US and Oklahoma COVID Impacts on Food Shopper Buying Patterns

Introduction

Food shopping patterns have been changing in recent years – even before the COVID-19 pandemic. The rise in online grocery shopping, which sped up with Walmart’s® purchase of Jet.com in 2016 and Amazon’s® purchase of Whole Foods® in 2017, established the foundation for the drastic increase in online grocery shopping experienced during the pandemic. Conversely, the increased emphasis on food-away-from-home (FAFH) purchases (i.e. restaurants, food service) experienced a massive setback due to the closures of restaurants for public safety reasons in 2020. While both trends and COVID impacts were noteworthy, it may be beneficial to view forecasts for food-at-home (FAH) shopping with consideration of a return to more FAFH-purchasing behaviors as the U.S. comes out of the pandemic lockdown.

The following examination of historic data and current survey results of food shoppers is intended to provide a basis for comparing U.S. and Oklahoma consumer trends before, during and after the lockdown.

Retail Grocery Shopping Patterns: In-store and Online

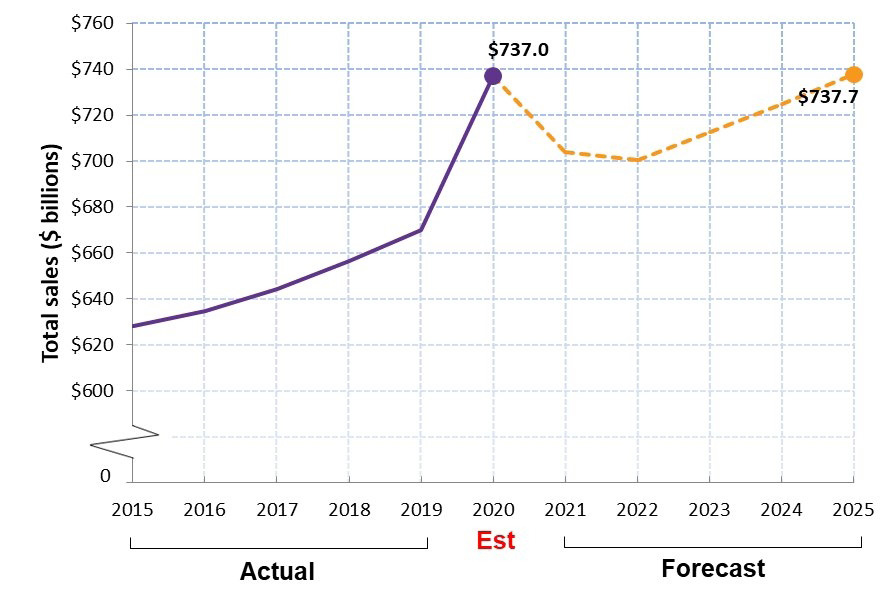

U.S. retail sales of FAH had been rising in recent years at a rate roughly equivalent to population growth, but concerns of food availability during the pandemic and the resulting grocery stockpiling by consumers caused a significant spike in FAH sales (Figure 1). Because early stockpiling results in a subsequent purchasing lag, Mintel (2021b) predicts the record sales seen in 2020 will not be matched until 2025. This is partly due to expected increases in FAFH expenditures as more consumers resume eating-out trends of the pre-pandemic economy.

Figure 1. Total US Retail Sales and Forecast of Food-At-Home (FAH) Expenditures, 2015-25 (current prices). (Sources: IRI, US Census Bureau, Mintel)

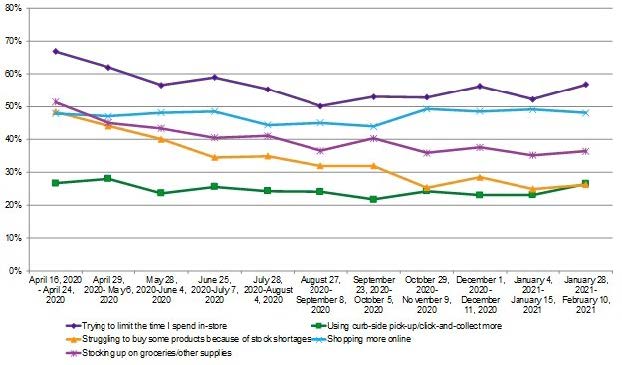

Online grocery shopping saw growth during the pandemic lockdown, as consumers tried various methods of limiting in-store time to meet their at-home food needs (Figure 2). However, while March 2020 and early April 2020 saw the largest increases in online grocery shopping – mostly by first-time online shoppers – as the months, passed consumer use of online shopping saw some declines. Reasons for the declines varied, but the primary factors were limited capacities by stores to handle the volume of online shopping requests and food shortages (e.g. temporary shortages of meat products in the meat counter, especially beef) that led consumers to forego online shopping and visit multiple outlets to meet their food needs.

Figure 2. COVID Lifestyle Change - Online Shopping, April-October 2020. (Source: Lightspeed/Mintel)

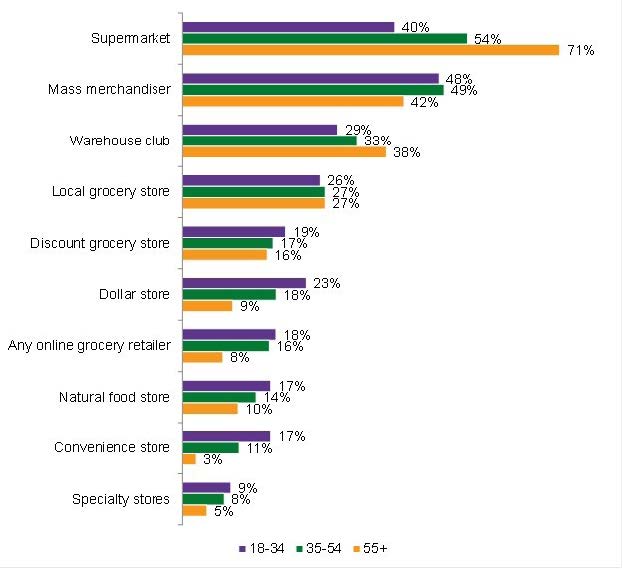

An October survey of more than 1,800 U.S. consumers shows the variation in grocery shopping venues by consumers (Mintel 2020b). Figure 3 depicts the breakdown of shopping venue preferences by age group, realizing that shoppers used multiple venues to meet their food needs during the survey period. Supermarkets and mass merchandisers were the most common retail outlets for all shoppers, regardless of age, but younger shoppers tended to attribute higher percentages of their food purchases to outlets such as online providers, natural/specialty stores and even convenience stores.

Figure 3. Food and Drink Purchase Locations, by Age Group, Ages 18+ Internet Users, October 2020. (Source: Lightspeed/Mintel)

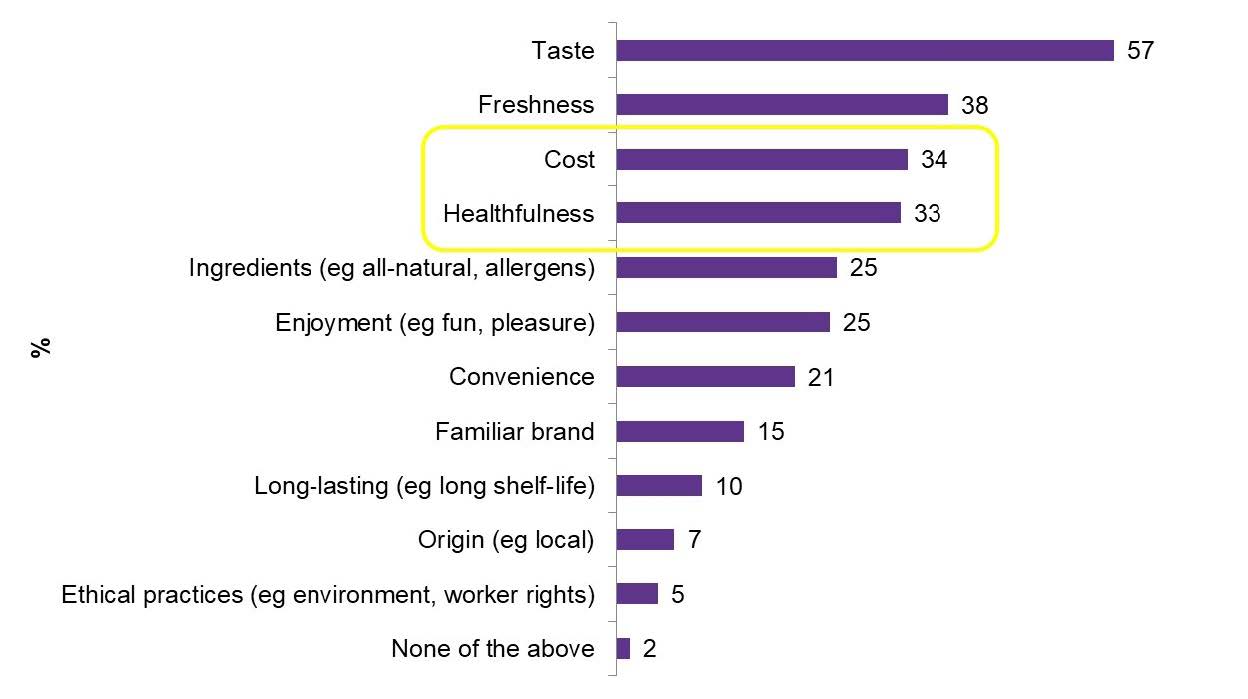

Food and beverage choices have been historically driven primarily by taste and quality/freshness. Figure 4 shows these factors are still two of the top three choice drivers among U.S. consumers. Cost also has traditionally been one of the top three choice drivers. While a November 2020 Mintel survey (Mintel 2021b) suggests this is still the case, a very close fourth choice driver is healthfulness. It is possible concerns of “COVID weight” in 2020 prompted the rise of healthfulness as a choice driver. Alternatively, as more food product introductions are marketed on the basis of their “healthy” attributes (either real or perceived), consumers may be choosing the “healthier” option among products with similar taste, quality and value perceptions.

Figure 4. Food and Drink Choice Drivers - US Consumers’ List of Top 3, November 2020. (Source: Lightspeed/Mintel)

Trends in Oklahomans’ FAH Shopping Habits

Oklahoma shoppers represent an even larger concentration of FAH purchases derived from one location: Walmart® Supercenters (Table 1). As a long-time testing ground for Walmart® store formats, Oklahomans have developed an affinity for purchasing groceries at this particular mass merchandiser. Several studies have indicated more than half of every dollar spent on food in Oklahoma is attributed to a Walmart® purchase. However, Oklahomans also have become patrons of the fast-growing number of Dollar General® and other dollar-store-format retailers that have included food items in their venues. Unlike the national average, a smaller percentage of Oklahomans tried and continued using online shopping platforms in 2020.

Table 1. Oklahomans’ 2020 Grocery Shopping Behavior Data. (Source: ESRI, Grk MRI)

| 2020 Oklahomans’ Grocery Shopping Patterns | Percentage of Respondents | |

|---|---|---|

| Household average spent per week at food stores: $1 to $99 | 21% | |

| Household average spent per week at food stores: $100 to $149 | 19% | |

| Household average spent per week at food stores: $150+ | 30% | |

| Shopped at grocery store in last six months: Albertsons® | 5% | |

| Shopped at grocery store in last six months: Aldi® | 18% | |

| Shopped at grocery store in last six months: Food Lion® | 7% | |

| Shopped at grocery store in last six months: GNC® | 2% | |

| Shopped at grocery store in last six months: Safeway® | 6% | |

| Shopped at grocery store in last six months: Save-A-Lot® | 9% | |

| Shopped at grocery store in last six months: Stop & Shop® | 3% | |

| Shopped at grocery store in last six months: Trader Joe`s® | 9% | |

| Shopped at grocery store in last six months: Walmart® Supercenter | 66% | |

| Shopped at grocery store in last six months: Whole Foods® Market | 7% | |

| Shopped at grocery store in last six months: Winn-Dixie® | 5% | |

| Shopped at warehouse or club store in last six months: Costco® | 16% | |

| Shopped at warehouse or club store in last six months: Sam`s Club® | 22% | |

| Purchased groceries online in last 30 days | 6% |

Post-COVID FAH vs. FAFH Forecasts

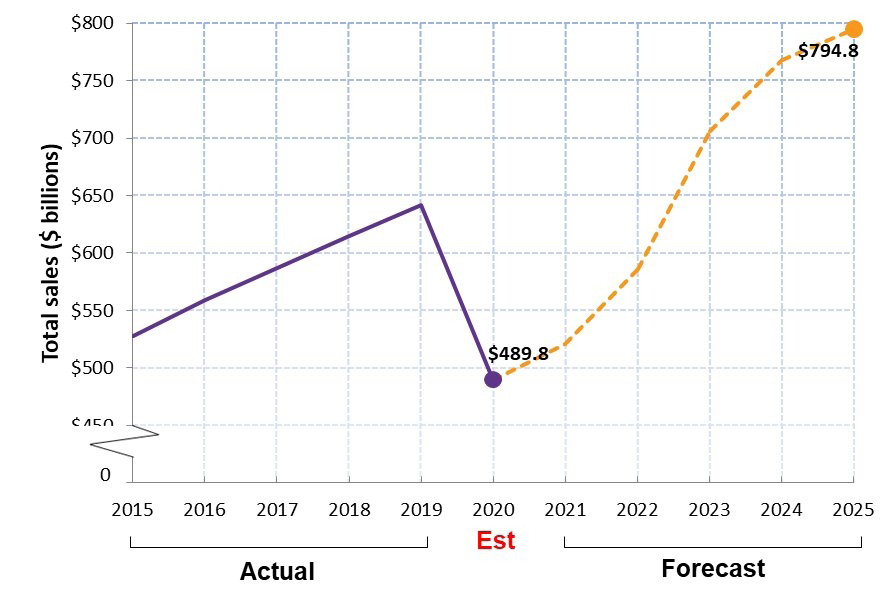

FAFH expenditures, which dropped precipitously in 2020, are expected to roar back in 2021 and subsequent years as more consumers look to dining out in a post-COVID pandemic environment. For decades, the share of consumers’ food dollars going to FAFH expenditures has been rising, with some models predict FAFH may actually surpass FAH expenditures in coming years. Figure 5 shows historical data and forecasts for dining out expenditures. Notice the 2025 forecast of FAFH expenditures ($794.8 billion) exceeds the forecasted 2025 value of FAH expenditures in Figure 1 ($737.7 billion)

Figure 5. US Retail Sales and Forecast of Dining Out Expenditures, 2015-2025 (current prices). (Sources: IRI, US Census Bureau, Mintel)

Whether or not FAFH expenditures eventually surpass FAH expenditures will depend largely on prevailing economic conditions. As the two significant recessions of this century have shown, when consumers have concerns about their future spending capabilities, they will opt to spend a larger share of their food dollars on FAH rather than FAFH. Concerns about the future of the oil and gas industry, along with other proposed policy changes and market factors impacting Oklahoma’s primary industry sectors, may cause Oklahomans to continue spending a larger share of their food dollars on FAH rather than FAFH. ESRI and Grk MRI (2021) suggest this in a forecast of Oklahomans’ food expenditures in 2025 relative to 2020 (Table 2), although the FAFH forecast does follow the U.S. trend of increasing at a higher rate than either total expenditures or FAH expenditures.

Table 2. Oklahoma Food Expenditures, 2020 and 2025 (forecast). (Source: ESRI, Grk MRI)

| Expenditure Category | 2020 | 2025 (forecast) | Change (%) |

|---|---|---|---|

| Total Food Expenditures | $11,779,753,155 | $13,244,413,731 | 12.43% |

| Food at Home | $6,987,184,297 | $7,852,293,645 | 12.38% |

| Food Away from Home | $4,792,568,859 | $5,392,120,086 | 12.51%. |

Conclusions

The COVID-19 pandemic of 2020-21 has impacted food expenditures and food purchasing habits for consumers, but nationally and at the state level. While online shopping technology has added convenience to grocery shopping, the pandemic has shown the ability of these systems to handle large volumes of orders is still lacking. Additionally, online shopping when certain products are in short supply has not instilled consumers with the confidence their online supplier can adequately match or substitute products to meet their needs. In-store shopping remains the primary method for obtaining food items, and while supermarkets and mass merchandisers are still the primary channels, younger consumers are more inclined to shop at specialty stores and convenience stores to meet their food and beverage needs.

Only time will tell how the restaurant/food service industry will rebound from the pandemic. The resulting changes may be structural in nature, such as more take-home food service relative to in-house dining, or the increased use of delivery services by restaurants. Economic conditions, primarily the ability to rebound from a recession, will determine what share of the consumers’ food dollar will go to FAH versus FAFH.

References

Fernandez, C. (2020) “Industry Report 44511: Supermarkets & Grocery Stores in the US.” IBISWorld.com market research report. Accessed at IBISworld.com on April 28, 2021.

ESRI/Grk MRI. (2021) “Grocer Shopping Behaviors – Oklahoma.” Individualized buyer behavior report generated by ESRI Business Analyst (esri.com). Accessed on April 28, 2021.

Mintel. (2021a) “What America Eats – U.S. – February 2021.” Research report retrieved from Mintel Ltd. (mintel.com). Accessed on March 18, 2021.

Mintel. (2021b) “How America Eats – U.S. – February 2021.” Research report retrieved from Mintel Ltd. (mintel.com). Accessed on March 18, 2021.