Cow-Calf Corner | October 6, 2025

The Slow Cattle Cycle Timeline

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

Increasingly, cattle producers, consumers, and policymakers are asking how high cattle prices will go; when will they reach a peak; and what happens after the peak. Questions about the cyclical peak in cattle prices and the trajectory of prices past the peak depend on factors that are still unknown at this time. We do not yet have any definitive indication of a cyclical bottom in cattle inventories - let alone the path of herd rebuilding to follow. The timeline of prices to the top has yet to be established and therefore speculation about the path of prices after the peak is widely variable at this point.

Three-quarters of 2025 have passed with no solid indication of heifer retention. The only direct data was the mid-year Cattle report, which showed the lowest beef replacement heifer inventory in the history of that particular data set. The 2025 U.S. calf crop is projected to be the lowest since 1941 leading to the July estimate of feeder cattle supplies outside of feedlots that is the lowest ever for that data set.

Industry response to rising cattle prices has been uncharacteristically slow to this point. The sharp decrease in beef cow slaughter (down roughly 40 percent since 2022) is enough to stabilize the cow herd at the current low level. The beef cow inventory could be fractionally larger in 2026. However, the small beef replacement heifer inventory (down about 27 percent from the cyclical peak in 2017) means that prospects for herd growth in 2026 are very limited. Unless heifer retention accelerates late in 2025, herd growth in 2027 will also be limited.

The beef cattle industry appears to be on a slow path of rebuilding. Prices are expected to peak some months after heifer retention begins and, at this point, are projected to move higher into 2026 (depending on the pace of heifer retention) and perhaps beyond. A sharp peak followed by a pronounced drop seems unlikely at this point. Prices are likely to remain elevated for much of the remainder of the decade with a gentle peak somewhere along the way. However, the front end of the process has not yet started so the path is subject to change and must be monitored for new developments.

Despite some anecdotal indications of heifer retention, there is no data yet to confirm that producers are collectively retaining enough heifers to initiate herd rebuilding. Beef cow slaughter has dropped enough in 2025, in addition to decreases in the previous two years, to likely show a slight increase in beef cow inventories going into 2026. While that would make 2025 the cyclical low in inventory, the lack of heifer retention thus far means that no significant herd growth is possible in 2026. Unless data from the final quarter shows significant heifer retention, the prospects for herd growth in 2027 will likewise be limited. Without heifer retention, the clock does not start on the timeline to anticipate the peak in prices and the duration of elevated prices. It looks increasingly like that peak is being pushed into the last part of the decade.

Carcass Weights, Quality Grades & Consumer Demand

Mark Z. Johnson, Oklahoma State University Extension Beef Cattle Breeding Specialist

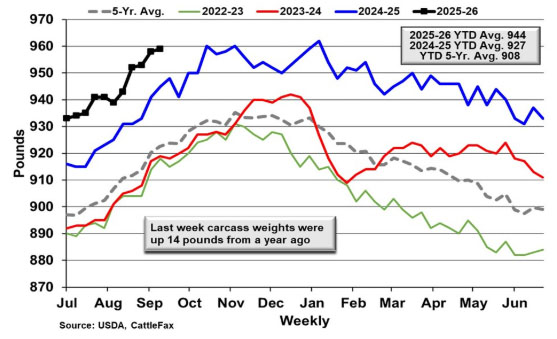

The chart below shows the trend of steer carcass weights over the past several years. The cattle feeding industry has maximized the number of days on feed in order to produce the tonnage of beef needed to meet consumer demand during a time of decreasing national cow herd inventory. According to seasonal norms, carcass weights are expected to increase through the end of the year and could top out at around 980 pounds. Heifer carcass weights are not shown in the chart but are currently at 872 pounds and expected to be near 900 pounds at their peak in December.

USDA Steer Carcass Weights

There are currently no market signals to indicate beef carcass weights will go down. Even long-term, pending increased heifer retention and a larger national cow inventory, market signals indicate more days on feed and heavier carcass weights will be the new normal. One of the most dramatic and interesting market signals is the proportion of higher USDA Quality Grade carcasses currently in the weekly harvest mix relative to robust consumer demand for consistently great tasting, higher quality beef.

For example, 20 years ago, the average harvest mix for the year 2005 was 36.5% Quality Grade Select and 55.8% Choice and Prime. Of those higher quality carcasses in the Choice and Prime grades, only 15.3% were in the upper two-thirds of Choice or Prime, with only 1 - 2% grading Prime. In 2005, the biggest determinant of carcass value was the Choice/Select spread.

How does that compare to 2025? Year to date, only 13.2% of carcasses are grading Select with 84.4% of all carcasses reaching Choice and Prime. Of those higher quality carcasses, a staggering 36.7% are in the upper two-thirds of Choice or Prime, with over 10% reaching the (formerly thought to be rarified air) USDA Quality Grade of Prime. In fact, for a stretch of over two months earlier this year, the weekly harvest mix yielded more Prime carcasses than Select carcasses. Currently, the Prime versus Choice spread is having the greatest impact on the value of a beef carcass. This as well could become the new normal as we look to meet consumer demand for a higher quality product.

Beef carcass quality is a result of the genetic potential to marble as well as the environment in which cattle are raised. That being said, marbling is a highly heritable trait in which cattle breeders have made significant improvement. Increased days on feed is an environmental influence permitting fed cattle to express their full genetic potential to reach higher marbling scores. Consumer preference for high quality beef and their willingness to pay for a great tasting beef product have created the need to supply this demand.

Vaccinating Calves Early Pays Off Later

Paul Beck, OSU Cooperative Extension Beef Cattle Specialist

Bovine Respiratory Disease (BRD) remains the leading health issue in feedlot cattle, costing the U.S. beef industry hundreds of millions of dollars each year not only in treatment and death losses but also in reduced life-time productivity of calves that get sick. While cow-calf producers often see little direct economic incentive to manage BRD of calves sold at weaning, what happens on the ranch has lasting effects downstream in the stocker and feedlot phases. A recent review paper in the special issue of the Applied Animal Science journal, I mentioned last week, “Vaccination against respiratory pathogens during the cow-calf phase: Effects on productive and health responses of feedlot cattle,” highlights how vaccination strategies early in life can improve animal health and performance later.

Vaccines against BRD pathogens—such as IBR, BVD, PI3, BRSV, Mannheimia haemolytica, and Pasteurella multocida—are widely available, but their effectiveness depends heavily on timing and management. Modified-live vaccines generally produce stronger immune responses than killed vaccines, but they require careful handling and can pose risks to pregnant cows if not used correctly.

Vaccinating cows before calving can enhance the quality of colostrum, providing calves with higher levels of protective antibodies. This “maternal immunization” not only improves calf health but may also lead to heavier weaning weights. However, research results are variable, and more work is needed to determine how long these benefits last.

Vaccinating calves shortly after birth can be challenging because maternal antibodies can block the vaccine’s ability to stimulate the calf’s immune system. As these antibodies decline, the calf becomes more responsive to vaccines—but also more vulnerable to disease. Timing the first vaccination to bridge this gap remains a management challenge.

Weaning and feedlot entry are among the most stressful events in a calf’s life, and stress suppresses immune function. Studies show that vaccinating calves two to three weeks before weaning, rather than at or after, can improve immune response and reduce BRD incidence in the feedlot.

The review concludes that vaccinating calves before stressful transitions—rather than reacting afterward—provides the best protection. As antibiotic use faces greater scrutiny, improving BRD prevention through strategic vaccination during the cow-calf phase offers one of the best opportunities to boost health, performance, and profitability across the entire beef supply chain.

5-State Beef Conferences

- Livestock and Range Field Day, Stillwater, OK, October 9, 2025

- 5-State Beef Conference, Beaver, OK, October 14, 2025

- 5-State Beef Conference, Dalhart, TX, October 15, 2025