Evaluation of Rainfall-Index Pasture, Rangeland and Forage Crop Insurance Program and Guidelines for Producers

Introduction

The United States Department of Agriculture - Risk Management Agency (USDA – RMA) has overseen the administration of the Rainfall-Index Pasture, Rangeland and Forage (RI-PRF) crop insurance program in Oklahoma since 2011, although it was offered as a pilot program in other states from 2007-2011. RI-PRF seeks to protect producers from losses of perennial pasture, rangeland or forage brought about by the lack of precipitation. Unlike other multi-peril crop insurance products, the RI-PRF does not measure production or loss from too little (or too much) rainfall. Instead, program payments are based on a rainfall index. When rainfall is sufficiently lower than historical rainfall in the coverage area, the insurance policy holder receives an indemnity.

Although Oklahoma has variable rainfall, so producers could potentially benefit from this program, use has been low. Nationally, only 22% of total pasture and rangeland in the U.S. was insured with RI-PRF in 2019. This report provides recommendations for producers who are considering participating in the program, whether for the purposes of reducing the risk of losses associated with low precipitation or for the purpose of increasing farm profit.

Program Details and Coverage Types

The rainfall index used for payment is published by the National Oceanic Atmospheric Administration Climate Prediction Center (NOAA CPC). NOAA CPC’s rainfall index values are based on a grid system, where each grid is 0.25 degrees in latitude by 0.25 degrees in longitude or approximately 17 miles by 17 miles at the equator. The rainfall index is the sole determinant of payments by each grid.

Indemnity payments are based on the difference between historical rainfall and the coverage period rainfall index multiplied by the base values and coverage options chosen when the policy was purchased. Unlike the rainfall index that is specific to a grid, the base values are specific to a county. Each county includes 10 to 15 grids, so a producer may have the same base value for fields covered under multiple rainfall indices.

The RI-PRF crop insurance program offers many options to customize protection:

- Coverage Level (five levels) : 70 %, 75% , 80%, 85% and 90%

- Productivity Factor: 60% to 150% in 1% increments

- Bi-monthly coverage intervals (11 levels) i.e. January-February, February-March and so on out to November-December.

The coverage options above interact to complete the coverage choice. Each index interval included in the coverage choice can have different weights (from 10% to 60% in Oklahoma), and the sum of interval weights must be 100%. At least two, and up to six, intervals may be selected but cannot overlap. For example, January-February and February-March cannot both be selected because of the overlap in February.

In addition, there is a premium subsidy rate that depends on the coverage level. These subsidy rates and coverage levels are: 59% subsidy for 70% and 75% coverage; 55% subsidy for 80% and 85% coverage; and 51% subsidy for 90% coverage. Due to the premium subsidy, over time producers are likely to receive more indemnity payment than they pay in premium (Cho and Brorsen, 2021). For example, during the time period from 2011 to 2017, an Oklahoma producer would have averaged getting back $18 per acre with total premium $20 per acre. Producers averaged paying less than $10 per acre because of the 51% to 59% premium is subsidy.

Evaluation of the Program

In this fact sheet, three issues are considered...

- how well the rainfall index corresponds with actual rainfall (and hay yields),

- the accuracy of county base values for hay in Oklahoma and

- optimal choices for producers.

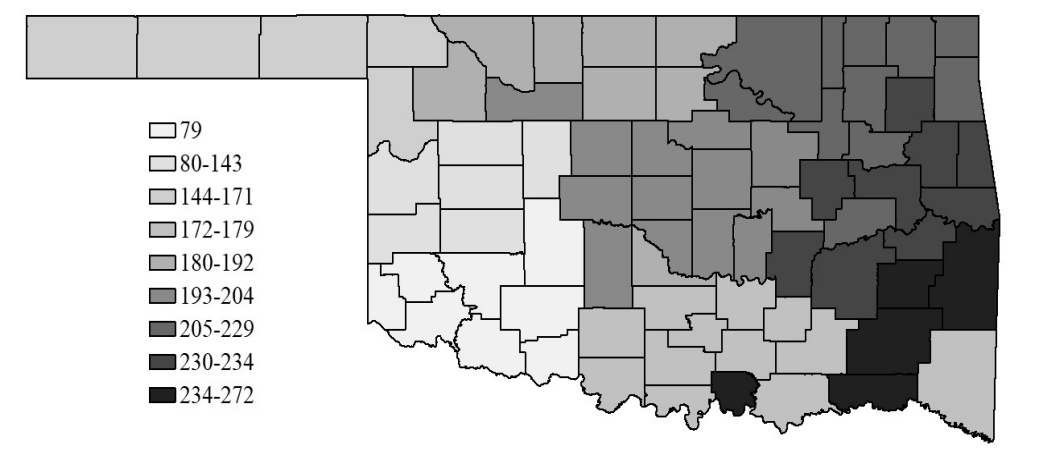

The first question is how well the rainfall index matches up with actual rainfall and hay yields. As shown in Table 1, the average correlation between rainfall index and actual rainfall is 0.95. So, the rainfall index values appear to track actual rainfall. With that said, hay yields are weakly correlated with the rainfall index, so the “rainfall” risk protection provided by this program does not directly translate to “hay yield” risk reduction. The second question is how accurate county base values for hay are in Oklahoma. The county base values in 2018 given by USDA RMA had strong correlation (0.94) with actual hay yields in Oklahoma, even though the 77 counties were aggregated into nine regions (Figure 1).

Figure 1. The Risk Management Agency nine county base values in Oklahoma, 2018

Notes. The county base values of hay production are used as standard hay production

values ($/ac) to calculate indemnities. The Risk Management Agency aggregated Oklahoma’s

77 county base values to nine sectors.

Table 1. The Estimated Pearson Product-Moment Correlations by bi-monthly intervals between rainfall index and the actual rainfall in Oklahoma, 1994-2017.

| Bi-monthly intervals | Correlations |

|---|---|

| January-February | 0.9416 |

| February-March | 0.9417 |

| March-April | 0.9537 |

| April-May | 0.9607 |

| May-June | 0.9534 |

| June-July | 0.9263 |

| July-August | 0.9125 |

| August-September | 0.9040 |

| September-October | 0.9303 |

| October-November | 0.9502 |

| November-December | 0.9541 |

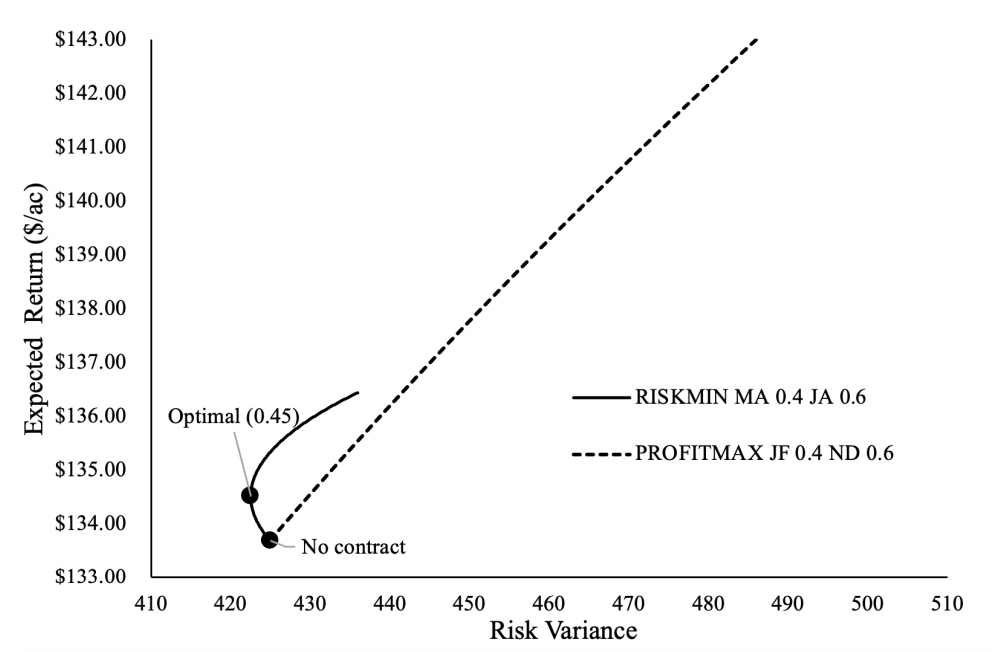

Cho and Brorsen (2021) evaluated optimal choices for Oklahoma producers. Economic analysis considered two different strategies: profit maximization and risk minimization (Figure 2). Recall producers can select coverage level, productivity factor and coverage intervals. The optimal coverage level, whether maximizing profit or minimizing risk, was the 90% coverage level. As shown on Figure 2, when pursuing profit maximization, the 150% productivity factor, January-February (40% weight) and November-December (60% weight) most often resulted in higher income. This is because the rainfall index is more variable in wintertime than summer. However, because average rainfall in Oklahoma is generally lower in these months, choosing winter months for the time interval also results in a higher risk of not receiving an indemnity greater than the premium paid, even though the producer’s expected income is maximized.

On the other hand, the objective of the RI-PRF crop insurance program is to compensate for the loss due to lack of precipitation. So, if a producer wishes to minimize precipitation risk, the optimal selection changes slightly. If the producer selects 90% coverage, a 45% productivity factor, and intervals for spring and summer months (March-April, May-June and July-August), they are more likely to minimize precipitation risk in most counties. The exact months varied considerably by county, but were concentrated in the key growth periods for hay and pasture. When this type of policy was selected, producers could reduce per acre variance by $2.43 as well as increase expected return by $0.82 per acre (Figure 2) as compared to other policy combinations. Even though a 45% of productivity factor is the optimal selection when minimizing risk, the current lowest productivity factor that the RMA offers is 60%. Moreover, when a productivity factor greater than 89% is chosen, risk variance is larger than having no contract. This means that the name “productivity factor” can suggest choosing a high number, but high productivity factors may in some cases be more risky.

The solution to reduce the risk from the lack of precipitation is to choose a 90% coverage level, 60% productivity factor, and choose bi-monthly intervals between March and September. Moreover, a common strategy appears to be to place equal weights on five or six intervals but spreading the weights across only the spring and summer seasons is ecommended.

Figure 2. The results of expected utility optimization problem by two strategies.

Notes. The plots shows the expected return ($/ac) and risk variance change following the

change of productivity factor 0 to 150 from the expected utility optimization. Solid

line represents the results when producer used risk minimization strategy, and dashed

line represents under profit maximization strategy. “No contract” shows the result

when producer does not contract the RI-PRF crop insurance program, and it is same

as when using productivity factor 0. “Optimal” means having a smallest risk variance.

Summary

If your goal is to reduce risk, then

- Choose the 90% coverage level

- Choose the lowest productivity factor allowed (60%)

- Choose bi-monthly intervals during spring and summer (intervals that include months from March to September) If your goal is to take advantage of the subsidies and maximize expected income

- Choose the 90% coverage level

- Choose the highest productivity factor allowed (150%)

- Choose the two (2) bi-monthly intervals for the winter months (November-December and January-February)

These are general conclusions, and a producer may want to consult with their crop insurance agent to help decide what insurance options are right for their operation. Contact an RMA agent to sign up this RI-PRF crop insurance program: the annual sign-up deadline is November 15.

Reference

Cho, W. and B. W. Brorsen. 2021. Design of the Rainfall Index Crop Insurance Program for Pasture, Rangeland and Forage. Journal of Agricultural and Resource Economics. 46(1): 85-100. https://10.22004/ag.econ.303607.

Whoi Cho

Graduate Student

B. Wade Brorsen

Regents Professor and A.J. and Susan Jacques Chair