The Environment for Oklahoma Agricultural Land Values, Past and Present

Information is based on thesis research completed in 2007 but findings are still valuable.

In January 2008, the average U.S. farmland price, including land and buildings, was $2,350 per acre (USDA/NASS 2008). The U.S. average for cropland values increased 10 percent from the prior year to $2,970 per acre while pasture increased 6 percent to $1,230 per acre. In comparison, Oklahoma cropland averaged $1,110 per acre, a 13.4 percent increase from 2007. Pasture values increased 11.1 percent to $1000 per acre. Although in Oklahoma reported cropland values are higher than pasture values, nominal values for pasture have increased more rapidly than cropland values in recent years.

Increasing land values pose challenges to farmers, both established and prospective. For established farmers, high land prices may make selling attractive, either to fund retirement or to finance the purchase of an alternative site with fewer urban intrusions. They wonder if selling property and relocating would help them capture appreciation in land values in a local market and lower their opportunity cost on the land investment. For prospective farmers, high land prices create a barrier to entry. Land is the biggest asset on the farm balance sheet and also the largest source of farm debt for many producers. Thus, farmland values are an important indicator of the financial condition of farmers.

While it is known that agricultural land prices have generally increased over time, the determining factors contributing to the increases are less well known. Land prices in rural Oklahoma are increasing at dramatic rates, even in areas of low agricultural productivity. Demand for land for recreational uses and “ranchettes,” rather than farm or ranch expansion, may be driving forces.

This article highlights current and historical data and is one in a series of articles highlighting recent research on factors impacting Oklahoma agricultural land values. Other articles include:

- AGEC-251, Farm and Non-farm Influences on Agricultural Land Prices;

- AGEC-252, Urban Influences on Oklahoma Agricultural Land Values; and

- AGEC-253, Oklahoma Agricultural Crop versus Pasture Values.

Background

The development of the OSU Extension Oklahoma Agricultural Land Values project began with the collection of actual agricultural land sales transaction data from the Oklahoma Farm Credit Services offices for 1971 to 2001 by Dr. Darrel Kletke, professor emeritus of agricultural economics at Oklahoma State University. He analyzed the data to provide information about cropland and pasture land values throughout Oklahoma and also presented data for eight production regions, plus individual counties, to illustrate local results. A website was built to make summaries readily available. In 2007, the website was updated with data from 2001 to 2006 and now offers charts, tables, and maps of various statewide, regional, and county level data (www.agecon.okstate.edu/oklandvalues). The website contains county land value changes, annual averages, and three-year weighted averages; statewide comparisons by size of tract; USDA Oklahoma agricultural land values; and regional cropland and pasture values.

Figure 1 shows changes in Oklahoma agricultural land values for the past 35 years based on actual sales data. Although this chart shows higher average land prices than the USDA data based on surveys, the results are similar. Land prices were bid up significantly in the late 1970s and 1980s, before falling dramatically during the farm crisis. The average price per acre for all sales in 1971 was $216, rose to nearly $1,000 in 1981, and then took more than 20 years to return to the 1981 high point.

Economic theory suggests that the value of land is derived from the net present value

of future returns. The direct capitalization formula is commonly used to define the

theoretical value of lands:

(1) agricultural land values = returns/discount rate.

Figure 1. Average Price for Agricultural Land in Oklahoma. Source: agecon.okstate.edu/oklandvalues

Historically, agricultural land prices followed agricultural returns and so studies focused on factors affecting agricultural returns such as commodity prices, soil productivity, land improvements, tract size, cash rents, government payment, interest rates, and farm income. However, recent research suggests that non-agricultural influences are increasingly important. For instance, the returns can be from agricultural uses, recreational uses, or opportunities for urban conversion. As urban influences increase in significance, data measuring population density, population growth, per capita income, and distance to urban areas are used in models. Now, recreational influences are recognized as important and variables such as hunting lease rates, recreational income, acres of wildlife habitat and wildlife population density are included in analyses.

Each of the articles in this series on land value research uses many of the same variables. Hence, the data are described in the following paragraphs so the reader gains a historical perspective on their potential impacts on land values. Key findings from analysis of the data are also highlighted.

Agricultural Land Sales Data

Agricultural land sales transactions data were collected for 1971 to 2005 from Farm Credit Services offices in Oklahoma for all 77 counties in Oklahoma. Data included land price per acre, county location, sales date, and land use separated into pasture, cropland, timber, waste, irrigated cropland, recreation land use, and areas of water. Percent of water acres describes wetland areas, lakes, and any other body of water included in the land sales transaction. These wet areas have potential recreational uses, but little or no agricultural value. The land use variables are specified as use percentages. Total acres per sales transaction were also specified. While the data included rental income from recreational uses such as hunting leases in some cases, because of concerns about its completeness, it was not used. The value for improvement contribution, as estimated by the appraiser, was subtracted from the net sales price to account for house, building, and other improvement values. The acres used by the improvements were also deducted in calculating the price per acre. The number of acres for each use was divided by the total deeded acres for that parcel to obtain a percentage of land in production. Overall averages for land price per acre are shown in Figure 1.

Land sales tracts with 85% or more cropland and 85% or more pasture land were also summarized separately (Figure 2). In 1971, the statewide price per acre was $315 for cropland and $163 for pasture land. In 2006, the state average cropland price per acre was nearly tripled at $908, while pasture land increased seven times to $1,213 per acre. The dip in 1995 is caused by missing data for a part of the state primarily in pasture land.

Figure 2. Oklahoma Pasture, Cropland, and All Land Sales1. Source: agecon.okstate.edu/oklandvalues

Rainfall

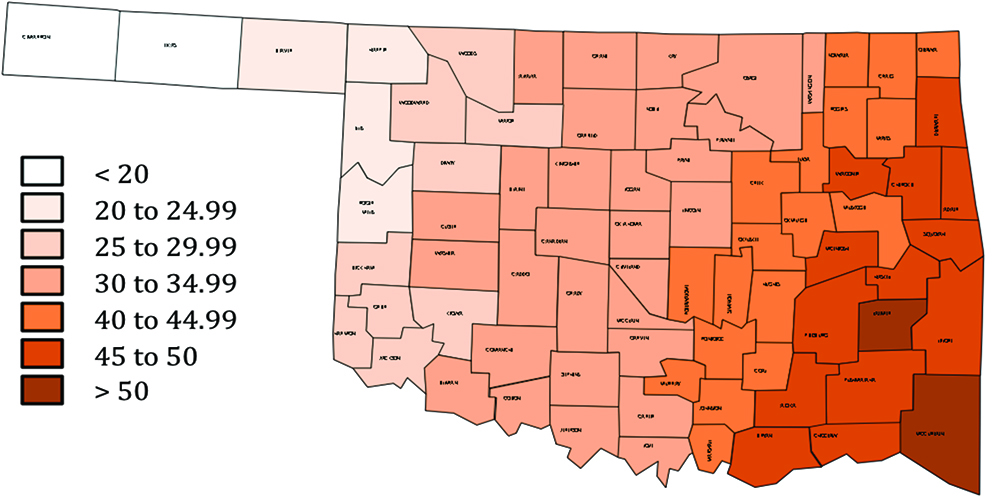

The Oklahoma Climatological Survey website lists average monthly rainfall amount in inches for each county based on precipitation for 1971 to 2000. In this research, rainfall was an average for the county developed from this data and the same number was used for 1971 to 2005 in all of the articles. Rainfall was a substitute for farm yield potential and therefore agricultural returns to land. Figure 3 shows average annual rainfall by county.

Figure 3. Annual Rainfall Value per County (inches). Source: Oklahoma Climatological Survey.

Cattle Prices

Annual cattle prices were collected from various issues of the USDA Economic Research Service Red Meats Yearbook for 1972 to 2005. The weekly cattle prices for 600- to 700-lb steers were used to calculate an average annual price. In models, the prices were lagged to allow the previous year’s cattle prices to affect the current year’s land values.

Crop Returns

The crop returns above operating costs variable was calculated using NASS, Oklahoma Farm Service Agency (FSA), and Oklahoma State University enterprise budget (OSU) data. Production by commodity for each county for 1971 to 2005 (NASS) was multiplied by a county level crop price. The county crop price for a given year was estimated by multiplying the state price (NASS) by the ratio of the county loan rate to the national loan rate. FSA provided county loan rate data for all commodities except cotton, which was obtained from a personal contact (Jay Cowert) and the Plains Cotton Cooperative Association, and peanuts, which came from a personal contact (Larry Vance) with The Clint William’s Company. This crop revenue value for the county was then divided by the total harvested acres for the commodity in the county.

Operating cost of production (OSU) was subtracted from the crop revenue per harvested acre to acquire a revenue per acre figure. The costs by year were calculated by taking the prices paid index (Jen Brown, NASS) and dividing the current year index by the 2005 index and multiplying that number by the total costs for a given commodity. The revenues for dryland and irrigated cropland were weighted separately by the total number of harvested acres for each commodity in each county for each year (NASS). The commodities included in this calculation for other commodities were dryland barley, alfalfa hay, soybeans, grain sorghum, wheat, and oats plus non-irrigated and irrigated cotton, corn, and peanuts. The crop returns for dryland was used in both the recreation and pasture versus crop article, but the irrigated returns were only used in the pasture and crop article.

Crop returns for both dryland and irrigated crops were highly variable over the study period (Figure 5). Crop prices, crop yields, and cost of production all contribute to the variability shown over time. Error checks (comparisons of net return calculations to NASS statistics) were conducted to ensure accuracy of the crop returns calculations. Note the lack of similarities between the crop returns chart and land price chart.

Figure 4. Statewide Average Cattle Prices for 600- to 700-lb Steer. Source: USDA/ERS Red Meats Yearbooks.

Figure 5. Net Crop Returns for Dryland and Irrigated Crops.

Government Payments

Government payments were collected from the Bureau of Economic Analysis by county for 1971 to 2005. To obtain an accurate measure, the government payment amount was divided by base acres for all program commodities, which were obtained from the State Farm Service Agency office.

Figure 6. Average Government Payments per Acre. Source: Calculated from US Bureau of Economic

Analysis and USDA/FSA Base Acre Data.

Population

Estimates of total population, by county, and for the twelve largest cities for the years 1971 to 2005 were obtained from the U.S. Department of Commerce, Bureau of Economic Analysis. The population data were used to create population growth and population density variables (county population divided by the county land area in acres). The populations ranged from 530,000 people in Oklahoma City to 22,000 people in Duncan. Metropolitan and micropolitan statistical areas were used for the population estimates and per capita income. Figure 7 shows the county average population for two cities plus the overall average county population. Obviously, averages for Oklahoma and Tulsa counties are much higher. The Ponca City graph is indicative of the population changes in oil-dependent communities while Stillwater represents communities with more diversified economic bases.

Figure 7. County Average Population and Micropolitan/Metropolitan Population of Selected Cities.

Source: U.S. Department of Commerce, Bureau of Economic Analysis.

Distances

The land sales data contained a legal description that included section, township, and range. Legal description data for Oklahoma was obtained from the state’s USDA Natural Resources and Conservation Services (NRCS) version of the Public Land Survey System (PLSS). The land sales legal descriptions were linked to the PLSS legal description ArcView 3.2 shape files. Distances were measured from the center of the sales transaction legal descriptions to the urban centers using the most direct route along a network road system. Distance was measured in meters (converted to miles) for each transaction for all thirty-five years of the data.

The twelve urban centers with the largest population were used. The urban centers included eleven towns in Oklahoma (Lawton, Oklahoma City, Tulsa, Ardmore, Bartlesville, Duncan, Enid, Muskogee, Ponca City, Shawnee, and Stillwater) and one in Arkansas (Fort Smith). The population data used to choose the locations was based on the metropolitan and micropolitan statistical area figures.

Income

Total per capita income from the Bureau of Economic Analysis was recorded in thousands of dollars. Real income for the twelve most populous cities was calculated by deflating the per capita income for the city metropolitan or micropolitan statistical area by the GDP implicit price deflator (Figure 8).

Figure 8. County Average and Selected City Per Capita Income. Source: Calculated from U.S.

Department of Commerce, Bureau of Economic Analysis Data.

Deer Harvest

Deer harvest data were obtained from the Oklahoma Wildlife Commission and included the total number of deer harvested for 1971-2005 by county. Figure 9 shows the average number of deer harvested per county over time; Figure 10 shows the average annual number of deer harvested per county. Total county acres were obtained from the Census Bureau. For models, the deer harvest was divided by the total county acres to obtain a deer density measure which could provide a more accurate measure of potential returns per acre.

Figure 9. Average County Deer Harvest, 1971-2005.

Recreational Income

Recreational income from agricultural uses, recorded in thousands of dollars, was collected from the USDA 2002 Agricultural Census data and applied to 2001 through 2005. There were eleven counties with missing values to avoid disclosing individual data. An average of the neighboring counties was calculated for the missing values. Recreational income was divided by total county acres (Census Bureau). Figure 11 shows the average reported recreational income per acre.

Figure 10. Average Annual Deer Harvest per County, 1996-2005. Source: Oklahoma Wildlife Commission.

Figure 11. County Average Recreational Values.

Key Findings

Extension Fact Sheet AGEC-251, “Recreational Influences on Oklahoma Agricultural Land Values,” found that agricultural factors were still important driving forces in land values. However, recreational influences were increasing. As tract size increased, per acre price decreased which could indicate a premium for residential, commercial, or recreational land uses, typically found in smaller tracts. Recent historical data clearly showed a more rapid rate of gain in pasture values than cropland values (see Extension Fact Sheet AGEC-253 “Oklahoma Pasture versus Cropland Values”). In the western region, cropland commanded a premium over pasture with pasture values steadily increasing. In the eastern region, pasture land has been at a premium for the previous eight years. In Extension Fact Sheet AGEC-252 “Urban Influences on Oklahoma Agricultural Land Values,” the analysis indicated that although Oklahoma is less populated than many other states, the urban influence on agricultural/land values was strong. We found that as the distance from urban centers increased, the price per acre decreased.

Past and Present

Past studies of agricultural land values used factors such as rental rates, government payments, crop yields and agricultural income to explain agricultural land values. Geographical Information System tools are increasingly used but typically on small areas. Our data is unique both in encompassing the entire state and having parcel-level detail for 35 years. The different data series highlighted here offer insights on different dimensions of farm land values. Due to changing situations and current events, it is important to remain aware of the agricultural land market and its influences.

References

Guiling, Pam. 2007. “Influence of Nonagricultural Values on Agricultural Land Prices.” Masters Thesis, Department of Agricultural Economics, Oklahoma State University.

Oklahoma Climatological Survey. Unpublished rainfall data. Accessed June, 2006.

Oklahoma Department of Wildlife Conservation. Unpublished deer harvest data. Accessed June, 2006.

Oklahoma Natural Resources and Conservation Services, State legal descriptions. 2006.

Oklahoma State Farm Service Agency, Base acres by county and county loan rates. 2007.

Oklahoma State University. Enterprise Budget System, cost of production. Accessed February 2007.

Plains Cotton Cooperative Association, Cotton county loan rates. February 2007.

The Clint William’s Company. Personal Contact: Larry Vance, Peanut county loan rates.

February 2007.

U. S. Census Bureau. www.census.gov (county acres) Accessed December 2006.

U. S. Department of Commerce, Bureau of Economic Analysis. Accessed June, 2006.

USDA, Economic Research Service. Red Meats Yearbook, 2006.

USDA, 2002 Agricultural Census. Accessed December 2006.

USDA, National Agricultural Statistics Service. Accessed January 2007.

USDA/NASS. Land Values and Cash Rents 2008 Summary. Washington DC: National Agricultural Statistics Service, Agricultural Statistics Board, U.S. Department of Agriculture. August 2008.

Pam Guiling

Former Graduate Student

Agricultural Economics

Damona Doye

Regents Professor and Extension Specialist

Wade Brorsen

Regents Professor, Econometrics and Ag. Marketing