E-Commerce and Sales Taxes: What You Collect Depends on Where You Ship

More and more small businesses have figured it out: the Internet is a valuable tool. A 2007 study by the Pew Internet and American Life Project found that 81 percent of Internet users have done research about a product they are thinking about buying online, and a full 66 percent have purchased a product online. Further, online sales (otherwise known as e-commerce) have been rising for the past decade. Figure 1 shows the percentage of total retail sales comprised by e-commerce has consistently increased between 2000 and 2009.

Many small businesses and entrepreneurs in Oklahoma have taken advantage of these trends and are actively building websites and selling items online. However, one item that continually causes concern or frustration is the charging and reporting of sales tax when items are sold online. When do you have to charge it? How much do you have to charge? What about selling out-of-state? This fact sheet will attempt to clarify these issues and provide online sellers with an easy-to-use guide for figuring out their sales tax requirements.

Figure 1. U.S. Retail E-commerce Sales as a Percent of Total Retail Sales, 2000 – 2009.

Source: U.S. Census Bureau.

The Basics

Sales tax is basically a tax charged by the government (either federal, state, or local) at the point of purchase for certain goods and services. Generally, these taxes are collected by the seller who then pays the tax to the government charging the tax. For on-line sellers, sales tax becomes more complicated because the nature of e-commerce allows inter-state and international sales to become relatively common.

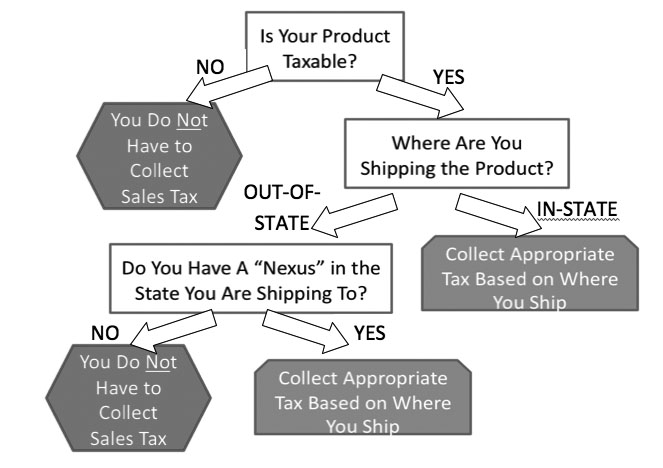

For most small businesses, the issue of how much sales tax to charge for an online purchase can be broken down into the following issues:

-

Is your product taxable?

-

Do you have a presence (or “nexus”) in the state where you will be shipping the product?

-

If the product is shipped to a state where you have a presence, what is the appropriate sales tax rate to charge?

Figure 2 presents a flow chart for determining whether or not you need to charge sales tax for your online sale.

Figure 2. E-Commerce Sales Tax Flow Chart.

Is Your Product Taxable?

The Oklahoma Tax Commission indicates that all tangible goods sold within the state are subject to sales tax. Thus, any actual good sold online (jewelry, clothing, steel) is considered a taxable product. Services (lawn-care, pet grooming, website maintenance) vary in terms of being taxable – check with the tax commission to determine whether or not the service you provide is taxable.

Where Are You Shipping the Product?

If you are shipping the product within the state of Oklahoma, you will need to collect and remit sales tax on that sale. This tax will vary based on where the product is shipped. The Oklahoma Tax Commission publishes county and city sales tax rates online each quarter, and also offers an online tool to assist in determination of the appropriate tax to collect and remit. This material is available at: http://www.tax.ok.gov/ratechts.html. The total tax you collect should be based on the state, county and city sales tax rates of the location where the product is delivered.

If you are shipping the product outside the state of Oklahoma, payment of sales tax depends on whether or not you have a presence, or “nexus,” in the state to which you are shipping.

Do You Have a "Nexus" in the State to Which You Are Shipping?

If you have a general presence or link to the state you ship to, then you will generally have to pay sales tax in that state. Some examples of items that may create a nexus or link include:

- Maintaining facilities (warehouse, office space, other physical presence) in that state.

- Maintaining a sales relationship with a company that has a physical presence in that state (for example, selling your product both online and through distributors in that state, or allowing customers to return products to those distributors’ locations).

- Having an employee in that state.

- Having a sales person travel to that state.

- Doing trade shows in that state.

- Substantial advertising in that state.

If none of these items pertain to your business, you are generally exempt from collecting sales tax for those sales.

If, however, you do have a “nexus” in the state to which you are shipping, you must collect and remit sales tax to the state in question. The appropriate rate to collect will be based on the state, county and municipality rates of the delivery location.

Examples:

- Joe sells custom watches that he builds himself in the town ofPoteau, OK. Two recent

purchases in his online store demonstrate the different rates that he must collect

when selling in-state:

- Buyer 1 is located in Tulsa, OK. When Joe sells this watch, he should collect sales tax equal to the state rate (4.5%) + the Tulsa County rate (1.017%) + the Tulsa city rate (3.0%) = 8.517%.

- Buyer 2 is located in Guymon, OK. When Joe sells this watch, he should collect sales

tax equal to the state rate (4.5%) + the Texas County rate (1.0%) + the Guymon city

rate (4.0%) = 9.5%.

(Tax rates taken from Oklahoma Tax Commission and are current as of January 2010)

- Melissa sells handmade purses from her store inWaurika, OK. She has two out-of-state

purchases from her online store that show how the definition of “nexus” is important:

- Buyer 1 is located in Dallas, TX, where Melissa regularly participates in trade shows.

Since she has a “nexus” in Texas, she should collect and remit the appropriate sales

tax to the Texas Comptroller. TX state rate (6.25%) + Dallas County rate (1%) + Dallas

city rate (1.0%) = 8.25%. Note: in some states this is defined as a “use” tax.

(Tax rates taken from Texas Comptroller and are current as of January 2010) - Buyer 2 is located in Ft. Smith, AR. Melissa does not have any presence in Arkansas, so she is not responsible for collecting and remitting sales tax to that state.

- Buyer 1 is located in Dallas, TX, where Melissa regularly participates in trade shows.

Since she has a “nexus” in Texas, she should collect and remit the appropriate sales

tax to the Texas Comptroller. TX state rate (6.25%) + Dallas County rate (1%) + Dallas

city rate (1.0%) = 8.25%. Note: in some states this is defined as a “use” tax.

In both of the out-of-state cases above, Melissa does not have to collect any Oklahoma sales tax since the delivery takes place outside of the state.

Summary

Sales tax can be a complicated issue for many small businesses, and the dramatic rise in e-commerce only serves to make the issue more complex. In general, for businesses based in Oklahoma, the amount of sales tax collected is dependent on where the item is shipped. Different sales tax rates are quite common when shipping to different locations in state. Some small businesses handle each of these transactions individually; others turn to software packages to calculate the appropriate tax based on a customer’s shipping address. When shipping out of state, sales (or “use”) tax needs to be collected and remitted to that state if your business has a presence or “nexus” within that state.

Make sure to contact a knowledgeable tax lawyer or the appropriate state tax commission if unsure about whether or not you should be collecting sales tax. State tax laws are constantly changing and will likely continue to do so as e-commerce becomes an even bigger player in the future.

Contact:

Brian Whitacre, Ph.D.

Assistant Professor and Extension Economist

Oklahoma Cooperative Extension Service

504 Ag Hall

Oklahoma State University, Stillwater, OK

(405) 744-9825

www.agecon.okstate.edu/broadband

References/Additional Reading

Oklahoma Tax Commission Sales and Use Tax Rate Locator: http://www.oktax.onenet.net/pod/index.htm

Safeselling.org: Do I need to Collect and Remit Sales and Use Taxes? http://safeselling.org/taxes.shtml

Combs, S. (2009) “Guidelines for Collecting Local Sales and Use Tax.” Fact sheet for Texas Comptroller of Public Accounts.

Quill Corporation v. North Dakota, 504 U.S. 298 (1992).

National Bellas Hess, Inc. v. Department of Revenue of Illinois, 386 U.S. 753 (1967)

Borders Online, LLC v. State Board of Equalization, 29 Cal. Reptr. 3d 176 (Cal Ct. App. 2005).

Baudier, Walter J. “Internet Sales Taxes from Borders to Amazon: How Long before All of Your Purchases are Taxed?” 2006 Duke L. & Tech. Rev. 5

Ess, Eric A. “Internet Taxation without Physical Representation? States Seek Solution to Stop E-Commerce Sales Tax Shortfall.” 50 St. Louis L.J. 893 (2006).

Brian Whitacre

Assistant Professor and Extension Economist

Shannon Ferrell

Assistant Professor

J.C. Hobbs

Extension Specialist – Tax Education