Cow-Calf Corner | October 13, 2025

Fall Beef Demand

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

Boxed beef cutout values peaked at Labor Day and fell through September. On a daily basis, the Choice boxed beef cutout peaked on September 3 at $416.01/cwt. and bottomed one month later on October 3 at $362.27/cwt. before stabilizing. Fall is when beef demand transitions from a grilling focus to cool-weather crock pot cooking and back-to-school restaurant traffic.

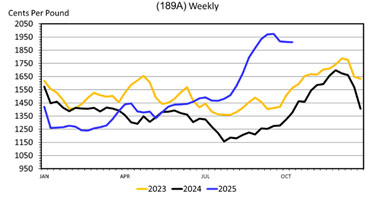

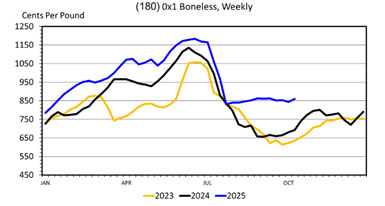

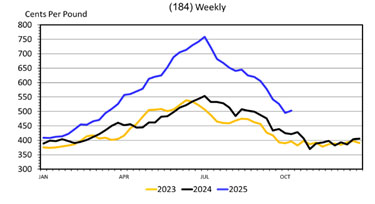

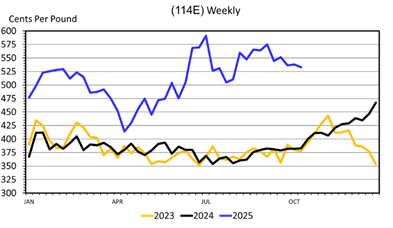

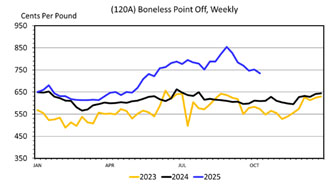

Figure 1 shows weekly prices for popular steak products. Beef tenderloin, after being relatively weak in 2024 and early 2025, has increased sharply in the third quarter (Figure 1 A). Tenderloins are typically strong in the fall and winter as restaurant traffic increases, with a bump in May for Mother’s Day. Panel B in Figure 1 shows wholesale ribeye, strong going into summer and again in the fall in anticipation of restaurant holiday Prime Rib demand. Strip loins were very strong in the first half of the year, then dropped sharply mid-summer before stabilizing the last few weeks (Figure 1 C). Top sirloin, popular for summer grilling, peaked mid-summer and has declined seasonally through the third quarter of the year (Figure 1 D). All of these wholesale values are well above year-ago levels.

| Image | Caption |

|---|---|

|

A: Wholesale Beef Tenderloin |

|

B: Wholesale Beef Ribeye |

|

C: Wholesale Beef Loin Strip |

|

D: Wholesale Beef Sirloin Butt |

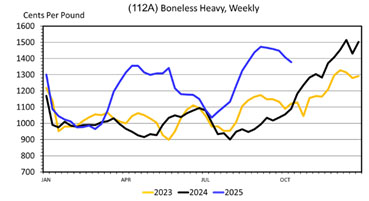

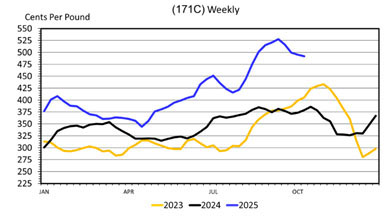

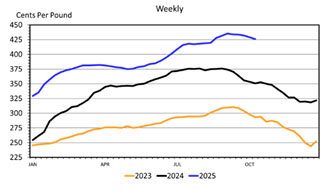

Figure 2 shows current strength in Chuck arm roast (Figure 2 A) and eye of round prices (Figure 2 B). Chuck and round products have more diverse demands compared to steak items. Though not as popular during summer grilling, chuck and round products may be demanded for value retail cuts, at-home slow-cooking, exports, or for grinding. Very strong prices for lean trimmings this year have pulled more round products into ground beef markets this year (Figure 2 D). Summer ground beef demand has likely peaked seasonally but tight lean supplies will keep ground beef prices elevated. Brisket values have decreased from an early fall peak but remain popular year-around (Figure 2 C).

| Image | Caption |

|---|---|

|

A: Wholesale Beef Chuck arm Roast |

|

B: Wholesale Beef Eye of Round |

|

C: Wholesale Beef Brisket Prices |

|

D: Wholesale Beef Fresh 90 Percent Lean |

Fall and winter weather and the upcoming holiday season change the relative demands for various beef products, but overall beef demand continues strong. Wholesale and retail beef prices will be supported by strong demand and continued decreases in beef production.

Derrell Peel, OSU Extension Livestock Marketing Specialist, shares key insights from his presentation at the 2025 Rural Economic Outlook Conference, focusing on current livestock market trends and challenges on SunUpTV from October 11, 2025.

Addressing Follow up Questions to Carcass Weights, Quality Grades & Consumer Demand

Mark Z. Johnson, Oklahoma State University Extension Beef Cattle Breeding Specialist

The article titled “Carcass Weights, Quality Grades & Consumer Demand” from last week led to several good questions. This week, I will address the most commonly asked questions.

First, the key points from last week. Carcass weights are going up and there are currently no market signals to indicate they will go down. Even long-term, pending increased heifer retention and a larger national cow inventory, market signals indicate more days on feed and heavier carcass weights will be the new normal. One of the most dramatic and interesting market signals is the proportion of higher USDA Quality Grade (upper two-thirds Choice and Prime) carcasses currently in the weekly harvest mix and robust consumer demand for consistently great tasting, higher quality beef. Consumer preference for high quality beef and their willingness to pay for a great tasting beef product have created the need to supply this demand.

Most frequently asked question: “Do commercial cow-calf producers need to select for more growth and accordingly increase mature cow size to produce calves that fit the current industry norms?”

Answer: No. The cows in our nation’s cow herd are the cows currently producing the feeder calves spending over 200 days on feed and finishing at live weights well in excess of 1,500 pounds. As an entire industry, it appears we have ample growth. The post weaning growth potential of feeder calves produced in the U.S. is not tethered to weaning weights. This suggests, at the cow-calf level, the production environment (forage availability and level of nutrition) is not permitting cows to tap their full potential for milk production, nor calves to tap their full potential for growth to weaning. Whereas, the post weaning production environments (stocker operations and feedyards), ARE permitting calves to tap their full genetic potential for growth which manifest itself in the form of strong postweaning growth, heavier finishing weights and heavier carcass weights than ever. Given the diversity of our production environments and biological diversity of the U.S. cow herd, it is still critically important that beef cows fit their production environment. The best evidence that a cow is a good fit to her production environment is producing a weaned calf each year. Repeating this process year after year, and weaning off as high a percentage of her body weight as is reasonably possible.

As cow-calf producers, we all like heavy weaning weights. That being said, there is a growing amount of evidence that efficiencies and profit potential of commercial cow-calf operations would be better served by focusing selection pressure on other economically important traits and avoiding excessive mature weight. Several Cow-calf Corner articles over the past three years have addressed this issue. Bottomline: seldom is the maintenance cost of high growth cows with excessive mature size offset by the additional calf weight that results.

This question leads to another question to consider: “How can commercial cow-calf operations responsible for producing calves with superior

post weaning growth and end-product merit reap the dividends of superior genetics?”

Answer: Avoid Information Asymmetry when marketing calves. This can be done by documenting the pre-weaning health/vaccination protocol and providing evidence of the post-weaning genetic potential. This is a long-term process that will require a combination of: 1) retaining a share of ownership through finishing and collecting evidence of post weaning performance which can be used in marketing future calf crops, 2) submitting DNA samples or, 3) enrolling calves in a program like Anguslink to receive a Genetic Merit Scorecard. More details about avoiding information asymmetry when marketing calves can be found in the August 18, 2025 Cow-calf Corner Newsletter.

Mark Johnson, OSU Extension Beef Cattle Breeding Specialist, takes a closer look at carcass weights, quality grades, and beef consumer demand on SunUpTV’s Cow-Calf Corner from October 11, 2025. Learn how market trends, breeding decisions, and production efficiency influence carcass outcomes and shape today’s beef quality standards. Mark also shares insights on how producers can align with shifting consumer preferences and maintain profitability in 2025.

Long-Term Impacts of Management During Weaning and Post-Weaning on Calf Performance

Paul Beck, Oklahoma State University Extension Beef Cattle Nutrition Specialist

How we manage calves at weaning and during backgrounding doesn’t just affect gain in the short term—it can carry over into how those calves perform all the way through the feedyard. A two-year study from Auburn University (Justice and others. Applied Animal Science 41:363–376) was conducted to increase the understanding of management options to add value to calves and the carry over effects through finishing.

Calves were weaned by one of three methods:

- Fence-line weaning

- Nose-flap weaning

- Abrupt weaning

After 14 days, all calves were brought together and placed on one of three 60-day backgrounding systems:

- Bermudagrass hay + supplemental dried distiller’s grains (DDGS) fed at 1% of bodyweight

- Cool-season baleage + DDGS

- Warm-season annual grazing + DDGS

Growth rate was monitored from weaning through the 60-day backgrounding period and then during finishing at a commercial feedyard through harvest.

Backgrounding Performance

Fence-line weaned calves hit the ground running with the highest ADG in the first 30 days, regardless of diet. Use of the nose-flap held no advantage over abrupt weaning. Diet also mattered—calves on the bermudagrass hay + DDGS diet gained the most early in backgrounding. However, in the last 30 days, calves on the baleage or warm-season annual grazing diets had greater performance.

Transition to the Feedyard

Shrink losses during transport were similar across all treatments, despite a long haul typical of southeastern calves going to Midwestern feedyards. Once in the feedyard, there were no major differences in body weight or ADG due to weaning or backgrounding strategy through the finishing period.

Health Outcomes

Health performance during backgrounding and finishing was consistent across treatments. Morbidity averaged 20% and death loss due to BRD was 2.2%—similar to industry norms for preconditioned calves.

Take-Home Message

This research has big implications on the effect of marketing plans on management decisions by producers. Low-stress, fenceline weaning has advantages in performance early in the post-weaning period over using nose-flaps or abrupt weaning. Producers selling shortly after weaning should consider using this technique.

Strategic weaning and backgrounding practices can improve early postweaning gain, but most of those differences disappear by the end of the backgrounding period. This gives flexibility to producers keeping calves through at least 60-days postweaning or retaining ownership through finishing.