Upgraded Packer-Feeder Marker Simulator

An earlier Extension fact sheet gave an overview of the market simulator developed nearly 20 years ago. It has been used regularly since then in classroom teaching, Extension education, and research. After the initial development, the simulator underwent two upgrades, first adding a futures market component, and secondly adding grid pricing and additional genetic types of cattle. Initial development of the simulator and early improvements were made possible by grants from the U.S. Department of Agriculture (Higher Education Challenge Grant program) and the Chicago Mercantile Exchange. The most major change was finished in 2008. Again, it was made possible by a second grant from the U.S. Department of Agriculture (Higher Education Challenge Grant program). The simulator now consists of a wireless network of laptop and handheld computers. This fact sheet describes the newest version of the packer-feeder simulator and Extension applications with it.

Game Overview

The packer-feeder game involves simulating the market for fed cattle. Participants role play as feedlot marketing managers and beefpacker cattle buyers. An important focus of the game involves interaction between participants in the weekly trading of fed cattle. Actions by participants, i.e., trading fed cattle and trading live cattle futures contracts, are entered into laptop and handheld computers. Activities of buyers and sellers are summarized and aggregate actions by all participants in the simulated market determine prices in the boxed beef and feeder cattle markets. Actions by individual players determine the profitability of each individual team (i.e., feedlot or packing plant) and the direction of aggregate market movements. The computer program keeps track of the financial performance of all teams.

One overriding objective of the market simulator is to provide participants with a similar experience to most aspects of the fed cattle market. The simulated market is compressed with respect to time — several months of fed cattle trading can be simulated in one class or workshop, allowing participants to gain considerable market experience in a short period of time. Furthermore, the fact that the market is simulated, but structurally realistic, allows participants the luxury of experimenting with different trading and management strategies. Strategies that may prove costly or ineffective in the game do not result in actual monetary losses, unlike experimenting with those strategies in the real-world market for fed cattle. Lastly, participants gain experience about the different perspectives of market participants in the fed cattle market by role playing positions on both sides of the market (as buyers and sellers).

The game is fairly fast paced. One week of real time trading is compressed into trading sessions of about 8 minutes in length. Therefore, even in a workshop as short as two hours, participants can experience several weeks of market dynamics in a single setting.

Game Structure and Operation

Below are essential features of the market simulator.

- Eight feedlot teams market pens of fed cattle to four meatpacking teams. Each team’s objective is to earn a profit.

- One pen equals 100 head of steers.

- Cattle are of three genetic types: low (lower quality grade, higher yield grade cattle), medium (average quality grade and average yield grade cattle), and high (higher quality grade, lower yield grade cattle).

- Cattle supplies cycle from larger to smaller cattle numbers and back to larger inventory numbers.

- Feedlot and packer teams negotiate prices in about 8-minute trading weeks.

- Teams can trade futures market contracts (one nearby and two distant contracts).

- Reports received by teams include: current (within-week) market reports and end-of-week market summaries; weekly profit/loss statements; and monthly Cattle on Feed reports (every four weeks).

- Cattle can be sold or bought from a show list any time during a five-week market window at weights from 1,200-1,300 lbs.

- Cattle at lighter weights (less than 1,200 lbs.) can be forward contracted for delivery at future show list weights.

- Cattle can be priced on a live weight, dressed weight, or grid method.

- Feedlots are penalized for feeding cattle to excessive weights (1,275 lbs. or more) due to the biological effects on cattle from overfeeding.

- Each packer has a different cost structure and minimum cost volume.

Simulator Basics for Feeders and Packers

The software written exclusively for the packer-feeder game (by InterWorks, Inc., a software development firm in Stillwater, OK) has many options. While it is not possible to detail what is on each screen and in each dialog box, a typical screen seen during a trading session with supplementary text boxes is given to each team as a guide.

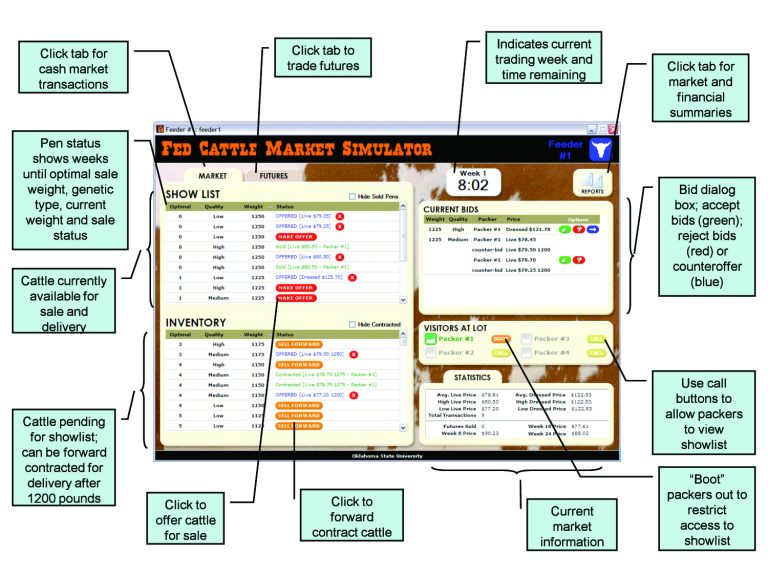

Figure 1 is an example of a feedlot screen during the trading session. From this screen, feedlot teams can see which trading round they are in, and how much time remains in the current trading round. Also shown on the screen is their show list of fed cattle that can be marketed during the next few weeks. The show list gives the weight and genetic type for each pen of cattle. Feedlot teams also can see the inventory of cattle not yet ready to be marketed, but will come onto the show list in the next few weeks.

Figure 1. Sample feedlot screen

Packers approach feeders to ask permission to see the show list and then negotiate trades. Feeders use a call button to allow packers access to the available show list of fed cattle. Feeders also can see the current week’s trading information (including average, high, and low prices, trading volume, etc.) so they know where the market is at all times. Feeders have the ability to make an offer (asking price) for pens of cattle they choose to sell, or they can allow the packer to make a bid on the cattle. After an offer or bid is made, the other party can accept it, reject it, or make a counter-offer or counter-bid, all of which can be done electronically.

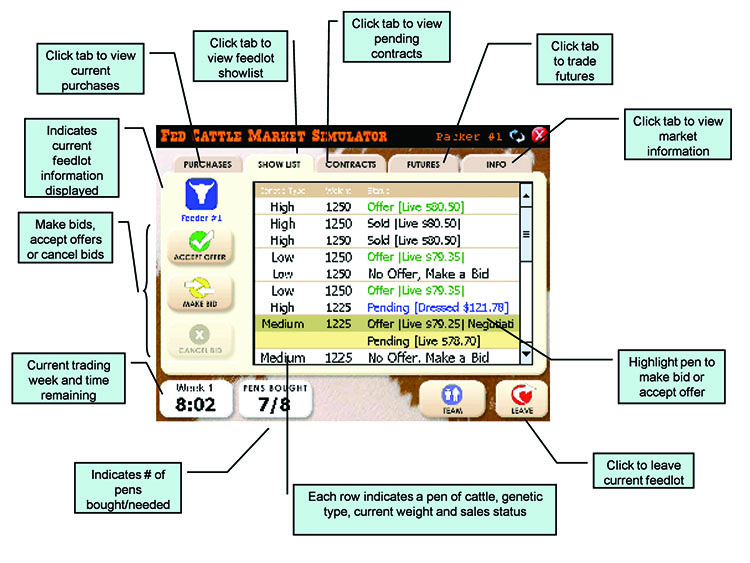

Figure 2 is an example of a packer screen on a packer’s handheld computer during a trading session after a feeder allows them to see the show list. Like feeders, packer teams can see which trading round they are in, how much time remains in the current trading round, and which feedlot’s show list they are seeing. After a feedlot calls a packer and the packer accepts the call, the packer can see the show list for that feedlot only. Packers can see the number of pens of cattle available as well as the weight and genetic type for each pen of cattle. Feeders can give packers access to their inventory of cattle not yet ready to be marketed, but will come onto the show list in the next few weeks. The two parties can then forward contract these pens of cattle for future delivery.

Figure 2. Sample packer screen

Like feeders, packers can see the current week’s trading information, so they know where the market is at all times. Packers, like feeders, also have the ability to make a bid for pens of cattle they choose to buy or they can allow the feeder to make an offer on the cattle. After a bid or offer is made, the other party can accept it, reject it, or make a counter-offer or counter-bid.

Packers have a button which tells them how many pens of cattle they should buy to operate their plant at the lowest possible cost. They can see how many pens of cattle they are buying during the trading week to compare the number purchased with the number needed. They have access to detailed information about each purchase, including price paid, pricing method, weight of cattle, and genetic type.

Each feedlot and meatpacking team has a notebook of materials at their table. The notebooks contain much useful information to assist teams understand the fed cattle market. Feedlot teams have information on the supply of feeder cattle, demand for feeder cattle, estimated breakeven prices, carcass characteristics for the three genetic types of cattle, and live weight to dressed weight conversion tables, among other information. Packer teams have information on the demand for boxed beef, packer processing costs, packer breakeven prices, carcass characteristics for the three genetic types of cattle, and live weight to dressed weight conversion tables, among other information.

Underlying Economics for Feeders and Packers

Detailed information regarding the economics built into the simulator can be found in Hogan et al. (2003). Each feedlot receives an inventory of feeder cattle each week to place in the feedlot and feed to slaughter weight. The overall placement pattern into feedlots mimics the cattle inventory cycle in the real marketplace. Cattle in the feedlot gain a constant 25 lbs. per week from the placement weight of 700 lbs. Thus, every week each feedlot has an inventory of fed cattle to market. Cattle on the show list (cattle available for sale this week) may be in five weight groups (1,200; 1,225; 1,250; 1,275; and 1,300 pounds) and three carcass quality groups (low, medium, and high). The number of pens of cattle received each week varies from week to week and feedlot to feedlot, but will usually range from three to seven pens.

The number of cattle placed into all eight feedlots each week determines the placement price for those cattle. The simulator has built-in a demand schedule for feeder cattle. Cattle feedlot teams know the placement price for feeder cattle and cost of gain each week. This information can be used to determine breakeven prices and the optimal weight to market their cattle.

Packers must determine the number of pens of cattle to buy each week in relation to their lowest-cost volume. They determine the price to pay by knowing the boxed beef price, adjusting the bid price for the carcass characteristics of each pen, and accounting for the projected slaughter-fabricating costs. The simulator also has a built-in boxed beef demand schedule which is driven by the number of pens and weight of cattle marketed by game participants each week during the simulation workshop. The slaughter-fabrication cost for each packer is based on past research showing cost economies associated with plant size.

Both feedlot and packer teams must decide how to price cattle traded, either on a live weight, dressed weight, or grid basis. Similarly, under certain market conditions or in accordance with given strategies, both feeders and packers may want to forward contract cattle for future delivery at some specified price.

Depending on the length of a workshop, a futures market is incorporated into the simulator and can be used along with the cash market. Feeders and packers can trade three kinds of futures market orders for three contract periods. Order types include market, limit, and stop. The emphasis with the futures market is on understanding the principles of futures markets and futures market trading, including hedging and using the futures market for price discovery.

Extension Applications

Workshops using the packer-feeder simulator range from 2 hours to 15 hours in length. The instructors suggest workshops of four to six hours in length for most Oklahoma groups. That length provides the most complete educational experience. Two hours is considered a little short (though still beneficial) and more than six hours makes it difficult to find and keep the necessary number of participants for the full period. Since the game has eight feeder and four packer teams, 24 participants are required and 30 to 36 are recommended.

County educators may want to work with one or two adjacent counties to attract enough participants to host the workshop. Potential participants might come from county cattlemen organizations, Master Cattleman classes, or other identifiable cattle educational groups. Persons interested in more information should contact Derrell Peel at derrell.peel@okstate.edu or 405-744-9816.

Summary

The fed cattle market simulator – or packer-feeder game as it is often called – was developed at Oklahoma State University and first used in 1990. Since then, it has been used in several ways:

- regularly in classroom teaching at OSU and other Land Grant universities,

- in Extension education programs throughout the U.S., in Canada and Mexico, by OSU faculty and faculty at other Land Grant universities, and

- in experimental economics research.

The packer-feeder simulator has been an effective tool to teach concepts related to how markets operate. Workshop participants range from youth (high school students) to college students, cattlemen (beginning ranchers to retired producers and wives), meatpacker employees, and corporate executives. Participants’ beginning knowledge of the beef industry may range from none to very extensive. Everyone begins the game at their specific knowledge level and learns how markets function from that starting point.

Upgrades to the simulator have been made in response both to changes in the beef industry and to changes in computer and information technology. Initial development and subsequent upgrades have been made possible by external grants, especially from the U.S. Department of Agriculture.

Reference

Hogan, Robert J. Jr., Clement E. Ward, James N. Trapp, Derrell S. Peel, and Stephen R. Koontz. “Economic Components of the Fed Cattle Market Simulator.” Oklahoma Agricultural Experiment Station, B-817, September 2003. http://agecon.okstate.edu/fcms/index.asp?type=publications

Clement Ward

Professor Emeritus

Derrell Peel

Professor and Extension Economist

Kellie Curry Raper

Associate Professor and Extension Economist