Considerations for Wineries Deciding to Ship Direct to Consumer

Introduction

The decision to ship your wine can be complicated. Shipping wine allows you to expand your potential customer base beyond those who visit your winery. However, there are legal as well as tax considerations that must be taken into account. Each state has its own laws, required licenses and tax requirements. This fact sheet is not intended to provide legal or tax advice, but to provide a starting place for wineries considering shipping wine direct-to-consumers within the U.S. and to provide an Excel spreadsheet to begin estimating costs.

Deciding to ship wine will require time dedicated not only to the physical shipment of wine, but also keeping track of required licenses, taxes, legislative updates and potential consumer volume limits. The first decision a winery should make is: which states will you ship to? Currently there are three states that do not allow direct-to-consumer wine shipping: Delaware, Utah and Mississippi1. Even if a state does allow the direct-to-consumer wine shipments, individual counties within the state may not. For example, in the state of Florida, there are two “dry” counties that cannot be shipped to: Lafayette and Liberty 2,3.

Types of Direct-to-Consumer Wine Shipping

It is important to note that there are two types of direct to-consumer wine shipping: on-site and off-site.

An on-site purchase meets the following requirements4:

- The wine was purchased at the physical location- this does not include over the phone or internet

- The legal age of the purchaser must be verified by the winery

- The wine is not for resale, but for personal use only

- The purchaser is the consignee (the recipient of the goods being shipped)

This scenario occurs when someone visits your winery, picks out some wine and would like it shipped back to their home. In this scenario, you are still required to have the appropriate licenses, pay the state taxes and meet the requirement set by the consumer’s home state. Currently, Arkansas and Mississippi only allow on-site shipping of wine4,5.

Off-site purchases would include any sales made online, over the phone, through email etc. Individual state rules must still be followed. Off-site purchases are unlikely to occur without a website, or online sales platform.

Individual State Rules and Regulations

Permit Fees

Permit fees vary greatly from state-to-state, ranging from$0 to $1,5006. Four states, Alaska, DC, Florida and Minnesota7 do not require permits. However, it is important to routinely check on an individual state’s status. For example, although Alaska currently does not require a permit, effective January 1, 2024 a permit will be required at the cost of $2008.

Missouri9 and North Carolina10 require permits, but the fee is $0. Illinois has the highest permit fees; however, they vary depending on the “class” of winery. For example, a first class wine manufacturer (manufactures up to 50,000 gallons annually) only has to pay $350 for a permit and if they produce under 25,000 they may qualify for self-distribution exemptions. However, for Illinois, second class wine manufacturers vary by the gallons manufactured annually: $350 for wineries that do not exceed 250,000 gallons, $1,000 for wineries that do not exceed 500,000 gallons and $1,500 for wineries that produce over 500,000 gallons annually11. Some states have different permits and fees for different counties within the state. For example, all four counties in Hawaii(Honolulu, Maui, Kauai and Hawaii) have separate permit applications and fees12.

For the states you plan to offer shipping, it is your responsibility to apply for the correct licenses/permits required. Depending on your budget and the home states of your most frequent customers, it may make sense to complete and pay for permits in only limited states. To start, you may only want to offer shipping for the state your winery is located, or simply your state and the surrounding states. It is a big financial and logistical commitment to offer shipping to all states and may not be feasible for smaller wineries.

Volume Limit

Similar to permit fees, volume limits vary from state-to-state. Three states, California13, Colorado14 and Florida2 do not have volume limits. For most states, volume limits are on a per-person per-year, or per-month basis. For example, Oklahoma15 limits volume to 6 nine-liter cases per-person per-year. A nine-liter case is equivalent to 12, 750 milliliter bottles16. Indiana sets both per-person and per-winery limits,17 limiting individuals to 24 6-bottle (1.5L/bottle) cases per-year (216 liters) and or wineries to 5,000 total 6-liter cases (45,000 liters) per-permit per-year. Georgia18, Hawaii12 and Wyoming19 all set limits per address.

In order to make sure you are not violating volume limits, you will need to be aware of each state’s limits and record the appropriate information. For example, if there is a limit per-person, you will need to keep track of volume sold by name. If there is a per-address limit, you will need to keep track of volume by address, as multiple people within a household may be ordering.

Tax

Each state has their own requirement for taxes and frequency of tax collection. Looking at individual state requirements is necessary. The wine institute has a fairly comprehensive summary, and links available for more updated information to get started. The interactive state map is available at Direct-To-Consumer Shipping Laws for Wineries. For example, in Oklahoma, state and local sales tax must be collected in addition to excise tax20. Excise taxes are imposed on various goods, series and activities21. Depending on the state, the excise tax can vary based on the type of wine or the alcohol content. In Oklahoma20, both the Vendor Use Tax Return and the Direct Shipper Alcoholic Beverage Excise Tax Return are due annually by January 20th.

Carriers that will Ship Wine Rules

Fed Ex Requirements

To ship using FedEx, licensed alcohol shippers must enter into the FedEx alcohol shipping agreement. Becoming an authorized alcohol shipper with FedEx is a 4-step process. Steps include (1) creating an account number (2) contacting a FedEx account executive (3) signing agreements and (4)complying with shipping requirements. Labels will need to be created using FedEx Ship Manager®, which is a free program. You can also use a third party approved system.Detailed information can be found at How to become an authorized alcohol shipper with FedEx.

FedEx accepts inner packaging of molded polystyrene as preferred, but also accepts die-cut corrugated units. Outer corrugated cartons are required. For many states, an adult signature is required for US packages that contain alcohol; this is also a FedEx policy. The fee for an adult signature service is $5.75 per shipment. Shipments will not be delivered if the shipment does not comply with all FedEx, federal, state and local laws/requirements. They will also not be delivered if the recipient is not 21 or does not have a valid ID, or if the recipient is intoxicated.

UPS Requirements

Similar to the rules for FedEx, UPS only ships wine for shippers licensed under the applicable law and who have signed into a contract with UPS. Detailed information can be found at How To Ship Wine. UPS offers free 15-minute consultations for those interested in becoming an approved wine shipper, available at solutions. Reimagine Your Business With a Free Virtual Consultation. All state licenses must be provided to UPS. The wine shipment must be processed through World Ship or an approved third-party vendor.

Acceptable inner packaging includes molded Expandable Polystyrene foam, folded corrugated trays, molded fiber trays with dividers or thermoformed plastic trays. Bottles must be secured in the center of the container away from the side walls. A sturdy outer corrugated container is also required.

Oklahoma example and Excel sheet

The following example and excel sheet are designed to help wineries have a better understanding of the costs associated with shipping wine. Again, this is not tax or legal advice. The interactive Excel sheet can be accessed here.

Purchase Information

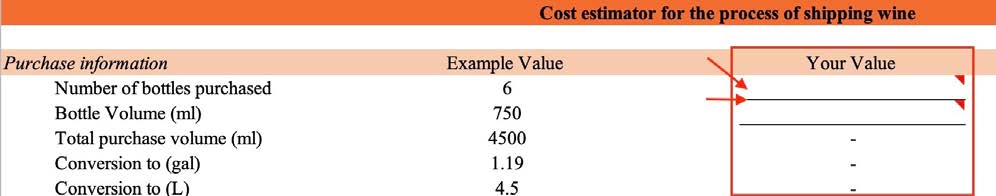

To begin, you will need to include some purchase information for further calculations throughout the sheet (Figure 1). For example, to calculate excise tax, either the gallon volume or liter volume of the wine purchased is needed. Whether excise tax is calculated by the gallon or liter is determined by the state. The Excel sheet will automatically calculate the volume of the purchase for you if the consumer purchased bottles of the same size. All you have to do is give the number of bottles and volume of each bottle in milliliters (ml). Note a standard bottle size is 750 ml. Once that information has been given, the Excel sheet calculates the total milliliters of the purchase and then converts the volume purchased to both gallons and liters.

Figure 1. Screen shot of Excel section for volume calculations

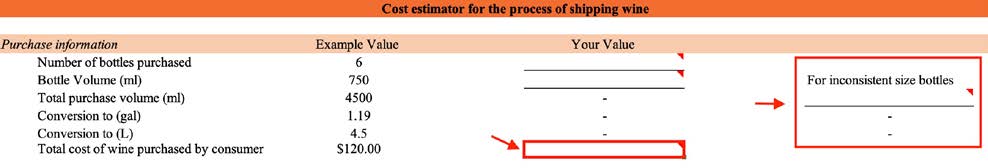

Figure 2. Screen shot of Excel section highlighting inconsistent size bottle, and cost of wine cells

Shipping and Packaging Information

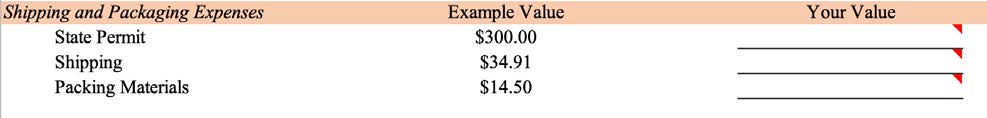

In this section, you will need to include the cost of the state permit (Figure 3). Remember, this value is set by the state and may be zero. For Oklahoma, the cost is $300 for the first year and $150 annually to renew.

For shipping, we assumed the package would be going from Adair, Oklahoma to Stillwater, Oklahoma. Since wine is shipped to Oklahoma via UPS, we used the UPS wine cost estimator available at Get a Quote. To use the estimator you will need the address you are shipping from, the destination and a weight. In general, assuming standard sized bottles, 6 bottles of wine packaged for shipping weigh approximately 19.3 lbs22. On average, shipping costs for 6 bottles is $36.01 and $58.50 for 12 bottles23. It is important to check with the shipper, as there may be fuel surcharges and unexpected price changes. If there is an extra charge for the carrier to verify the age of the consumer, make sure to include that cost on the shipping line.

There are many types of approved wine packaging. Make sure to carefully read the requirements of your carrier. Most online options offer price breaks for bulk orders. Having a good estimate of the number of containers you will need throughout the year and ordering in bulk can help you save money. Some companies include the box and the insert materials as a package, others will sell them separately. For our estimate, we assumed the cost of packaging for the 6 bottle shipment was $14.5024.

Figure 3. Screen shot of Shipping and Packaging Expenses from Excel

Taxes

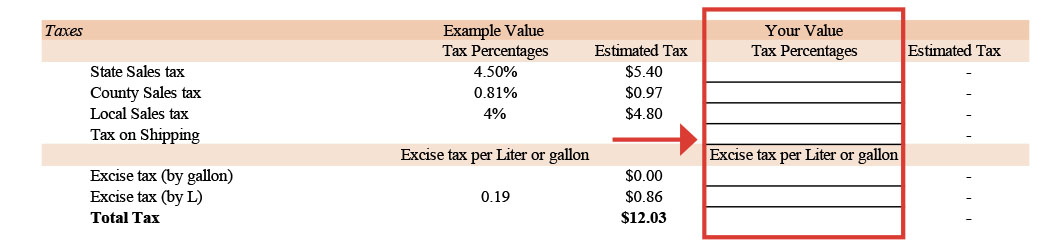

The state rules regarding taxes must be read carefully. For Oklahoma the state sales tax is currently 4.5%, the county sales tax (Payne County because that is where we are shipping to) is 0.81% and local sales tax (Stillwater) is 4% (Figure 4)25. Oklahoma charges an excise tax at a rate of $0.18 per liter for still wine. Different states charge per liter, or per gallon and may have different rates based on the type of wine. For your value-put the rate in the correct per gallon or per liter line and the calculation will be done for you. Leave the other line blank. Notice in our example, there is no value on the line “Excise tax (by gallon)” because Oklahoma charges per liter.

Figure 4. Screen shot of Taxes section from Excel

Summary Section

The intention of this tool is to provide a general frame work when considering shipping wine. At the bottom of the Excel sheet are some simple summary calculations. The first line gives the total cost of shipping for the producer, this includes the cost of the permit and the packaging. It is unlikely that you would purchase a permit to only do one shipment of wine; therefore, it is important to note that you will be spreading the cost of the permit over several shipments. Because of this, we also included the cost of shipping for the producer without the permit. Finally, we have included the total cost of the wine purchase for the consumer. This includes the retail value of the wine, the shipping costs and the tax. Many wineries have specials with discounted or no shipping costs. If you do this, remember that the winery will have to absorb the full cost of the shipping.

| Example Value | Your Values | |

|---|---|---|

| Total cost of shipping for producer | $314.50 | - |

| Total cost of shipping without permit cost for producer | $14.50 | - |

| Total cost wine for consumer (wine, shipping and tax) | $166.94 | - |

Table 1. Summary calculations

Conclusion

Deciding to ship wine is a big decision for a winery. Although the opportunity to reach more customers is tempting, there are additional costs including permits, packaging and management. The key to deciding to ship wine is to research the individual state requirements, rules and regulations. Keep in mind any labor limitations your winery may have, as keeping track of shipping requirements, records and shipping itself will require time.

References

- Todorov, Kerena. (2022) Wine Business."State of the States: More Work has to be done to ensure DtC Programs Success."

- Wine Institute. (2022) “State Shipping Laws:Florida.”

- SOVOS. (2006) “Dry Counties in Florida.”

- UPS. (2021) “Wine Shipping Agreement Addendum A.”

- FedEx. (2021) “Direct-to-Consumer Wine Shipping State Reference Guide.”

- Wine Institute. (2022) “Off-Site Direct Shipping Summary.”

- MN House Research. (2019) “Importation of Liquor for Personal Use.”

- Koral, Alex. (2022) SOVOS. “Alaska Paces New DtC Alcohol Shipping Laws.”

- Missouri Department of Public Safety. (2022) “Wine Direct Shipper.”

- NC Department of Commerce. (2022) “Wine Shipper.”

- Illinois Liquor Control Commission. “Application for state of Illinois winery shipper’s license.”

- Wine Institute.(2022) “State Shipping Laws:Hawaii.”

- California Department of Tax and Fee Administration. (2022) “Alcoholic Beverage Tax Law.”

- Wine Institute. (2022). “State Shipping Laws: Colorado.”

- Justia US Law.(2021). "2021 Oklahoma Statutes Title 37A. Alcoholic Beverage §37A-3-106. Direct Wine Shipper’s Permit-Requirements."

- Washington State. (2020). “ Wine Conversion Chart.”

- State of Indiana. (2015). “Supplement for Direct to Wine Seller’s Permit Application.”

- Wine Institute. (2018) “State Shipping Laws: Georgia.”

- Wine Institute. (2021) “State Shipping Laws: Wyoming.”

- Wine Institute. (2019) “Oklahoma Clarifies Tax Requirements for DTC Shipping.”

- IRS. (2022) “Excise Tax.”

- Sonoma Wine and Garden. (2022). “How Much Does One Case of Wine Weigh? (Chart).”

- Nozik, Diane. (2015) “How much should it cost to ship wine?”

- Uline. (2022). “Plastic Wine Shippers.”

- Avalara. (2022). “Stillwater, Oklahoma Sales Tax Rate.”