Cooperative Equity Management Systems

- Jump To:

- Equity Redemption Systems

- Age of Stock (revolving fund)

- Percentage of all Equities

- Age of Member

- Age of Member-Pro Rata Pool

- Base Capital

- Nonsystematic Methods

- Proportionality of Alternative Equity Management Systems

- Alternatives to Redemption

- Redemption at a Discounted Rate

- Conversion to Preferred Stock

- Exchange of Equity among Members

Equity redemption is the process of returning cash to members who had been previously issued equity patronage. Equity redemption is unique to cooperatives. Because cooperatives distribute profits in proportion to use, there is no direct rationale for holding equity. Therefore, there is no market for cooperative equity. Because cooperative equity typically has no market value, the cooperative must establish a system to eventually redeem the equity for cash. It is only through equity redemption that the member realizes any benefit from the patronage distributed as equity. Due to the time value of money the member’s return is increased when the cooperative revolves equity more rapidly.

The process of equity redemption, or equity management, is important to keep the member’s investment proportional to their use of the cooperative. If a cooperative fails to revolve equity, or has a long equity revolving period, many older members may have high equity balances but have slowed or discontinued use of the cooperative. Or, younger members may be using the cooperative but have relatively little equity, hence be underinvested. Ideally, a cooperative board would like to manage equity so that equity investment is roughly proportional to use.

Equity Redemption Systems

Equity redemption is important to maintain the member’s return from the cooperative, to help keep equity in proportion to use and to eliminate unpredictable outflows to estates. It also reduces the cooperative’s cash flow and reduces equity, which increases its debt-to-equity ratio. Equity redemption is a complex balancing act for the cooperative board of directors. An equity redemption system is an established plan for redeeming equity. Most cooperatives have systematic systems which include age of stock, age of patron, percentage of all equities and base capital. The cooperative can also have a nonsystematic program such as having members petition for equity redemption in the case of hardship. Estate settlements also are often categorized as a non-systematic program.

Factors Affecting the Choice of Equity Redemption Systems

Cooperative boards consider a number of factors when selecting an equity redemption system.

- They would like the system to be fair to members. In general, that means the system keeps equity investment proportional to the use of the capital.

- It should encourage members to contribute equity or at least support the structures which create equity.

- The cooperative needs to consider if it has the cash flow to support the plan.

- Local cooperatives would like the equity management system to be compatible with that of the federated cooperative.

- The cooperative would like the system to meet the requirements of the lenders.

Age of Stock (revolving fund)

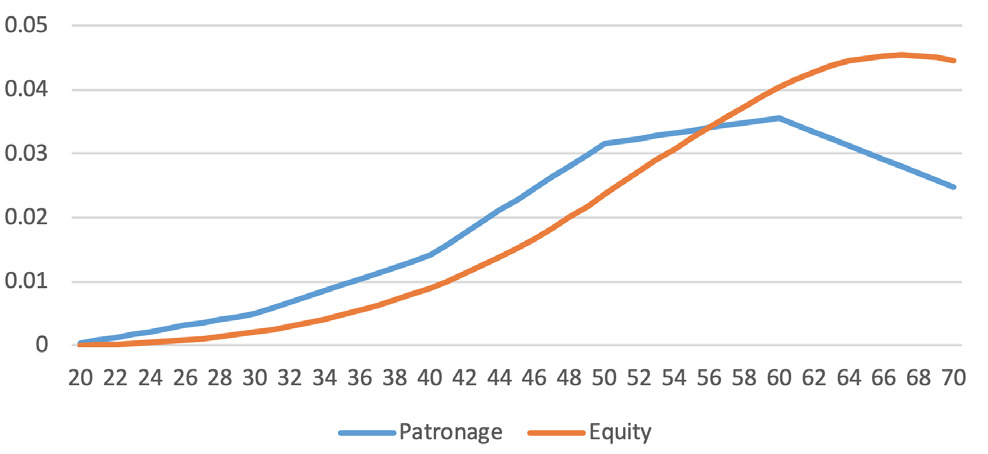

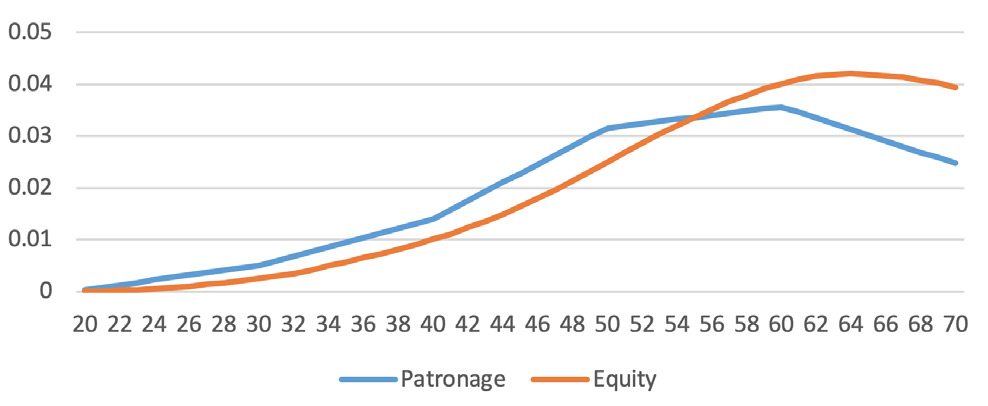

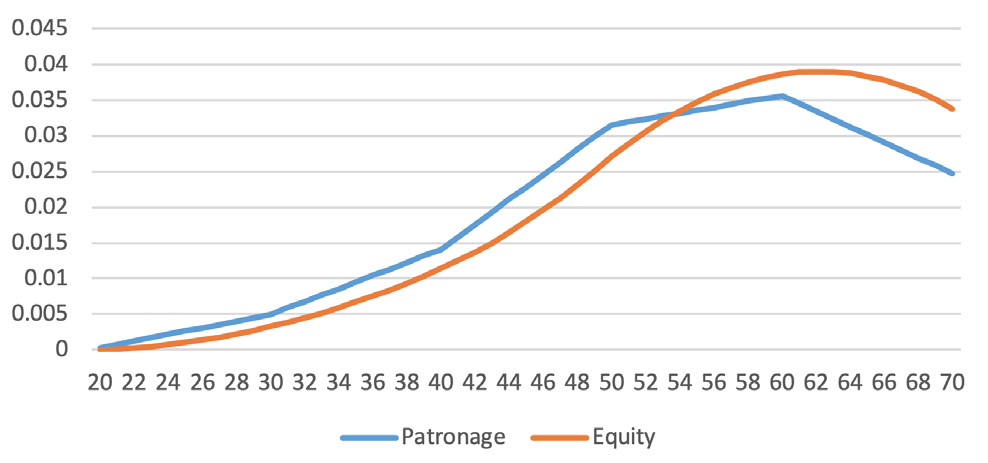

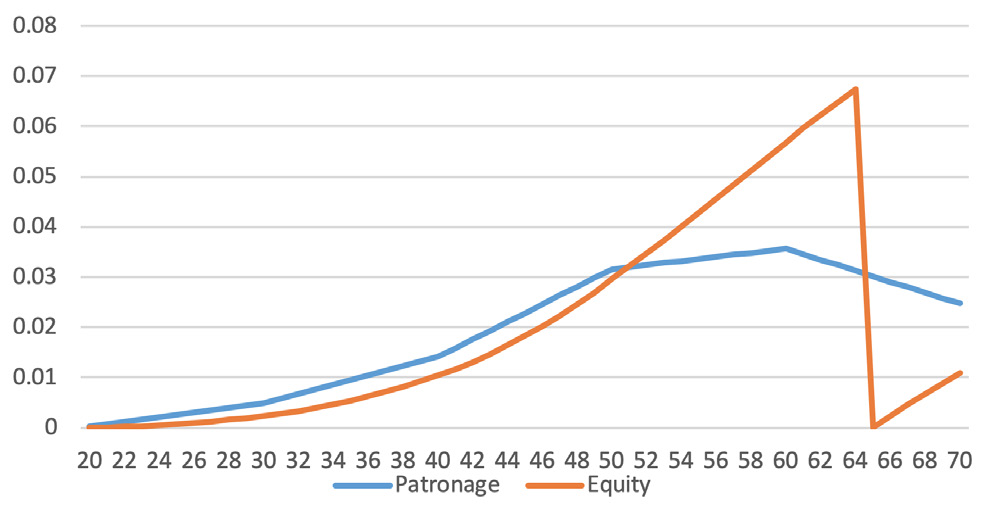

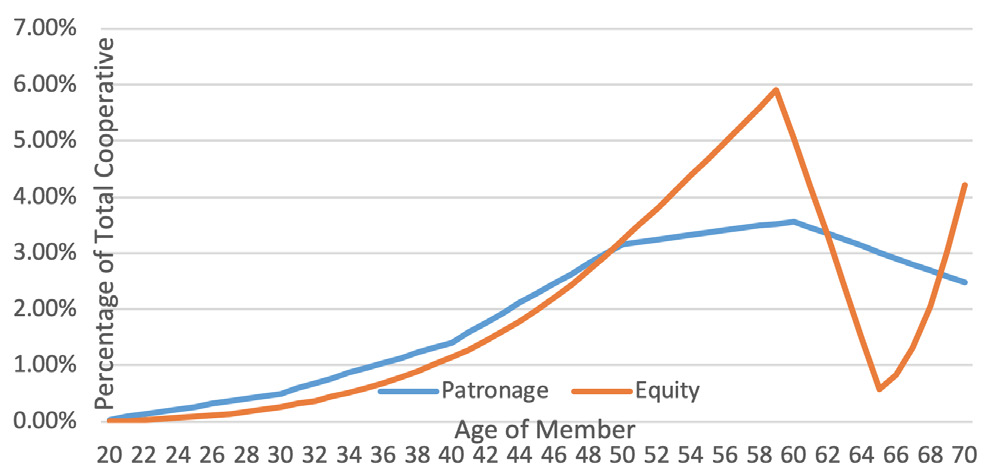

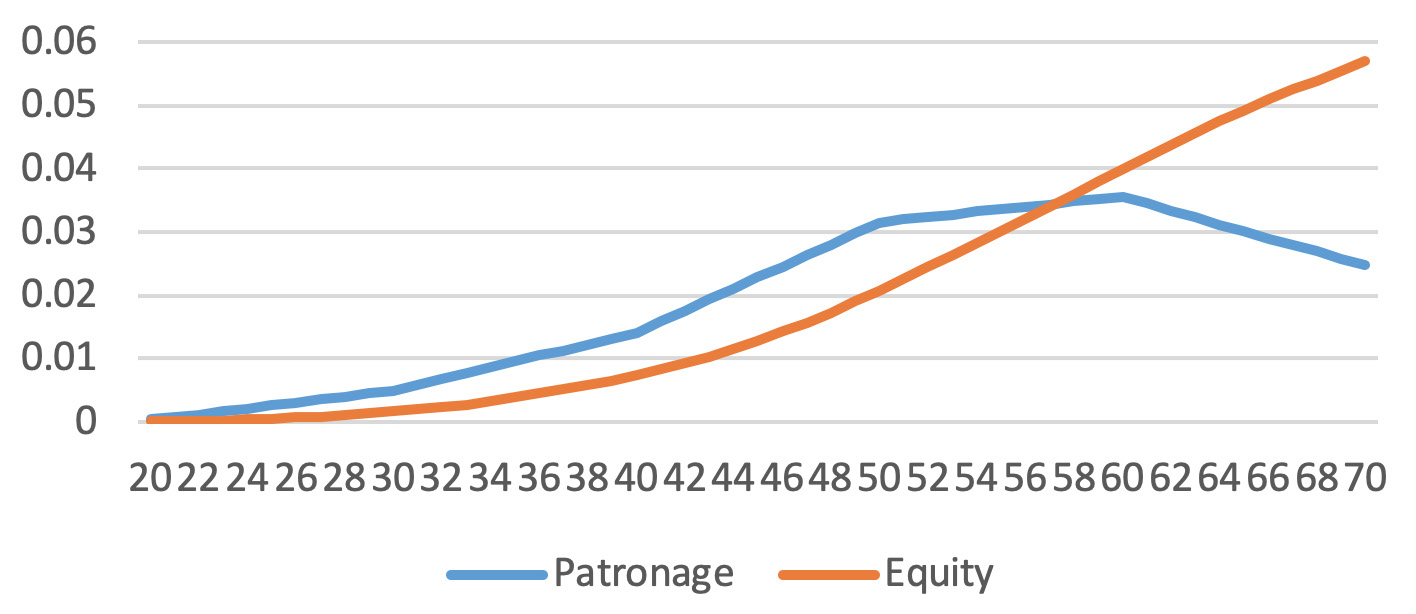

Under an age of stock plan, also called a revolving fund, the cooperative redeems the oldest equity on a first in, first out basis. For example, if the cooperative was on a 10-year age of stock plan, it would redeem the equity that it issued in 2009 in the year 2019. Cooperatives using an age of stock plan can attempt to maintain a fixed revolving schedule or can accelerate or slow the cycle according to the financial condition of the cooperatives. Cooperatives can also revolve part of a year or multiple years. For example, if the cooperative was very profitable in 2009 and issued a large amount of stock patronage, they might have to revolve that year over a 2-or 3-year period. At other times, they might have the funds to revolve two or three previous years in a single year. The operation of an age of stock system is shown in Table 1. The proportionality (relational ship between patronage to equity investment over the lifetime of a member) depends on the length of the revolving period. The age of stock system becomes more proportional as the revolving period decreases(Figures 1 to 3).

Table 1. Age of Stock (revolving fund) Plan.

| Year | Beginning equity | Patronage refund retained | Amount redeemed | Years redeemed |

|---|---|---|---|---|

| 1 | $0 | $500 | $0 | |

| 2 | $500 | $500 | $0 | |

| 3 | $1,000 | $500 | $0 | |

| 4 | $1,500 | $500 | $500 | 1 |

| 5 | $1,500 | $1,000 | $1,000 | 2 and 3 |

| 6 | $1,500 | $500 | $500 | 4 |

Figure 1. Patronage versus equity, 20-year revolving.

Figure 2. Patronage versus equity, 15-year revolving.

Figure 3. Patronage versus equity, 10-year revolving.

Percentage of all Equities

Under the percentage of all equity system, the cooperative redeems a percentage of every patron’s equity balance each year. The board would establish the percentage based on the financial condition and balance sheet goals for the cooperative. For example, the cooperative might consider how much new equity was created through equity patronage and establish a percentage to redeem such that the total equity in the cooperative remained constant. The percentage of all equities program rewards new members because every member with an equity balance receives some redemption. One disadvantage with the percentage of all equities system is that it delays the time for a new, underinvested member to build equity. For that reason, the percentage of all equities system does a poor job of keeping equity investment in proportion with patronage. The mechanics of the percentage of all equities system is shown in Table 2, while the proportionality is illustrated in Figure 4.

Table 2. Percentage of all equities program.

| Beginning Equity | $2,000 |

|---|---|

| Retained Patronage | $500 |

| Equity Available | $2,500 |

| Target level of Equity | $2,300 |

| Equity to be Redeemed (2,500 to 2,300) | $200 |

| Redemption Percentage (200/2,000) | 10% |

Figure 4. Patronage versus equity, 5 percent of all equity revolved each year.

Age of Member

Under an age of member system, the member has all of their revolving equity redeemed when they reach the specified age. Many agricultural cooperatives were formed in the 1930s and 1940s. Their memberships tended to be young farmers who saw the need for the cooperative and were content to build equity to fund the cooperative’s growth. The concept that the equity would be redeemed when they reached a retirement age was acceptable. Now that those cooperatives have matured, many of them struggle with the cash flow and equity implications of their age of patron systems. A high percentage of their memberships are now nearing the redemption age, creating challenges in meeting the redemption cash flows. Members also often come to expect redemption at a specified age to be a right or a contractual obligation of the cooperative. That makes it very difficult for the board to adjust the trigger age to manage redemptions within a specified budget. Under an age of member system, members are often underinvested after they reach the trigger age. The proportionality of the age of member system is illustrated in Figure 5.

Figure 5. Patronage versus equity, age 65 revolve.

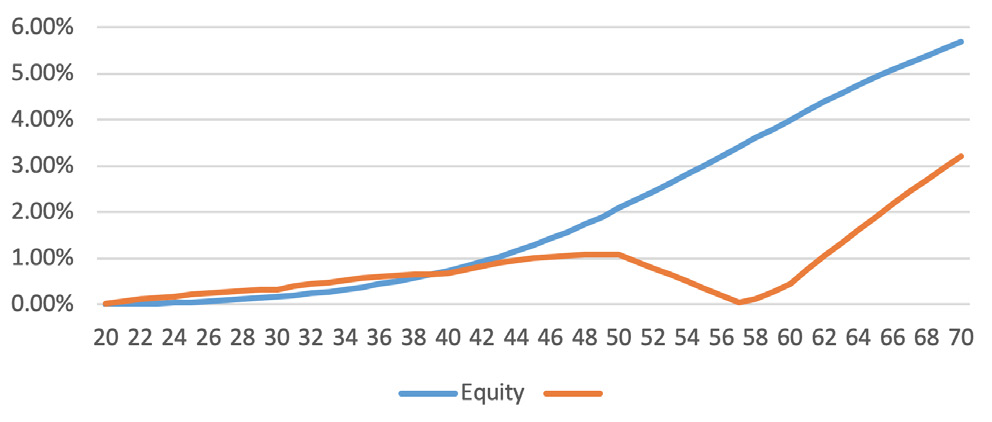

Age of Member-Pro Rata Pool

An age of patron system can be modified by giving patrons a percentage of their equity balance for a given number of years after they reach a trigger age. For example, an age 60, five-year pool system might give patrons 20 percent of their age 60 equity balance during the next five years. The additional equity earned during each year of the withdrawal period is typically revolved in the subsequent year. An age of member pool system is generally somewhat more proportional relative to an age of patron system, since equity redemption can start at a younger age. Also, the annual redemption budget is less impacted by a member with a high equity balance reaching the trigger age. The proportionality of the age 60, five-year pool system is illustrated in Figure 6.

Figure 6. Patronage versus equity, age 60, five-year pool.

Base Capital

The base capital system is conceptually very simple, but can be complex to implement. Under the base capital system, the patron’s percentage of the total equity in the cooperative is matched with the patron’s percentage of the cooperative’s business volume. The base capital system is the best system for keeping equity investment in proportion to use. The mechanics of a “pure” base capital system is shown in Table 3. A base capital system is not attractive to new members since they would have to make an immediate investment to bring their equity balance up to the required level. A beginning farmer may not have the funds to invest the equity required under a base capital system.

Table 3. Base capital plan.

| Member | Beginning equity | Patronage (5-year average) |

Share of business | Equity Obligation | Redemption or payment |

|---|---|---|---|---|---|

| A | $1,685 (9.2%) | $120,208 | 11% | $2,035 | -$350 |

| B | $3,345 (18.3%) | $207,631 | 19% | $3,515 | -$170 |

| C | $2,805 (15.4%) | $152,991 | 14% | $2,590 | +$215 |

| D | $5,515 (30.2%) | $327,839 | 30% | $5,550 | -$35 |

| E | $4,550 (24.9%) | $284,127 | 26% | $4,810 | -$260 |

| F | $350 (0%) | — | — | 0 | 0 |

| TOTAL | $18,250 | $1,092,796 | 100% | $18,250 | $0 |

In practice, many cooperatives using base capital do not require an underinvested member to make a direct investment, but instead eliminate their cash patronage until they build the required equity level. Because those cooperatives do not instantaneously receive equity from underinvested members, they also cannot instantaneously redeem the equity of overinvested members. Cooperatives using a base capital system also may calculate the patronage and equity balances on a multi-year moving average. Because of those factors, the implemented base capital system may not keep equity in exact proportion to use, but rather continually adjusts equity balances adjusting towards that level. The proportionality of a base capital system using a three-year moving average is illustrated in Figure 7.

Figure 7. Patronage versus equity base capital, three-year moving average.

Nonsystematic Methods

A nonsystematic plan, also called a specialized plan, is one where equity is redeemed only if a special situation occurs. One special situation is the death of the member. Less frequent situations would be when the member moves away or is in a hardship situation. Aside from estate settlements, which are often required by statute, cooperative boards consider special situations on a case-by-case basis. Relying on a nonsystematic system would have a low financial burden for the cooperative. However, they provide a poor financial return to members and result in unpredictable cash outflows. They also do a poor job of keeping equity in proportion to use. Nonsystematic or specialized systems generally do not meet any of the goals of a desirable equity management system.

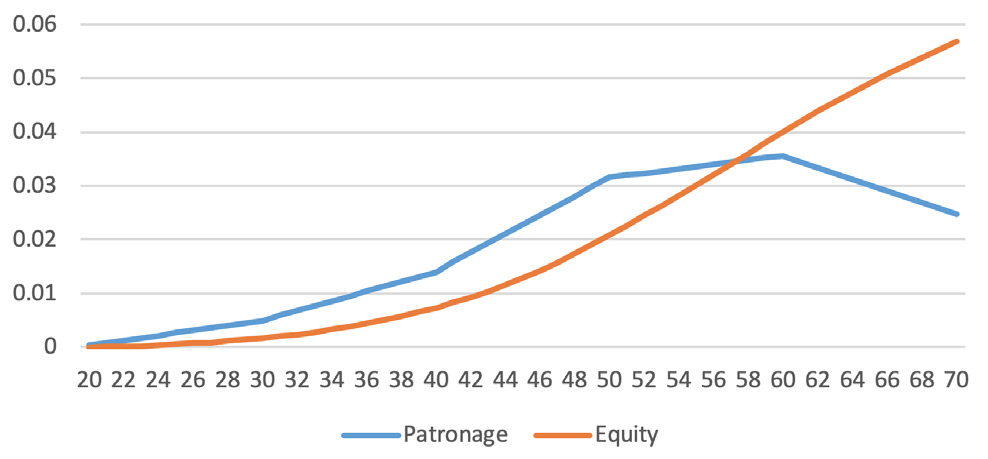

They tend to occur as the end result of not implementing a systematic program. The proportionality of an “Estates Only” equity management system is illustrated in Figure 8.

Figure 8. Patronage versus equity, no revolving or estates only.

Proportionality of Alternative Equity Management Systems

As discussed earlier, one important goal of equity management is to keep the member’s share of the cooperative’s total equity investment in proportion to their share of the cooperative’s total patronage. That ensures that the members who are using the cooperative are financing the cooperative in a similar proportion. The proportionality of the alternative equity management systems are summarized in Table 4. Age of stock systems are reasonably proportional and become much more proportional as the revolving period decreases. The age of patron age 65 example is actually less proportional than an estates only program. Under an age of member system, the members become overinvested prior to the trigger age, but often is underinvested as they continue to do business with the cooperative past that age. The age of patron pro rata pool is generally more proportional relative to that age of patron because it begins to redeem some equity to overinvested members at an earlier age. The percentage of all equities system is also no more proportional relative to the estates only system, since it delays the time at which the member becomes adequately invested and returns equity to overinvested members at a very slow rate. As expected by its design, the base capital system even using a three-year moving average is extremely proportional.

Table 4. Proportionality rating of alternative systems.*

| No revolving system | 0.42 |

|---|---|

| Age of Stock 20 | 0.32 |

| Age of Stock 15 | 0.26 |

| Age of Stock 10 | 0.18 |

| 5% of All Equity Each Year | 0.42 |

| Age 65 | 0.46 |

| Age 60 to 65 Pool | 0.33 |

| Base Capital | 0.05 |

*sum of absolute differences

Alternatives to Redemption

While redeeming revolving equity is the method by which a member receives value for their stock patronage, it does create management challenges for the cooperative board. It also is difficult to design an equity management program that is attractive to the members and meets the cooperative’s needs for financial stability. Cooperatives have experimented with alternatives to equity redemption.

Redemption at a Discounted Rate

Under certain circumstances, some cooperatives have redeemed a member’s equity before they would have otherwise received a payment but redeemed the equity at a discounted rate. In essence, they paid the member the present value of the equity and not the future value. One situation for discounted redemption would be when a member of a cooperative with an age of stock program dies. In that case, the estate could wait and receive the equity over a number of years as each year of stock becomes eligible. In order to close the estate, the executor may ask if the cooperative could pay the future redemption payments immediately but at a discounted rate to reflect the time value of money. If the equity balance is not large, the cooperative may be interested in complying in order to simplify recordkeeping. Establishing a fair discount rate for discounted redemptions can be difficult and some members do not understand the concept of the time value of money and may consider the payment unfair. Most cooperatives describe the face value of the retained patronage as a benefit flowing to the member. Therefore, they are reluctant to discuss the present value of the revolving equity since it would be perceived as diminishing the value of stock patronage. A cooperative that was implementing discounting would obviously want to carefully specify the procedures and limitations in the bylaws or policies since it would not have the funds to retire everyone's equity.

Conversion to Preferred Stock

One alternative to redemption is to convert the equity to a dividend-paying preferred stock. That reduces the cooperative’s immediate cash outflow and the member may be content to hold the equity since they receive dividend payments. Unless the dividends can be paid with non-member profits, the cooperative is reducing patronage based profit distribution to distribute a portion of profits to the preferred stock holders. The cooperative must also establish some system to eventually redeem the preferred stock or allow it to be sold to another member. Otherwise, they will eventually have to redeem the equity as an estate settlement.

Exchange of Equity among Members

Closed membership cooperatives often allow members to sell their equity an associated usage rights to another eligible producer. The price for the equity is negotiated between buyer and seller. Under that structure, the value for the equity and usage rights is determined by the anticipated amount of future patronage. Therefore, it tracks the profitability of the cooperative. The possibility of exchange between members creates the potential for cooperative equity to appreciate in value. It also increases its liquidity since a member may have the opportunity to sell it at any time. Of course, by selling the equity, the member loses the right to use the cooperative. Also, since the exchange is limited to other qualifying members, the market for the equity might be thin and not result in a fair price.

A few open membership cooperatives have experimented with equity exchange between members. Similar to the concept of discounting, a member who desires immediate redemption could sell his equity to another member at a privately negotiated discounted rate. Again, another problem is that the market for the equity is thin. The member purchasing the equity also bears the risk that the cooperative expands the revolving period or writes down the value of the equity due to a loss.

Table 5. Comparison of alternative equity management systems.

| System | Advantages | Disadvantages |

|---|---|---|

| Age of Stock (revolving fund) |

Easy to understand, moderately proportional if revolving period is short, easy to match to the budget by extending or shortening the revolving period. | Members place low value on equity and proportionality is low if revolving period is long. |

| Percentage of all Equities | Rewards new members, easy to understand. | New members are already underinvested and percentage redemptions expand the time period

for them to become adequately invested. |

| Base Capital | Most proportion, only method that forces underinvested members to contribute additional capital. | Difficult to explain and complex to implement, new members may be unable to meet equity obligations. |

| Age of Member | Seemed logical when new cooperatives were being formed and all members were young and a similar age, Some cooperatives sell the concept as retirement income. | Not attractive to young producers, difficult to manage within a redemption budget, ranks poorly in keeping equity proportional to use. |

| Age of Member Pro Rata Pool |

May allow members to receive some redemption at a younger age. More proportional relative to Age of Patron. Spreads the redemption of a single large patron over multiple years. | Still difficult to manage within a redemption budget. Somewhat complex to administer. |

Phil Kenkel

Regents Professor and Bill Fitzwater Cooperative Chair