Life Insurance

“How will my family manage financially when I die?” is a question that few of us really want to think about. If someone depends on your income, it’s a question that you cannot avoid. Life insurance is a simple solution to this difficult question.

Life insurance is an essential part of financial planning. This fact sheet can help you:

- decide if you need life insurance.

- decide how much life insurance you need.

- decide what type of policy is right for you.

- understand basic policy provisions.

- determine how to purchase life insurance.

Who Needs Life Insurance?

Life insurance protects anyone who is dependent on your income or who would be responsible for your debts upon your death. Life insurance needs are like fingerprints – no two people’s needs are alike. These needs also change depending on your stage of life or because of specific life events.

Most single people do not have a pressing need for life insurance because no one depends on them financially. Exceptions are those who provide financial support for aging parents or siblings or those who have debts that would need to be paid off in full at their death. Single persons may wish to buy enough life insurance to cover final expenses such as funeral costs and medical bills.

Single parents need life insurance because their children rely on them for everything. The single parent should consider the amount of support for children available from the other parent or family members and how long the support will continue.

Married couples with children should give priority to life insurance on the primary earner(s). Many of today’s modern families have two earners. If a family relies on two incomes, then both parents need insurance. You may want to buy insurance for a non-employed parent (such as a homemaker), but only if the earner has enough coverage. The death of the primary child caregiver may cause a financial burden for a family because the family will now need to pay for childcare, transportation, and other hard-to-replace services.

Married couples without children usually need little life insurance if both spouses can support themselves and have a low debt load. For a young spouse, life insurance could provide an education fund to increase the spouse’s earnings capacity. An older spouse such as a full-time homemaker may need insurance protection to provide an income for the rest of his or her life.

Retired couples and those planning for retirement may feel their need for life insurance has passed once their children are on their own. However, your spouse may outlive you 10, 20, or 30 years. Having adequate life insurance helps widows and widowers avoid financial hardships during retirement. Life insurance can also be used for estate planning purposes, to provide an inheritance to heirs, and to make gifts to charitable organizations or support causes important to the individual or couple.

Children generally do not need life insurance. Parents sometimes purchase life insurance on their children to assist with burial expenses or to build cash value that can be transferred when the child turns 21. Another reason would be if children have a health condition that would make them uninsurable when they reach legal age.

Life insurance needs are also influenced by specific life events such as:

- Becoming a homeowner—life insurance can be used to pay off a mortgage, sparing your family from having to move to a less expensive home. Update your coverage if you refinance your mortgage.

- Changing jobs—update your life insurance coverage for your new lifestyle.

- Change of marital status—make sure you change the beneficiaries on your policy.

- A loved one suddenly needing long-term care—life insurance can be used to pay for long-term care services previously provided by family caregivers or fund a special needs trust.

How Much Life Insurance Do You Need?

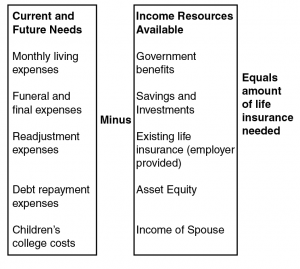

Conducting a needs analysis is the most accurate way to determine the amount of life insurance required (See Figure 1).

- Estimate future needs – the dollar amount needed to cover funeral expenses, medical bills, pay off debts, readjustment expenses (to cover a transition period, including child care, additional homemaking help, and job training for a surviving spouse), provide money to pay unusual expenses, and college expenses of children.

- Estimate future income available to the family – add Social Security and other government benefits, interest and dividends from savings and investments, income from assets that could be sold, and the spouse’s earnings.

- Amount of insurance needed is the difference between future needs and future income.

Figure 1. Determining Life Insurance Needed

Online insurance calculators can help you perform a needs analysis. One example can be found at http://www.smartmoney.com/personal-finance/insurance/how-much-life-insurance-do-you-need-12949/

There are other methods that can be used to determine life insurance needs:

- Use an income multiplier. Multiply annual gross income of the insured by the number of years the income is needed. This method is easy to use, but it ignores Social Security benefits, both the assets and debts of the family, and the impact of inflation over time on income needs.

- Rely on an agent’s estimate. While this requires little effort on your part, keep in mind who is making the estimate. Agents will make many assumptions about your family’s needs. You know your family’s needs better than anyone else. Make assumptions yourself and then tell your agent.

Types of Life Insurance

There are five basic types of life insurance polices.

Term Life

This insurance provides coverage for a specific time. The longer the term, the more expensive the premium. It pays a benefit only if you die during the period covered by the policy. Purchase a policy that is renewable without requiring a medical exam. With term life, your premium will rise with age unless a level premium policy is purchased. If you purchase a policy that is convertible, you can exchange it for a whole life policy without proof of insurability but you will pay a higher premium. Term insurance provides the most protection for your dollar because it has no savings element, which increases the premium. Term insurance is useful to parents of young children because of high future needs as well as people who need large amounts of coverage for a home mortgage and other debts. Term insurance is also appropriate for those who need life insurance for just a short period of time (to cover college education expenses).

Whole Life

This insurance combines protection with a savings plan; this protection covers you for your entire life. The premium and death benefit stays the same for life. The premium will be higher than that of a term policy – the difference goes into the savings plan. The insurance policy will state the guaranteed interest rate you will earn on this excess premium. As a result, the policy will build up a cash value. The policy will allow you to borrow on the cash value. The interest on the cash value is tax-deferred. If you decide to cancel (also referred to as surrender) the policy, you will receive the cash value but it may be subject to income taxes. Many choose whole life because the need(s) for life insurance do not end after a set period of time.

Universal Life

Similar to whole life, except the premiums and the death benefit can be adjusted up or down by the policyholder. Interest on the savings plan (cash value) is at current market interest rates, with a guaranteed minimum interest rate.

Variable Life

This insurance is also similar to whole life except the policyholder (not the insurance company) controls the investments made in the savings plan. The growth of the cash value will depend on the performance of the investments chosen by the policyholder. The cash value is placed in a separate account at the insurance company. Why is this important? If the company were to fail, the assets in this separate account would not be frozen. With whole and universal life, cash values are placed in the company’s general account and can be frozen (no surrenders, loans, or withdrawals of the cash value can then be made by the policyholder). If investments chosen by the policyholder were to fall in value, additional premiums may be required to keep the policy in force.

Variable Universal Life

Similar to variable life, but the premium and death benefit are no longer fixed. They can be adjusted up or down by the policyholder. The policyholder decides where to invest the policy’s cash value. Assets are placed in a separate account.

Regardless of the type of life insurance selected, beneficiaries generally receive death benefits income-tax free. The exception to this is the transfer of value rule. If you sell your insurance policy, then the death benefit becomes taxable (there are some exceptions). It is better to gift your life insurance policy to a family member or trust than to sell it to them. Life insurance contracts are not subject to probate unless your estate is named as beneficiary. Depending upon the ownership of the policy, the death benefit proceeds may be subject to federal estate taxes. In 2014, estates under $5,340,000 exempt from federal estate tax. There has not been any Oklahoma estate tax since 2009. Consult an estate attorney or a tax professional for additional guidance.

Basic Contract Provisions

Name, age, and sex of the insured: The insured is the person on whose life the policy is issued. The age stated on the policy is the insured’s age on the day the policy was purchased (date of issue). If the policy contains a misstatement of age clause, the benefits under the policy will be adjusted to that which the premium paid would have purchased at the correct age.

Policy classification (standard, preferred, or substandard): This refers to the amount of risk the company is assuming. Most policies are standard. A preferred risk is someone who is likely to live longer (e.g., a non-smoker). A substandard risk is someone who is likely to die sooner (e.g., someone with a heart condition).

Face value: The amount the company will pay at the death of the insured.

Beneficiary: The person (or persons) named in the policy to receive the proceeds at

the death of the insured. Keep beneficiary designations up-to-date; review whenever

you have a change in life status such as a divorce. Do not name minor children as

beneficiaries. The insurance company will keep the money until the child(ren) turns

18. If the proceeds are needed for the child’s upbringing, name either a guardian

or create a life insurance trust to be named as the beneficiary.

Premiums: The amount of payments to keep the policy in force. Reinstatement clauses

explain what will happen if you do not pay the premiums. You may be able to start

the policy again (reinstate the policy) by paying the overdue premiums plus interest.

If you wait too long to seek reinstatement, you may have to prove insurability.

Grace period: An additional time, usually 31 days after the due date, to pay the premium.

Policy loan provision: Allows the policyholder to borrow on the cash or investment

value of the policy. This provision is not available for term insurance. It does not

add to the cost of the policy.

Dividends: Many life insurance companies pay dividends to policyholders. They are

a return of part of the premiums paid. You can:

- choose to take them in cash.

- apply them to future premiums.

- use them to purchase paid-up additions of whole or term life insurance.

- reinvest them to increase the cash value of the policy.

Dividends are generally not paid on term insurance.

Incontestability clause: This sets a time limit during which a company can refuse

to pay all or part of a claim. The company can refuse to pay if false statements were

made on the application for insurance. After a set time limit (usually two years),

the company must pay claims even if mistakes were made on the application.

Suicide clause: Sets a period during which the company will not pay death benefits

if the insured commits suicide. The insurer is only liable for the return of premiums

paid.

There are riders that can be added to a life insurance policy for an additional cost.

The most common are:

Accidental death (also referred to as double indemnity): This rider doubles or triples

the face value of the policy for accidental death. This extra benefit amount should

not be included in your needs analysis (Figure 1).

Disability waiver of premium: This rider states that the company will pay premiums

on the policy if the insured becomes disabled. This is a low-cost rider. When comparing

polices, check the policy definition of total disability. Polices also vary on the

ability to convert the policy to another type if disability occurs.

Guaranteed insurability: This rider allows the policyholder to purchase additional

insurance at specific times, regardless of health. This rider is a good idea if you

expect your insurance needs to increase as your family grows.

Accelerated benefit rider: This pays a portion of the death benefit early if the insured

is medically certified to be terminally ill. Some policies also allow accelerated

benefits for those considered chronically ill (like those needing long-term care services).

Consult the policy for the company’s definition of chronically ill. The death benefit

payable is reduced by the amount of the accelerated payments.

Buying Life Insurance

Many employers, especially larger ones, offer life insurance as part of their benefits package. Employers can deduct the cost of term life insurance with face values up to $50,000 per employee from corporate taxes. Employees typically have to pay for additional coverage. Often employees can purchase limited amounts of additional coverage without having to answer questions about their health. This is a good option for those considered to be substandard risks. Another benefit of buying life insurance from your employer is the premium can be automatically deducted from your paycheck.

You can also contact an insurance agent for help in finding the best life insurance policy for your needs. Look for an independent agent that considers your needs rather than selling a particular company’s product. An agent should look for ways to get you the right type and amount of insurance at a reasonable cost. Ask how the agent is compensated. Agents generally get higher commissions for selling cash value policies rather than term policies. Get names of agents from relatives and friends. Ask agents if they sell insurance full-time and whether they sell for more than one company. Ask what kind of training they have received in life insurance planning. A Chartered Life Underwriter (CLU) has completed specialized training in life insurance.

Agents must be licensed to sell life insurance in Oklahoma. Those selling variable insurance products must also have a Series 6 license from the National Association of Securities Dealers (NASD). At the Oklahoma Insurance Department’s website, http://www.ok.gov/oid, you can determine if your insurance agent or company is properly licensed to sell insurance in Oklahoma. You can file a complaint against an insurance agent at this same website, or call either 1-800-522-0071 (in state only) or 405-521-2291.

Your life insurance policy may be in force for many years. You need to make sure your company is financially stable. The A.M. Best Company rates the financial strength of companies. Any company with a rating of B or lower is considered vulnerable. Consider companies with superior ratings (A++ or A+). Visit the company’s website, http://www.ambest.com, to find ratings.

Your Next Steps

- Examine your life insurance needs before making a purchase.

- Learn about the different types of life insurance mentioned in this publication.

- Shop around and compare cost of policies from several companies licensed in Oklahoma.

- Buy only the amount of life insurance you need and can afford.

- When you have narrowed your choice to several policies, request a copy of each policy. Read the policy and ask about anything you do not understand before you buy.

- Provide accurate information on the policy application. Omitting health information can cause denial of your application or cancellation of the policy.

- Inform family members about the kind and amount of life insurance as well as location of policies.

- Review your life insurance coverage and beneficiaries whenever your family status changes. It is important to determine if the coverage meets your current needs.

Helpful Websites

- A. M. Best Company: http://www.ambest.com

- Insurance Information Institute: http://www.iii.org

- Insure.com: http://www.insure.com/articles/lifeinsurance

- National Association of Insurance Commissioners Life Insurance Buyer’s Guide:

http://www.naic.org/documents/consumer_guide_life.pdf - Oklahoma Insurance Department: http://www.ok.gov/oid

- Smartmoney.com life insurance worksheet:

http://www.smartmoney.com/personal-finance/insurance/how-much-life-insurance-do-you-need-12949

Eileen St. Pierre, Ph.D., CFA, CFP®

Former Assistant Professor

Personal Finance Specialist