Extent of Alternative Marketing Arrangements for Fed Cattle and Hogs, 2001-2013

Price discovery in livestock procurement by packers has been a major concern to many in the beef and pork industries for over three decades. Following passage of the Livestock Mandatory Reporting Act in 1999, there has been considerably greater transparency in volume and price information related to livestock procurement. Since then, the phrase “alternative marketing arrangements” has replaced the previously used phrase “captive supplies.” Alternative marketing arrangements also could be correctly termed alternative procurement or purchasing arrangements depending on one’s perspective – as a livestock producer (seller) or packer (buyer).

This fact sheet provides a twelve-year summary of the available data on the extent of alternative marketing arrangement usage for fed cattle and slaughter hogs. The key question addressed is: To what extent do packers purchase fed cattle and hogs in the cash market versus by alternative marketing arrangements? As will become evident, use of negotiated pricing is declining for both fed cattle and hogs, but much more rapidly for hogs. This has raised increasing questions and concerns about how the “thinning” negotiated cash market affects price discovery, especially when many contract prices are tied to the negotiated cash market.

Data summarized here are taken from selected mandatory price reports at the Agricultural Marketing Service (AMS) Market News site for livestock reports ( http://www.ams.usda.gov/AMSv1.0/LPSMarketNewsPage ). Two companion fact sheets, AGEC-617 “Price Comparison of Alternative Marketing Arrangements for Fed Cattle, 2001-2013” and AGEC-616 “Price Comparison of Alternative Marketing Arrangements for Hogs, 2001-2013,” (both available at osufacts.okstate.edu ) compare prices paid by packers for fed cattle and hogs by alternative marketing arrangements. Prior to implementation of mandatory price reporting, information in this and the two companion fact sheets was not possible.

Data Period and AMAs

Implementation of the Livestock Mandatory Reporting Act occurred in April 2001. Allowing for a brief startup period, weekly data for this fact sheet begin in May 2001 and extend through April 2013. For convenience, years are identified by their end point, thus the year beginning in May 2001 and ending in April 2002 is referred to as 2002; the year ending April 2003 is referred to as 2003; and similarly for the remaining years 2004-2013.

Alternative marketing arrangements (AMAs) discussed here fall into five categories for fed cattle; negotiated cash trades, forward contracts (mostly basis contracts), formula arrangements (mostly marketing/purchasing agreements with price tied to the cash market), negotiated grid trades, and packer-owned transfers. For slaughter hogs, alternative marketing/procurement arrangements (AMAs) discussed here fall into four categories; negotiated cash trades, swine market formula arrangements (usually marketing contracts with price tied to the cash market), other market formula arrangements (with price often tied to the futures market), and other purchase methods (which may be production contracts with price tied to cost of production or with price window clauses).

Fed Cattle Volume by Marketing Method

Mandatory price reporting data are discussed from two aspects in this section. The first considers annual averages from which we can identify general trends. The second shows the week-to-week dynamics which are found among AMAs.

Annual Averages

Table 1 provides annual summary statistics for the various pricing methods for the twelve-year period, May 2001 to April 2013. Scanning down the annual averages by AMA, a few trends can be identified. First, negotiated cash pricing and negotiated grid pricing have declined over the data period. Their decline has been replaced by an increase in formula agreements and forward contracts. It should be noted that in 2004, AMS began reporting negotiated grid pricing transactions. Therefore, for the two prior years, negotiated grid transactions were recorded as formula transactions or negotiated cash transactions, thus inflating the extent of those procurement alternatives somewhat for 2002 and 2003. Second, packer ownership of livestock, one of the most controversial procurement methods and a frequent target for legislative reform, has varied from year to year but has not trended either up or down during the 12 years.

Comparing 2004—after AMS began reporting negotiated grid transactions to 2013—shows how procurement methods have changed in the past decade. The percentage of total procurement by AMA in 2004 was (from highest to lowest): negotiated cash, 49.2 percent; formula agreement, 37.0 percent; negotiated grid, 11.0 percent; packer-owned, 8.3 percent; and forward contract, 4.3 percent. In 2013, the percentages were (from highest to lowest): formula agreement, 55.8 percent; negotiated cash, 20.5 percent; forward contract, 11.1 percent; negotiated grid, 6.6 percent; and packer-owned, 5.8 percent. Therefore, the trend has been away from negotiated cash and negotiated grid pricing, creating more concerns and questions about thin market impacts and alternatives.

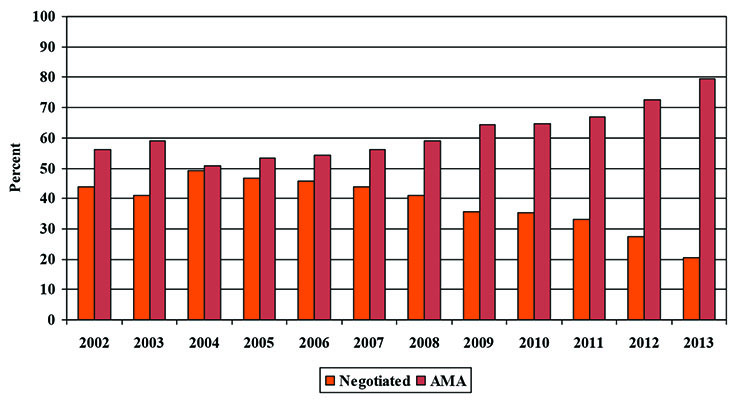

Figure 1 shows the annual averages for negotiated cash trades compared with the sum of the other four AMAs each year. This more clearly shows the trend away from negotiated cash prices to AMSs. However, nothing can be implied about market behavior or performance from this trend alone.

Figure 1. Annual average fed cattle procurement for cash market trades vs. other alternative

marketing arrangement (percent of total), 2002 to 2013.

Table 1. Fed cattle volume summary by AMA (May to April, by year).

| Year | Weekly Mean (head) | Percent of Yr Total | Min | Max | |

|---|---|---|---|---|---|

| Negotiated Cash | |||||

| 2002 | 172496 | 43.8 | 87069 | 303729 | |

| 2003 | 179900 | 1 | 119128 | 280801 | |

| 2004 | 204752 | 49.2 | 42624 | 320214 | |

| 2005 | 197431 | 46.6 | 93903 | 312293 | |

| 2006 | 196586 | 45.8 | 86730 | 291709 | |

| 2007 | 186761 | 43.7 | 94247 | 256064 | |

| 2008 | 178651 | 41 | 90801 | 254952 | |

| 2009 | 154901 | 35.5 | 98700 | 234031 | |

| 2010 | 155539 | 35.4 | 119174 | 196906 | |

| 2011 | 147732 | 33 | 92457 | 212069 | |

| 2012 | 118927 | 27.6 | 67416 | 159730 | |

| 2002-13 | 165177 | 38.6 | |||

| Forward Contract | |||||

| 2002 | 12923 | 3 | 5160 | 36671 | |

| 2003 | 17591 | 4 | 6834 | 46297 | |

| 2004 | 17116 | 4.3 | 5305 | 34927 | |

| 2005 | 21023 | 5 | 3742 | 94319 | |

| 2006 | 24155 | 5.8 | 8763 | 73966 | |

| 2007 | 25838 | 6 | 9477 | 51163 | |

| 2008 | 35070 | 8.2 | 5886 | 63323 | |

| 2009 | 33867 | 9.2 | 19597 | 67647 | |

| 2010 | 53404 | 12.2 | 29129 | 84139 | |

| 2011 | 50957 | 11.4 | 24996 | 84139 | |

| 2012 | 51871 | 12 | 29050 | 81506 | |

| 2013 | 47844 | 11.1 | 26679 | 68679 | |

| 2002-13 | 32638 | 7.7 | |||

| Formula Agreement | |||||

| 2002 | 199886 | 48.9 | 87069 | 303729 | |

| 2003 | 217002 | 48.5 | 119128 | 280801 | |

| 2004 | 150655 | 37 | 42624 | 320214 | |

| 2005 | 122530 | 29.5 | 93903 | 312293 | |

| 2006 | 142073 | 33.7 | 86730 | 291709 | |

| 2007 | 145269 | 34.4 | 94274 | 256064 | |

| 2008 | 163385 | 38.1 | 90801 | 254952 | |

| 2009 | 184029 | 42.5 | 143567 | 226034 | |

| 2010 | 183345 | 41.9 | 157721 | 211134 | |

| 2011 | 193688 | 43.3 | 164056 | 232186 | |

| 2012 | 207377 | 48 | 162238 | 241952 | |

| 2013 | 239047 | 55.8 | 203785 | 353033 | |

| 2002-13 | 179024 | 41.8 | |||

| Negotiated Grid | |||||

| 2002 | |||||

| 2003 | |||||

| 2004 | 50058 | 11 | 35814 | 64764 | |

| 2005 | 50156 | 12.1 | 31621 | 68636 | |

| 2006 | 39748 | 9.5 | 27622 | 58259 | |

| 2007 | 39530 | 9.4 | 23922 | 57195 | |

| 2008 | 30492 | 7.1 | 17783 | 44975 | |

| 2009 | 33643 | 7.7 | 19295 | 57155 | |

| 2010 | 24774 | 5.7 | 19118 | 31189 | |

| 2011 | 30420 | 6.8 | 18817 | 76079 | |

| 2012 | 27434 | 6.4 | 20316 | 37681 | |

| 2013 | 28178 | 6.6 | 18133 | 38738 | |

| 2002-13 | 35443 | 8.2 | |||

| Packer Owned | |||||

| 2002 | 26625 | 6.2 | 13450 | 39320 | |

| 2003 | 28353 | 6.5 | 12995 | 42630 | |

| 2004 | 32986 | 8.3 | 20320 | 25517 | |

| 2005 | 28186 | 6.8 | 12645 | 46344 | |

| 2006 | 22131 | 5.3 | 13531 | 33973 | |

| 2007 | 26898 | 6.4 | 13254 | 40375 | |

| 2008 | 24525 | 5.7 | 10399 | 42419 | |

| 2009 | 22053 | 5.1 | 10507 | 32251 | |

| 2010 | 20613 | 4.7 | 14950 | 31072 | |

| 2011 | 24632 | 5.5 | 12693 | 35785 | |

| 2012 | 26050 | 6 | 13990 | 41379 | |

| 2013 | 24730 | 5.8 | 12034 | 38109 | |

| 2002-13 | 25649 | 6 |

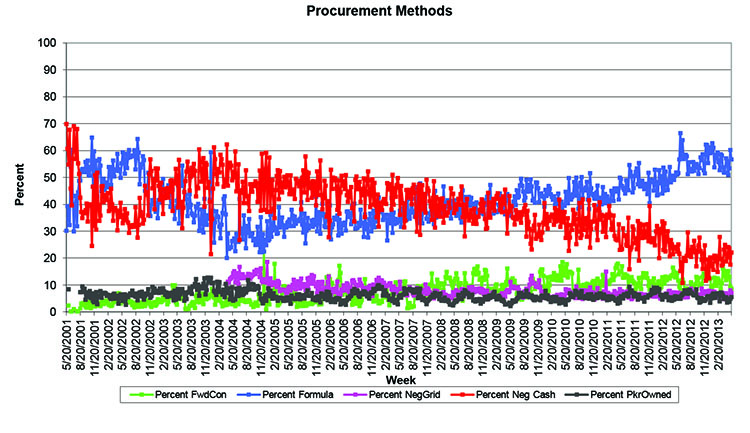

Weekly Dynamics

The proportion of total fed cattle procurement by various methods changes quite sharply from week to week as can be shown in Figure 2. Week-to-week procurement, whether expressed in percentage of the total as in Figure 2 or number of head, varies widely. High and low percentages on a weekly basis are well above and below the annual average percentages reported in Table 1. In fact, 10 percent shifts from one AMA to another are quite common from one week to the next.

While the weekly variation is evident in Figure 2, the overall trends discussed from the annual averages can be seen in the weekly variation figure also. Most notable over the data period is the decline in negotiated cash transactions and the rise in formula agreement trades. Less evident but also notable is the small increase in forward contracts and small decline in negotiated grid transactions. Also, it is clear no trend up or down appears for packer-owned procurement.

The exact reason for the week-to-week variation in procurement methods is not clear. It may be related to specific market conditions (e.g., regional marketing or procurement differences, specific feeding conditions, or consumer beef demand), or periodic changes in marketing or procurement strategies either by cattle feedlots or packers. However, trade-offs seem to occur between negotiated pricing and formula pricing, and appear not to necessarily involve forward contracting, negotiated grid pricing, or packer ownership of fed cattle.

Figure 2. Weekly fed cattle procurement by alternative marketing arrangement (percent of total), May 2001 to April 2013.

Slaughter Hog Volume by Marketing Method

As with fed cattle, AMA data for slaughter hogs are discussed from two aspects, annual averages and week-to-week dynamics. AMAs for hogs differ from those for cattle and the reliance on negotiated cash pricing for hogs is greatly diminished compared with fed cattle, even when mandatory price reporting was first implemented. Another difference should be noted between data reported for fed cattle and hogs. Packer-owned hogs are not included in the four procurement methods discussed here. In this fact sheet, reference to total hogs procured excludes hogs owned by packers.

Annual Averages

Table 2 provides summary statistics for the various hog procurement methods for the period May 2001 to April 2013. In sharp contrast to fed cattle, negotiated cash transactions for hogs represent a much smaller percentage of total purchases compared with other alternative arrangements. Negotiated cash trades in hogs were a smaller percentage of total procurement in 2002 than negotiated cash trades in cattle in 2013.

Again, a few trends are evident from scanning the annual data by AMA. First, negotiated cash trades have dwindled sharply, to a low of 3.8 percent of hog procurement in 2013. Negotiated cash transactions have been replaced by an increase in swine market formula agreements and other purchase agreements. Other formula arrangements have fluctuated from year to year with no distinguishing trend. For many years, but increasingly in recent years, concerns have been expressed regarding how many cash market transactions are necessary to adequately represent market supply-demand conditions. Adding to the importance of cash market transactions is the fact many swine market formula transactions are tied to reported, negotiated cash prices.

Comparing 2002 to 2013 shows how procurement methods have changed since MPR began. The percentage of total procurement by AMA in 2002 was (from highest to lowest): swine market formula, 55.8 percent; other formula, 17.4 percent; negotiated cash, 15.5 percent; and other purchases, 11.3 percent. In 2013, the percentages were (from highest to lowest): swine market formula, 62.3 percent; other purchases, 22.8 percent; other formula, 11.1 percent; and negotiated cash, 3.8 percent. Therefore, the trend has continued away from negotiated cash pricing and the concerns and questions about thin market impacts and alternatives has increased.

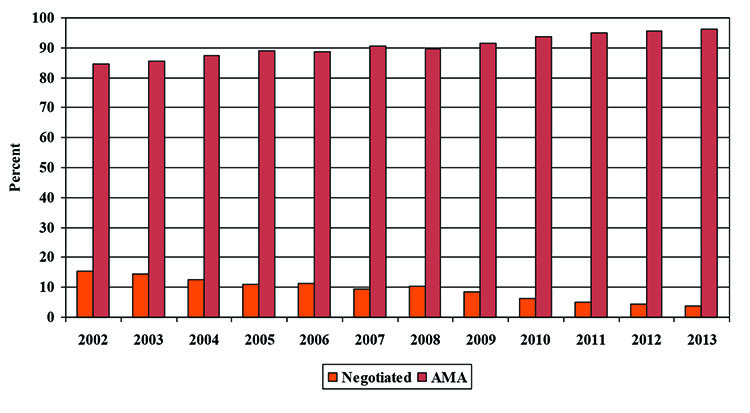

Figure 3 shows annual averages for negotiated cash trades compared with the sum of the other three AMAs each year. This more clearly shows the trend away from negotiated cash prices to AMSs and how thin the cash market has become. However, again, nothing can be implied about market behavior or performance from this trend alone.

Figure 3. Annual average slaughter hog procurement for cash market trades vs. other alternative

marketing arrangements (percent of total), 2002 to 2013.

Table 2. Hog volume summary by AMA (May to April, by year).

| Year | Weekly Mean (head) | Percent of Yr Total | min | Max | |

|---|---|---|---|---|---|

| Negotiated Cash | |||||

| 2002 | 167636 | 15.5 | 110266 | 200739 | |

| 2003 | 178288 | 14.5 | 106009 | 203734 | |

| 2004 | 157752 | 12.7 | 108516 | 203421 | |

| 2005 | 143198 | 10.9 | 89385 | 211169 | |

| 2006 | 148585 | 11.4 | 102207 | 225797 | |

| 2007 | 111281 | 9.5 | 85385 | 211169 | |

| 2008 | 135940 | 10.3 | 102207 | 180064 | |

| 2009 | 112629 | 8.5 | 55897 | 161896 | |

| 2010 | 77578 | 6.2 | 55813 | 97579 | |

| 2011 | 66071 | 4.9 | 41595 | 101658 | |

| 2012 | 61115 | 4.5 | 32054 | 90294 | |

| 2013 | 51880 | 3.8 | 28487 | 79009 | |

| 2002-13 | 117672 | 9.4 | |||

| Other Formula | |||||

| 2002 | 196197 | 17.4 | 56383 | 327794 | |

| 2003 | 113192 | 9.4 | 45101 | 275396 | |

| 2004 | 129759 | 10.3 | 53764 | 321017 | |

| 2005 | 184016 | 13.9 | 106337 | 431823 | |

| 2006 | 163723 | 12. 5 | 84579 | 287652 | |

| 2007 | 151346 | 12.8 | 84338 | 363949 | |

| 2008 | 217240 | 15.8 | 86831 | 613908 | |

| 2009 | 157559 | 11.6 | 63476 | 355069 | |

| 2010 | 215641 | 17.1 | 130886 | 380489 | |

| 2011 | 224670 | 16.6 | 107405 | 643451 | |

| 2012 | 204848 | 15.2 | 105588 | 439828 | |

| 2013 | 151524 | 11.1 | 81043 | 292833 | |

| 2002-13 | 175810 | 13.6 | |||

| Swine Market Formula | |||||

| 2002 | 608854 | 55.8 | 429540 | 754581 | |

| 2003 | 646545 | 52.4 | 481633 | 776568 | |

| 2004 | 650869 | 51.9 | 432354 | 784341 | |

| 2005 | 703513 | 56.9 | 556214 | 824173 | |

| 2006 | 721005 | 55.4 | 568109 | 829943 | |

| 2007 | 651490 | 55.4 | 492791 | 746000 | |

| 2008 | 700293 | 53.2 | 509065 | 816164 | |

| 2009 | 833908 | 62.5 | 567118 | 906109 | |

| 2010 | 727207 | 58.4 | 631447 | 798945 | |

| 2011 | 770956 | 57 | 535017 | 910741 | |

| 2012 | 774301 | 57.5 | 541902 | 1031981 | |

| 2013 | 852336 | 62.3 | 638729 | 1234857 | |

| 2002-13 | 720106 | 56.6 | |||

| Other Purchase | |||||

| 2002 | 127612 | 11.3 | 30327 | 200045 | |

| 2003 | 297018 | 23.7 | 110881 | 402517 | |

| 2004 | 314770 | 25.2 | 227336 | 401255 | |

| 2005 | 277270 | 21.3 | 227634 | 329203 | |

| 2006 | 270474 | 20.7 | 191202 | 326909 | |

| 2007 | 263387 | 22.4 | 208382 | 335430 | |

| 2008 | 271289 | 20.7 | 221784 | 370388 | |

| 2009 | 232621 | 17.5 | 188031 | 295831 | |

| 2010 | 226510 | 18.3 | 179610 | 252246 | |

| 2011 | 291932 | 21.6 | 173758 | 395800 | |

| 2012 | 306596 | 22.8 | 182930 | 428667 | |

| 2013 | 311883 | 22.8 | 218843 | 478780 | |

| 2002-13 | 265947 | 20.7 |

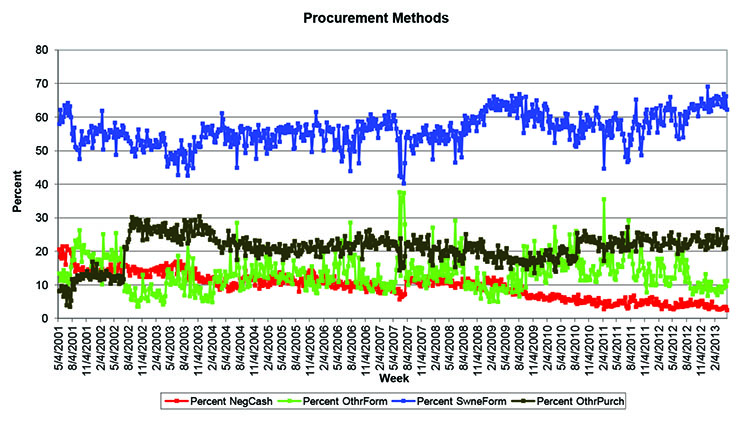

Weekly Dynamics

As with fed cattle, hog procurement by AMAs exhibits considerable week-to-week variability (Figure 4). There does not appear to be a clear trade-off between the use of one method with another, though the upward trend in use of swine market formula agreements and the downward trend in use of negotiated cash prices can be seen.

Week-to-week variation in negotiated cash trades over the most recent couple years is 1-3 percent. The lowest percentage for negotiated cash trades was 2.5 percent. For the other AMAs, variability from week to week can be 5 percent or more. As with fed cattle, variability in use of a specific AMA from week to week is not clear but may be related to market conditions and is dependent on hog producers as well as pork packers.

Figure 4. Weekly slaughter hog procurement by alternative marketing arrangement (percent of total), May 2001 to April 2013.

Recent Research and Concluding Comments

Prior to mandatory price reporting, there were no timely reports on the extent and type of packer purchases of livestock. The only official data available were annual averages compiled and released by the Grain Inspection, Packers and Stockyards Administration (GIPSA) of the U.S. Department of Agriculture, but its statistics were published well after the end of the year in which the data occurred. Therefore, mandatory price reporting legislation greatly increased the quality, quantity, and usefulness of data on alternative marketing arrangements for livestock.

Even when MPR began, there was considerable concern among some hog producers about the thinning cash market. Those concerns have increased and similar concerns among some cattle feeders have increased as well. Data presented in this fact sheet confirms the thinning cash market both for fed cattle and hogs. Reliance on the cash market, both for hogs and fed cattle, reached its lowest level in 2013. Economists and the industry continue to wrestle with two questions: How much cash market trading is enough? When does the decline in cash market trading seriously jeopardize the accuracy of prices reflecting true supply and demand conditions?

Two recent studies have focused on the thin market issue, taking quite different approaches. Franken and Purcell (2012) drew upon earlier, innovative research on thin markets to determine the representativeness of negotiated cash transactions for hogs and pork. They used MPR data since implementing the Act in 2001 through 2009 (for pork) and 2010 (for hogs). They concluded that the transaction volume of negotiated trades in those years was sufficient to maintain a 90 percent confidence in a $0.35/cwt. level of pricing accuracy for hogs and $0.45/cwt. level for pork. However, whether or not their level of confidence and degrees of accuracy are adequate for market participants was not addressed; but certainly is a relevant question.

Lee, Ward, and Brorsen (2012) addressed market thinness of negotiated cash prices from another angle. They, too, use MPR data since the Act was implemented up to 2010, both for cattle and hogs. They examined cointegration of prices across procurement methods and tested for Granger causality. They found little concern in terms of cointegration and causality for fed cattle, either for the entire nine-year period or segmented into three-year subperiods. Similar results were found for hogs over the full data period. However, for the most recent three-year subperiod alone (2008-2010), when negotiated cash trading was at its lowest for hogs (or market thinness at its highest), results confirmed concerns regarding market thinness of negotiated cash trades.

Some might think both studies provide reassurance the thinning cash market is still adequate for price discovery. However, readers are reminded data for those studies ended in 2010 and data presented in this fact sheet shows a continuing trend in market thinness for the 2011-2013 period.

References

Franken, J.R.V. and J.L. Parcell. “Evaluation of Market Thinness for Hogs and Pork.” Journal of Agricultural and Applied Economics 44(2012):461-75.

Lee, Y., C.E. Ward, and W.B. Brorsen. “Procurement Price Relationships for Fed Cattle and Hogs: Importance of the Cash Market in Price Discovery.” Agribusiness: An International Journal 28(2012):135-47.