Dual Use Wheat and Risk Management Alternatives for Oklahoma Cattle Producers

Introduction

Agricultural producers encounter a variety of uncertainties, underscoring the need for effective risk management in farm and ranch planning. Factors like rising input costs, weather fluctuations, market volatility and legal risks emphasize the importance of proactive risk mitigation. Lenders may require risk management, including insurance, to uphold credit lines. Crop and forage insurance, coupled with USDA disaster programs, are vital tools for mitigating weather damages to pastures, crops and livestock. Navigating these challenges successfully requires a comprehensive understanding of the programs, developing good relationships with agents, and maintaining good records with regular reporting.

This factsheet specifically delves into risk management strategies for Southern Plains cattle producers grappling with a prevalent challenge—drought. A 2022 study revealed that nearly 98% of crop acres in Oklahoma and Texas lacked sufficient soil moisture (USDA NASS, 2022), resulting in a 44% reduction in wheat harvested acreage (Ellis, 2022). About 35% of the harvested wheat exhibited poor quality, attributed to both low yields and heightened input costs (USDA NASS, 2022), and exemplified by the price of nitrogen fertilizer increasing by 108% year over year during the 2022 topdressing season (US BLS, 2024). In the Southern Great Plains, grazing of cool-season small grain pasture (mostly winter wheat) is an important cattle enterprise. Stocker operations, prominent in certain areas of Oklahoma and Texas, experienced a doubling of stocking rates on pastures in 2022 and 2023, primarily due to persistent drought conditions generating low forage yield for both grazing and haying (Ellis, 2022). This reduction in forage production was accompanied by increased input costs for supplemental feeding.

Producers counter increased input costs by utilizing winter wheat grazing. This form of grazing is popular in the Southern Great Plains. Producers stock cattle on winter wheat and graze on it during the winter season. This grazing helps lower supplemental feeding costs for the producer and provides an opportunity to add value to retained calves. The exact length of time cattle are grazed can depend on several factors, but can be as short as four to eight weeks (Holman, Lyon and Luebbe, 2011) or as long as 14 to 18 weeks (Lollato et al., 2017). Producers utilize wheat for grazing cattle prior to the development of wheat grain. At first hollow stem, it is necessary to move the cattle off the wheat pasture to allow for proper grain development. More information on winter wheat grazing can be found in the fact sheet “Dual Purpose Wheat: Management for Forage and Grain Production” (Lollato et al., 2017) and the video series “Managing Wheat and Small Grains for Grazing” (OSU Extension, 2020).

The 2018 Agriculture Improvement Act (2018 Farm Bill) introduced a dual-use insurance alternative for cattle producers grazing small grains. Small grains include wheat (winter and spring), barley, oats, rye, flax and buckwheat for Risk Management Agency insurance participation. Dual-use coverage, available since the 2019 crop year, includes both grazing and grain harvest. The dual-use option combines annual forage insurance and multi-peril crop insurance. The policy is offered in counties in Texas, Oklahoma, Kansas, Nebraska and NewMexicowhere “grain/ graze” is considered a “good farming practice” (USDARMA, 2019). These states have commonly faced severe drought conditions (Riganati, 2023). From 2004 to 2023, extreme or exceptional drought was experienced somewhere in that five-state region 79% of the time, and it covered more than 20% of land area 27% of the time (NIDIS, 2022). This document outlines the policy rules and potential benefits.

How does dual use insurance fit into overall drought risk management?

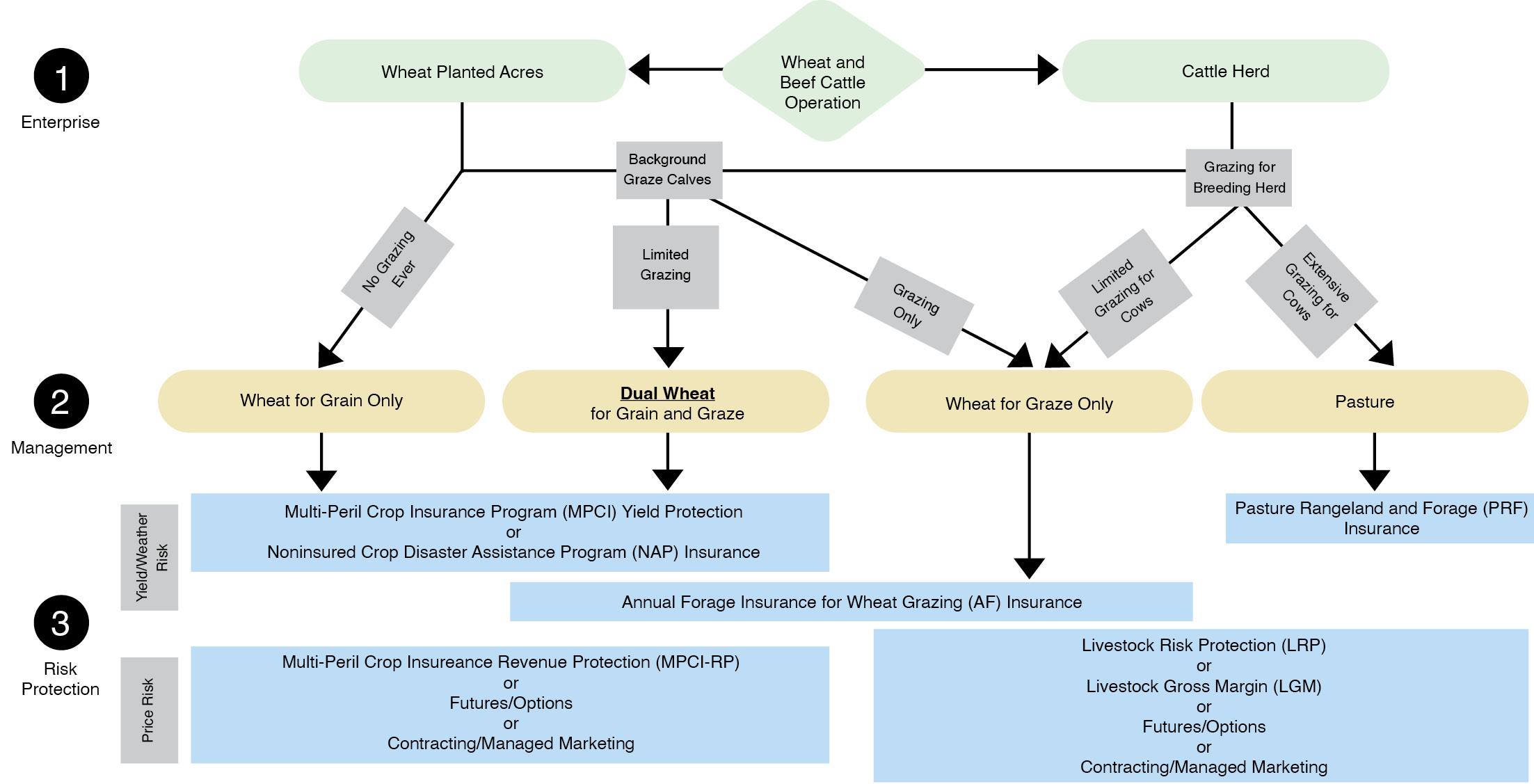

Insurance, disaster programs, diversification, and a range of marketing and input purchase strategies can be strategically integrated for comprehensive, whole-farm risk management. For a full overview of risk management tools, see “Where’s the Risk? Livestock Risk Management” (Fischer, Benavidez, and Hagerman, 2022). Here, we will focus on USDA-subsidized insurance tools. Understanding the interplay and interactions between policies is crucial when choosing the right insurance options for producers’ operations. Below is a livestock risk management alternative flow chart (Figure 1) that explains the various pathways producers can follow for risk protection and highlights the relationships between policies.

In Figure 1, the top row of boxes (1) represents the distinct enterprises of a typical wheat and cattle operation in Oklahoma, where the second row of boxes (2) represents the different management alternatives available to the producer. The third row of boxes (3) indicates different risk management programs. Operations can utilize various programs for wheat (grazing, grain or dual) and cattle risk management, some of which can be stacked. The lines connect with multiple policies, showcasing the multitude of options producers have when stacking protection policies. The black lines below indicate several dual usage methods. Table 2, provides a concise description of each program, along with a link to additional information.

How to choose a combination of programs that make sense for an individual operation

Understanding risk protection alternatives is crucial, but assessing the financial impacts of programs like dual use is equally important for producers since insurance policies come with a cost. So, starting with an enterprise budget is recommended. This budget serves as a financial representation of an agricultural operation, estimating potential profitability under specific market conditions. Utilizing enterprise budgets for cow-calf, stocker and wheat operations from OSU Extension, we conducted a scenario analysis for Garfield County, Oklahoma, under 2022 costs and drought conditions. The example operation comprises 135 cows on a 2,000-acre plot, with 1,600 acres of native grass and 400 acres of wheat. While the length of wheat grazing is typically affected by drought, it is assumed that a producer can get a stand of wheat that makes grazing possible and that cattle are grazed in a 120-day period at a more conservative rate than normal.

Table 1, presents the results of the enterprise budget analysis. The top half of the figure describes the operation and risk management alternatives selected. The bottom half contains the financial analysis. The second and third columns display the outcomes for individual enterprises, while the third column depicts risk management on a dual use operation. Each option includes revenue, fixed and variable costs, breakeven, total cost and an insurance coverage cost. Additionally, a projected indemnity indicates potential revenue loss offset by insurance.

The economic analysis reveals the capacity to offset drought-related losses through dual-use insurance coverage. In our scenario, grazing retained calves on winter wheat provides higher overall revenue with a low breakeven cost for feeding. Comparing dual use to a wheat and cattle budget, a producer in Garfield County could offset drought-related losses with an expected indemnity of $74.17. This analysis suggests that dual use is a reasonable alternative for producers seeking to graze cattle on winter wheat.

Conclusion

Various insurance coverages, including LRP, PRF, MPCI, and AF, can be stacked within program terms, offering comprehensive coverage against multiple forms of risk. In instances of drought, rainfall insurance and MPCI have proven effective in offsetting drought-related financial risks, as demonstrated in this example. Enterprise budgets provide producers with valuable insights into diverse insurance methods, assisting them in selecting the most suitable option for their operations. These findings play a pivotal role in underlining the importance of implementing risk protection methods, particularly in current conditions where a safety-net alternative can mitigate production declines. The array of options for risk protection allows producers to make a customized choice that matches their specific operation. If you have questions about any of these programs, please reach out to your local insurance agencies and OSU Extension specialists.

Acknowledgements

The authors would like to thank members of the Southern Agricultural Economics Association and the Texas and Southwest Cattle Raisers Association for their feedback at poster sessions presenting early results of this work.

Figure 1. Conceptual Overview of Risk Management Alternatives for Cattle and Wheat Producers in Oklahoma.

| Cow Herd: | 135 head of commercial cows | ||

|---|---|---|---|

| Acres: | 1,600 acres of native grass pasture | 400 acres of wheat | 2,000 total acres |

| Marketing: | Cow-calf herd of 135 head. Calves sold at weaning in 2022 market conditions | Calves sold at weaning in 2022 market conditions | Calves sold after four months grazing wheat pasture |

| Insurance Pathway: | LRP for price risk PRF for drought risk |

Marketings/storage plan for price risk Multiperil crop insurance for grain production risk |

LRP and marketing/storage plan for price risks AF for wheat/PRF for grass for drought risk Multiperil crop insurance for grain production risk |

| BUDGET | Cattle Operation Budget ($/Acre) | Wheat Operation Budget ($/Acre) | Whole Farm Operation Budget ($/Acre) |

| Fixed Cost | $11.19 | $27.83 | $39.01 |

| Variable Production Cost | $64.15 | $314.74 | $397.14 |

| Total Production Cost | $75.33 | $342.57 | $443.22 |

| Breakeven Cost | $51.03a | $314.74 | $65.73a |

| Insurance Cost | $3.49 | $7.08 | $7.81 |

| Production Revenue | $57.73 | $341.80 | $430.42 |

| Projected Indemnities | $9.00 | $30.15 | $74.17 |

| Total Revenue | $66.73 | $371.95 | $504.59 |

Table 1. Enterprise Budget Analysis Results Comparison for Separate Risk Management for Cattle and Wheat Operations and Dual Use Joint Risk Management.

*For the market conditions and timing of this analysis, LRP was not expected to result in an indemnity.

Source: Insurance policy information was obtained using USDA RMA Online tools. 2022-2023 insurance costs were obtained for LRP (Mayand August), and PRF and AF (July). Costs of multi-peril crop insurance were estimated within the enterprise budgets.

a/ Breakeven cost reflects only the variable cost associated with the primary risk being offset by insurance, feeding cost.

**This budget is based on a baseline set of assumptions for 2022 input use and costs for cow-calf, wheat production and stocker productionon small grains grazing. For a full list of inputs and prices, as well as production and management assumptions, please download the OSUenterprise budgets for details.

| Policy Type | Description | Outside Resources |

|---|---|---|

| Noninsured Crop Disaster Assistance Program (NAP) | Provides financial assistance to producers with crops that fall under noninsurable with low yields. This also aids producers who were unable to plant due to natural disasters | USDA NAP Webpage |

| Multiperil Crop Insurance (MPCI) | This provides a wide range of subsidized crop insurance protection. This type of insurance has three varying types and eight different levels of policies, which are sold at four different unit types. | USDA MPCI Webpage |

| Annual Forage (AF) | This program is presented through the USDA and provides coverage on annually planted forage or grazing crop. This protection program only relates to lack of precipitation. | USDA AF Webpage |

| Pasture Rangeland Forage (PRF) This |

This risk protection alternative provides protection on pasture, rangeland and certain forages. This type of insurance method utilizes a rainfall index rather than production output. | USDA PRF Webpage |

| Livestock Risk Protection (LRP) | This insurance alternative is designed to protect against declining market prices. Prices for beef cattle producers of either feeder (stocker or cow-calf) cattle or fed cattle. | USDA LRP Webpage |

| Livestock Gross Margin (LGM) | LGM is a risk protection method that provides gross margin protection in the case of potential loss for fed cattle. | USDA LGM Webpage |

Table 2. Description of Insurance Policy Alternatives for Cattle and Wheat Producers.

References

Ellis, G. 2022. “Wheat harvest recap: the drought was ugly and a few other takeaways.” Oklahoma State University Extension.

Fischer, B., J. Benavidez, and A.D. Hagerman. 2022. “Risk Management for Livestock Producers.” Texas AgriLife Extension Handbook. https://www.afpc.tamu.edu/extension/resources/livestock-book/wheres-the-risk-a-livestock-risk-management-handbook.pdf

Holman, T.L., D.J. Lyon, M.K. Luebbe. 2011. “Grazing Winter Wheat in Nebraska” University of Nebraska Lincoln Extension, EC185 https://extensionpublications.unl.edu/assets/pdf/ec185.pdf

Lollato, R.P., D. Marburger, J.D. Holman, P. Tomlinson, D. Presley, J.T. Edwards. 2017. “Dual Purpose Wheat: Management for Forage and Grain Production” Oklahoma State University Extension, PSS-2178. https://extension.okstate.edu/fact-sheets/dual-purpose-wheat-management-for-forage-and-grain-production.html

National Integrated Drought Information System (NIDIS). 2022. “Historical Data and Conditions” National Oceanic and Atmospheric Agency. https://www.drought.gov/historical-information?dataset=0&selectedDateUS=&selectedDateUSDM=20240924

Oklahoma State University Extension (OSU Extension). 2020. “Managing Wheats and Small Grains for Grazing” Rancher’s Lunchtime Learning Series, Department of Animal Science. https://extension.okstate.edu/programs/beef-extension/ranchers-thursday-lunchtime-series/cattle-on-wheat-and-small-grains.html

Riganati, C. 2023. U.S. Drought Monitor: Oklahoma. US Drought Monitor. Accessed January 2023. https://droughtmonitor.unl.edu/CurrentMap/StateDroughtMonitor.aspx?OK

United States Bureau of Labor Statistics (US BLS), 2024. “Producer Price Index by Industry: Nitrogenous Fertilizer Manufacturing” [PCU325311325311], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org

United States Department of Agriculture Risk Management Agency. 2019. “USDA Announces Dual Use Insurance for Grain and Graze.” https://www.rma.usda.gov/en/News-Room/Press/National-News-Archive/2019-News/2019 News/USDA-Announces-Dual-Use-Insurance-Coverage-for-Grain-Graze

United States Department of Agriculture, National Agricultural Statistics Service (USDA NASS). 2022. “Oklahoma Crop Progress and Condition” Oklahoma Field Office, October 24, 2022.