Market Research Study: Organic Fruit, Vegetable and Herb Production

- Jump To:

- Organic foods and beverages

- Future and forecast

- Health

- Price/supply

- Product innovation

- Natural food stores: Future warehouse distribution possibilities?

- Production and farmer-controlled marketing

- Companies producing/processing organic food and beverages

- Profiles of major manufacturers

- Earthbound Farm

- Organic Valley

- Amy’s Kitchen

- Summary and Conclusions

- References

Organic foods and beverages

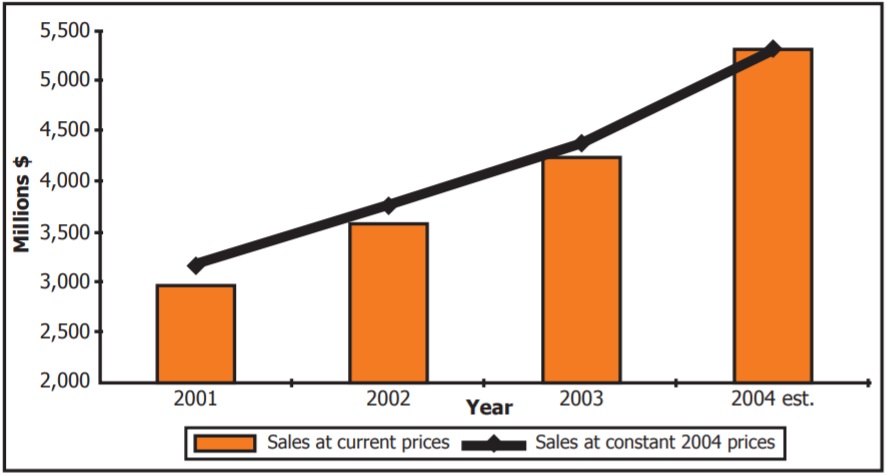

Overall, the market for organic foods and beverages grew 81 percent between 2001 and 2004, a constant 2004 dollar growth of 70 percent. U.S. organic food sales totaled nearly $17 billion in 2006, up 22 percent during the previous year, according to preliminary findings from the Organic Trade Association’s 2007 Manufacturers Survey. In the United States, organic foods’ share of total retail sales of food and beverages was about 3 percent, up from 1.9 percent in 2003 and approximately 2.5 percent in 2005. In addition, this high rate of growth has come in a very steady fashion.

While some organic segments grew more and faster than others (see Market Segmentation section), all of the biggest segments grew at a rate much higher than that for the overall food and beverage market. Consumers’ concern about food safety and the integrity of the food chain have contributed to increased sales. Media reports about bovine growth hormones in milk, mad cow disease and other crises of the food supply, whether exaggerated or not, spur consumers to seek out organic products.

As found in Mintel International’s consumer survey, about half of respondents in both 2002 and 2004 rate their concern about food safety as “high” and also say they are concerned about genetically modified foods. Consumers sometimes choose organic versus non-organic because they believe organic farming practices produce a safer final product because they eliminate fertilizers, pesticides, hormones and genetically-modified products.

Table 1: Total U.S. retail sales of organic food and beverages, at current and constant prices, 2001-2004

| Year | Sales at current prices (Million $) |

Index | Percent change | Sales at constant 2004 prices* (Million $) |

Index | Percent Change |

|---|---|---|---|---|---|---|

| 2001 | 2,940 | 100 | -- | 3,131 | 100 | -- |

| 2002 | 3,548 | 121 | 20.7 | 3,720 | 119 | 18.8 |

| 2003 | 4,238 | 144 | 19.4 | 4,344 | 139 | 16.8 |

| Est. 2004 | 5,308 | 181 | 25.2 | 5,308 | 170 | 22.2 |

*Adjusted for inflation using the All Items CPI; CPI for 2004 calculated through June 2004

SOURCE: SPINS/ACNielsen/OTA/Mintal International

Another factor contributing to the growth of the organic food market is retail distribution. When organic foods first became available, it was only through small stores in the natural food channel that consumers could find a good selection of products. Distribution widened after Whole Foods and Wild Oats took the natural food store concept and applied the “supermarket” format to it. Yet, even then, shopping for natural foods was a hit or miss venture, with many small independent stores offering only a limited supply of organics. During 2001 to 2004, the “natural food supermarket” concept in both the natural food channel and the supermarket channel has made organic products more available and shopping easier.

Around 1999, more mainstream supermarkets began to carry comprehensive organic product lines in produce and dairy, and some have since enlarged their natural and organic food offerings to include fresh meat, bakery and prepared/packaged foods. As more mainstream grocery shoppers find a wider alternative to non-organic in their own familiar stores, they are more likely to try the organic products and boost organic food sales in the mainstream channel. According to the Organic Consumer Association, about 31 percent of overall organic sales in 2006 were through mainstream supermarkets or grocery stores.

Large mainstream manufacturers have experimented with organic product lines, either buying existing companies (e.g. General Mills’ acquisition of Cascadian Farms in 2000 and Danone’s majority stake in Stonyfield Farms, which was initiated in 2001) or by creating their own lines of organic products (e.g. Heinz’s Linda McCartney line or General Mills’ organic lines). At the same time, organic companies have increased their product offerings and have moved beyond their “crunchy granola” image to become major food processors in their own right (e.g. Hain Celestial).

The consumer has benefited from the increased manufacturing efforts in the organic food industry. More prepackaged organic produce, for example, has made the purchasing of organic salad greens more convenient while organic prepared and packaged foods make it easier for consumers to provide organic meals to their families. Widespread availability of organic dairy products such as milk, yogurt and cheese, as well as organic non-dairy alternatives such as soy and rice milk, also has given consumers the option to switch from traditional foods to organic equivalents. Mere trial of this range of organic products by curious consumers has driven sales growth to some extent, though this does not likely contribute the bulk of sales growth.

As organic food manufacturers and retailers adopt the marketing and distribution systems used by mainstream counterparts, it is likely sales of organic products will continue to increase. Consumers who consider themselves “organic loyal” will be able to continue purchasing products through natural and organic channels, while those who are “occasional organic shoppers” will probably take advantage of organic options through mainstream venues. Both options have contributed to increased sales of organic foods and will continue to do so for the foreseeable future. Furthermore, Mintel International estimates sales of organic foods will increase by 71 percent from 2006 through 2011.

The overall market for organic foods and beverages increased 50 percent between 2002 and 2004. This total includes sales through mainstream supermarkets, drug stores and mass merchandisers (excluding Wal-Mart), as well as sales through natural food stores with annual sales of $2 million or more. Not included are sales through smaller outlets (either mainstream or natural) as well as those through independent natural food retailers, farmers’ markets, foodservice or other smaller channels (e.g. export channels or club stores). The Organic Trade Association (OTA) provides sales estimates of all organic food and beverage products through all channels and placed the total market at $10.4 billion in 2003. In 2005, U.S. sales of organic foods and beverages increased by 16.2 percent to $13.8 billion, according to the Nutrition Business Journal.

The biggest segment in the organic market, fruits and vegetables, comprises fresh organic produce items, both those that are sold in bulk and those that are packaged (e.g. bagged salad greens). Also included in this segment are shelf-stable, frozen and refrigerated fruits and vegetables. Sales of organic produce account for almost 45 percent of total sales, having gained 4.3 share points in 2002-2004 as the segment benefited more than the overall market from increased distribution. According to the Natural Food Merchandiser, in 2005, organic produce accounted for one-third of organic food and beverage sales. Sales of organic dairy products (including milk, cream, butter, yogurt, cheese and other dairy) amount to 14.5 percent of the market in 2004, down slightly in the two-year period. On the other hand, a study located in Shopping for Health 2006, found 30 percent of U.S. shoppers purchase organic dairy products.

Table 2: Sales of organic fruits and vegetables, at current and constant prices, 2001-2004

| Year | Sales at current prices (Million $) |

Index | Percent change | Sales at constant 2004 prices* (Million $) |

Index | Percent change |

|---|---|---|---|---|---|---|

| 2001 | 1,152 | 100 | -- | 1,227 | 100 | -- |

| 2002 | 1,436 | 125 | 24.7 | 1,505 | 123 | 22.7 |

| 2003 | 1,724 | 150 | 20.1 | 1,767 | 144 | 17.4 |

| Est. 2004 | 2,376 | 206 | 37.8 | 2,376 | 194 | 34.5 |

*Adjusted for inflation using the All Items CPI; CPI for 2004 calculated through June 2004

SOURCE: SPINS/ACNielsen/OTA/Mintel International

This channel is followed by organic beverages (including soy milk; frozen, shelf-stable and refrigerated fruit juices and juice drinks; functional beverages; carbonated beverages; and water). The organic beverage segment has not been as successful as the overall market at conveying benefits to consumers, resulting in a market share decline of 3.1 percent in 2002-2004. Part of the relative underperformance is due to soy milk versus organic milk (discussed below, in the Supply Structure section). However, according to Mintel International, sales of organic beverages through food, drug, mass merchandisers and the natural supermarket channel topped $1.3 billion in 2006. This represents a 97 percent increase since 2001 and indicates the extent to which organic beverages have become an important part of the American market basket.

Sales of organic fruits and vegetables increased 106 percent between 2001 and 2004, a constant 2004 sales increase of 94 percent. A number of factors contributed to this increase—more acres of organic crops under cultivation and an increase in the availability of convenience-based organic crops brought the organic market in line with the non-organic side of the industry. For example, the move towards more organic bagged salads (e.g. by Earthbound Farm, an organic producer, as well as by mainstream producers such as Dole and Fresh Express, which expanded their organic product lines) has boosted the availability of convenience organic products in mainstream channels. Furthermore, 70 percent of consumers surveyed by Mintel International who purchased organic food, purchased fresh vegetables and 67 percent purchased fresh fruit. Sales of organic fruits and vegetables increased from $688 million in 2004 to $921 million in 2006. This represents an increase of 34 percent.

When organic fruits and vegetables first became available through wider distribution, consumers were informed that organic products, grown without pesticides or chemicals, were not likely to look as “pleasing” as mainstream equivalents. Many mainstream consumers also were put off by organic produce that did not live up to their expectations. Yet, improvements in growing techniques as well as in preparation of the organic products to get them to market has led to more visually appealing organic items. This type of development strikes a chord not just with the hard-core organic buyers, but more importantly, among occasional organic shoppers who believe the products look “good enough to eat” and are no longer reluctant to buy them.

Future and forecast

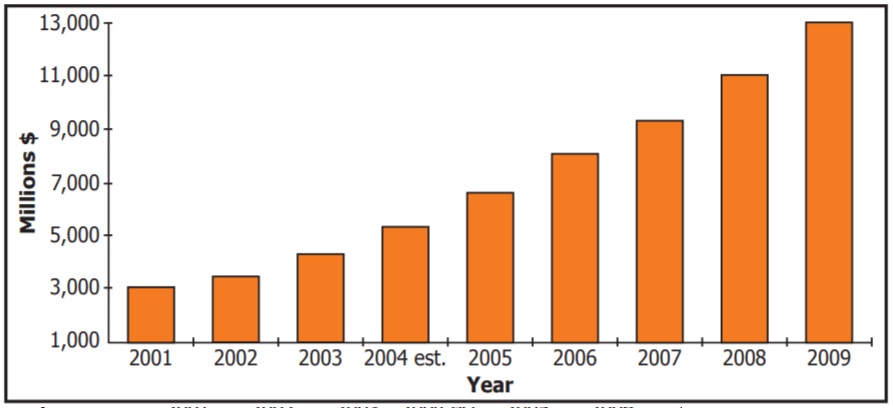

The market for overall organic food and beverages is a good indicator of the market potential for raw fruits, vegetables and herbs. Mintel International predicts total U.S. sales of organic food and beverages will increase 143 percent at current prices and increase 115 percent at constant prices from 2004 to 2009. The projected annual inflation adjusted growth rate of 16.5 percent for 2004-2009 represents a small decline from the 19.5 percent rate achieved in 2001-2004, but this is a natural function of the market growth curve. In essence, the market will continue growing quickly, but the rate of growth relative to previous years’ sales will decline somewhat as annual sales reach higher and higher levels.

Figure 2: U.S. sales of organic food and beverages, 2001-2004 and forecast, 2005-2009

Table 3: Forecast of U.S. sales of organic food and beverages, at current and constant prices, 2004-2009

| Year | Sales at current prices (Million $) |

Index | Percent change | Sales at constant 2004 prices* (Million $) |

Index | Percent change |

|---|---|---|---|---|---|---|

| Est. 2004 | 5,308 | 100 | -- | 5,308 | 100 | -- |

| 2005 | 6,544 | 123 | 23.3 | 6,384 | 120 | 20.3 |

| 2006 | 7,943 | 150 | 21.4 | 7,559 | 142 | 18.4 |

| 2007 | 9,491 | 179 | 19.5 | 8,810 | 166 | 16.6 |

| 2008 | 11,159 | 210 | 17.6 | 10,105 | 190 | 14.7 |

| 2009 | 12,911 | 243 | 15.7 | 11,406 | 215 | 12.9 |

*Adjusted for inflation using the All Items CPI; CPI for 2004 calculated through June 2004

SOURCE: Mintel International

The forecast for total U.S. sales of food and beverages will be affected by changes in the following factors:

Health

The organic market is small relative to the total food market, and the fact that one of the main drivers of this market is health (or fear of contamination through traditional foods) means that sales growth can change substantially based on health-related developments or the findings of future scientific studies by the USDA, FDA or other sources.

Price/supply

The substantial price premium for organics over non-organics has limited market growth: limited supply ensures price premiums. However, as more supermarkets carry organics and more acres are planted to organic crops, the levels of price premiums could fluctuate significantly due to changes in product availability and competition between retail outlets to attract organic customers.

Product innovation

If manufacturers increase the rate of new product development faster than expected, or conversely find that demand does not rise for processed organic foods, the overall category will be similarly affected.

Natural food stores: Future warehouse distribution possibilities?

Table 4 shows sales of organic foods and beverage through the natural food store (chains) channel for 2001 through 2004. Sales are tracked for stores with at least $2 million in annual sales.

Table 4: U.S. natural food channel sales of organic foods and beverages, at current and constant prices, 2001-2004

| Year | Sales at current prices (Million $) |

Index | Percent change | Sales at constant 2004 prices* (Million $) |

Index | Percent change |

|---|---|---|---|---|---|---|

| 2001 | 1,302 | 100 | -- | 1,387 | 100 | -- |

| 2002 | 1,526 | 117 | 17.2 | 1,600 | 115 | 15.4 |

| 2003 | 1,922 | 148 | 26 | 1,970 | 142 | 23.1 |

| Est. 2004 | 2,229 | 171 | 16 | 2,229 | 161 | 13.1 |

*Adjusted for inflation using the All Items CPI; CPI for 2004 calculated through June 2004

SOURCE: SPINS/ACNielsen/OTA/Mintel International

Sales of organic foods and beverages increased 71 percent between 2001 and 2004, or 17 percent less than for mainstream supermarkets. The Organic Trade Association estimates the total organic food and beverage sales were $13.8 billion in 2006. The two major players in this segment, Whole Foods Market and Wild Oats Market, have both seen their sales increase significantly as they expand operations throughout the country.

In August 2004, Wild Oats Market announced it would test a branded store-within-a-store natural/organics department at selected Stop & Shop stores in the Northeast and begin selling private-label products through the Peapod.com online shopping service in Chicago. Both Stop & Shop and Peapod are divisions of Quincy, Massachusetts-based Ahold USA. According to Wild Oats, a three-to-five store test of departments at Stop & Shop began in late 2004 or early 2005. Termed as a test, it began offering private-label products through Peapod.com during the fourth quarter of 2004.

Table 5: Top organic grocer operating statistics, latest fiscal year-end

| Company | Sales Data | Outlet Data | |||

|---|---|---|---|---|---|

| Annual million $ | Per ft2 | Per outlet | Number of outlets | Sales area (ft2) |

|

| Whole Foods Market, Inc. (9/29/2003) | 2,690 | 699 | 20,696 | 135 | 4,100 |

| Wild Oats Markets, Inc. (10/28/2003) | 969 | 337 | 8,502 | 126 | 3,658 |

SOURCE: Retail Interactive/Mintel International

Whole Foods, which in 2003 operated some 150 stores in 26 states, reported a 17 percent increase in sales over 2002. The company sells only natural and organic products. The company plans to open some 15 stores in 2004 and another 15 to 20 stores in 2005. It is also expanding to England with its acquisition of Fresh & Wild Holdings Limited, a chain of seven natural and organic foods stores in the United Kingdom. Wild Oats derives about two-thirds of its sales from its perishables, but it also offers six lines of store brand prepared and packaged items, including three separate organic lines. Again, it should be stressed that both Whole Foods and its rival Wild Oats do not sell organic foods exclusively; rather they both sell only natural foods, some of which also are organic.

Table 6: Percentage change from latest fiscal year-end versus year prior

| Company | Sales Data | Outlet Data | |||

|---|---|---|---|---|---|

| Change percent (billion $) |

Change percent (per ft2) |

Change percent (per outlet) |

Change percent (per no. of outlets) |

Change percent (per sales area) |

|

| Whole Foods Market, Inc. (9/29/2003) | 18.4 | 4.3 | 10.2 | 7.1 | 14.1 |

| Wild Oats Markets, Inc. (10/28/2003) | 5.4. | -23.4 | -5.6 | 23.5 | 75.3 |

Wild Oats, which rivals Whole Foods, is the third largest natural food chain in the United States, trailing both Whole Foods and Trader Joe’s (a privately owned chain, which does not share sales data and therefore is not included in this report). Wild Oats has some 100 stores in 24 states and in British Columbia, Canada, and sells natural, organic and some traditional grocery items. The stores operate under the Capers Community Market, Henry’s Marketplace, Sun Harvest Farms and the Wild Oats Natural Marketplace names. Wild Oats’ private label program is not as fully evolved as Whole Foods’ private label program, and its total sales are considerably lower, but it also is continuing to expand, adding 10 stores in 2004 and approximately the same number in 2005. Whole Foods recently announced that it will buy 110 stores from Wild Oaks (Burros, p.1). If successful, the purchase will increase the number of Whole Foods stores to more than 300 nationwide.

Whole Foods, which has been adding stores in both the Kansas City metroplex and the Dallas/Ft. Worth metroplex, while also attempting to buy out Wild Oats, widely has been speculated to have plans for three or four stores in Oklahoma in the near future. The Tulsa area is the first place being considered for the stores, although the Wild Oats stores already exists in that market and could be converted if the proposed buyout takes place. One opportunity would be to contract delivery of organic and specialty produce to the warehouses for these chains as they expand in this region, thereby providing both an outlet for produce and marketing of locally-grown produce.

Production and farmer-controlled marketing

Production information such as production quantities and dollar values have been difficult to ascertain on a local/regional scale. The prevalence of cash transactions and unreported income have made a true assessment of local/regional production of organic, pesticide-free and greenhouse fruits, vegetables and herbs virtually impossible. USDA has been increasing its efforts in tracking organic and specialty producers, but federal policy to protect the privacy of information for small producers has resulted in only aggregate data being published.

Acreage certified for organic crops increased 151 percent between 1992 and 2001. The increase was fueled by demand for more organic fruits and vegetables as consumers’ awareness of these products increased. The total number of certified agriculture operations rose 94 percent.

Organic cropland and pasture accounted for only about 0.3 percent of U.S. farmland in 2001, according to the USDA, and only a small percentage of the top U.S. field crops were organic. These include 0.1 percent of corn, 0.2 percent of soybeans and 0.3 percent of the wheat grown in the United States in 2001. However, commonly consumed horticultural commodities such as apples and lettuce have higher percentages of organic cropland: organic apples made up 3 percent of the total U.S. apple acreage, while organic lettuce constituted 5 percent of the total acreage.

Farmers’ markets have become a fast-growing and producer-friendly outlet for organic fruits, vegetables and herbs. These markets allow producers to forego several middlemen in the marketing chain and directly present their product to consumers – thereby allowing them to capture both the marketing margins associated with transportation and retail presentation while also capturing the premiums associated with organics. The number of farmers’ markets increased 79 percent between 1994 and 2002—a rate that far exceeds that of population growth or income growth. According to Shopping for Health 2006, 2 percent of people purchase their organic foods from farmers’ markets.

Table 7: Total Organic Acreage 1992-2001 (Selected years)

| Year | United State organic certified farmland | ||

|---|---|---|---|

| Acres of Pasture/Rangeland | Acres of Cropland | Total Acreage | |

| 1992 | 532,050 | 403,400 | 935,450 |

| 1993 | 490,850 | 464,800 | 955,650 |

| 1994 | 434,703 | 556,750 | 991,453 |

| 1995 | 279,394 | 638,500 | 917,984 |

| 1997 | 496,385 | 850,117 | 1,356,558 |

| 2000 | 810,167 | 1,218,905 | 2,029,073 |

| 2001 | 1,039,505 | 1,304,766 | 2,344,272 |

Farmers’ markets are an interesting phenomenon because they simultaneously heighten interest and compete with organic products in supermarkets. Many long-time or “hard core” organic consumers may not buy a substantial amount of organics in supermarkets because they believe the new organic standards to be too loose. For instance, some organic consumers believe it is more important for products to be from a local farmer than that they necessarily meet USDA organic labeling standards. Similarly, some organic consumers would never consider buying such a thing as an organic TV dinner (processed food) or products shipped across the country (wasteful distribution of otherwise good products). These types of consumers could contribute to a reduced growth rate for organics in supermarkets, particularly if there is a backlash against the number and type of products that are allowed to carry the organic label.

Table 8: Organic acreage for fruits and vegetables, 1997, 2000 and 2001

| Year | Vegetables | Fruit | Other | Total Acreage |

|---|---|---|---|---|

| 1997 | 48,227 | 49,414 | 752,476 | 850,117 |

| 2000 | 62,342 | 43,481 | 1,113,082 | 1,218,905 |

| 2001 | 71,667 | 55,675 | 1,177,424 | 1,304,766 |

| Percent Change | 48.6 | 12.7 | 56.5 | 53.5 |

SOURCE: Economic Research Service, USDA 2003/Mintel International

Companies producing/processing organic food and beverages

The OTA estimates there are some 700 companies currently involved in the production and sale of organic foods. Some of the top players in the organic food and beverage market are owned by multi-national and national firms, like White Wave and Horizon, which are both owned by Dean Foods. Others, such as Amy’s Kitchen, continue to hold on to their independent status. In general, consolidation in the organic industry has come with an increased interest in the industry; major non-organic companies have acquired organic companies to boost their portfolios and also established organic lines of their own. In some cases, the products bear the name of the non-organic parent company (as in the case of Frito Lay Naturals), and in others a separate entity is adopted (e.g. Heinz’s Linda McCartney line). At the same time, major organic players also have consolidated and acquired lesser brands. For example, Hain-Celestial has purchased a number of smaller organic companies in recent years. Heinz has a further investment in organics through an 18 percent interest in Hain-Celestial.

The produce and meat segments are hard to estimate, as the majority of sales in these segments are bulk or PLU and are not identified by a specific manufacturer. Some major organic produce manufacturers, such as Earthbound Farm, brand their produce (e.g. Earthbound Farm bagged salads), and sales of these are more easily counted. However, prepackaged and “named” organic produce accounts for only about one-fourth of the total organic produce segment, according to the OTA. The remainder of produce sales, which cannot be tracked, are not included in sales figures in this report.

It is these larger companies that should be considered most carefully by producers as they consider production, processing, packaging and branding possibilities. The small market share held by these hundreds of companies, combined with a growing market, represent multiple opportunities for branded produce and further processed products to establish a market presence.

Profiles of major manufacturers

Following are brief profiles of the top manufacturers in the organic food and beverage industry. As the OTA asserts, there are some 700 companies in this industry; therefore, only those with overall share of 3 percent or more are profiled.

Earthbound Farm

Based in San Juan Bautista, Calif, privately held Earthbound Farm is the country’s largest grower of organic salad greens: the company produces more than 100 varieties of lettuce, arugula, baby spinach and mixed greens salad packs. In addition to salads, the company also sells fresh organic vegetables and fresh and dried organic fruits in supermarkets throughout the United States. Current financials are not available, although 2002 sales were estimated at about $200 million. The company estimates its products can be found in 70 percent of American mainstream supermarkets.

Table 9: Farmers market growth, 1994-2002

| Year | Farmers Markets | ||

|---|---|---|---|

| Number | Index | Percent Change | |

| 1994 | 1,755 | 100 | -- |

| 1996 | 2,410 | 137 | 37.3 |

| 1998 | 2,746 | 156 | 13.9 |

| 2000 | 2,863 | 163 | 4.3 |

| 2002 | 3,137 | 179 | 9.6 |

SOURCE: USDA/Mintel International

Organic Valley

Lafarge, Wisconsin-based Organic Valley is a dairy cooperative formed in 1988 by a group of family farmers whose belief in sustainable agriculture led them to distribute organically produced milk and other dairy products. In 2003, the co-op reported sales of $156 million, a 20 percent increase since 2002.

Currently the co-op has expanded to include more than 600 organic farmers in 16 states and one province in Canada. By 2003, the co-op added 15,000 acres into the organic system for a national total of 90,000 acres, brought 118 farmers into the cooperative for a national total of 633 organic farmers and added 2,675 cows being raised organically for a national total of 20,475 cows.

Amy’s Kitchen

Based in Santa Rosa, Calif., privately owned Amy’s Kitchen produces frozen and pre-packaged vegetarian meals, made primarily with organic ingredients. Although sales figures for the company are not available, the company claims it accounts for two-thirds of natural/organic sales in its categories and it represents 70 percent of the growth in the natural/organic food category at natural food stores. Primarily distributed through natural foods channels, Amy’s products, including ready meals, side dishes, sauces and condiments, also are becoming more of a presence in mainstream outlets.

Table 10: Manufacturer sales of organic foods and beverages in the United States, 2001 & 2003

| Manufacturer | 2001 Sales (Million $) |

% | 2003 Sales (Million $) |

% | Change | Percent point change |

|---|---|---|---|---|---|---|

| Earthbound Farm | 101 | 3.4 | 203 | 4.8 | 101 | 1.4 |

| Organic Valley | 89 | 3.0 | 140 | 3.3 | 57.3 | 0.3 |

| Amy's Kitchen | 105 | 3.6 | 139 | 3.3 | 32.4 | -0.3 |

| Other | 2,226 | 75.7 | 3,103 | 73.2 | 39.4 | -2.5 |

SOURCE: SPINS/ACNielsen/OTA/Mintel International

Summary and Conclusions

Overall, the market for organic foods and beverages grew 81 percent between 2001 and 2004, a constant 2004 dollar growth of 70 percent. Starting around 1999, an increasing number of mainstream supermarkets began to carry comprehensive organic product lines in produce and dairy, and some have since enlarged their natural and organic food offerings to include fresh meat, bakery and prepared/packaged foods. During 2001-2004, the “natural food supermarket” concept in both the natural food channel and the supermarket channel has made organic products more available and shopping easier.

The biggest segment in the organic market, fruits and vegetables, comprises fresh organic produce items, both those that are sold in bulk and those that are packaged (e.g. bagged salad greens). Also included in this segment are shelf-stable, frozen and refrigerated fruits and vegetables. Sales of organic produce account for almost 45 percent of total sales, having gained 4.3 share points in 2002 to 2004 as the segment benefited more than the overall market from increased distribution.

Sales of organic fruits and vegetables increased 106 percent between 2001 and 2004, a constant 2004 sales increase of 94 percent. A number of factors contributed to this increase—more acres of organic crops under cultivation and an increase in the availability of convenience-based organic crops brought the organic market in line with the non-organic side of the industry. The consumer has benefited from the increased manufacturing efforts in the organic food industry. More prepackaged organic produce, for example, has made the purchasing of organic salad greens more convenient while organic prepared and packaged foods make it easier for consumers to provide organic meals to their families.

There appears to be significant potential for a number of short- and long-term marketing efforts carried out by a consortium of producers. Coordinated marketing of bulk produce to warehouses and small specialty food stores, whether branded or unbranded, has significant potential in Oklahoma. Further, coordinated marketing of produce through existing farmers’ markets would allow for the build-up of brand recognition for either bulk fresh horticultural commodities or minimally processed products. In the long-term, the producers may want to consider investing in packing/processing facilities that would generate consumer-ready products identified by a brand.

References

ACNielsen. June 2007. < http://www2.acnielsen.com/site/index.shtml >.

FMI AND Prevention Magazine. “Shopping for Health”. [Online] 5, June 2007.

Mintel International Group Ltd. “Organic Food & Beverages—U.S.,” August 2004.

Natural Foods Merchandiser Market Overview. [Online] 5, June, 2007.

Organic Consumers Association. “U.S. Organic Food Sales.” [Online] 5, June 2007. < http://www.organicconsumers.org >.

Organic Trade Association. “The Organic Food Market.” [Online] 5, June 2007. < https://ota.com/l >.

OTA’S 2006 Manufacturer Survey. [Online] 5, June 2007. < https://ota.com/ >.

SPINS. August 2004. < http://www.spins.com >.

USDA Economic Research Service. Various reports and data related to organic food production and sales as utilized by Mintel.

Rodney Holcomb

FAPC Agribusiness Economist

Chuck Willoughby

FAPC Business & Marketing Relations Manager

Erin Early

FAPC Business & Marketing Client Coordinator

Keneshia Reed

FAPC Business Planning & Marketing Intern