Use Tax for County Government

For fiscal year 2014 (July 2013 – June 2014), the State of Oklahoma collected $418.1 million in “use tax” on the State’s 4.5 percent use tax rate. During the same fiscal year, the 74 counties that collect use tax received $33.6 million. Collectively, about 500 cities and towns in Oklahoma received $129.9 million in use tax receipts by application of use tax rates varying from 1 percent to 5 percent. The purpose of this publication is to answer the fundamental questions about a county use tax. In-depth information can be obtained from the Oklahoma Statutes, the Oklahoma Tax Commission and the State Auditor and Inspector. Information is also available through your local Oklahoma Cooperative Extension Service office.

What Is It?

Use tax is essentially the same as sales tax, but applied to purchases from out-of-state vendors. The sales tax is collected on retail purchases from Oklahoma merchants. The use tax is collected on mail, telephone order, and internet (web) purchases from merchants who have no physical presence in Oklahoma. Use tax applies to the same items as sales tax. Vendor location is the key difference. It is a little known and widely ignored fact that purchases by mail, phone, or internet from out-of-state vendors are taxable just like the purchases of similar goods from your local retail store. (Title 68, sections 1354.1 and following, Oklahoma Statutes) In 1998, the state Legislature adopted House Bill 1816, allowing counties to begin collecting the use tax, effective January 1, 1999 (Title 68, section 1411, Oklahoma Statutes). Many city governments and the state government were already collecting the use tax.

Why is it Important?

Historical sources of funding for county government services were restricted, and for many years, the ad valorem (property) tax was the primary source of General Fund revenue. In 1984, the Legislature authorized a county sales tax, by vote of the people. In 2014, 76 counties had a county sales tax and 74 counties also had a county use tax. The use tax is relatively new, having begun in 1999 for county government. Collectively, sales and use tax now generate as much or more than ad valorem in many counties.

How Much Is It?

The Board of County Commissioners sets the use tax rate, but the rate must not exceed the sales tax. Counties may have a sales tax rate (by vote of the people) of up to 2.0 percent. Cities may also have sales and use taxes, but the rate is not restricted. The State of Oklahoma collects use tax equal to the state sales tax rate of 4.5 percent. (Title 68, section 1411, Oklahoma Statutes) As of December 2013, 74 counties levied a use tax. This is an increase of 28 counties since April 2002, when 46 counties were collecting use tax. Use tax receipts are much smaller than sales tax receipts. For the 2014 fiscal year, total county use tax revenue was $33.6 million and total county sales tax revenue was $354.5 million, hence use tax was 9 percent of the amount of sales tax revenues statewide. Use tax revenue tends to be more variable than sales tax revenue. For example, in fiscal year 2014, use tax as a percentage of sales tax varied greatly among the counties. In McIntosh County, the use tax was 3 percent of the amount of sales tax; in Seminole County, use tax was 35 percent of the amount of sales tax. The median use tax as a percentage of sales tax was 9 percent among the 74 counties collecting both. Use tax collections vary more widely than sales tax. Monthly and annual use and sales tax data is available from the Oklahoma Tax Commission, http://www.tax.ok.gov/.

How is it Collected?

Basically, there are three ways that use tax is received by the Oklahoma Tax Commission (OTC) before it is remitted to the state, city and county governments. First, out-of-state vendors may register and set up an account with the OTC just like an in-state vendor is required to do. (If you ever make a purchase online from a vendor that does not have a physical presence in Oklahoma yet charges sales tax on the purchase, then you know the vendor has voluntarily registered with OTC and is remitting “sales tax,” probably based on point of delivery. Vendors doing this will usually ask your postal zip code, county location and whether you live inside a city. This enables them to collect the appropriate tax rate for the point of delivery.) Second, businesses and industries who purchase from out-of-state vendors may self-assess the tax when they purchase taxable goods. For example, a company laying a petroleum pipeline may purchase the pipe from an out-of-state pipe manufacturer. The pipe is taxable at the point of use and the purchasing company knows in what counties (and perhaps cities) they will lay the pipe. Therefore, they compute the applicable tax, according to location, and remit it to the OTC. These companies are subject to audit, so there is an incentive to appropriately collect and remit the tax. The third method of collection is in the annual state income tax filings of Oklahomans. The tax form has a line on which to declare and pay taxes on goods bought from out-of-state vendors for which no tax was paid at the time of sale. So, these are the three basic avenues by which use taxes are paid.

How to Adopt a County Use Tax?

Unlike the sales tax, the adoption of the use tax does not require a vote of the people. State law simply requires passage of a resolution by the governing board, that is, the Board of County Commissioners. However, use tax adoption is limited to those counties (and cities) that have already adopted, by vote of the people, a sales tax. (Title 68, section 1411, Oklahoma Statutes)

How to Use It?

Whereas the county sales tax must be used as designated by vote of the people, the use tax may be used for any function of county government. Thus, the Board of County Commissioners may designate, by resolution, its use for any legitimate purpose. There are no statutory restrictions beyond the requirement that it be used for legitimate functions of county government.

Down the Road

Rapid growth in e-commerce (electronic commerce) — whether by Internet, telephone or other electronic communications technology — could result in lost sales to local merchants, hence lost sales tax collections for local governments. Use tax could be part of the answer. Effective use tax collection will help ensure that local purchases generate local funds to support public services provided by county and city governments. Collection of use taxes also provides more equitable competition between local merchants and out-of-state merchants, both of which are competing for sales to Oklahoma citizens.

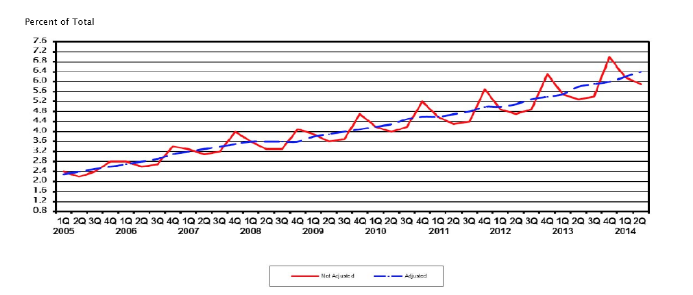

The growing size of e-commerce gives a hint at the potential local tax consequences of failure to collect on out-of-state commerce. For example, the U.S. Census Bureau shows e-commerce growing from about 2.4 percent of retail sales in 2005 to about 6.4 percent of retail sales in 2014 (Figure 1). (http://www.census.gov/retail/mrts/www/data/pdf/ec_current.pdf)

Figure 1. Estimated Quarterly U.S. Retail E-commerce Sales as a Percent of Total Quarterly Retail Sales: 1st Quarter 2005 through 2nd Quarter 2014.

Sources of More Information

Your county cooperative Extension office can provide additional information or connect you with the people and resources who have additional detail.

Notie Lansford

Professor, Rural Development