GLP-1 Drugs and Consumer Preferences: Assessing Market Opportunities for Oklahoma Food Businesses

Introduction

Healthy living and a healthy diet are undeniably correlated. Conversely, obesity and the prevalence of diabetes are also undeniably correlated. Recent data from the National Center for Health Statistics indicate the U.S. population is more than 40% obese (Emmerich et. al, 2024) and almost 16% of all U.S. adults are estimated to have diabetes (Gwira, Fryar and Gu, 2024). Those consumers impacted by obesity and diabetes may make efforts to alter their diet in ways to promote healthier living, including the use of appetite-suppressing drugs to lessen caloric intake. However, the use of these drugs requires careful consideration of food purchases to ensure appropriate macronutrient intake.

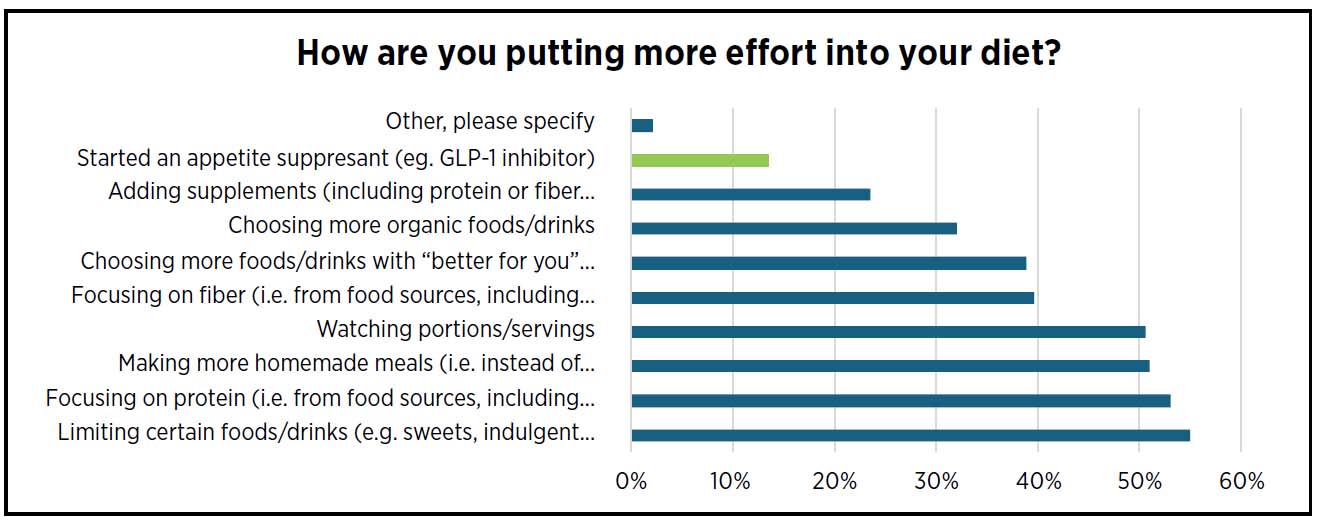

The push for healthier dieting is not a new phenomenon. In fact, a recent survey by

Mintel showed that 41% of people are putting more effort into their diet and only

7% are intentionally putting less effort into their diets (Chychula, 2025). There

remains a standard focus on consuming more produce and protein while consuming fewer

sweets and fewer products with food additives. However, one increasing trend is the

use of appetite suppressants, primarily GLP-1 drugs, to lessen hunger and force portion

control. Figure 1 shows 14% of people in a recent survey of US consumers over age

18 said that they started using a GLP-1 drug as an appetite suppressant.

GLP (glucagon-like peptide) is a hormone that tells the pancreas to release more insulin; consequently, people on GLP-1 drugs take longer to digest their food and feel fuller longer. Because these drugs cause people to eat less, it becomes important that the food they do eat contains lean protein, fruits, vegetables and whole grains. It is also necessary to stay hydrated while on the drug. These diet requirements can be influential in consumer preferences when purchasing food. Understanding GLP-1 consumer preferences can be used to the advantage of the producer.

Figure 1. U.S. Consumers’ Diet Intentions, 2024. (source: Mintel Ltd.)

GLP-1 drugs have seen exponential increase in use over the past 15 years as doctors continue to prescribe the drug for type 2 diabetes, obesity, and cardiovascular disease. Historically, those using GLP-1 drugs to treat their diabetes have constituted the largest share of GLP-1 drug use. However, a recent survey showed the number of people using these GLP-1 drugs for weight-loss has surpassed the number of people using the drug to treat diabetes – and the margin between the two is growing (Hristakeva, Liaukonyte, and Feler, 2024).

GLP-1 User Consumer Preferences

Increased use of GLP-1 drugs impacts food choices made by consumers. Different studies show conflicting results regarding the impacts of GLP-1 drug use on food expenditures, but both NielsenIQ and Numerator surveys conclude that the users spend less eating out, spend less on high-calorie and indulgent food items, and spend more on produce, nutritional snacks and meat snacks. These shifts in consumer preferences correlate directly with the directions dieticians are giving GLP-1 users (Snashall, 2024). Because these consumers do not eat as much, they are looking for nutrient-dense foods to satisfy their nutritional needs in small portions.

In conjunction with these findings, protein-rich foods continue to experience greater

demand growth relative to other food categories. In fact, a recent Mintel study showed

that 53% of people are focusing more on increasing protein in their diet (Chychula,

2025). While studies vary in their estimates of impacts, it is presumed that high-protein,

low-sugar meal and snack products will continue to grow as the number of GLP-1 drug

users grows.

In an interview with Food Business News in February 2025, Sean Connolly, president and CEO of Conagra Brands, emphasized how Conagra is attempting to capitalize on the opportunity that comes with the GLP-1 trend by designing new products and redesigning existing products to attract GLP-1 consumers. Most notably, Conagra has introduced small-portion, high-protein frozen meals with a GLP-1-friendly badge in their efforts to capitalize on the trend (Figure 2).

Other companies looking to capitalize on the upswing in GLP-1 drug users are developing

new menus and even new product lines. Smoothie King released a new GLP-1-friendly

menu with five new smoothie recipes focusing on high protein and high fiber with no

added sugars. In May 2024, Nestle introduced a new brand called Vital Pursuit. When

released, the frozen food line offered 14 different options from pizza to taco bowls

with a marketing campaign focused on high-protein and essential nutrients in small

portions.

Figure 2. Example of a Packaged Food Product with a “GLP-1 Friendly” Label. (source: Conagra Brands)

GLP-1 Market Outlook and Opportunities for Oklahoma Food Processors

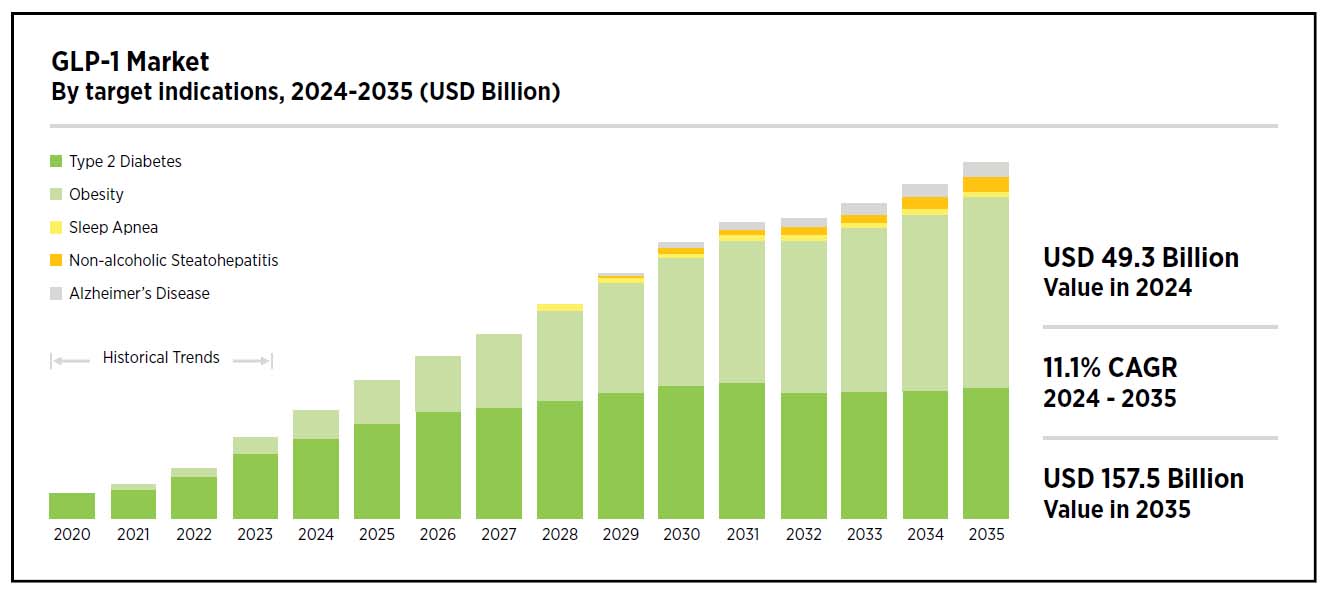

Goldman Sachs Research says GLP-1 drugs could affect the U.S. GDP by as much as 1% this year. This gives strong reason to believe that as GLP-1 drug users continue to grow exponentially, the market for GLP-1 friendly foods will continue to grow. TD Cowen has recently projected that the major GLP-1 producers, Eli Lilly and Novo Nordisk, will grow to $139 billion by 2030. This projection is up 38% from their previous projection. Figure 3 shows Research and Markets projections of GLP-1 sales through 2035. Note that not only do they project a compound annual growth rate of 11.1%, but GLP-1 drug usage as a weight loss drug is projected to take over type 2 diabetes as the main target indication.

Both large and small Oklahoma food processors and marketers should be cognizant of

these trends and consider marketing opportunities created by growing GLP-1 use in

the state. Oklahoma has the third-highest adult obesity prevalence in the nation according

to the CDC (trailing only Louisiana and West Virginia), so Oklahoma represents one

of the biggest market growth areas for GLP-1 drugs and GLP-1 friendly product lines.

Food businesses interested in capturing a share of this growing target market should

consider the following action items:

- Survey your customers or target market area to determine how many of your area’s consumers are using or may use GLP-1 drugs.

- Evaluate how these patterns may impact your existing product offerings, whether you are a manufacturer or a marketer/retailer.

- Assess the potential for producing and/or marketing new, GLP-1 tailored product lines to expand your market presence in this area. Combine this with existing opportunities for your local or Made In Oklahoma marketing efforts.

- Depending on the nature of your products, determine which (if any) current products can be marketed/promoted to attract GLP-1 customers. [For reference, in recent years products that were already gluten-free were relabeled/advertised as gluten-free to attract that market segment.]

you are interested in examining the market potential for GLP-1 friendly foods, or want more market information for these or other food trends, contact the Robert M. Kerr Food & Agricultural Products Center (FAPC) at Oklahoma State University. The FAPC business and marketing staff can help you determine various niche marketing opportunities for your products. To learn more about the FAPC, visit our FAPC website.

Figure 3. US GLP-1 Drug Market Forecast, 2024-2035. (source: ResearchAndMarkets.com)

References

Broad, A. (2024, October 29). Smoothie king launches GLP-1 support menu to support health and... Smoothie King. https://www.smoothieking.com/news/smoothie-king-launches-glp-1-support-menu-to-support-health-and-fitness-journeys-to-medication-users

Chychula, A. (January 2024). Better For You Eating Trends – US – 2025. Mintel Group

Ltd. Available with subscription at https://clients.mintel.com/content/report/better-for-you-eating-trends-us-2025.

Emmerich, S.D., C.D. Fryar, B. Stierman, and C.L. Ogden. (2024, September 2024). Obesity

and Severe Obesity Prevalence in Adults: United States, August 2021-August 2023. Center

for Disease Control, National Center for Health Statistics, Data Brief No. 508. Available

online at https://www.cdc.gov/nchs/products/databriefs/db508.htm.

Fernandas, L. (2024, September 23). Consumer outlook: Guide to 2025. NIQ. https://nielseniq.com/global/en/insights/report/2024/mid-year-consumer-outlook-guide-to-2025/

Gwira, J.A., C.D. Fryar, and Q. Gu. (2024, November 2024). Prevalence of Total, Diagnosed,

and Undiagnosed Diabetes in Adults: United States, August 2021-Agust 2023. Center

for Disease Control, National Center for Health Statistics, Data Brief No. 516. Available

online at https://www.cdc.gov/nchs/products/databriefs/db516.htm.

Hristakeva, S., Liaukonyte, J., and Feler, L. (2024). The No-Hunger Games: How GLP-1

medication adoption is changing consumer food purchases. Social Science Research Network.

https://doi.org/10.2139/ssrn.5073929

Lokuwithana, D. (2025, February 22). Lilly, Novo lead as TD Cowen lifts GLP-1 sales

forecast (LLY). Seeking Alpha. https://seekingalpha.com/news/4412203-lilly-novo-lead-td-cowen-lifts-glp-1-sales-forecast

Nunes, K. (2025, February 25). GLP-1s – the perspectives of two CEOS. Food Business

News. https://www.foodbusinessnews.net/articles/27761-glp-1s-the-perspectives-of-two-ceos?utm_source=Food%2BBusiness%2BNews%2BDaily&utm_medium=Newsletter&oly_enc_id=3126E7783601E2X

Snashall, S. (2024, September 17). Taking a GLP-1? here are foods to limit - and what

to prioritize. Ohio State Health and Discovery. https://health.osu.edu/wellness/exercise-and-nutrition/glp1-foods-to-limit

Silver, K. (2024, July 10). “ozempic diet”: Foods to eat and avoid on a GLP-1 obesity

drug. WebMD. https://www.webmd.com/obesity/features/ozempic-diet-foods

Sparks, G., and Montero, A. (2024, May 10). KFF Health Tracking Poll May 2024: The

public’s use and views of GLP-1 Drugs. KFF. https://www.kff.org/health-costs/poll-finding/kff-health-tracking-poll-may-2024-the-publics-use-and-views-of-glp-1-drugs/

Unknown (2024, August). GLP-1 market: Industry trends and global forecasts to 2035:

Distribution by type of molecule, active compound used, type of GLP-1 agonist drugs,

type of agonist, route of administration, Target Indication, geography, leading developers

and sales forecast. Research and Markets - Market Research Reports - Welcome. https://www.researchandmarkets.com/reports/5993044/glp-1-market-industry-trends-global-forecasts

Vital pursuit hits shelves nationwide. Nestlé USA. (2024, September 18). https://www.nestleusa.com/media/pressreleases/vital-pursuit-nationwide-glp-1

Wenzel, R. (2024, December 18). From pharmacy to pantry: How GLP-1 drugs are shifting

consumer preferences and shopping patterns. Wells Fargo. https://www.wellsfargo.com/com/insights/agri-food-intelligence/GLP1-shifting-patterns/#:~:text=From%20the%20center%20of%20the,2