| Item | Applicable? | Approval Secured |

|---|---|---|

| EPA Fuel Production Facility Registration | ||

| EPA Fuel Registration | ||

| IRS Excise Tax Registration | ||

| OTC Excise Tax Registration | ||

| EPA Central Data Exchange (CDX) / RIN Registration | ||

| DEQ Air Emissions Permit | ||

| DEQ OPDES (water pollutant) Permit | ||

| DEQ Solid/Hazardous Waste Generator Registration | ||

| EPA/OCC SPCC Plan | ||

| OCC Storage Tank Registration | ||

| DEQ/Local Emergency EPCRA Notifications | ||

| DOL Boiler Inspection | ||

| Local Zoning Code Compliance Check | ||

| Local Building Code Compliance Check | ||

| Local Fire Code Compliance Check | ||

| Local Plumbing Code Compliance Check | ||

| Local Electrical Code Compliance Check |

APPENDIX 2

Permitting Programs

EPA Fuels Program Facility Registration Forms

http://www.epa.gov/oms/regs/fuels/rfgforms.htm

EPA Fuel Registration Forms

http://www.epa.gov/oms/regs/fuels/ffarsfrms.htm

EPA Guidance for Biodiesel Producers and Biodiesel Blenders/Users

http://www.epa.gov/otaq/renewablefuels/420b07019.pdf

IRS Application for Registration for Certain Excise Tax Activities

http://www.irs.gov/pub/irs-pdf/f637.pdf

IRS Publication 510 – Excise Taxes

http://www.irs.gov/pub/irs-pdf/p510.pdf

EPA Renewable Fuels Standard Forms

http://www.epa.gov/otaq/regs/fuels/rfsforms.htm

DEQ Air Permitting Page

http://www.deq.state.ok.us/aqdnew/permitting/index.htm

DEQ Water Permitting Page

http://www.deq.state.ok.us/wqdnew/wqprogrms.html

DEQ Waste Management Programs Page

http://www.deq.state.ok.us/lpdnew/index.htm

EPA SPCC Program Page

http://www.epa.gov/emergencies/content/spcc/index.htm

OCC Storage Tank Division Page

http://occ.state.ok.us/

DEQ Land Protection Division Page

http://www.deq.state.ok.us/lpdnew/index.htm

OCC Petroleum Storage Tank Division Page

http://occ.state.ok.us/

EPA List of Lists

http://www.epa.gov/ceppo/pubs/title3.pdf

DEQ Risk Communications Page

http://www.deq.state.ok.us/CSDnew/saratitleiii/index.htm

Oklahoma Department of Labor Safety Programs Page

https://www.ok.gov/

National Fire Code and National Electrical Code

www.nfpa.org

International Code Council

www.iccsafe.org

Web References for Additional Information

This publication released by EPA Region 7 lists the federal laws and EPA regulations that a person must abide by when

constructing or modifying a biodiesel plant.

National Agricultural Law Center

Congressional Research Service Publication that primarily discusses general information

on the national level, such as greenhouse gas emission information and an overview

of the ethanol industry. Also provides useful economic information with the possibility

programs that a producer could use to start a small-scale ethanol production facility.

National Agricultural Law Center

Arkansas University of Law – Ag Law Research Publication that cites specific citations

for the state of Oklahoma in regard to ethanol and biodiesel production. Citations

cited specifically provide policy information regarding biofuel development in the

state as well as financial incentive/tax information.

Congressional Research Service Reports

CRS Congressional Report that discusses the many federal economic and tax incentives

for producing biofuel ethanol and biodiesel. The report also provides information

about tax breaks and loan programs.

National Agricultural Law Center

CRS publication that cites a broad range of federal statutes dealing with the financial,

environmental, and economical aspects of biodiesel and ethanol production.

Oklahoma Department of Enviromental Quality

Fact sheet discussing biodiesel production released by the Oklahoma Department of

Environmental Quality.

Department of Energy

List of ethanol tax credits for producers/retailers in the State of Oklahoma.

Department of Energy

List of biodiesel tax credits for producers/retailers in the State of Oklahoma compiled

by the U.S. Department of Energy

Biodiesel Laws and Incentives in Federal

List of federal biodiesel tax credits and laws compiled by the U.S. Department of

Energy.

Biodiesel

Web site of the National Biodiesel Board, an advocacy group solely dedicated to the

production of biodiesel in the U.S. Web site provides a wealth of information regarding

the environmental, economic and agricultural impacts of biodiesel.

1 Production of 10,000 gallons or more of biodiesel per year triggers a number of

mandatory fuel reporting requirements, such as registration under the Environmental

Protection Agency’s Renewable Fuels Standard Program. See 40 C.F.R. § 80.1126.

2 “Refinery” is defined by the EPA diesel fuel regulations at 40 C.F.R. § 80.2(h)

as “any facility, including but not limited to, a plant, tanker truck, or vessel where

gasoline or diesel fuel is produced, including any facility at which blendstocks are

combined to produce gasoline or diesel fuel, or at which blendstock is added to gasoline

or diesel fuel.”

3 40 C.F.R. § 80.2(x) defines diesel fuel as “any fuel sold in any State or Territory

of the United States and suitable for use in diesel engines, and that is (1) [a] distillate

fuel commonly or commercially known or sold as No. 1 diesel fuel or No. 2 diesel fuel;

(2) [a] non-distillate fuel other than residual fuel with comparable physical and

chemical properties (e.g., biodiesel fuel); or (3) [a] mixture of fuels meeting the

criteria of paragraphs (1) and (2) of this definition.” (Emphasis added).

4 Use of biodiesel fuel for off-road equipment would likely trigger the definition

of that fuel as NRLM diesel. NRLM stands for “NonRoad, Locomotive, or Marine” diesel,

and is defined as “any diesel fuel or other distillate fuel that is used, intended

for use, or made available for use, as a fuel in any nonroad diesel engines, including

locomotive and marine diesel engines.” 40 C.F.R. § § 80.2(kkk) and 1068.30. 40 CFR

§ 80.597 requires registration for “refiners having any refinery that is subject to

a sulfur standard under § 80.520(a)” and “refiners and importers that intend to produce

or supply NRLM diesel fuel” to register their refineries with EPA. Thus, use of the

fuel in an NRLM application would trigger the sulfur standard, and thus the registration

requirement.

5 EPA guidance document “Guidance for Biodiesel Producers and Biodiesel Blenders/Users,”

p. 2. 40 CFR Part 79 requires the registration of fuels with EPA and the submission

of data regarding their emissions (and the health impacts thereof). Specifically,

40 C.F.R. § 79.4(a) states “No manufacturer of any fuel designated under this part

shall, after the date prescribed for such fuel in this part, sell, offer for sale,

or introduce into commerce such fuel unless the Administrator has registered such

fuel.” A “fuel manufacturer” is defined at 40 C.F.R. 79.2(d) as “any person who, for

sale or introduction into commerce, produces, manufactures, or imports a fuel or causes

or directs the alteration of the chemical composition of a bulk fuel, or the mixture

of chemical compounds in a bulk fuel …” 40 C.F.R. § 79.33 states that “the following

fuels commonly or commercially known or sold as motor vehicle diesel fuel are herby

individually designated: (1) Motor vehicle diesel fuel, grade 1–D; (2) Motor vehicle

diesel fuel, grade 2–D” (emphasis added). Importantly, “motor vehicle” is defined

by the Clean Air Act at 42 U.S.C. § 7550(2) to mean “any self-propelled vehicle designed

for transporting persons or property on a street or highway.” As a result, EPA has

interpreted the regulations and Clean Air Act definitions to mean that diesel fuels

that are used only for nonroad applications are not required to register under the

act.

6 26 U.S.C. § 4101

7 68 Okla. Stat. § 500.3(3), defining “biodiesel” as “a fuel comprised of mono-alkyl

esters of long chain fatty acids generally derived from vegetable oils or animal fats,

commonly known as ‘B100’, that is commonly and commercially known or sold as a fuel

that is suitable for use in a highway vehicle. The fuel meets this requirement if,

without further processing or blending, the fuel is a fluid and has practical and

commercial fitness for use in the propulsion of a highway vehicle.” “Diesel,” in turn,

is defined as “any liquid, including but not limited to, biodiesel, biodiesel blend

or other diesel blended fuel, that is commonly or commercially known or sold as a

fuel that is suitable for use in a diesel-powered highway vehicle. A liquid meets

this requirement if, without further processing or blending, the liquid has practical

and commercial fitness for use in the propulsion engine of a diesel-powered highway

vehicle.” Note that if the fuel is fit for use in a highway vehicle, it satisfies

the definition.

8 See 68 Okla. Stat. § 500.3(56), defining “supplier.”

9 Okla. Admin. Code § 710:55-4-100.

10 68 Okla. Stat. § 500.10(8).

11 68 Okla. Stat. § 500.10(18).

12 26 U.S.C. § 40A.

13 26 U.S.C. §40A(d)(2).

14 26 U.S.C. §§ 4081, 4083.

15 26 U.S.C. §6426(a).

16 26 U.S.C. §§ 4041(b)(2), 6426, 6427(e), 2426.

17 68 Okla. Stat. § 500.4(a)(1).

18 68 Okla. Stat. § 500.10(8).

19 68 Okla. Stat. § 500.10(18).

20 Pub. L. 109-58 (2005).

21 42 U.S.C. § 7545(o).

22 40 C.F.R. § 80.1101(o).

23 40 C.F.R. § 80.1126.

24 42 U.S.C. §§ 7401 et seq.

25 42 U.S.C. §§ 7661a(a), 7661(2).

26 Okla. Admin. Code §252:100-8-2 (definition of “potential to emit”).

27 Okla. Admin. Code § 252:100-7-1.1 (defining “permit exempt facility” as “a facility

that has actual emissions in every calendar year that are 40 tons per year (tpy) or

less of each regulated air pollutant”).

28 See Oklahoma Department of Environmental Quality “Advice for Obtaining ‘Permit

Exempt’ Applicability Determinations,” available at http://www.deq.state.ok.us/aqdnew/resources/PermitExemptAdvice.pdf.

29 Okla. Admin. Code § 252:100-7-2(d).

30 Okla. Admin. Code § 252:100-7-3(a)(1).

31 See Okla. Admin. Code §§ 252:100-1-3, 252:100-8-2, defining “potential to emit”

to include artificial operations limitations if those limitations are legally enforceable.

32 33 U.S.C. §§ 1251 et seq.

33 33 U.S.C. § 1362(6).

34 Such discharges do not constitute a “point source” discharge pursuant to the definition

at 27A Okla. Stat. § 2-6-202.

35 See generally Okla. Admin. Code title 252, chapter 606, subchapter 5.

36 Okla. Admin. Code § 252:606-1-3, incorporating by reference 40 C.F.R. § 122.21(c).

37 Okla. Admin. Code § 252:606-1-3, incorporating by reference 40 C.F.R. §122.26.

38 Id.

39 42 U.S.C. §§ 6901 et seq. Oklahoma’s Solid Waste Management Act is found at 27A

Okla. Stat. § 2-10-101.

40 40 C.F.R. § 261.3.

41 40 C.F.R. § 260.10, 40 C.F.R. Part 262, generally.

42 See “Biodiesel Production Techniques,” OSU Fact Sheet FAPC-150, available at http://www.fapc.okstate.edu/files/factsheets/fapc150.pdf.

43 See Materials Safety Data Sheet for Methanol, available at http://www.methanol.org/pdf/MethanolMSDS.pdf.

Methanol’s Chemical Abstract Number (CAS) is 67-56-1.

44 See Materials Safety Data Sheet for glycerine, available at http://avogadro.chem.iastate.edu/MSDS/glycerine.htm.

The Chemical Abstract Number (CAS) for glycerine is 56-81-5.

45 40 C.F.R. § 261.3(a)(2)(iv). However, if the mixture does not demonstrate a hazardous

characteristic, it may be excluded by virtue of 40 C.F.R. § 261.3(b)(3).

46 27A Okla. Stat. §§1-3-101(E)(5), (7).

47 40 C.F.R. § 112(b).

48 40 C.F.R. §§ 112.1(b), 112.2.

49 40 C.F.R. §§ 112.3, 112.7.

50 40 C.F.R. § 280.12. See also Okla. Admin. Code § 165:25-1-11.

51 42 U.S.C. § 9601(14).

52 Tanks coming under OCC’s jurisdiction are those tanks containing “antifreeze, motor

oil, motor fuel, gasoline, kerosene, diesel or aviation fuel [and] does not include

compressed natural gas.” Okla. Admin. Code § 165:25-1-11. Per 27A Okla. Stat. §§1-3-101(E)(5),

(7), regulated tanks that are not under OCC’s jurisdiction are placed under DEQ jurisdiction.

53 40 C.F.R. Part 280.

54 40 Okla. Stat. §§ 141.1, et. seq.

55 40 Okla. Stat. § 141.2.

56 Okla. Admin. Code § 380:25-3-2.

57 11 Okla. Stat. § 43-101 (cities given authority to enact zoning codes); 19 Okla.

Stat. chapter 19A (zoning limitations on Oklahoma counties).