Cow-Calf Corner | June 9, 2025

Cattle and Beef Trade Continues with Uncertainty

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

The latest beef trade data shows a continuation of recent trends – decreased exports and increased imports. Beef exports in April were down 8.6 percent year over year and are down 4.2 percent for the January – April period. Beef imports were up 44.9 percent year over year in April and up 28.4 percent for the year-to-date.

In April, beef exports to South Korea were up 15.3 percent from last year and are up 3.1 percent so far this year. South Korea was the largest beef export market in April and is the largest for the year-to-date. Beef exports to Japan were up 8.1 percent year over year in April but are down 0.9 percent thus far in 2025. Mexico jumped to the number three spot in April despite a drop in beef exports of 9.5 percent for the month compared to last year. Mexico is down 9.9 percent for the January-April period year over year in the number four spot.

The most noticeable early impacts of the tariffs is the 67.7 percent decrease in beef exports to China in April. However, beef exports to Hong Kong were up 86.6 percent in April due to differences in tariffs between Hong Kong and mainland China. The two markets are usually considered as a single market, so combined April beef exports were down 52.2 percent year over year and are down 13.8 percent thus far in the year. China/Hong Kong was the fourth largest beef export market in April but remains the third largest for the year-to-date.

Beef exports to number five market Canada were down 14.0 percent in April and are down 0.5 percent year over year for the first four months of the year. Taiwan was down 18.8 percent in April compared to last year and is down 7.4 percent thus far in 2025.

Beef imports from Brazil jumped 308.5 percent in April making Brazil the largest source of beef imports thus far in 2025. Australia is number two with April imports from the country up 33.1 percent year over year and up 32.3 percent for the year-to-date. Beef imports from third ranked Canada were down 14.4 percent in April and are down 9.6 percent year over year for the first four months of the year. Beef imports from number four New Zealand were up 49.2 percent from last year and are up 17.5 percent through April. Beef imports from Mexico were down 0.7 percent year over year in April and are up 10.4 percent compared to the January – April period last year. Mexico is the number five source of beef imports. Uruguay is the sixth largest beef import source, up 15.7 percent year over year in April and up 36.1 percent in the first four months of the year.

The complex trade situation will continue to evolve in the coming months with continued policy uncertainty and global market disruptions. Trade relationships are shifting rapidly and market volatility is expected going forward.

Cow-Calf Sector of Beef Production

Mark Z. Johnson, Oklahoma State University Extension Beef Cattle Breeding Specialist

Cattle production is the most important U.S. agricultural industry, consistently accounting for the largest share of total cash receipts for agricultural commodities. In 2024, U.S. cattle production represented about 22 percent of the $515 billion in total cash receipts for agricultural commodities. With rich agricultural land resources, the United States has developed a beef industry that is largely separate from its dairy sector. The U.S. beef industry is unique when compared with countries. In addition to having the world's largest cattle finishing industry, the United States is also the world's largest total consumer of beef. Primarily high-quality, grain-fed beef. The U.S. beef cattle industry is segmented and has a long production cycle.

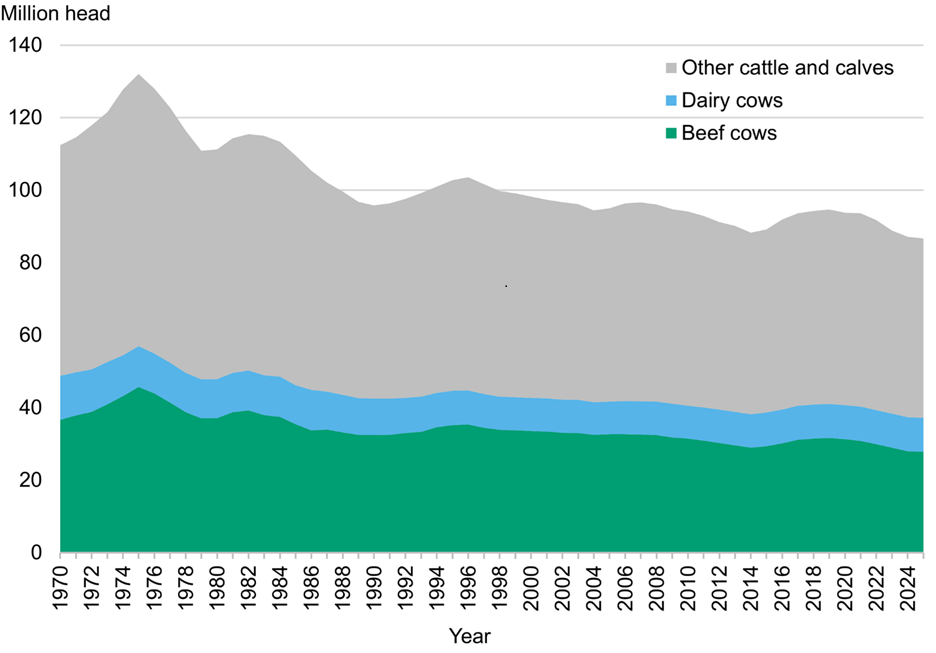

Figure 1. Cattle and cow inventories, 1970-2025. Source: USDA, Economic Research Service calculations using USDA, National Agricultural Statistics Service, Cattle report.

The cow-calf sector serves as the source of calves that will eventually become beef, the product. This sector maintains a herd of beef cows for raising calves. Most calves are born in spring and weaned at 3 to 7 months. Following the weaning stage, calves can move through the production chain in several different ways. Select heifer and bull calves may be retained and developed as breeding stock. If additional pasture forage is available at weaning, (typical of Oklahoma winter wheat grazing), calves may be retained for further grazing and growth until the following spring then sold as yearlings. Yearlings then move into the finishing segment and are typically fed to finish to a compositional endpoint offering the best trade-off between Quality Grade and red meat yield. Throughout the United States, cow-calf operations are located on land that is not typically suited or needed for crop production. These operations depend on range and pasture forage conditions, which vary a great deal across the U.S. based on the area’s rainfall and temperature. Beef cows graze on forage from grasslands to maintain themselves and raise a calf with very little, if any, grain input. The cow is maintained on pasture year-round, as is the calf until the calf is weaned. Based on USDA, NASS 2022 Census of Agriculture data, the average beef cow herd size is 47 head. Operations with 50 or fewer head likely coexist alongside other income streams, or the operations provide supplemental income to off-farm employment. Operations with 100 or more beef cows compose 10.5 percent of all beef operations and 60.5 percent of the beef cow inventory.

As indicated in figure 1, the current inventory of cows in the U.S. is historically low. This coupled with robust consumer demand for high-quality beef results in historically high value for beef and all classes of live beef cattle. In terms of tonnage, consumer demand is currently being supplied through finishing cattle to historically heavier carcass weights than ever seen during the modern feedlot era.

The biological time lag of beef production is such that if we selected a high percentage of our current heifer calves to develop as replacements. Next spring (2026), those properly developed replacement heifers would be ready to breed by 14 – 15 months of age. The following spring, those heifers would calve at two years of age (Spring, 2027). Those calves would be ready to market at weaning in the fall. Those calves would become yearlings in 2028 and eventually become marketed as finished “A Maturity” finished cattle or beef carcasses six to eight months after entering the feedyard. Bottomline: when we begin to retain heifers (on a large scale), we are a couple of years away from increasing the cow inventory, and at least 30 months away from increasing the supply of weaned calves, and so on, regarding yearlings and fed cattle. That being stated, the basic fundamentals of supply and demand favor strong prices for all categories of cattle until cow inventory begins to increase, and that will take some time.

Reference: Cattle & Beef - Sector at a Glance | Economic Research Service

Is Profitability Possible for Stocker Producers in Today’s Cattle Market?

Paul Beck, Oklahoma State University Cooperative Extension Beef Cattle Nutrition Specialist

Why Stocker Programs Work

Feedlots prefer calves that are weaned, healthy, and accustomed to feed and water. Derrell Peel stated in the March 3 Cow-Calf Corner Newsletter “In the current market with relatively low feedlot costs of gain and tight feeder cattle supply, feedlots are willing to place cattle earlier and at lighter weights putting a squeeze on stocker producers.”

What is the potential for adding value and improving the odds of positive stocker cattle margins?

Stocker Cattle Opportunities

I used the Beef Basis Price Forecasting Tool to run a few scenarios to consider. For a baseline, I used a 450 #1 medium to large frame steer calf purchased in a large group in central Oklahoma with a price forecast of $400 per hundred pounds. This steer with low risk for disease or death loss would cost $1,800 per head in today’s market.

450 pound steer x $4/pound = $1,800 per head initial cost

We will sell this calf in western auction markets close to the feedlots at 850 pounds. To get this steer to 850 pounds we would expect2 pounds per day over 200 days and sell in December at a projected market of $283/ hundredweight for $2,405 per head.

850 pound steer x $2.83/pound = $2,405 per head selling value

The total gross margin on this set of steers is projected to be $605 per head (2,405 selling value – 1800 initial cost). The value of gain, or gross margin per pound of gain, for this steer would be $1.51 per pound ($605 gross margin/400 pounds of gain).

2,405 – 1,800 = $605 gross margin = $1.51/pound value of gain

850 – 450 400 lbs gain

An Alternative is to put together a group of 650-pound medium to larger frame #1 and 2 bull calves in local auction markets in the east in single head lots and smaller groups. Small groups, intact bulls, and #2 muscling all receive discounts at the sale barn, providing an opportunity to upgrade cattle for increased returns. Using the Beef Basis Price Forecasting Tool, these bulls are valued at $271/hundredweight costing $1,762 per head. When sold as steers in a large group in the west closer to the feedlots these steers in September at 850 pounds the calves are valued at $282/hundredweight. The value of gain is projected to be:

2,400 – 1,762 = $638 gross margin = $3.19/pound value of gain

850 – 650 200 lbs gain

Purchasing a mismanaged bull calf and adding value by castration, grouping and effective marketing has the potential to increase the value of gain by over 200%.

Health is Key

Animal health is one of the most significant drivers of cost in stocker operations. A 1% death loss on $1,800 calves translates to an additional $18 per head in prorated cost that must be covered by the remaining calves. Respiratory disease is especially costly in newly received high-risk comingled calves not only incurring the cost of treating the disease and death loss but also having long-term impacts on performance. Bull are over twice as likely to be treated for bovine respiratory disease, have 2.4-times greater death loss than steers, and cost on an average $65/head more to receive. These increased costs and risks appear to be bearable with the added value in the current market.

Bottom Line

The old adage is still true “Buy low, sell high, keep them alive, and put gain on them cheap”. When managed properly, stocker programs can add significant value to your cattle operation. Prioritize animal health, forage quality, nutrition, and cost control. With the right approach, stocker producers can upgrade discounted calves and turn a profit.