Cow-Calf Corner | March 11, 2024

Slaughter Cattle and Ground Beef Market Soars

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

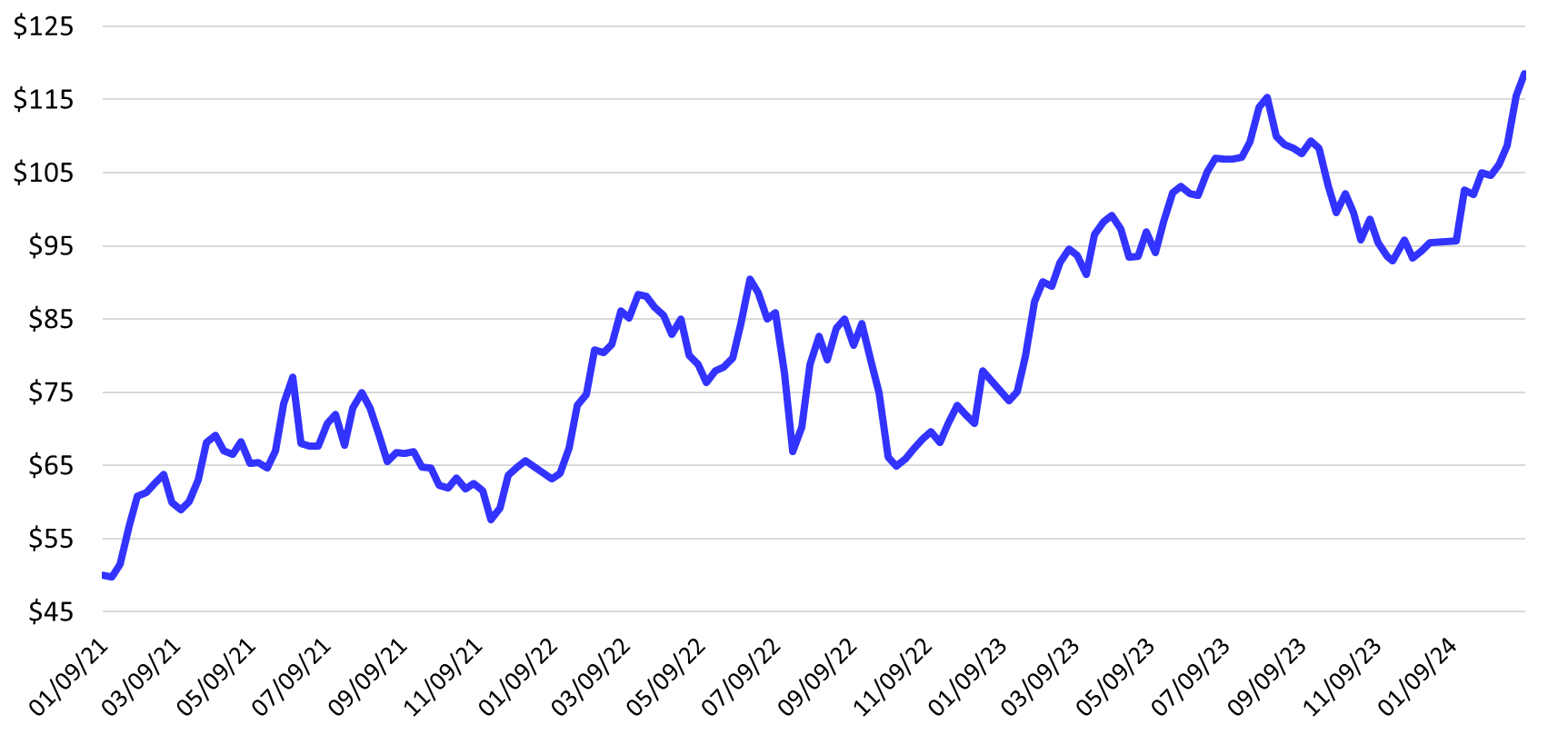

Slaughter cow prices continue to move higher with declining cow inventories and reduced cow slaughter. Boning cow prices in Oklahoma auctions averaged $118.54/cwt. (average dressing) for the week ending March 8, 2024 (Figure 1). Slaughter cow prices for the week ranged from $126.87/cwt. for high dressing breaking cows to $99.13/cwt. for low dressing lean cows.

Figure 1. Slaughter Cow Prices

Boning, $/Cwt. Weekly, Oklahoma Auctions

Slaughter cow prices are driven by the price of 90 percent lean beef trimmings (90s), which posted a price of $317.36/cwt. the first week of March. This is a record high price for 90s in data back to 1978 and undoubtedly an all-time record weekly price. The supply of nonfed beef (cow + bull) is down 12.7 percent year over year thus far in 2024, the result of a 13.1 percent year-to-date decrease in cow slaughter. Dairy cow slaughter is down 15.0 percent and beef cow slaughter is down 11.4 percent year over year, while bull slaughter so far in 2024 is down 9.4 percent from one year ago.

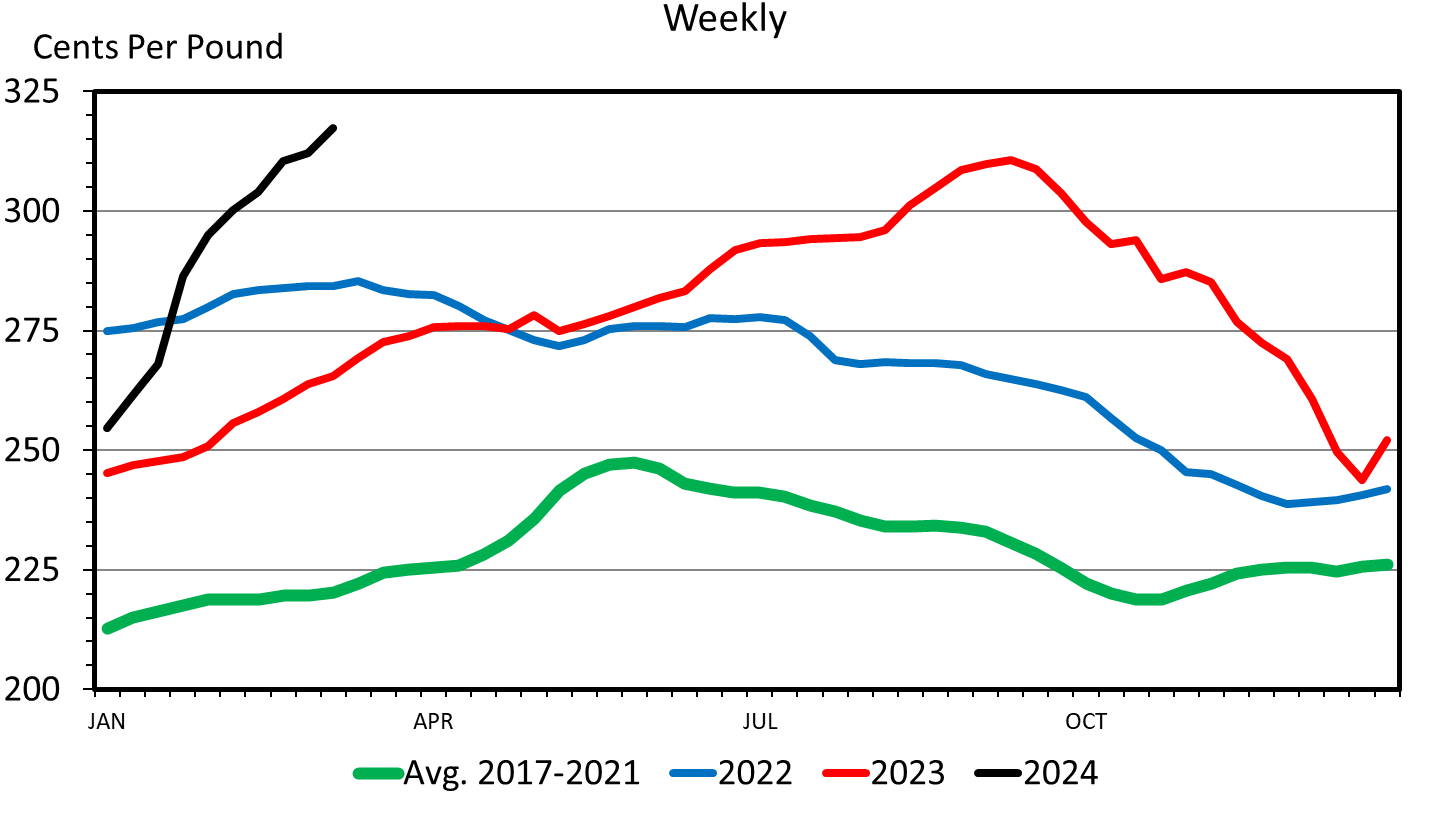

Figure 2. Wholesale Beef Fresh 90 Percent Lean

Lean beef trimmings are a key component of ground beef production. A wide variety of lean and fatty trim products are used to provide ground beef supplies for food service and retail grocery markets. A standard reference for ground beef values is the ratio of five pounds of 90s to one pounds of 50s (50 percent lean trimmings), which is equivalent to 83.3 percent lean ground beef. The increased price of 90s has pushed this reference price of wholesale ground beef to $281.28/cwt. in the first week of March. This reference price of ground beef was exceeded only one week during the pandemic disruptions in 2020 and is otherwise at an all-time high.

The major portion of U.S. beef imports is lean beef used for the ground beef market. As domestic lean beef supplies decrease and prices increase, markets respond with increased beef imports to moderate impacts domestically. Accordingly, beef imports in 2023 increased 9.9 percent year over year. In the latest data for January, beef imports were up 38.1 percent year over year. Beef imports are typically front-loaded in the new year as countries, especially Brazil, scramble to fill the unassigned “Other Country” import quota. Monthly imports will moderate later in the year and total imports for 2024 are projected to increase 12-13 percent year over year.

Slaughter cow and wholesale ground beef prices are expected to move higher in the coming months. Net cow culling (beef and dairy) decreased to 17.2 percent in 2023 from the cyclical peak of 17.8 percent in 2022. However, during the last herd expansion, net cow culling decreased to a low of 13.3 percent in 2015. Without herd rebuilding, cow slaughter will decrease in 2024 simply because cow inventories are smaller; if herd rebuilding begins in earnest in 2024, cow slaughter will decrease more sharply.

A Question About Buying Bulls

Mark Z. Johnson, Oklahoma State University Extension Beef Cattle Breeding Specialist

I recently received a call from an Oklahoma producer about which bulls to purchase for their commercial cow-calf operation. The operation needs two more Angus bulls this spring and has narrowed the selection list down to the following five bulls which were all available to purchase private treaty:

| ID | CED | BW | WW | YW | CEM | HP | MW | Marb | $B | Price |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 12 | 0.2 | 70 | 120 | 9 | 13 | 76 | 0.35 | 154 | $10,000 |

| 2 | 4 | 2.9 | 82 | 141 | 12 | 6 | 96 | 0.79 | 180 | $8,000 |

| 3 | 15 | 0.1 | 78 | 135 | 14 | 17 | 86 | 1.80 | 215 | $12,500 |

| 4 | 5 | 3.5 | 91 | 157 | 8 | 5 | 99 | 0.71 | 185 | $7,500 |

| 5 | 11 | 0.7 | 63 | 108 | 8 | 10 | 65 | 1.90 | 189 | $5,500 |

The bulls are all spring yearlings and will be approximately 15 months of age at turnout and accordingly should be expected to cover 15 cows this year. All the bulls have passed a Breeding Soundness Exam and sell with a registration paper and a Breeding Soundness Warranty. So the buying decision boils down to identifying the right bulls for this operation. The right bulls to buy are the ones most capable of adding value to the calf crop sired relative to their purchase price. In order to do so the bulls need to:

- Complement the females to which they will be mated

- Offer genetic values of economic relevance to the marketing endpoint of the calves they will sire.

This operation intends to use the bulls as terminal sires on spring calving cows, four to six years of age. After weaning, the calves will run on cool season grass until marketed as yearlings. In this operation the trait of primary economic importance is Yearling Weight (YW).

In order to calculate the profit potential of each bull, we will assume each bull will sire 135 calves over their lifetime of service, each will have the same salvage value and the value of a pound of YW sired will be $2.00.

Using the least expensive bull as our starting point:

Bull 5 serves as the baseline for least YW sired with a 108 YW EPD at expense of $5,500

Bull 1 is expected to sire 12 pounds more YW per calf, this multiplied by 135 calves results in an additional 1,620 pounds. 1,620 pounds of YW at a value of $2 equals $3,240. The purchase price of bull 1 is $4,500 more than bull 5. $3240 - $4,500 = $ -1,260. So, Bull 1 is a worse choice than bull 5 by $1,260.

Bull 2 is expected to sire 33 pounds more YW per calf, this multiplied by 135 calves results in an additional 4,455 pounds. 4,455 pounds of YW at a value of $2 equals $8,910. The purchase price of bull 2 is $2,500 more than bull 5. $8,910 - $2,500 = $6,410. So, Bull 2 is a superior choice than bull 5 by $6,410.

Bull 3 is expected to sire 27 pounds more YW per calf, this multiplied by 135 calves results in an additional 3,645 pounds. 3,645 pounds of YW at a value of $2 equals $7,290. The purchase price of bull 3 is $7,000 more than bull 5. $7,290 - $7,000 = $290. So, Bull 3 generates $290 more relative to his purchase price than bull 5.

Bull 4 is expected to sire 49 pounds more YW per calf, this multiplied by 135 calves results in an additional 6,615 pounds. 6,615 pounds of YW at a value of $2 equals $13,230. The purchase price of bull 2 is $2,000 more than bull 5. $13,230 - $2,000 = $11,230. So, Bull 4 is a vastly superior choice than bull 5 by $11,230.

Another way of looking at the buying decision. Over their lifetime of service:

- Bull 5 will sire 135 calves at a cost of $5,500.

- Bull 4 sire 135 calves while paying this cow-calf operation $5,730 for the opportunity.

- Bull 3 will sire 135 calves at a cost of $5210

- Bull 2 will sire 135 calves while paying this cow-calf operation $910 for the opportunity.

- Bull 1 will sire 135 calves at a cost of $6760

Mark Johnson, OSU Extension beef cattle breeding specialist, explains why calving season is a great time to analyze your herd and make key decisions on SunUpTV from March 9, 2024.

Oklahoma Quality Beef Network Maintains Strong Premiums in 2023

Kellie Curry Raper, Oklahoma State University Livestock Marketing Specialist

Derrell S. Peel, Oklahoma State University Livestock Marketing Specialist

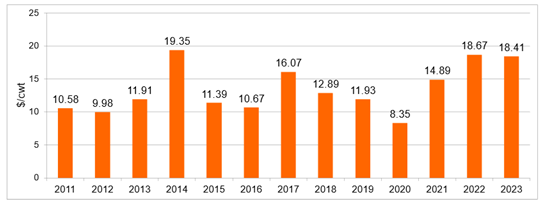

Calf enrollment numbers may have been down, but premiums for Oklahoma Quality Beef Network (OQBN) Vac-45 calves were not. The combination of drought and higher calf prices did entice some producers to forgo preconditioning programs last fall. However, those producers who did participate in OQBN’s 3rd party verified Vac-45 preconditioning program during 2023 saw the 3rd highest average premium in program history. Data collected on 6,200 head of cattle across 767 lots indicate that 2023 OQBN premiums averaged $18.41/cwt. OQBN premiums are measured as the weighted average premium for OQBN VAC-45 calves relative to non-preconditioned calves at the same sale.

Figure 3. OQBN Premium over Calves Marketed with No Preconditioning ($/cwt)* all calves, 2011-2023

*Premium is weighted average premium for preconditioned calves relative to non-preconditioned

calves at the same sale. Source: K.C. Raper and D.S. peel, Historical OQBN data collection.

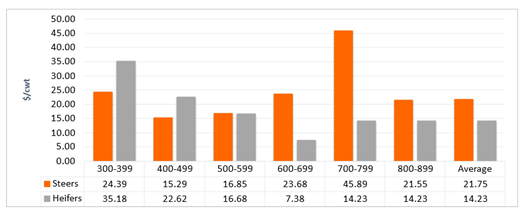

While premiums were strong across all weight classes, this year’s pattern looks a bit different. In a typical year, premiums per hundredweight tend to be higher for lighter weights. Interestingly, heifers generally followed that pattern, commanding higher premiums at lighter weights. However, the premiums for steers this year deviated from that norm. Steer premiums tapered slightly as weight class increased, but then spiked back up beyond the 5-weight category. The average premium across all weight classes was $21.75/cwt for steers and $14/23/cwt for heifers. Across the years, the bulk of OQBN calves are typically marketed between 400 and 600 pounds. However, 2023 saw that shift toward slightly heavier calves. For steers, 77% sold at weights between 500 and 700 pounds, as did 68% of heifers.

Figure 4. 2023 OQBN Premiums by Weight Class and Gender

*OQBN lots and average premium represent sales where data was collected. Premium is

weighted average premium of preconditioned calves relative to non-conditioned calves

at same sale. Source: K.C. Raper and D.S. Peel, OQBN data, 2022.

Overall, OQBN added an estimated additional $238,777 in revenue across 2,091 head from 50 producers in 2023. That’s an average increase in value of $114/head based on premiums alone. Approximately $6.2 million in value has been added to Oklahoma calves through OQBN since 2010, for an increased average revenue of $103/per head over that extended time period.

Data collection helps us provide immediate feedback to producers regarding overall value differences associated with preconditioning. Over the longer run, it also facilitates opportunities to measure and communicate market values for the research-based calf health management and marketing practices encouraged in Extension efforts. OQBN is available to all producers willing to follow the protocol, as there is no minimum number of calves required for program enrollment. Most producers market through special OQBN sales at designated livestock markets, but some choose to direct market their certified OQBN cattle or to market through alternative livestock markets. The overarching goal of the program is to encourage continual improvement of the Oklahoma beef industry and to provide value-enhancing opportunities to producers. If you’d like more information, visit the Oklahoma Quality Beef Network homepage.

Donation Centers for Wildfire Relief

If you are interested in helping the victims of he recent Panhandle Wildfires please visit the Donation Centers for Wildfire Relief page.