Marketing Puzzle: Futures Option Contracts

The cash price received for most agricultural commodities traded on futures exchanges is determined by the underlying futures contracts. The following equation may be used to determine the cash price (OSU Facts Sheet # 548): cash price = futures contract price + basis. The appropriate futures contract price directly impacts the cash price.

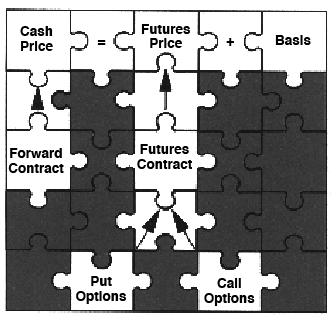

The equation, cash price = futures price + basis is a key to understanding how to use pricing tools (Figure 1). Each tool and cash price may be thought of as a piece of a puzzle. Just as each pricing tool is connected, each puzzle piece is connected indirectly to every other piece of the puzzle.

For example, the puzzle piece cash price does not change unless either the futures price or basis changes. If the futures price increases 5 cents per bushel and the basis does not change, the cash price increases 5 cents per bushel. Conversely, if the futures price decreases 5 cents per bushel and the basis does not change, the cash price decreases 5 cents per bushel.

In grain markets, the basis is relatively stable. Major changes in the cash price are mostly caused by changes in the futures contract price. There are many futures contracts. For hard red winter wheat, there are five contracts; March, May, July, September, and December. The cash price is determined by the next contract to expire before the expiration month.

For example, during December, January, and February, the Kansas City Board of Trade (KCBT) March contract is used to determine the cash price. During March and April, the KCBT May contract is used. During May and June, the KCBT July contract is used. During July and August, the KCBT September contract is used. And during September, October, and November, the KCBT December contract is used to determine the cash price.

A key to understanding the market is to understand this simple principle: The equality, cash price = futures price + basis must hold. Any change in the futures contract price will cause the cash price to change. If the futures price changes, either cash price or basis must change. Producers who own cash commodities (wheat, corn, soybeans, cattle, hogs, etc.) normally lose when futures contract price declines. Producers who must buy cash commodities normally lose when futures contract price increases. Futures option contracts may be used to insure against these losses.

Futures Option Contracts

Agricultural commodity option contracts traded on the Kansas City Board of Trade (KCBT), the Chicago Board of Trade (CBT), and the Chicago Merchantile Exchange (CME) were introduced in 1988. Their purpose is to provide agricultural commodity producers and merchandisers price risk management tools.

A futures option contract is a contract which gives the contract buyer the right (option) to either buy (call option) or sell (put option) a specified futures contract at a contracted price. Assume a KCBT December $4 wheat Put option contract has been bought for 20 cents per bushel. The buyer of the Put has the option to sell a KCBT December contract for $4. Now assume that the December wheat futures contract price goes to $3.75 per bushel. The buyer of the $4 Put option contract has the option to sell the KCBT December contract for $4 and then buy it back for $3.75, netting a profit of 25 cents. After subtracting the original 20 cents costs, the actual profit from the trade is 5 cents.

In this example, the buyer “exercised” the option to buy the futures contract. Very few option contracts are converted to a futures position (exercised). Most option contracts, which have value, are sold. For example, if a $4 wheat Put option has been bought and the underlying futures contract is $3.75, the Put option may be sold for at least 25 cents per bushel.

The value of futures option contracts changes as the underlying futures contract price changes. Buyers of futures option contracts may use the contracts to insure against changes in futures contract or cash prices. Futures option contracts are price risk management tools which impact the net price received through futures contracts. In most cases, profit from buying or selling option contracts goes directly to the buyer or seller.

Futures option contracts provide agricultural producers with a price risk management alternative for no potential loss, but with unlimited gain. If having an alternative with “no potential loss” sounds too good to be true, it is. Buyers of options must pay someone to take the price risk. The payment or premium is paid to the buyer when the option is purchased.

Option Terminology

Understanding option terminology is not essential to knowing how to use options, but it is important to know the terms when options are incorporated into the marketing plan. Full understanding will come with use. For this fact sheet, you may refer to the following terms.

Buyer—The person who purchases the contract. The buyer is the only person who has the choice of whether or not to use the contract.

Seller—The person who sells the contract to the buyer. The sellers receive the premium (see premium below) and in turn must take the opposite position if and when the option is exercised.

Put—An option contract which gives the buyer the right to sell (short) a specific futures contract at a specified price. If requested, the seller of the put must buy from the buyer of the put option the specified futures contract at the contracted price.

Call—An option contract which gives the buyer of the call option contract the right to buy (long) a specific futures contract at a specified price. If requested, the seller of the call option must sell to the call option buyer the specified futures contract at the contracted price.

Underlying Contract—The specific futures contract (i.e. KCBT December wheat) which the buyer has the right to, in case of a Put sell, or in case of a Call buy.

Strike Price—The underlying futures contract price at which the buyer of the option contract has the right to accept a sold position (Put) or bought position (Call). Strike prices are in 10¢ increments for wheat and corn, and 25¢ increments for soybeans.

Premium—The “price” of an option. The money the option contract buyer pays the option contact seller. The “premium” is the maximum amount the option buyer can lose. The “premium” is the maximum amount the seller can gain.

Expiration Date—The last day on which a option can be exercised. Options, except CME feeder cattle, expire about the 20th of the month before the underlying futures contract expires.

Exercise—The action taken by the buyer (and only the buyer) to obtain the contracted position in the underlying futures contract at the specified price.

Option Contracts

The following Put and Call Option contract discussions pertain to buying Puts or Calls and the buyers rights and responsibilities. There are many terms associated with option contracts. Some of these terms are presented above, but they are only important when options are actually used. Before options are implemented into the marketing plan, the important thing to know is the price impact of buying a Put or a Call Option. The Premium is the cost of the contract. For example, a KCBT $4 July wheat Put Option contract may cost $0.15 per bushel or $750 for one 5,000 bushel futures contract.

The Strike Price is the “starting point” for establishing the option contract value. Assume a KCBT July $4 Put Option contract is bought (strike price is $4). The Put Option contract value will depend on whether the KCBT July wheat contract price is above or below the $4 strike price.

The buyer chooses the strike price. Each strike has a different value and will depend on the price level of the underlying futures contract. It would be easy to get “tied up” with terminology, but don’t. The key is to learn two basic principles. Put Option value increases when futures contract price declines and Call Option value increases as futures contract price increases. These two principles are the most important points to remember about Options.

Put Option Contracts

Note that Put Option contracts impact Price through the futures contract and futures contract price (Figure 1). The single most important thing to remember about Put Option Contracts is that the Put Option Contract’s value increases as the underlying futures contract price declines. The single most important thing to remember about the futures contract price is as the futures contract price declines, the cash price declines.

Figure 1. The Marketing Puzzle.

Visualize a Futures Contract and a Put Option Contract as two connected tanks of water. If the water level in the Futures Contract tank declines, the water level in the Put Option tank increases. If the water level in the Futures Contract tank increases, the water level in the Put Option tank declines until the Put tank is empty. The Put Option water level can not get any lower than zero.

If a commodity (wheat, corn, cattle, hogs, etc.) is owned and the underlying futures price increases without a change in the basis, the cash price increases. This could be good. If a commodity is owned and the underlying futures price decreases without a change in the basis, the cash price decreases. This could be bad. If a Put Option contract has been purchased on the underlying contract, it is OK to have declining prices.

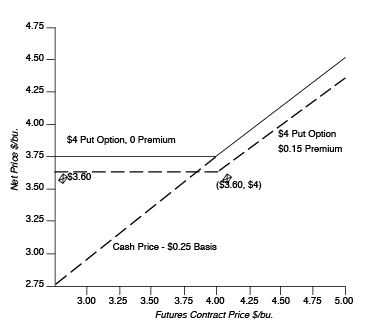

Assume wheat is growing in the field, the KCBT July wheat contract price is $4, the expected basis is minus $0.25, and a $4 July Put Option contract premium (cost) is $0.15 per bushel. Wheat may be hedged or forward contracted for $3.75 per bushel ($4 – $0.25). An alternative to forward contracting or hedging is to buy a $4 KCBT July put option contract. The minimum expected price from buying the Put Option contract would be $3.60 ($4 – $0.25 – $0.15). This is the $4 futures contract price plus the expected basis (-$0.25) and minus the Put Option premium ($0.15).

A graphic representation of the price impact from buying Put Option contracts is shown in Figure 2. The diagonal or dashed/solid line represents the relationship between the futures contract price and the cash price. Assuming the basis is a minus $0.25, the cash price is always 25¢ less than the futures price. If the futures price is $3, the cash price will be $2.75. If the futures price is $4, the cash price will be $3.75. If the futures price is $5, the cash price will be $4.75.

In Figure 2, the solid line represents the relationship between the futures price, a put option contract, and the price received without considering the put option’s premium. Assume a KCBT $4 July Put Option contract had been purchased in April. If the KCBT July contract price is $5, the local cash price would be $4.75 ($5 – $0.25). Since the futures contract price is greater than the Put Option strike price of $4, it is not logical to use the put to sell for $4 when the futures contract price is $5; therefore, the KCBT $4 July Put Option contract will have no value. The cash price plus any profit from the Put $0 would be $4.75 (Note: premium is being ignored).

Figure 2. Net price received from buying a $4 KCBT July Put Option contract with a minus $0.25 basis.

Now assume that a KCBT $4 July Put Option contract had been purchased in April. If at harvest the KCBT July contract price is $4, the local cash price would be $3.75. The KCBT $4 July Put Option Contract would have little or no value. And the Price would be $3.75.

Again, assume that a KCBT $4 July Put Option contract had been purchased in April. If at harvest the KCBT July contract price is $3.50, the local cash price would be $3.25. The KCBT $4 July Put Option Contract would be worth at least $0.50 per bushel ($4 – $3.50). The Price would be $3.75 ($3.25 cash price plus $0.50 final value of the Put Option).

When the futures price is less than $4, the value of the Put Option contract increases and offsets the lower futures price. This in effect creates a “price floor” at a price level determined by adding the basis of $-0.25 to the strike price. The minimum price is $3.75. Above $4, the Put Option has little or no value, but the cash price increases as the futures price increases.

Now take into consideration the $0.15 premium (dashed line in Figure 2). The premium shifts the net Price down by the amount of the premium. Assume a KCBT $4 July Put Option contract had been purchased for $0.15 per bushel or $750 for a 5,000 bushel contract in April. Then if the KCBT July contract price is $5, the local cash price would be $4.75 ($5 – $0.25). The KCBT $4 July Put Option contract will have no value. The cash price plus any profit from the Put of $0, would be $4.75. Subtracting the $0.15 cent premium creates a net Price of $4.60 per bushel. This is the $4.75 cash price minus the $0.15 KCBT July Put Option premium.

Call Option Contracts

Call Option contracts impact Price through the futures contract (Figure 1). As the futures contract price increases, the value of Call Option contracts increases. As the futures contract price declines, the value of the Call Option contract declines until the futures contract price is equal to or less than the Call Option “Strike” price, then the value of the Call Option is zero.

Since Call Option contract values move in the same direction as the underlying futures contract price, Call Option contracts by themselves can not be used to protect against lower prices. Call Option contracts are used to protect against higher prices. Call Option contracts are used in combination with other marketing tools.

Producers may want to buy Call Option contracts after the wheat or cattle have been sold. The sale may be through a cash sale (wheat at harvest), after forward contracting (planted wheat or stockers on pasture, cattle in the feed lot), or after hedging. Cash sales, forward contracts, or hedges all lock in the futures price. Cash sales and forward contracts also lock in the basis. Buying a Call Option captures any futures contract price increase above the Call Option “strike” price.

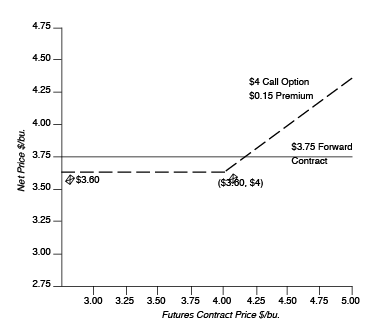

Assume wheat is growing in the field, the KCBT July wheat contract price is $4, the expected harvest basis is minus $0.25, and a $4 July Call Option contract premium (costs) is $0.15 per bushel. Wheat may be hedged or forward contracted for $3.75 per bushel ($4 – $0.25). Forward contracting for $3.75 per bushel locks in both the futures price at $4 and the basis at minus $0.25. After forward contracting, neither a decline nor an increase in the KCBT July futures contract price will impact the Price received (Figure 3). Note that forward contracting or selling “locks in” the price and may be represented by a horizontal line at the forward contract price, which is $3.75 in this example.

Producers do not like missing the opportunity to receive higher prices. Buying Call Option contracts after the commodity has been sold allows producers to receive any increase in futures contract prices.

Assume wheat is forward contracted for $3.75 per bushel and a $4 KCBT July Call option contract is bought for $0.15 per bushel (Figure 3). The minimum price would be $3.60 ($3.75 – $0.15). This is the $3.75 forward contracted price minus the Call Option premium ($0.15). It is represented by a horizontal, dashed line at $3.60 until the futures price reaches the strike price, which is $4 in this example.

Figure 3. Net price received form forward contracting at $3.75 and buying a $4 KCBT July Call Option contract.

If the futures price is less than the strike price, $4 in this example, the Call Option may not have any value. If the futures contract price is above the strike price, $4 in this example, gains in the futures are not received because the commodity has already been sold. If a Call Option contract had been bought, the value of the Call Option increases as the futures contract price increases. The forward contracted price plus the increased value of the Call Option allows the price to increase at the same rate as the futures price.

Assume that a KCBT July Call Option contract was purchased for $0.15 per bushel or $750 for a 5,000 bushel contract in April. Then if the KCBT July contract price is $5, when the wheat is delivered in June, the local cash price would be $4.75. The wheat would be delivered for the forward contracted $3.75. The KCBT $4 July Call Option contract will have a value of $1.00 ($5 – $4). The Price would be $4.60 per bushel ($3.75 + $1.00 – $0.15). This is the $3.75 forward contracted price, plus the $1.00 Call Option value, minus the $0.15 KCBT July Call Option premium.

Again, assume that a KCBT $4 July Call Option contract was purchased for $0.15 per bushel in April and the wheat was forward contracted for $3.75. If when the wheat is delivered in June and the KCBT July contract price is $3.50, the local cash price would be $3.25. The wheat would be delivered for $3.75, the KCBT $4 July Call Option Contract would not have a value ($4 > $3.50 => 0), and the Price would be $3.60 ($3.75 forward contract price minus $0.15 premium).

Another use of Call Option contracts is to sell wheat at harvest and buy Call Option contracts to protect against higher prices. If wheat is to be stored and sold later in the marketing year, carrying costs are incurred. Selling wheat at harvest removes these costs.

Assume wheat is to be stored until December 15 and carrying costs are $0.30 per bushel. If the wheat is sold, KCBT March Call Option contracts could be bought to protect against higher prices. A KCBT March contract would be purchased rather than a December contract because the December Call Option expires in late-November.

Selecting which KCBT March wheat Call Option contract “Strike Price” to buy may be complicated. Rather than confuse the matter, follow the example and do not worry about the underlying prices.

Assume that wheat is sold in June for $3.50 per bushel. At the time the wheat is sold, the KCBT March wheat futures contract price is $4 per bushel and a KCBT March $4 Call Option contract may be bought for $0.30 per bushel. The minimum Price received for the wheat will be $3.20 ($3.50 – $0.30).

If the wheat was going to be stored until December 15, storage and interest costs would have been $0.30 per bushel (about the same as the costs of the KCBT March Call Option contract). Carrying costs have been used to pay for nearly all the call option contract and any increase in the KCBT March futures contract price will be captured by an increase in the value of the Call Option contract.

Summary

Commodity futures option contracts are relatively easy to use. Care must be made to not get caught up in the terminology. Just concentrate on two simple facts. The first is that the value of a put option contract increases as the underlying futures contract price declines. The second fact is that the value of a call option contract increases as the underlying futures contract price increases.

Based on these two simple rules, use put option contracts when the commodity is owned and lower prices will reduce the price received. For example, when wheat is in the field or livestock are on wheat pasture or in the feed lot. Use call option contracts when the commodity has been sold or priced (forward contracted) and there might be an opportunity to get a higher net price by taking advantage of increasing futures contract prices.

Kim Anderson

Extension Agricultural Economist