Cow-Calf Corner | January 19, 2026

Beef Exports Update

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

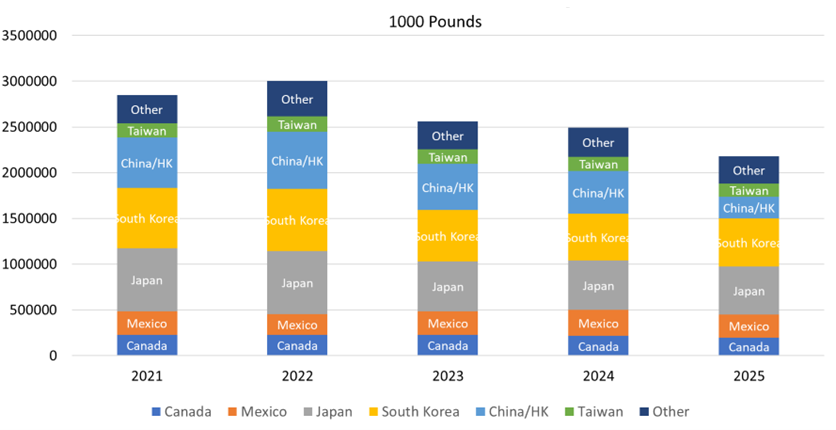

Beef exports were down 12.6 percent year over year through the first ten months of 2025 (Figure 1). This follows decreases in 2023 and 2024 from record beef exports in 2022. Decreased beef exports were anticipated in the current environment of decreased beef production and record high beef prices in the U.S. Beef exports were additionally impacted negatively in 2025 by tariffs and trade wars.

South Korea and Japan were the two largest beef export markets through October. South Korea was up 3.0 percent year over year while Japan was down 3.3 percent compared to the same period in 2024. South Korea gained market share to exceed Japan fractionally by October. Both markets had a market share of 24.1 percent for the year to date. Beef exports to Mexico were down 11.8 percent year over year through October. Mexico is the number three market in 2025, with an 11.5 percent share of beef exports, up from fourth place a year earlier. For the January-October period, beef exports to number five Canada were down 7.4 percent, with Canada having a 9.1 percent share of total beef exports. Taiwan was the number six market with a ten-month export total down 10.6 percent year over year and a 6.5 percent share of beef exports.

Figure 1. Beef Exports, January-October

The combined export market of China/Hong Kong was the most impacted in 2025, dropping from third to fourth place with total exports through October down 48.9 percent year over year (Figure 1). For the year to date, China/Hong Kong had a 10.9 percent share of total exports, down from 18.7 percent share in 2024.

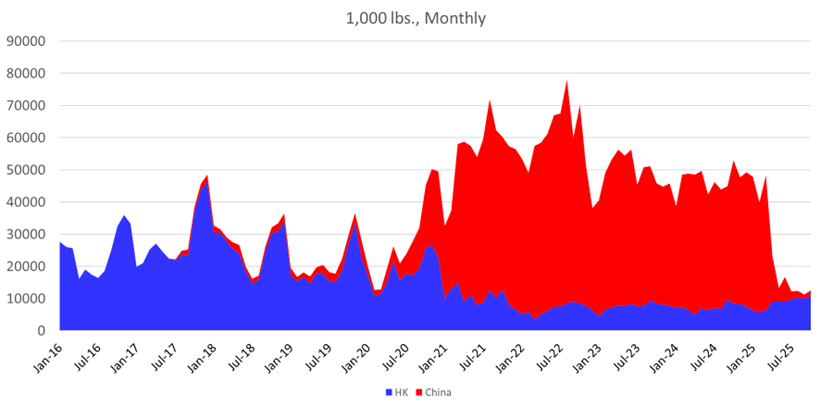

China and Hong Kong are, in many ways, a single market, which is why beef export data for China and Hong Kong are frequently combined. However, there are some important differences that impacted beef exports in 2025. Figure 2 shows the history of beef exports to China and Hong Kong in recent years. Prior to official U.S. access to China in 2017, Hong Kong was a major beef export market. In 2016, Hong Kong was the number four export market with an 11.5 percent share of total beef exports. It was widely recognized that a significant portion of beef exports to Hong Kong were transshipped into China. Starting in 2020, as beef exports to China were officially possible and recognized, beef exports to Hong Kong decreased as expected. Hong Kong’s share of total exports to China/Hong Kong decreased from 100 percent in 2016 to 14 percent in the 2022-2024 period.

Figure 2. Beef Exports to China/Hong Kong

The distinction between the two markets became important again in 2025. In response to U.S. tariffs, retaliatory tariffs imposed by China essentially closed China as an export destination starting in April. In October, China represented 0.7 percent of beef exports and year to date exports to China alone were down 96.8 percent year over year. However, Hong Kong did not impose the same retaliatory tariffs as China so beef exports to Hong Kong have increased year over year, and Hong Kong once again represents more than 88 percent of total beef exports to China/Hong Kong (Figure 2).

Beef exports are expected to decline further in 2026 as the impacts of declining U.S. beef production, high beef prices and continued political wrangling are felt. The impact of declining beef exports has been largely masked relative to record domestic cattle and beef prices and has not received a great deal of attention in the industry. However, decreased beef exports and lost international market share may impact cattle and beef markets for many years going forward.

Robust Beef Cattle Commerce

Mark Z. Johnson, Oklahoma State University Extension Beef Cattle Breeding Specialist

The sale and price of beef cattle (both purebred seedstock and commercial), of all classes and age has been healthy, resilient and vigorous to kick of the new year. Consider the following:

- The National Angus Bull sale held during the Cattlemen’s Congress in Oklahoma City included 28 registered Angus bulls that sold at an average value of $22,276. Furthermore, EACH sale held during the Congress saw increased sale averages and/or total gross. Sales held during the Cattlemen’s Congress generated over $14 million in revenue.

- Included in that Congress total is the commercial female sale which included two year old pairs selling at an average of $5,350. Three year old cows, due to calve this spring averaging $4,500 and spring calving bred heifers averaging $4,261 per head. Seventy two head of open replacement heifers averaged $3,241/head.

- Last week, Northern Video livestock Auction included a group of 200 head of commercial Angus replacement heifers, weighing 810 pounds, with genetic merit scorecard information which sold for $411/cwt for an average of $3,329 per head.

- The Oklahoma weekly market reports for the first two weeks of 2026 indicates steady to increasing prices of calves and feeder cattle.

- Prices of Boxed Beef and Fed Cattle are firm as supplies remain tight even relative to the reduction in packing plant capacity.

Consumer demand for beef remains strong and beef carcass quality remains at an all-time high with beef consistently delivering a satisfying eating experience to consumers. In regard to the price of retail beef, (specifically, if there is a price point at which we meet consumer resistance), consider the following:

- Since 1980, the price of beef has increased 355%

- In comparison, during that same time, the price of Diesel fuel has increased 391%. Coca-Cola has increased 536%, Doritos 500% and the price coffee has increased 775%. The price of a John Deere tractor has increased almost 1,200% since 1980.

Winter is Finally Coming

Paul Beck, Oklahoma State University State Extension Beef Cattle Nutrition Specialist

We have had a great winter so far, with dry but warm weather making it easy for our cows out in the elements, but a winter storm is predicted in Oklahoma later this week. Cows need to get adjusted to cold temperatures over time and grow a thick winter haircoat to be acclimated before winter storms arrive, or they will suffer from cold stress and require extra care. Body condition of cows and their hair coat can play a large part in their tolerance to colder conditions. What do we need to do to get through this week’s arctic blast?

Consider the Cow

Cows in good body condition, those with body condition scores of 5 to 6, with good thick winter hair coats have a lower critical temperature around 32° Fahrenheit. Thin cows with thin hair coat are at more risk to cold stress with lower critical temperatures of around 40° F, while cows with wet haircoat have lower critical temperature of 59° F. For each degree below the lower critical temperature energy requirements increase by 1%. With wind chills down to expected to get below 0° F, maintenance energy requirements will increase by up to 30 to 40%.

How Much More Feed?

Let’s use a 1,200-pound cow in good body condition that needs 2 pounds of supplemental 20% range cubes to meet her requirements in normal conditions as an example. When temperatures get down to 20°F her requirements increase by 12%, to meet the shortfall in energy she will require 3 pounds of additional cubes per day for a total of 5 pounds of cubes per day.

If we consider a thin cow with a thin hair coat, it gets to be more critical. She is already needing to gain body condition to increase her chances of rebreeding for the next calf crop so we should already be feeding around 4 pounds of cubes a day. Her lower critical temperature is 40° F so, when temperatures fall to 20°F her requirements increase by 20%. We will need to provide 7 additional pounds of supplement for a total of 11 pounds of supplemental feed daily. Feeding this much supplement is expensive and hard to manage.

Water is Still Important

Northwest Area Livestock Specialist Dana Zook summarized the water needs for cows during cold weather in a previous article. Feed intake is tied to water consumption. Access to clean fresh water is always essential. Water is essential to feed digestion. Limiting water decreases passage rate of feeds which will in turn compromise feed intake, making it very hard for cows to maintain weight. Another factor that affects water needs is the stage of production. The need for water increases with the demands of production. For example, lactating cows require more water than dry pregnant cows. Dehydration is an added stress and cows deal with winter stress better when we ensure they have adequate water.

Other Considerations

This week's arctic blast can create significant dangers for animal health and production. OSU Extension cold-weather recommendations include:

- Make sure cattle have access to as much hay as they want to eat. Ruminal fermentation helps keep the animals warm.

- If increasing concentrate supplementation rates to help offset energy deficiencies it is best to provide feed concentrate supplements every day.

- Provide a windbreak to lower the animal’s cold stress.

- Unrolling low-quality hay as bedding will provide some relief from the extreme temperatures.

Paul Beck discusses management of cattle in cold weather on SunUpTV from February 6, 2021 and February 20, 2021

Oklahoma Beef Cattle Summit

Erin Hubbard and Brian Freking, OSU Cooperative Extension Service

Cattle producers seeking ways to better manage their operations in ever more challenging business conditions should register now to attend the Oklahoma Beef Cattle Summit in Ada on March 24th.

The summit will take place at the Pontotoc County Agri-Plex Convention Center, located at 1700 North Broadway in Ada, Oklahoma. Registration is $20 per participant, which covers the cost of summit materials, refreshments, and lunch.

The meeting will begin at 8 a.m. and should be over by 4:00 p.m.

Pre-registration is due by March 13th, but event day participants are welcome. Early registration helps ensure we have sufficient numbers of materials, refreshments and lunches are available.

This year’s summit will emphasize, “Focus on Forages.” With sessions providing information on:

- NIR Forage Analysis

- Regenerative Agriculture

- Sandbur Control

- Fescue Toxicosis

- the Cattle Market outlook

Sessions will be led by experts from OSU’s Division of Agricultural Sciences and Natural Resources, the Oklahoma Cattlemen’s Association and Oklahoma Beef Council.

A trade show and door prizes also will be showcased.

The summit has become one of the premier single-day beef events in the region and is an opportunity not only to interact with experts from industry and academia but also speak with fellow producers who may be in situations similar to your own, and who may have developed solutions that could prove useful into your own operation.

For more information about the Oklahoma Beef Cattle Summit, you can call the Pontotoc County OSU Extension office or persons with disabilities who require alternative means for communication or program information, or reasonable accommodations contact Erin Hubbard, at (580) 332-2153 or erin.r.hubbard@okstate.edu.