Energy Development and Its Impact on Farms and Farm Households

Lease and royalty income from oil, gas and wind production has the potential to improve the wellbeing of farm households and farm businesses by contributing to current and future income. It may influence farm management decisions, for example, by providing funds to expand an operation or by providing income to assist the transition of older farmers into retirement. In Oklahoma, oil, gas and wind energy payments are known to impact farms and farm families. When statements are made in an Extension meeting hypothesizing that a lot of Oklahoma farmland has been paid for by royalty income, many heads nod in agreement. The recent uptick in horizontal drilling and hydraulic fracturing and associated royalty payments has contributed to a landscape dotted with new homes. An agricultural lender recently described a scene with a truck selling furniture in a community too small to have a furniture store.

Further anecdotes in the popular press describe how new millionaires in North Dakota use royalty income to buy new tractors, pay off mortgages, establish college funds, pay for special health programs or the occasional vacation. Extension educators in the area have noted an increase in requests for financial planning services, a sign that an individual is likely the recipient of new royalties and experiencing additional income. Negative effects have also been voiced. Residents in oil rich areas claim increasing animosity between royalty recipients and non-recipients while cattle ranchers attribute increased rates of dust pneumonia to the increase of truck traffic (Stone 2008). These anecdotes led to an interest in learning more about what research has been done on the impact of energy on farming. This fact sheet highlights findings on energy industry growth, impacts on rural communities, royalty and associated exploration and development income received by producers and the use of royalty income by producers.

Energy Industry Growth

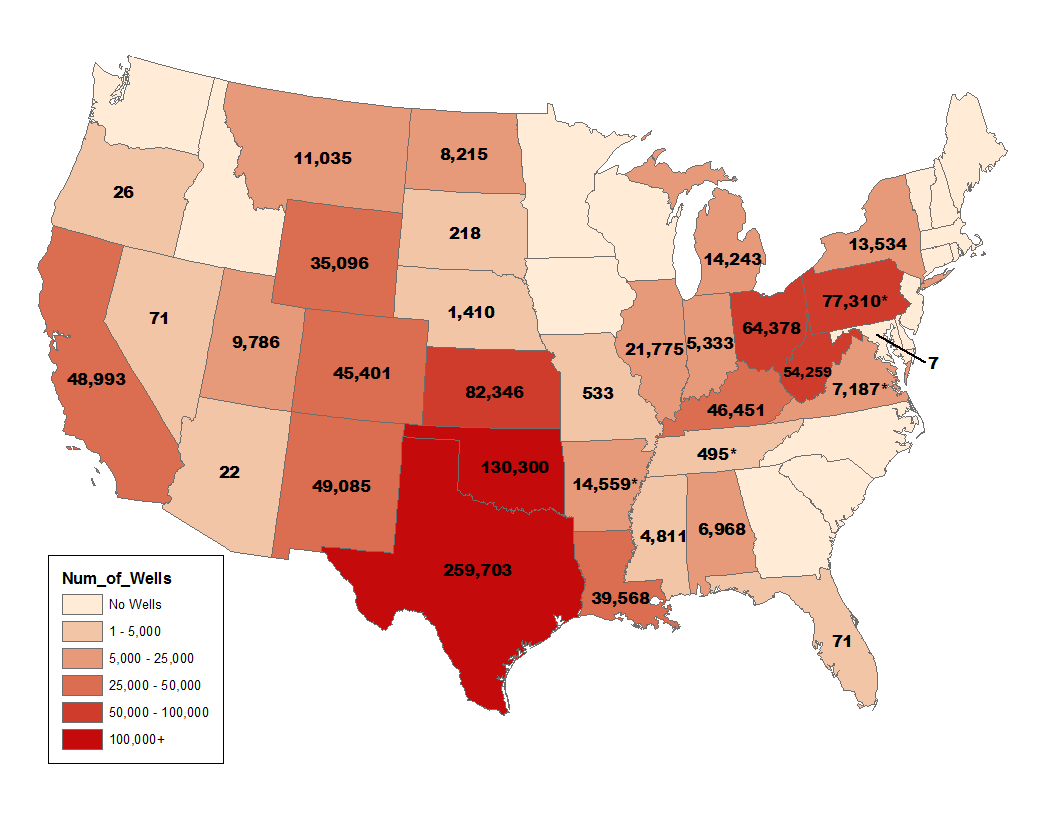

Domestic energy development—extraction of oil and gas, and production of energy from wind—contributes to the rural economy through lease agreement and royalty payments to agricultural producers and other mineral owners. Figure 1 shows the location of producing oil and gas wells in the U.S. Texas, Oklahoma and Kansas host the highest number of wells. The value of energy development in energy rich counties in the U.S. is sizably larger than the value of agricultural production and “is concentrated in the south-central U.S., the western Plains and the Appalachian Mountain region” (Hitaj, Boslett, and Weber 2014). In 2002, the value of energy production was six times greater than the value of agricultural production value. By 2012, the difference had expanded to being 16 times greater (Hitaj, Boslett and Weber 2014).

Figure 1. Producing oil and gas wells in the U.S., including offshore wells, 2010.

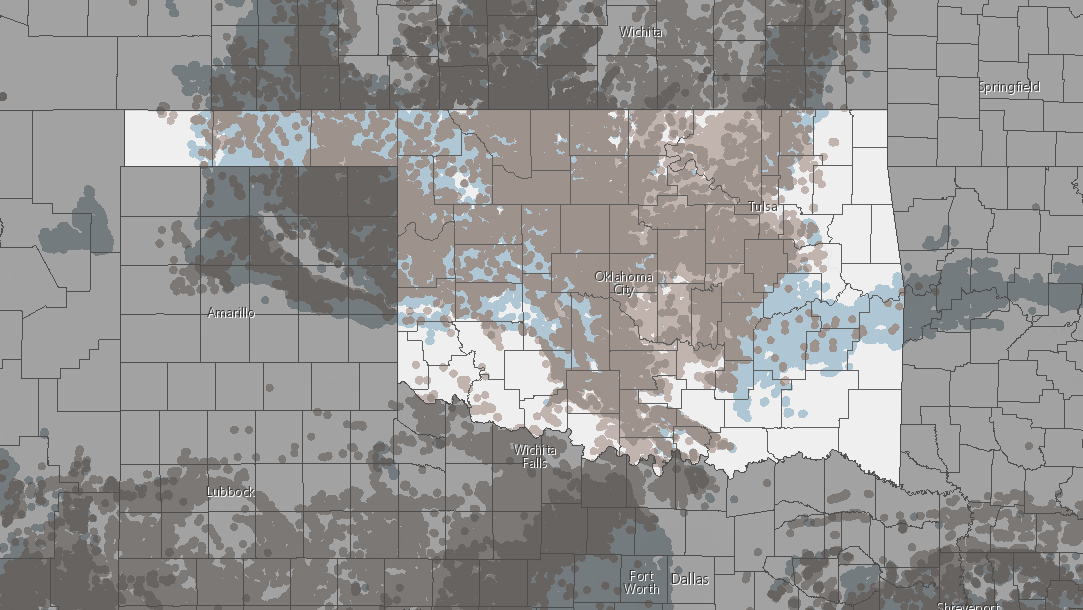

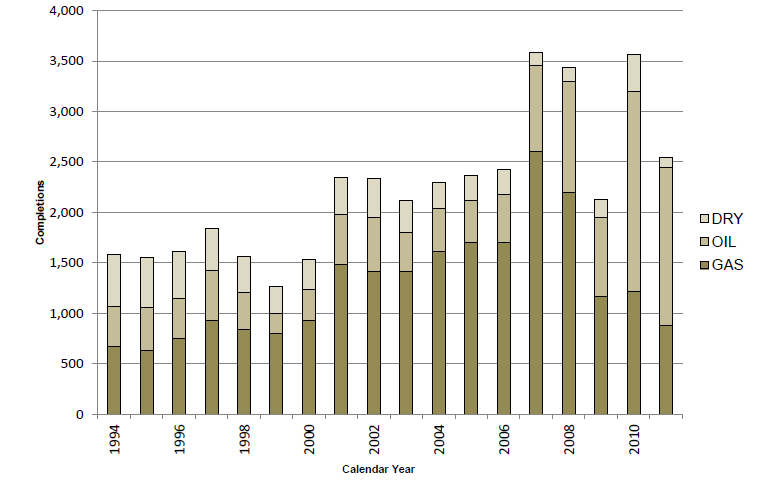

Texas, the country’s top energy producer, produces nearly a fifth of primary energy from coal, natural gas, crude oil, nuclear electric and renewable sources (U.S. Energy Information Administration 2016). The remainder of the top 10 energy producing states include Wyoming, Pennsylvania, Louisiana, West Virginia, Oklahoma, Colorado, Illinois, Kentucky and California. Figure 2 highlights the oil and natural gas wells in Oklahoma. Figure 3 shows well completions by type between 1994 and 2011. However, well location and completions are not necessarily indicative of production in an area.

Figure 2. Oil and Gas Wells in Oklahoma.

Gray: Oil Wells

Blue: Gas Wells

Brown: Oil & Gas Wells

Figure 3. Completions by Well Type, Oklahoma, 1994 – 2011.

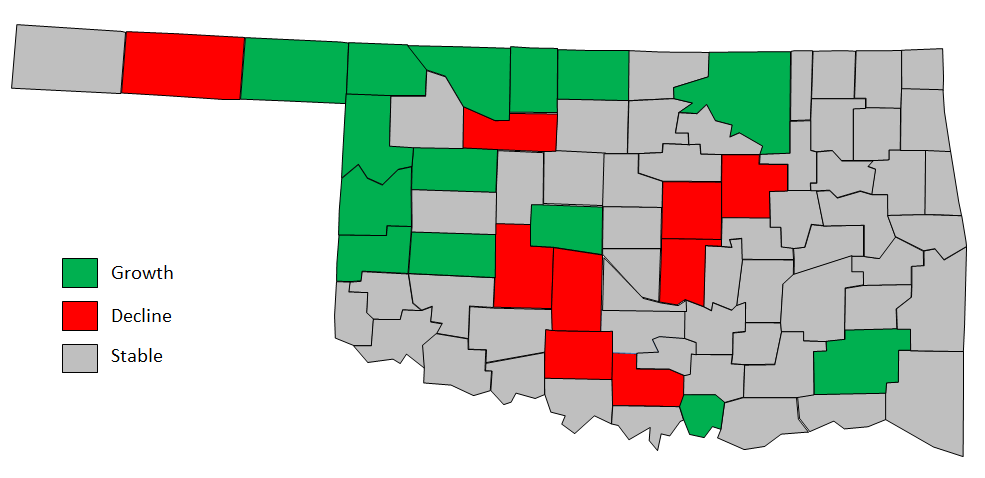

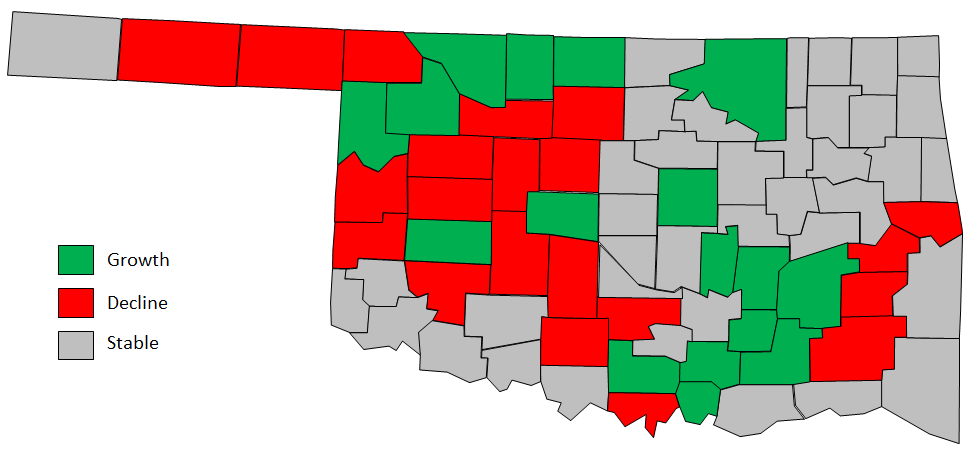

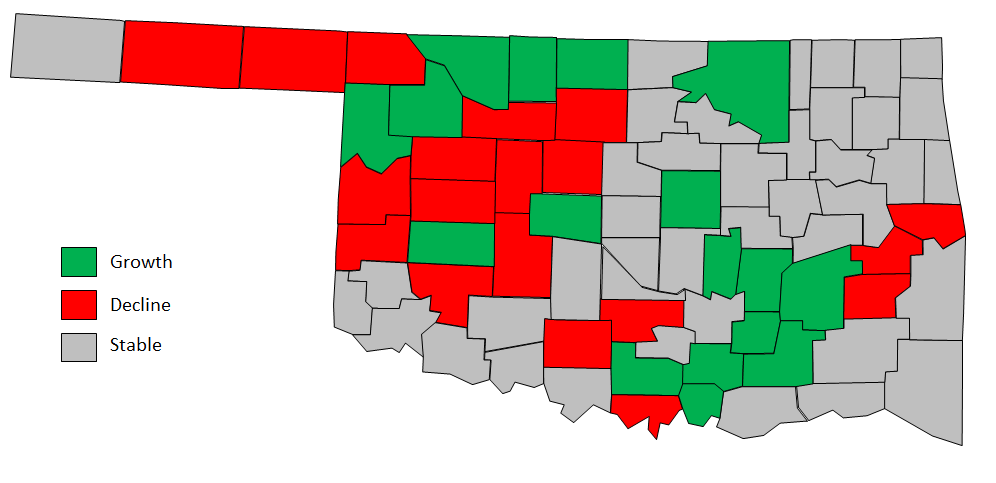

Between 2000 and 2011, 218 counties nationally saw growth in the value of oil and natural gas production of at least $20 million, while 212 counties experienced the opposite effect in decline. During that time period in Oklahoma, 24 counties saw a decline of at least $20 million and 18 counties had an increase of equal value in oil and natural gas production (Hitaj, Boslett and Weber 2014). Figures 4, 5 and 6 highlight growth, decline and stable counties for oil production, natural gas production and oil and gas production combined in Oklahoma. Certainly, recent horizontal drilling and fracturing could contribute to different changes. Documenting recent growth in energy production is complicated because published data may lag several years.

Figure 4. County-level growth, decline and stability of oil production value, 2000-2011 ($USD).

Figure 5. County-level growth, decline and stability of natural gas production value, 2000-2011 ($USD).

Figure 6. County-level growth, decline and stability of oil and natural gas production value, 2000-2011 ($USD).

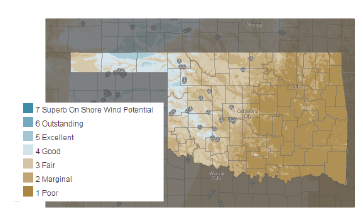

During the first decade of the 21st century, wind turbines emerged as a viable energy source that also provides royalty income to those who lease land for turbines. The first year that Oklahoma registered installed wind capacity production was 2003 and 176 megawatts (MW) was produced, increasing to 2,007 MW in 2011. Wind developers are able to receive financial incentives and tax credits for constructing turbines through state and federal programs. These programs include the USDA-funded Real Energy for America Program grants and loans. Recently, the Oklahoma Legislature ended tax credits related to new job creation and property tax exemptions due to increasing costs for the state budget. The tax credits will end in early 2017, allowing developers to complete current projects. It is unclear how the end of tax incentives will impact future wind development, but it should be noted that Oklahoma currently ranks 4th in the nation for wind power capacity. The Wind Coalition cites more than $6.1 billion has been invested in wind projects in the state between 2004 and 2014 (Monies 2014). Figure 7 shows the location of industrial wind turbines in Oklahoma.

Figure 7. Oklahoma Wind Potential with Locations of Industrial Wind Turbine Projects.

Impacts on Rural Economies

The Federal Reserve Bank of Kansas City regularly conducts research on the impact of oil and natural gas development on rural economies. Each quarter, a survey is conducted to document energy activities and economic well-being of the industry in the Tenth District, which covers Kansas, Colorado, Nebraska, Oklahoma, northern New Mexico and Missouri’s western third. The information and insight gathered by the surveys provide a base for related research, including the impacts of energy development and wealth creation in local and farming economies. Commonly evaluated indicators are employment and the economic strength of secondary industries that rely on demand from energy firms.

Few studies have been conducted on the impact of wind energy on the local economy. A 2004 report by the U.S. Department of Energy (DOE) projected that in the following 20 years, wind energy would attract “$60 billion in capital investment in rural America, provide $1.2 billion in new income for farms and rural landowners and create 80,000 new jobs” (U.S. DOE 2004). Between 2006 and 2010 wind power was responsible for a 35 percent increase in electric power capacity in the U.S. (Brown et al. 2011). A study from the USDA Economic Research Service found a positive $21,604 impact on annual per capita income for each megawatt produced from wind energy development (Brown et al. 2011). Beyond the individual benefits, wind energy projects produce higher property tax revenues because projects require more capital than traditional power plants. In Oklahoma, the Economic Impact Group conducted research with data leading up to 2012 that examined the impact of wind development in the state. Wind project investments generated $42 million in property taxes, which support school districts and municipalities (OCCE 2014). The OCCE study found that $22 million was paid to landowners for wind projects with $15 million for the direct wages of workers.

Royalty Income Received by Producers

The 2004 DOE report estimated a wind lease could produce $14,000 of additional income per year for a 250-acre farm, approximately $56 per acre. Weber, Brown and Pender noted an increase in annual personal income of $11,000 and the addition of 0.5 jobs with each installed megawatt of wind energy (Weber, Brown and Pender, 2013). Leases for wind energy are typically 20 to 25 years with “annual payments ranging between $4,000 to $8,000 per turbine and royalty payments of three to 6 percent of gross revenues” (Weber, Brown and Pender, 2013).

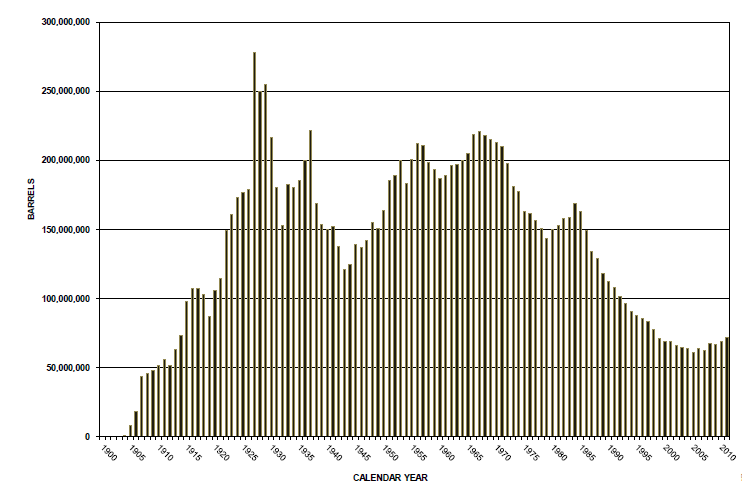

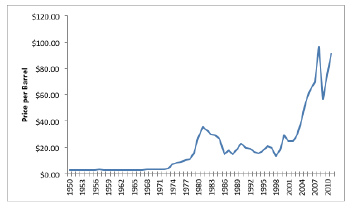

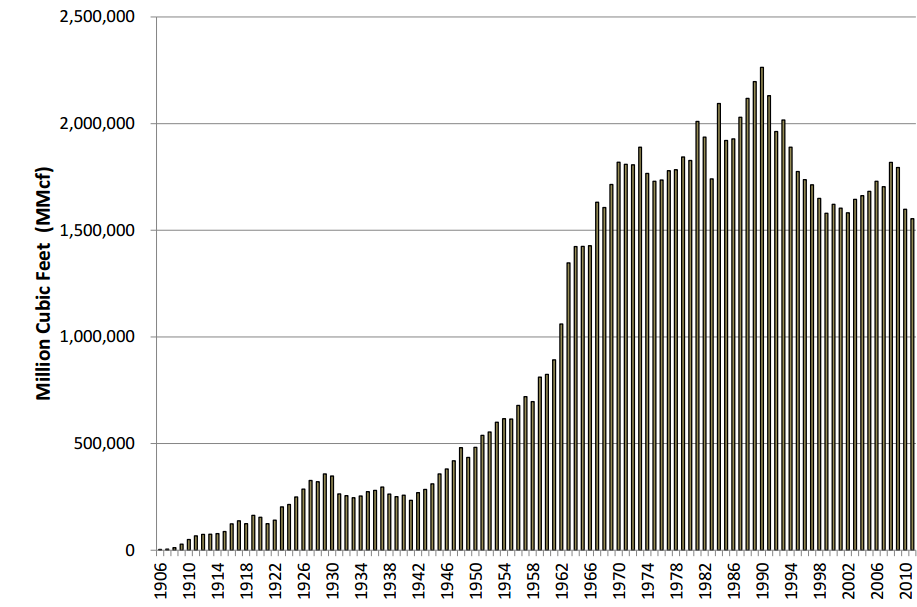

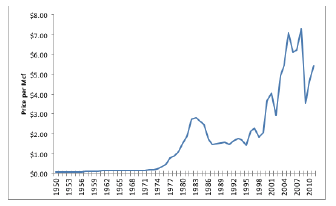

In Oklahoma, mineral rights can be split from the surface land in every county with the exception of Osage county. Income derived from energy production can be subject to production and price risk in the years following well completion. A typical mineral right lease covers three years and often includes an option to renew for an additional two years. Royalty rates are commonly calculated to be 1/5, 3/16 or ¼ of the production value (Mungle 2011). The mineral right owner will first receive a one-time bonus payment when the lease is signed. The royalty rate, which determines subsequent payments, is based on the type of formation and depth of the producing well. Once established, the well’s production begins to decrease with time, often by 60 percent in the first 18 months (Mungle 2011). Since royalty payments are tied to production, a mineral right owner can see a decline in payments with a decrease in production. Likewise, royalty payments are often tied to oil or gas prices meaning royalty payments will decrease with a decline in the commodity prices of oil and natural gas. Royalties associated with wind energy differ due to the consistency of the renewable energy source and are less likely to decline through time. Once production is underway, producers must consider fluctuating energy prices affecting the value of their mineral and wind rights. Figures 8 and 9 show oil production and prices in Oklahoma and Figures 10 and 11 highlight production and prices of natural gas.

Figure 8. Oklahoma oil production, 1900 – 2011.

Figure 9. Oklahoma average annual oil price, 1950 – 2011.

Figure 10. Oklahoma natural gas production, 1906– 2011.

Figure 11. Oklahoma average annual natural gas prices, 1950 – 2011.

In the farm sector overall, royalty receipts are not a large source of income. The USDA’s Economic Research Service introduced a question concerning income from energy royalties or leases in the 2011 Agricultural Resource Management Survey (ARMS). In 2011, the median energy payment for farms receiving payments was $7,000 and a quarter of farms receiving payments were paid at least $25,000 (Weber, Brown and Pender 2013). In comparison, federal payments for agricultural programs annually averaged $11.8 billion between 2008 and 2011. The median federal payment amount was significantly lower than energy payments (Weber, Brown and Pender, 2013). In 2012, approximately 3 percent of all U.S. farms received energy payments, with an average payment of $27,456 on farms receiving payments (Williamson and Doye 2015). Total royalty income was about 3 percent of the $52.8 billion total farm income to the operator. As a percentage of farm household total income from all sources, royalties represented less than 1 percent.

2013 ARMS data show:

- Farms receiving royalty income were larger than farms without royalty income as measured by average gross value of sales, acreage, farm income and net worth. Farm size may be correlated with geographic location as farm size in western and southern states with relatively more oil/gas are larger.

- More than 40 percent of the farms receiving royalties specialized in beef cattle (43 percent). The next largest group was farms with field crops (27 percent).

- More farms with royalty income received government payments and the average payment was higher. Again, this may be linked with location as a greater percentage of farms with royalty income specialize in major field crops. However, the difference in percentage of farms specializing in beef production was even greater. This would be expected to contribute to lower average government payments in years without government payments related to drought and loss of forage.

- For farms with royalty income, a greater percentage of the principal operators indicated their major occupation was farm or ranch work (54 percent), with 33 percent noting work other than farming/ranching and 13 percent currently not in the work force.

- Government payment funds of 8.9 percent, averaging $20,517, went to producers who also received energy royalties, with the average government payment almost two times greater than payments made to producers without energy royalties.

- A greater percentage of operators age 65 and older have royalty income (41 percent).

- Not surprisingly, few operators younger than 35 years old and beginning farmers receive royalty income (less than 1 percent and 3 percent, respectively). Over time, this might be expected to decrease further as royalty rights, excluding wind farms, are increasingly separated from farmland.

- Farms with royalty income have higher average farm incomes, non-farm incomes and thus, total income. Household expenditures are only slightly higher on farms receiving royalty income. Capital expenses however are significantly higher.

- Farms with royalty income also had a significantly higher farm net worth on average ($1,534,366) than those not receiving royalties. Net worth (farm, non-farm and total) are higher on farms receiving royalty income.

- Interestingly, farm debt is higher on average for farms with royalty income, while personal debt is lower. A greater percentage of farms with royalty income have farm debt, but a lower percentage have non-farm and personal debt.

Table 1 summarizes differences in the top 10 well-producing states between recipients of energy royalties and non-recipients for the U.S. in 2013.

Table 1. Characteristics of principal farm operator households, by royalty receipt, 2013, with comparison for top 10 well states.

| Item | Farms not receiving royalty or lease income | Farms receiving royalty or lease income | All Farms | Farms receiving royalty or lease income, top 10 oil well states |

|---|---|---|---|---|

| Number of family farms | 1,976,027 | 68,466 | 2,044,493 | 48,219 |

| Percent of family farms | 97 | 3 | 100 | |

| Gross vales of sales (GVS) | 163,451 | 292,913 | 167,787 | 260,490 |

| Percent of total value of production | 94 | 6 | 100 | |

| Distribution by GVS | ||||

| Less than $10,000 | 57 | 31 | 56 | 31 |

| $10,000 to $249,999 | 32 | 45 | 32 | 48 |

| $250,000 or more | 11 | 24 | 12 | 21 |

| Farm size (mean operated acres) | 361 | 1,965 | 415 | 2,249 |

| Farm size (median operated acres) | 85 | 360 | 90 | 345 |

| Percent of acres | 84 | 16 | 100 | |

| Farms receiving government payments | 634,939 | 34,150 | 669,088 | 20,645 |

| Percent of farms within group receiving payments | 32 | 50 | 33 | 43 |

| Average gov. payment (all farms) | 3,651 | 10,234 | 3,872 | 8,312 |

| Average gov. payment (payment farms) | 11,363 | 20,517 | 11,830 | 19,413 |

| Major occupation of principal operator | ||||

| Farm or ranch work | 46 | 54 | 47 | 53 |

| Work other than farming/ranching | 40 | 33 | 39 | 32 |

| Currently not in the workforce | 14 | 13 | 14 | 15 |

| Age of principal Operator | ||||

| Less than 35 years old | 4 | 1 | 4 | 1 |

| 35-54 years old | 26 | 31 | 26 | 31 |

| 55-64 years old | 36 | 28 | 36 | 25 |

| 65 years old or more | 34 | 41 | 34 | 43 |

| Mean age of principal | 59 | 61 | 59 | 61 |

| Experience of operators farming | ||||

| Established farm | 82 | 97 | 83 | 98 |

| Beginning farm | 18 | 3 | 17 | 2 |

| Farm location | ||||

| Northeast | 6 | 9 | 7 | 12 |

| Midwest | 37 | 36 | 37 | 27 |

| South | 42 | 48 | 42 | 56 |

| West | 15 | 8 | 15 | 4 |

| Farm income, average | 25,694 | 79,195 | 27,486 | 72,489 |

| Off-farm income, average | 90,078 | 103,650 | 90,533 | 106,246 |

| Oil and gas royalty revenue, average | - | 55,583 | 1,861 | 70,411 |

| New worth, mean | 1,273,601 | 2,273,255 | 1,307,078 | 2,219,587 |

| New worth, median | 783,952 | 1,395,280 | 801,980 | 1,383,737 |

| Farm net worth, mean | 841,161 | 1,534,366 | 864,376 | 1,384,390 |

| Farm net worth, median | 396,977 | 901,626 | 406,321 | 821,480 |

| Farm debt, mean | 66,177 | 116,945 | 67,826 | 114,418 |

| Non farm debt, mean | 27,500 | 4,500 | 26,250 | 57,511 |

| Personal debt, mean | 6,874 | 3,319 | 6,748 | 3,481 |

| Percent of farms with farm debt | 27 | 34 | 27 | 33 |

| Percent of farms with nonfarm debt | 63 | 55 | 63 | 56 |

| Percent of farms with personal debt | 54 | 44 | 53 | 43 |

| Personal debt as a share of nonfarm debt | 11 | 8 | 11 | 8 |

| Specialization of operation | ||||

| Major field crops: Grains, oilseeds, tobacco, cotton | 16 | 20 | 16 | 18 |

| High value crops--Fruit, nut, veg, nursery | 8 | 2 | 7 | 5 |

| General and other crops | 26 | 16 | 25 | 13 |

| Beef cattle | 32 | 48 | 32 | 53 |

| Hogs and Poultry | 4 | 1 | 4 | 3 |

| Dairy | 2 | 4 | 2 | 4 |

| General and other livestock | 13 | 9 | 13 | 4 |

Source: 2013 USDA NASS/ERS Agricultural Resource Management Survey

Other Income to Producers Related to Energy Development

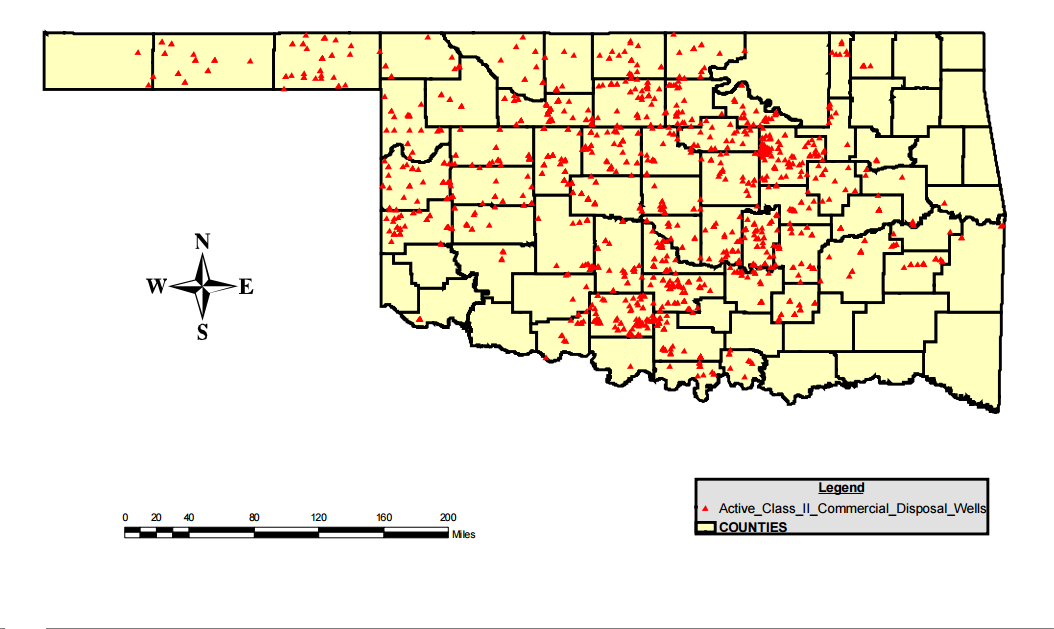

In addition to royalty payments, a farmer can be compensated for saltwater injection well sites, pipeline right-of-ways and well mud applications. Injection wells are used to dispose of brine and other liquids that are a by-product of hydraulic fracturing. Landowners who lease their land for injection sites can expect to earn a monthly payment based on the number of barrels of fluid injected into the site. In some cases, an injection well can be as–or more–profitable than an extraction well. Figure 12 details the location of commercial injection sites, which are classified as Class II wells by the OCC.

Figure 12. Oklahoma injection well sites, 2013.

Pipeline right-of-ways can generate a one-time payment for landowners. Payments can range from $50 to $150 per pipeline rod (Mungle 2011). Drilling mud applications also can offer financial incentives to landowners, but can pose a land management risk. Applications are regulated due to the chemical contents, which can adversely affect the soil health. An additional opportunity for farmers to earn diversified income from local oil and gas development is providing farm equipment and heavy machinery for nearby well sites. Once a well site is completed, it can cost an energy company $12 to $14 million and landowners can receive a one-time payment for providing a well site location (Mungle 2011). Payments can range between $25,000 and $125,000, and sites can be as large as five acres with multiple wells (Mungle 2011). The one-time payment is considered the bonus payment. Royalty payments are issued over the lifetime of the well and are based on production.

Use of Royalty Income by Producers

Although little is known about the direct effects of energy payments on management decisions of farmers and ranchers, Weber, Brown and Pender (2013) analyzed how much of each energy payment was consumed, and whether payments were associated with greater farm investment and higher land values. With the risk associated with energy production, producers perceive royalty income as moderately stable (Weber, Brown and Pender, 2013). Additional spending related to energy income falls between the lower consumption expenditures of farm income (0.7 cents) and the higher consumption expenditures of off-farm income, which is an increase of 5.9 cents for each dollar. For each dollar of energy royalties, spending increases 4.2 cents (Weber, Brown and Pender, 2013). In comparison, previous studies have found that farm “households consumed 10 cents of every dollar of off-farm income but only one cent of every dollar in net farm income” (Weber, Brown and Pender, 2013). Even though there is an identifiable increase of spending related to energy payments, the effect of energy consumption on household consumption remains statistically insignificant. In cases allowing landowners to establish an off-take agreement on gas production for personal use, the wealth effect is confounded due to the decreased energy spending in the household.

Agricultural Land Values

The effect of energy payments extends beyond farm household consumption and includes effects on land values. Land with attached mineral rights can sell for double or triple the cost of surface-only land (Mungle 2011). Weber, Brown and Pender found the value of an acre increases $2.60 for each dollar in energy payments from oil and/or natural gas activities. Interpretation of the relationship between energy and land values can become complicated due to the variance in land quality for agricultural production, the presence of nearby farms not receiving energy payments and the desirability of land with well pads. Often, surface land owners cannot regulate the location of well pads, which can potentially have negative consequences on the accessibility and efficiency for agricultural activities. Well pads vary in size and can affect the overall desirability of land and options to utilize the well pad after production has ceased.

In April 2014, Low, Walsh and Weber (2014) identified counties with increases and decreases of at least $20 million in oil and natural gas production and classified them in growth, decline or stable categories. To analyze whether recent land value increases in Oklahoma might be correlated with increases in oil and gas production, the average increase in land value from 2001 to 2011 was compared for counties experiencing significant growth in the value of production of oil, natural gas and combination of oil and natural gas to those with stable or declining levels of production. Average land value data used is featured on www.agecon.okstate.edu/oklandvalues. Initial comparisons show little evidence that agricultural land values increased at faster rates in counties with higher growth in oil, natural gas or oil/natural gas production (Table 2). Land values between 2000 and 2011 increased on average 125 percent. The largest increase in land values occurred in counties that experienced an increase of at least $20 million in oil production. On average, land values increased 142 percent in these 14 counties; however, counties with a decline of at least $20 million in oil production had land value increases of 127 percent and land values increased 113 percent on average in counties with stable oil production levels. Counties with either growth or decline in natural gas production have seen an average increase in land values of 137 percent and 133 percent, respectively, with stable counties seeing a land value growth of 106 percent. During this time period, oil production was at historic lows and gas production was also low compared to recent decades in Oklahoma.

Table 2. Average percentage change of average value per acre of rural and urban counties in Oklahoma, 2001-2011.

Table 2A. Oil

| County Type | Growth, ≥$20 mil | Decline, ≥$20 mil | Stable, +/- $20 mil |

|---|---|---|---|

| Rural | 154.2% | 133.0% | 126.5% |

| Urban | 69.0% | 116.7% | 70.6% |

| Total | 142.0% | 127.0% | 113.0% |

Table 2B. Natural Gas

| County Type | Growth, ≥$20 mil | Decline, ≥$20 mil | Stable, +/- $20 mil |

|---|---|---|---|

| Rural | 148.6% | 138.6% | 120.0% |

| Urban | 83% | 78.5% | 76.9% |

| Total | 137.0% | 132.8% | 105.7% |

Table 2C. Oil & Natural Gas Combined

| County Type | Growth, ≥$20 mil | Decline, ≥$20 mil | Stable, +/- $20 mil |

|---|---|---|---|

| Rural | 148.6% | 138.6% | 120.0% |

| Urban | 83% | 78.5% | 76.9% |

| Total | 137.0% | 132.8% | 105.7% |

Source: Authors’ calculations using USDA ERS growth, decline or stable categories (Low, Walsh, and Weber 2014) and Oklahoma average land value data (www.agecon.okstate.edu/oklandvalues).

To examine possible metro influences, the counties were grouped as either rural or urban according to USDA ERS specifications. The urban influence code has 12 levels and 18 counties in Oklahoma qualify as metropolitan counties with a small metro area (Parker 2013). Interestingly, the average percentage change of the average per acre agricultural land value was significantly higher in rural counties than urban counties. For rural counties, the stable production areas had the lowest average increase in land value; for urban counties, the pattern is mixed for oil, natural gas and oil/natural gas combined.

Summary and Conclusions

The energy sector boom in recent years has impacted farmers and rural communities. Farmers must adjust to growth, stabilization and decline of energy production with time. Also, communities face the implied economic, social and environmental effects on agricultural producers along with broader employment, spending and income impacts. Energy industry growth does not necessarily translate into growth in royalty income for farmers. Mineral rights may have been separated from the land and sold by the farmer or by a previous owner of the land. Not all farmers and ranchers own the land they operate. While USDA Agricultural Resource Management data offers insight into the characteristics of agricultural operations receiving energy payments at different points in time, it does not capture the impact on individual operators as energy production increases or declines in a region.

References

Brown, J.P., Hoen, B., Lantz, E., Wiser, R. 2011. Economics Impacts of Wind Turbine Development in U.S. Counties. Washington DC: U.S. Department of Agriculture, ERS.

Corporation Commission of Oklahoma. 2014. “Inquiry of the Oklahoma Corporation Commission to Identify and Resolve Issues Related to the Development and Use of Wind Energy.” Oklahoma City, August 26, 2014.

http://www.occeweb.com/pu/NOI2014-232/1sttech/THeWindCoalition.pdf

Fitzgerald, T. 2014. “Importance of Mineral Rights and Royalty Interests for Rural Residents and Landowners.” Choices. http://www.choicesmagazine.org/choices-magazine/theme-articles/is-the-natural-gas-revolution-all-its-fracked-up-to-be-for-local-economies/importance-of-mineral-rights-and-royalty-interests-for-rural-residents-and-landowners. 4th Quarter.

Hitaj, C., Boslett, A., Weber, J. 2014. “Shale Development and Agriculture”. Choices. http://www.choicesmagazine.org/choices-magazine/theme-articles/is-the-natural-gas-revolution-all-its-fracked-up-to-be-for-local-economies/shale-development-and-agriculture. 4th Quarter.

Kirkpatrick, J. 2013. “Retired Farmers – An Elusive Concept”. Choices. http://www.choicesmagazine.org/choices-magazine/theme-articles/transitions-in-agriculture/retired-farmer–an-elusive-concept. 2nd Quarter.

Low, S.A, Walsh, N., Weber, J. 2014. “County-level onshore oil and natural gas production in the lower 48 States, 2000-11”. Washington DC: U.S. Department of Agriculture, ERS for Agr. Econ. Rep. 8, April.

Lord, C. 2013. “Oklahoma Class II Commercial Disposal Wells Map”. Oklahoma Corporation Commission.

Monies, P., 2014. “Oklahoma wind farm opponents tally state incentives for wind developers.” The Oklahoman. http://newsok.com/oklahoma-wind-farm-opponents-tally-state-incentives-for-wind-developers/article/4248012/?page=2

Mungle, M. Farmers Royalty Company President. Personal Communication. August 19, 2015.

Oklahoma Corporation Commission. 2011. 2011 Report on Oil and Natural Gas Activity Within the State of Oklahoma. Oklahoma City.

Parker, T. “Urban Influence Codes.” Washington DC: U.S. Department of Agriculture, Economic Research Service. http://www.ers.usda.gov/data-products/urban-influence-codes/documentation.aspx. Accessed March 2, 2016.

Stone, A. 2008. “Oil boom creates millionaires and animosity in North Dakota.” USA Today. http://abcnews.go.com/Business/story?id=5768171&page=1&singlePage=true. September 9, 2008.

U.S. Department of Energy. 2004. Wind Energy for Rural Economic Development. Washington DC, August. http://www.nrel.gov/docs/fy04osti/33590.pdf

U.S. Energy Information Administration, U.S. Department of Energy. 2014. Annual Energy Outlook 2014 with projections to 2040. DOE/EIA-0383. April 2014.

U.S. Energy Information Administration, U.S. Department of Energy. 2016. “State Profiles and Energy Estimates.” http://www.eia.gov/state/. Accessed March 2, 2016.

Weber, J., J. Brown and J. Pender. 2013. “Rural Wealth Creation and Emerging Energy Industries: Lease and Royalty Payments to Farm Households and Businesses.” The Federal Reserve Bank of Kansas City. Research Working Paper RWP 13-07. June.

Williamson. J. and D. Doye. 2015. “The Contribution of Energy Extraction Activities to Farm Household Wellbeing: Oil, Gas and Wind Lease and Royalty Income.” Selected Poster. Agricultural and Applied Economics Association Annual Meeting. San Francisco, California. July 26-28.

Source: Authors’ calculations using USDA ERS growth, decline or stable categories (Low, Walsh, and Weber 2014) and Oklahoma average land value data (www.agecon.okstate.edu/oklandvalues).

Anna Stehle

Graduate Student

Damona Doye

Rainbolt Chair of Agricultural Finance and Regents Professor

James Williamson

USDA Economic Research Service