What is the Health Insurance Marketplace?

Introduction

The Patient Protection and Affordable Care Act (also known as ACA or ‘Obamacare’) was signed into law on March 23, 2010. The new law aims to make healthcare more affordable and efficient; and to improve the quality of care. One of the more notable provisions is the increased availability and affordability of health insurance. Several expanding measures have already been implemented, such as allowing young adults (26 and younger) to continue to be covered as dependents on their parents’ policy, prohibition of lifetime spending limits, and the elimination of preexisting conditions as a basis of coverage denial (U.S. Department of Health and Human Services, 2013).

One of the largest expanding measures is the creation of an insurance exchange where those seeking to purchase health insurance can compare rates and coverage. States have the option and are urged to create their own state-specific exchange, or they can use the national exchange available through www.healthcare.gov. As of November 2013, 17 states have received conditional approval for operation of their state-level marketplaces. Oklahoma is not one of these states, so Oklahoma residents are able to purchase insurance through the national exchange. Most people are eligible to purchase insurance through the national exchange, including those who already have insurance through their work. The national insurance exchange is operated through the website www.healthcare.gov.

Within the national exchange, the insurance plans are divided into four categories, Bronze, Silver, Gold, and Platinum. They primarily differ by the amount of the monthly premium and the percentage of benefits paid, and do not reflect differences in the quality or amount of care the plans provide. All plans cover “essential health benefits” such as emergency services, hospitalization, prescription drugs, mental health, maternity/newborn care and pediatric services. Catastrophic plans are also available to those less than 30 years of age and those who face a hardship (such as being homeless, being evicted, or filing for bankruptcy in the past 6 months). Table 1 displays the differences among the four plans.

Table 1. Comparison of Insurance Categories.

| Category | Percentage of Essential Health Benefits Paid by Plan | Percentage of Essential Health Benefits paid by Individual |

|---|---|---|

| Bronze | 60% | 40% |

| Silver | 70% | 30% |

| Gold | 80% | 20% |

| Platinum | 90% | 10% |

Source: www.healthcare.gov

Selecting the appropriate insurance category depends on an individual’s (or family’s):

- Ability to pay the monthly premium.

- Likelihood of needing coverage (i.e., expected health level).

- Ability to pay expenses that are not covered by the insurance.

How Many Insurance Providers do I Have to Choose From in My County?

The number of companies providing insurance in the healthcare exchange varies by county, and ranges from two (typically in the most rural counties) to five (typically in the most urban counties). However, a multitude of healthcare plan options are available in each county, with most insurance providers offering several variations on Bronze, Silver and Gold plans. The total number of Bronze, Silver and Gold plans ranges from 5 to 18 (in each category) across counties in the state. Platinum plans are not available in all counties. You can explore the plans available to you at www.healthcare.gov (you do not have to sign up for an account to do this).

What is the Cost?

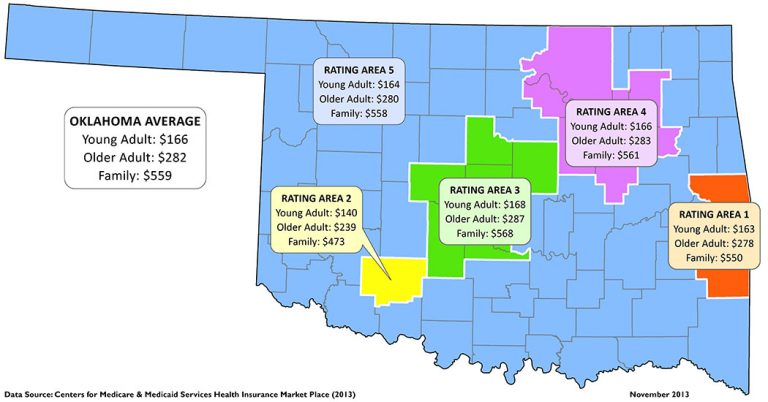

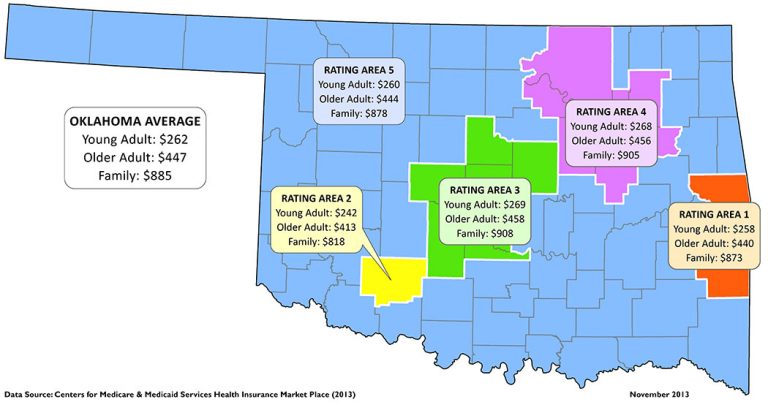

Figures 1 and 2 demonstrate the average monthly premium costs for Bronze and Gold plans, respectively, across Oklahoma. Three costs are displayed for each health insurance rating area: young adult (27 years old), older adult (50 years old), and family (regardless of number of children). Note that these are average costs, as all Bronze or Gold plans have at least five options to choose from in each county. The cost may vary significantly among these different options.

Figure 1. Average Monthly Premiums by Health Insurance Rating Area – Bronze Plans.

Figure 2. Average Monthly Premiums by Health Insurance Rating Area – Gold Plans.

Do I Qualify for a Subsidy?

Families who earn less than 400 percent of the Federal Poverty Level (FPL, see Table 2 for exact income requirements) are eligible for a tax credit subsidy to reduce the cost of health insurance premiums. For example, a family of four earning less than $94,200 will qualify for a subsidy. The subsidy caps your contribution for health insurance coverage at 9.5 percent or less of your income (see Table 3 for the actual percentages of income). If your employer offers health insurance, you are not eligible for a subsidy.

For example, a single person earning $28,725 per year has a salary that is 250 percent of the FPL (28,725/11,490 *100 = 250). Based on income, the insurance premium would be capped at 8.04 percent of their annual income or $2,310 (about $193 per month). If a Silver Plan premium is $300 per month then they will receive a subsidy of $107, the difference between the maximum contribution ($193) and the cost of insurance ($300). Similarly, a family of four earning $47,100 has an income 200 percent of the FPL (47,100/23,550 * 100 = 200). This family would have premiums capped at 6.3 percent of their annual income, the equivalent of $2,967.30 or $247.28 monthly.

Table 2. Income Requirements by Federal Poverty Line (FPL) for ACA Subsidy Eligibility.

| Family Size | Annual FPL | 400% FPL |

|---|---|---|

| 1 | $11,490 | $45,960 |

| 2 | $15,510 | $62,040 |

| 3 | $19,530 | $62,040 |

| 4 | $23,550 | $94,200 |

| 5 | $27,570 | $110,280 |

| 6 | $31,590 | $126,360 |

| 7 | $35,610 | $142,440 |

| 8 | $39,630 | $158,520 |

Note: For families of more than eight members, add $4,020 for each additional member.

Table 3. Premium Cap as a Percent of Income Based on FPL.

| Federal Poverty Level | Premium Cap as a Percent of Income |

|---|---|

| <133% FPL | Medicaid |

| 133%-149% | 3.0%-4.0% |

| 150%-199% | 4.0%-6.3% |

| 200%-249% | 6.3%-8.05% |

| 250%-299% | 8.05%-9.5% |

| 300%-399% | 9.5% |

| ≥400% | n/a |

Note: To calculate your premium cap, take your annual income and divide by the Annual FPL value from Table 2 for your family size and multiply by 100. The result is your percent FPL.

There are user-friendly internet-based tools to assist you with estimated subsidy calculations. One is the Kaiser Family Foundation Subsidy Calculator, http://kff.org/interactive/subsidy-calculator/ and another is hosted by ValuePenguin, http://www.valuepenguin.com/. These calculators allow you to select your state and county of residence, zip code, income, tobacco status, age and family size to receive a detailed report providing important information including your eligibility for a tax credit subsidy and the total cost of Bronze and Silver plans.

Persons earning 100 to 250 percent of the FPL are eligible for additional subsidies that reduce their out of pocket expenses when using their health coverage. Silver plans cover 70 percent of essential health benefit expenses, and these additional subsidies can increase coverage from 73 percent up to 94 percent of eligible expenses. Eligibility for these additional subsidies is shown in the report generated by the Kaiser Subsidy Calculator.

What if I Choose to Forego Health Insurance?

Individuals who choose to forego health insurance could be faced with a financial penalty. Starting in 2014, those who forego health insurance will face a fee of either 1 percent of income or $95 per adult, whichever is higher (www.healthcare.gov, 2013). The penalty will be assessed through individual tax returns through the Internal Revenue Service (IRS). Table 4 displays the growth in the penalty over time. Note that paying the penalty is not a replacement for having health insurance.

Table 4. Fee Schedule for Individual Responsibility Payment.

| Percent of Income | Per Adult | Per Child | |

|---|---|---|---|

| 2014 | 1.0% | $95 | Half of the adult fee |

| 2015 | 2.0% | $325 | Half of the adult fee |

| 2016 | 2.5% | $695 | Half of the adult fee |

Source: www.healthcare.gov

Participants have until March 31, 2014 to enroll and avoid the penalty fee for 2014. Individuals who are uninsured more than 3 months out of the year (after March 31, 2014) must pay the penalty on a prorated basis for every month not covered. After March 31, those looking to change policies or purchase insurance must wait until the enrollment period beginning October 1.

Certain exemptions to the financial penalty do apply. For example, members of federally recognized Native American tribes or those who can receive services through Indian Health Services are exempt. Also, individuals and families whose income is too low to file income taxes, or if the lowest cost option exceeds 8 percent of a household’s income, are also exempt from penalties. Various hardship exemptions are also available. For more information about exemptions, please visit www.healthcare.gov.

Where Can I Get Help Navigating www.healthcare.gov?

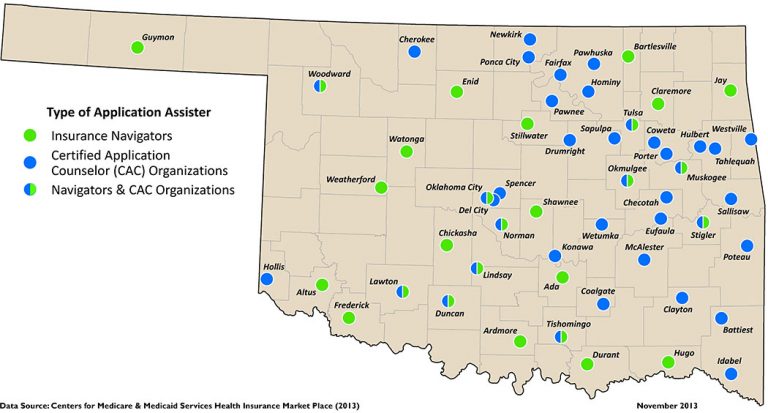

Because the Health Insurance Marketplace can be complex and intimidating, you may need help navigating www.healthcare.gov as you try to obtain health insurance. Fortunately, there are a number of people who can help you. www.healthcare.gov reports more than one hundred organizations in the State of Oklahoma as Application Assisters who can help you select a qualified health plan and submit an application.

Application Assisters in Oklahoma include Navigators and Certified Application Counselors. Navigators are individuals or organizations that provide outreach and education to inform consumers about the Marketplace and the availability of qualified health plan options. They work directly with consumers to clearly explain the differences between various qualified health plans. Navigators also help consumers prepare applications to obtain qualified health plans and enroll in insurance affordability programs (i.e., subsidies). In Oklahoma, community health centers and community action agencies commonly serve as Navigators.

Certified Application Counselors (CACs) can also explain available qualified health plan options to consumers. The counselors can assist consumers with completing applications to obtain a plan and enroll in insurance subsidies. Counselors are typically employed by a healthcare provider, such as a hospital, but any organization may choose to have staff trained to become a CAC.

Figure 3 shows the general location of Application Assisters across Oklahoma. If you would like to contact an Application Assister in your community, you can find their contact information at https://localhelp.healthcare.gov/. Simply enter your city or zip code and the website will provide the contact information of the nearest Application Assisters. You can also call 1-800-318-2596 to speak with a representative at www.healthcare.gov who can either assist you directly or provide contact information for an Application Assister in your community.

Figure 3. Location of Application Assisters in Oklahoma

Sources and More Information:

Centers for Medicare & Medicaid Services. 2013. Accessed November 12, 2013 at: http://www.cms.gov/CCIIO/Resources/Fact-Sheets-and-FAQs/state-marketplaces.html

Healthcare.gov. 2013. Accessed November 11, 2013 at: https://www.healthcare.gov/rights-protections-and-the-law/

Oklahoma Policy Institute. 2013. Health Insurance Marketplace and the Affordable care Act: Resources and Information. Accessed November 18, 2013 at: http://okpolicy.org/health-insurance-marketplace-affordable-care-act-resources-information

Robert Wood Johnson Foundation. 2013. Navigators and In-Person Assistors: State Policy and Program Design Considerations. Accessed November 15, 2013 at: http://www.rwjf.org/content/dam/farm/reports/issue_briefs/2013/rwjf404796

U.S. Department of Health and Human Services. 2013. Accessed November 12, 2013 at: http://www.cms.gov/CCIIO/Resources/Fact-Sheets-and-FAQs/state-marketplaces.html

Brian Whitacre, PhD

Associate Professor and Extension Economist

Lara Brooks, MS

Extension Associate

Jeff Hackler, JD, MBA

Assistant to the Dean for Rural Service Programs

Center for Health Sciences

Denna Wheeler, PhD

Director, Rural Research and Evaluation

Center for Health Sciences

Chad Landgraf, MS

GIS Specialist

Center for Health Sciences