Oklahoma Pasture Rental Rates: 2018-19

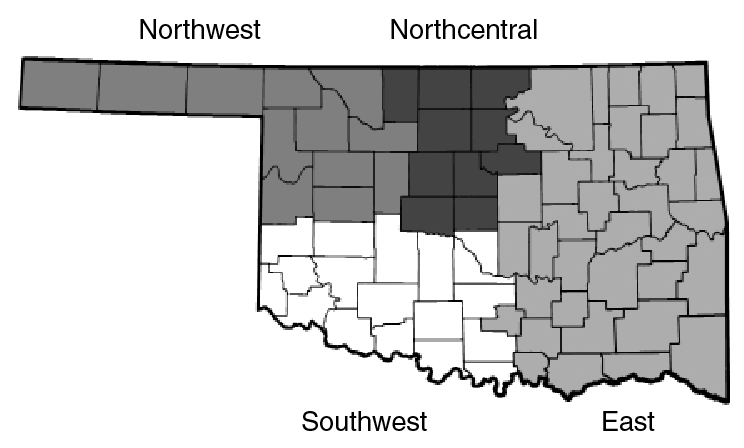

Rental agreements and rates are influenced by the landowner’s costs, the tenant’s expected earnings, previous rates charged, competition for the land, government programs, tax laws and the non-agricultural economy. The results of a statewide farmland leasing survey conducted in 2018 are reported here. Respondents were recipients of a survey mailing by the Oklahoma Agricultural Statistics Service. Approximately 410 surveys were returned with useable data. Figure 1 shows regions of the state used in reporting survey results: northwest, southwest, northcentral and east.

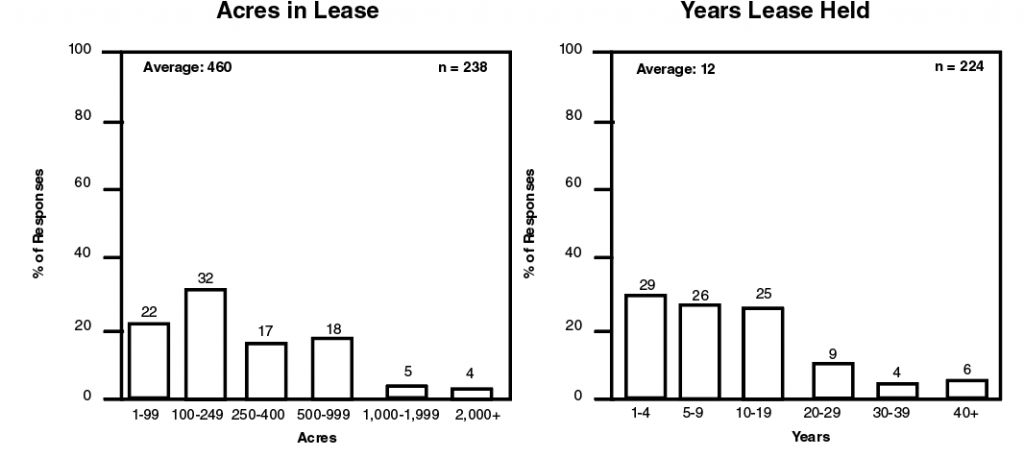

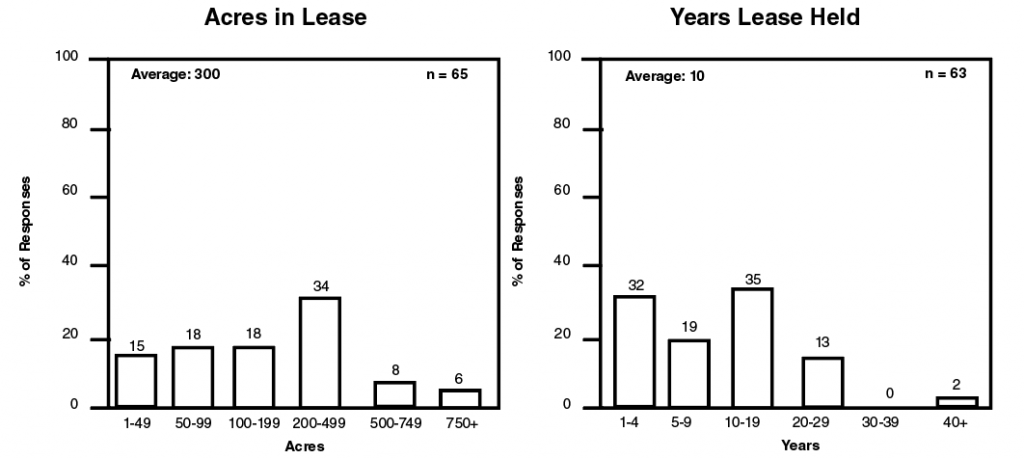

On average, rental agreements for native pasture had been in effect for 12 years,

10 years for Bermudagrass and 12 years for other pasture (Table 1). The statewide

average lease size was 460 acres for native pasture, 300 acres for Bermudagrass and

515 acres for other pasture. Median values are provided as an additional measure of

the central tendency of the survey response distribution. The median is the value

at the midpoint of the survey responses. Survey results document some regional differences

in years held and average sizes of tracts rented. Figures 1a and 1b show the distribution

of statewide responses regarding acres and the years held for native and Bermudagrass

pasture leases, respectively. Stocking rates and the length of the grazing season

are also shown in Table 1 for cows with spring calves.

Most tenants and landlords in Oklahoma appear to be satisfied with their lease agreements.

About 67 percent of the respondents classified their leasing agreements as good or

excellent from the standpoint of fairness with an additional 20 percent classifying

their agreements as adequate. These levels of satisfaction have remained steady over

the past several years.

Figure 1. Regions Used in Reporting Farmland Leasing Survey Results.

Table 1. Rental Statistics for Pasture, 2018-2019.

| Native Pasture Northwest |

Native Pasture Southwest |

Native Pasture North Central |

Native Pasture East |

||

|---|---|---|---|---|---|

| Acres in Lease | |||||

| Number of Observations | 63 | 39 | 70 | 66 | |

| Average | 504 | 470 | 369 | 507 | |

| Median1 | 320 | - | 200 | 170 | |

| Average Years Lease Held | |||||

| Number of Observations | 60 | 36 | 65 | 63 | |

| Average | 14 | 10 | 11 | 11 | |

| Median1 | 10 | 6 | 7 | 8 | |

| Cows with Spring Calves | |||||

| Stocking Rate (Acres/hd) | |||||

| No. of Observations | 16 | 6 | 16 | - | |

| Average | 13.3 | 8.1 | 8.1 | - | |

| Median1 | 11 | 7 | 8 | - | |

| Grazing Season (Months) | |||||

| No. of Observations | 23 | 9 | 19 | 7 | |

| Average | 8.7 | 8.3 | 6.9 | 10.3 | |

| Median1 | 8 | - | 6 | 12 | |

| Native Pasture State |

Bermuda Southwest |

Bermuda North Central |

||

|---|---|---|---|---|

| Acres in Lease | ||||

| Number of Observations | 238 | 12 | 18 | |

| Average | 460 | 321 | 385 | |

| Median1 | 200 | 165 | 235 | |

| Average Years Lease Held | ||||

| Number of Observations | 224 | 10 | 18 | |

| Average | 12 | 10 | 12 | |

| Median1 | 7 | 9 | 10 | |

| Cows with Spring Calves | ||||

| Stocking Rate (Acres/hd) | ||||

| No. of Observations | 40 | - | 5 | |

| Average | 9.9 | - | 6.2 | |

| Median1 | 10 | - | 5 | |

| Grazing Season (Months) | ||||

| No. of Observations | 58 | 4 | 6 | |

| Average | 8.3 | 8 | 8.6 | |

| Median1 | 7.8 | 7.5 | 7.5 | |

| Bermuda East |

Bermuda State |

Other Pasture Northwest |

||

|---|---|---|---|---|

| Acres in Lease | ||||

| Number of Observations | 30 | 65 | 11 | |

| Average | 256 | 300 | 316 | |

| Median1 | 169 | - | 160 | |

| Average Years Lease Held | ||||

| Number of Observations | 30 | 63 | 12 | |

| Average | 9 | 10 | 15 | |

| Median1 | 9 | - | 6 | |

| Cows with Spring Calves | ||||

| Stocking Rate (Acres/hd) | ||||

| No. of Observations | 6 | 14 | - | |

| Average | 4.7 | 5.6 | - | |

| Median1 | 5 | 5 | - | |

| Grazing Season (Months) | ||||

| No. of Observations | 8 | 20 | - | |

| Average | 8.6 | 8.5 | - | |

| Median1 | 8 | 8 | - | |

| Other Pasture North Central |

Other Pasture East2 |

Other Pasture State |

||

|---|---|---|---|---|

| Acres in Lease | ||||

| Number of Observations | 11 | 32 | 60 | |

| Average | 446 | 668 | 515 | |

| Median1 | - | 236 | 200 | |

| Average Years Lease Held | ||||

| Number of Observations | 11 | 27 | 55 | |

| Average | 11 | 8 | 12 | |

| Median1 | 10 | 5 | 7 | |

| Cows with Spring Calves | ||||

| Stocking Rate (Acres/hd) | ||||

| No. of Observations | - | - | 7 | |

| Average | - | - | 4 | |

| Median1 | - | - | - | |

| Grazing Season (Months) | ||||

| No. of Observations | - | - | 12 | |

| Average | - | - | 7.2 | |

| Median1 | - | - | 8 | |

- Insufficient observations.

1 Median values that represent single observations are omitted.

2 Predominantly Fescue.

Figure 1a. Relative Frequency for Rental Statistics for Native Pasture, 2018-2019.

Figure 1b. Relative Frequency for Rental Statistics for Bermudagrass, 2018-2019.

Pasture Rental Rates

Common methods of renting pasture include:

- rate per acre,

- fixed rate per hundredweight per month,

- flat rate per pound of gain or

- share of gain or profit.

In addition to factors previously mentioned — the landowner’s costs, the livestock owner’s expected earnings and previous rates charged, etc. — the kind and quality of pasture, fences, location and water also influence the pasture rental rate. Negotiations determine the type of agreement and the relative weight given to different factors.

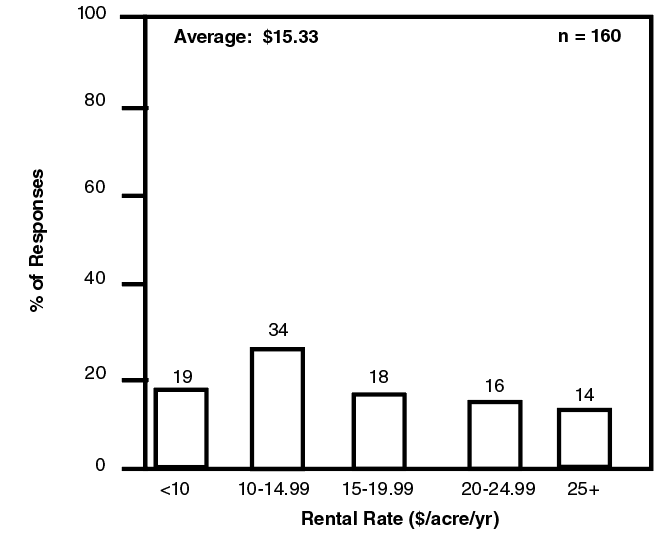

Rental rates for native, Bermudagrass and other pasture are listed in Table 2. With

regards to native pasture, the state average rental rate of $15.33 per acre increased

more than $1 per acre compared to the 2016 rate of $13.95. Native pasture rental rates

were lowest in northwest Oklahoma at $11.61 per acre and highest in eastern Oklahoma

at $17.97 per acre. Figure 2a shows the distribution of per acre rates reported for

native pasture in Oklahoma.

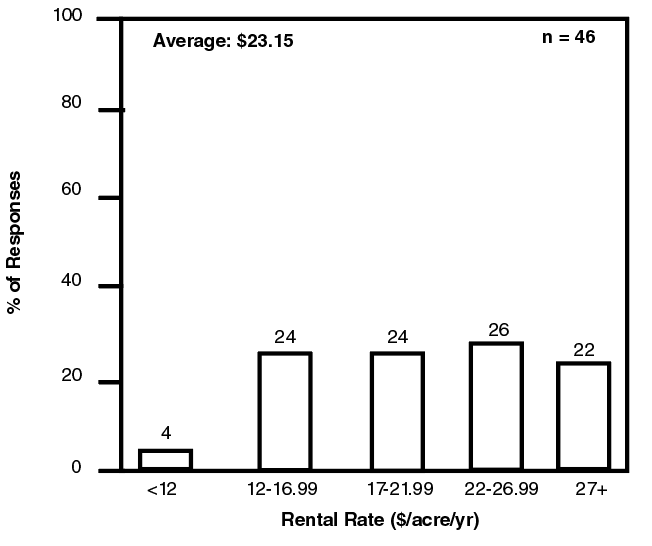

The state average rental rate for Bermudagrass pasture was $23.15 per acre, up just

marginally from $22.79 reported from the previous survey. Figure 2b shows the distribution

of per acre rates reported for Bermudagrass pasture in Oklahoma. Unfortunately, pasture

rental rates for stockers on small grain winter grazing are not available due to an

insufficient number of reports.

Table 2. Cash Rental Rates for Pastures, 2018-2019.

| $/acre/year | Native Pasture Northwest |

Native Pasture Southwest |

Native Pasture North Central |

Native Pasture East |

|---|---|---|---|---|

| Number of Observations | 48 | 23 | 46 | 43 |

| Average | 11.61 | 15.32 | 16.76 | 17.97 |

| Median1 | 10 | 15 | 15 | 15 |

| $/acre/year | Native Pasture State |

Bermuda Southwest |

Bermuda North Central |

|---|---|---|---|

| Number of Observations | 160 | 6 | 11 |

| Average | 15.33 | 21.15 | 25.22 |

| Median1 | 13.31 | 22.19 | 20 |

| $/acre/year | Bermuda East |

Bermuda State |

Other Pasture Northwest |

|---|---|---|---|

| Number of Observations | 25 | 46 | 10 |

| Average | 22.85 | 23.15 | 14.43 |

| Median1 | 20 | 20 | 14 |

| $/acre/year | Other Pasture North Central |

Other Pasture East2 |

Other Pasture State |

|---|---|---|---|

| Number of Observations | 5 | 21 | 43 |

| Average | 20.4 | 26.82 | 22.27 |

| Median1 | 20 | 25 | 20 |

- Insufficient observations.

1 Median values that represent single observations are omitted.

2 Predominantly Fescue.

Figure 2a. Relative Frequency of Responses for Native Pasture Rental Rates.

Figure 2b. Relative Frequency of Responses for Bermuda Pasture Rental Rates.

Pasture lease agreements may assign responsibility for checking livestock, providing salt and minerals or supplemental feed or pasture and repairing fence to the tenant or landlord or both. Table 3 summarizes the distribution of survey responses by type of pasture: small grain winter grazing, small grain grazeout and other pasture (includes native, Bermudagrass and other improved pasture). Generally, the livestock owner was responsible for most of the terms of the pasture lease, although there are opportunities for sharing by both parties. With the winter grazing leases, more responsibilities were reported to be assumed by the livestock owner as compared to the 2016 survey.

Table 3. Responsibility of Parties in Pasture Lease Agreements, 2018-19 (percent of responses).*

| Pasture Producer | Livestock Owner (percent) |

Both | No. Obs. | |

|---|---|---|---|---|

| Checking livestock | 4 | 88 | 8 | 26 |

| Salt and minerals | 4 | 88 | 8 | 26 |

| Fencing materials | 31 | 65 | 4 | 26 |

| Fencing labor | 12 | 80 | 8 | 25 |

| Fertilizer cost | 28 | 60 | 12 | 25 |

| Supplemental feeding | 4 | 88 | 8 | 26 |

| Supplemental pasture | 4 | 87 | 9 | 23 |

| Water | 20 | 68 | 12 | 25 |

| Death loss | 8 | 85 | 8 | 26 |

| Pasture Producer | Livestock Owner (percent) |

Both | No. Obs. | |

|---|---|---|---|---|

| Checking livestock | 26 | 63 | 11 | 46 |

| Salt and minerals | 20 | 69 | 11 | 45 |

| Fencing materials | 48 | 39 | 13 | 46 |

| Fencing labor | 36 | 48 | 16 | 44 |

| Fertilizer cost | 33 | 48 | 20 | 46 |

| Supplemental feeding | 20 | 67 | 13 | 46 |

| Supplemental pasture | 15 | 67 | 18 | 39 |

| Water | 37 | 46 | 17 | 46 |

| Death loss | 16 | 76 | 9 | 45 |

| Pasture Producer | Livestock Owner (percent) |

Both | No. Obs. | |

|---|---|---|---|---|

| Checking livestock | 14 | 80 | 6 | 315 |

| Salt and minerals | 14 | 82 | 5 | 310 |

| Fencing materials | 31 | 59 | 10 | 312 |

| Fencing labor | 22 | 67 | 11 | 312 |

| Fertilizer cost | 17 | 75 | 7 | 315 |

| Supplemental feeding | 12 | 83 | 5 | 310 |

| Supplemental pasture | 14 | 80 | 6 | 292 |

| Water | 27 | 64 | 9 | 308 |

| Death loss | 12 | 83 | 6 | 303 |

* Totals may not add to 100 due to rounding.

Other Lease Terms

Many lease agreements specify terms and conditions beyond the rental rate, which affect the value of the lease and the “real” rental rate. Tenants may or may not be allowed to hunt, harvest pecans, cut timber, use buildings or other improvements and lease out hunting privileges. Lime application costs or similar costs for improvements in which the benefits are returned over a number of years may be shared by the landlord and tenant, or if the tenant pays for them initially, repaid by the landlord at a fixed rate per year.

Tenants may be required to maintain fences, spray or clip weeds annually, provide

liability insurance, share oil field damages, maintain terraces and leave strips of

grain in the field for game. Landlords may provide a well and water, fencing material,

or land for a mobile home. Tenants may ask for several months notice if the landlord

wishes to terminate the lease agreement. In some cases, leases contain an option to

buy with rental payments applied to the purchase price.

Historical and Regional Perspective

Table 4 provides historical data on pasture rental rates for Oklahoma, Kansas, Missouri and Texas for 2009-2018 as reported by the USDA National Agricultural Statistics Service (NASS). County level pasture rental rate data is available at: http://www.nass.usda.gov/Statistics_by_State/Oklahoma/ Publications/County_Estimates/index.asp. The next bi-annual USDA Cash Rent Survey will be available with the 2019 release in September 2019.

Table 4. Average Gross Cash Rent (Dollars per Acre) for Dryland Pasture, Selected States, 2009-2018.

| 2009 | 2010 | 2011 | 2012 | 2013 $/acre |

|

|---|---|---|---|---|---|

| Oklahoma | 10.5 | 11 | 11.5 | 11.5 | 12 |

| Kansas | 15.5 | 15.5 | 16 | 16.5 | 17.5 |

| Missouri | 25 | 24 | 25.5 | 28 | 29 |

| Texas | 6.2 | 6.1 | 7.5 | 6.5 | 6.5 |

| 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|

| Oklahoma | 12 | 12 | 13.5 | 13 | 13.5 |

| Kansas | 17.5 | 20 | 19 | 19 | 19.5 |

| Missouri | 29 | 34 | 32 | 31 | 33 |

| Texas | 6.5 | 7.5 | 6.8 | 6.6 | 6.7 |

Source: USDA/NASS, Quick Stats, https://quickstats.nass.usda.gov.

Concluding Comments

“Fair” rents must be negotiated between tenant and landlord. Regional or state average rental rates may be used as a beginning point for discussion and negotiation of rental rates. However, differences in land quality and improvements, and restrictions on land use can greatly impact the value of potential leases. Likewise, differences in family living expenses and hired labor costs can be substantial for different operations, affecting the maximum rental bids.

New legal restrictions and liability factors may call for changes in future farm lease

agreements. Some farm management firms include language requiring that the tenant

will be responsible for following label restrictions in the use of pesticides, for

remaining in compliance with the farm’s conservation plan, and for disposing of wastes

in a manner approved by the Environmental Protection Agency, etc. Some leases already

stipulate precisely what fertilizers, pesticides and seed may be used on the property.

Both landlords and tenants must be aware of changing environmental laws and regulations

to avoid potentially costly liabilities.

Related Publications and Other Resources

To help educate landlords and tenants with equitable lease agreements and current best management practices, visit the Oklahoma State University (OSU) Ag Land Lease website at http://www.aglandlease.info or http://www.aglease. info. A joint effort between OSU’s Plant and Soil Sciences and Agricultural Economics Departments, the website contains a wide assortment of farm management spreadsheet tools, lease information and forms, rental rate and land value resources, legal and tax considerations, livestock and hunting lease publications plus the latest production practices in Oklahoma.

The AgLease101.org website hosts several North Central Farm Management Extension Committee

(NCFMEC) publications on leasing including these titles:

- Crop Share Rental Arrangements For Your Farm, NCFMEC-2

- Fixed and Flexible Cash Rental Arrangements For Your Farm, NCFMEC-1

- Pasture Rental Arrangements, NCFMEC-3

In addition to publications, worksheets and free downloadable samples, lease forms are available on the site.

Recent Oklahoma school land lease auction information also is available through the

Real Estate Management Division of Commissioners of the Land Office at http://oklaosf.state.

ok.us/~clo/.

Roger Sahs

Extension Assistant Specialist