Cow-Calf Corner | September 30, 2024

An Update on Herd Rebuilding

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

The biggest question in the cattle industry continues to be that of herd rebuilding. Specifically, there are questions regarding the status of the beef cow herd in 2024 and, more importantly, how is the industry setting up for 2025 and beyond. Beef herd expansion involves two components: reduced cow culling and increased heifer retention. Direct measures of the cow herd inventory and replacement heifer inventories are only available in the January 1 USDA-NASS Cattle report, with the next release in late January 2025. In the meantime, it is challenging to determine what is happening in 2024.

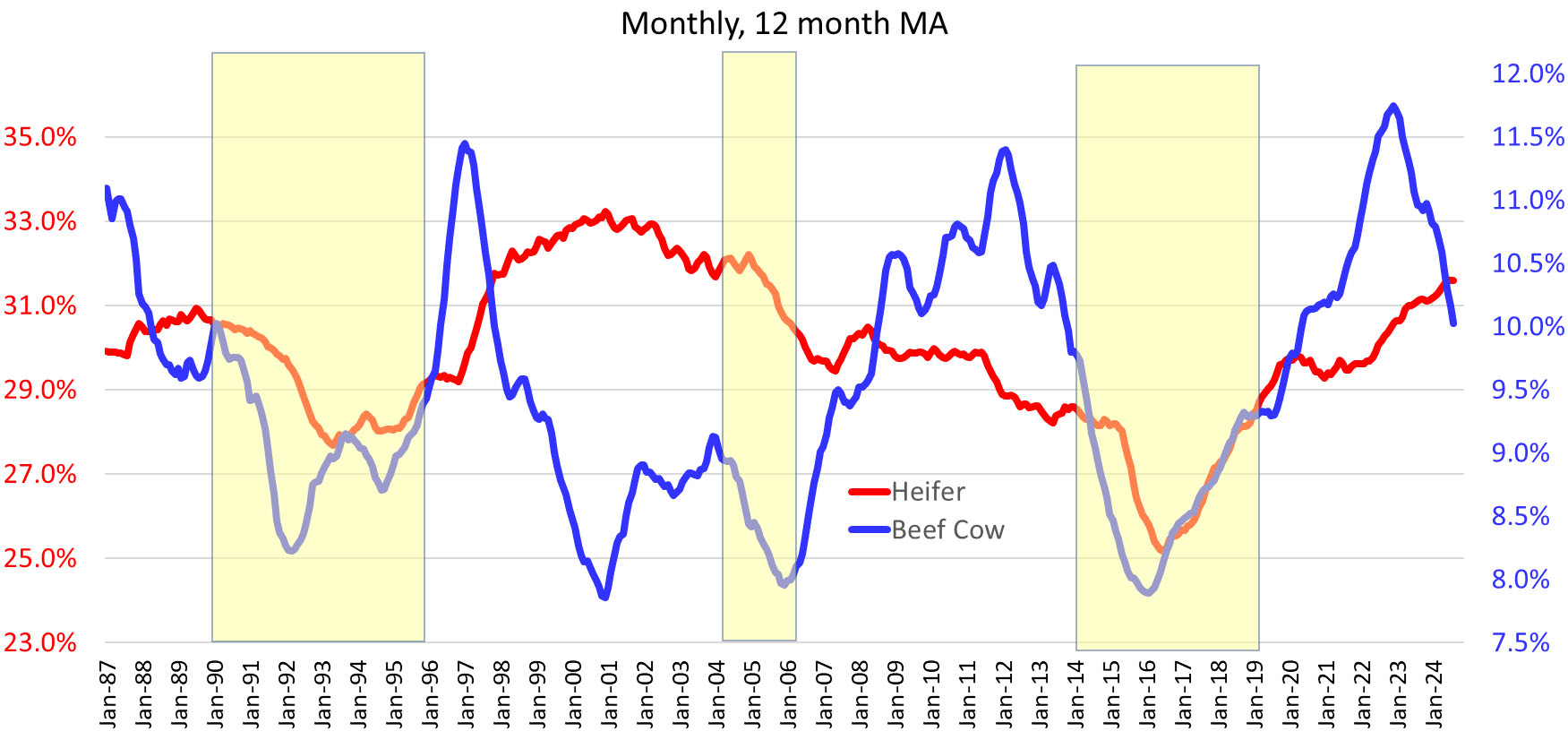

There is data on beef cow slaughter through the year that does indicate the beef cow herd culling rate. The final rate is usually expressed annually as total annual beef cow slaughter as percent of the January 1 beef cow inventory. The annual beef cow slaughter total will not be available until after the end of the year. In the first 37 weeks of 2024, beef cow slaughter is down 16.3 percent year over year. Monthly beef cow slaughter can be expressed as a percentage of total cattle slaughter. On an annual basis, beef cow slaughter as a percent of total cattle slaughter is 97.5 percent correlated with the annual herd culling rate. A twelve-month moving average of this percentage provides an indication during the year of beef cow herd culling. The blue line in Figure 1 shows this moving average since 1987. The two major cyclical beef herd expansion in the 1990-1996 and 2014-2019 periods shows how beef cow herd slaughter behaves during herd expansion.

Figure 1. Beef Cow and Heifer Slaughter as % of Cattle Slaughter

In the two previous herd rebuilds, beef cow slaughter bottomed in 1992 and in 2016. The moving average reflects the previous twelve months suggesting that beef cow slaughter was at a low in the first year of herd expansion in each of these cycles. Figure 1 indicates that beef cow slaughter is declining currently but has not bottomed and is not yet low enough to indicate herd expansion. Moreover, the rate of beef cow slaughter in 2024, although sharply lower year over year, is not down enough to offset the small bred beef heifer inventory at the beginning of the year. The beef cow herd is likely down year over year in 2024.

Figure 1 also contains a similar twelve-month moving average of heifer slaughter as a percentage of total cattle slaughter. Heifer slaughter goes down when heifer retention increases and there is a 72.5 percent correlation (negative) between this slaughter percentage and beef replacement heifer percentage (beef replacement heifers as a percent the beef cow herd inventory). The correlation is strong but less than for cows because heifer slaughter includes more than just beef heifers.

Figure 1 shows that the moving average of heifer slaughter also bottoms during herd expansion, typically about a year later than the cow slaughter moving average. In 2024, the twelve-month moving average of the heifer slaughter percentage of total cattle slaughter has not decreased at all thus far. Both of the measures in Figure 1 suggest that there is only minimal indication of industry movement towards herd rebuilding. The beef cow herd will likely be smaller on January 1, 2025 and has very limited potential to do anything other than stabilize and hold steady in 2025.

Biological Time Lag of Heifer Retention

Mark Z. Johnson, Oklahoma State University Extension Beef Cattle Breeding Specialist

It is evident the pace of expansion of the U.S. cow inventory will be slower than past cycles. Several factors will continue to contribute to the slow rebuild. Our beef cow inventory continues to tighten and pushes market prices to record levels. With regard to heifer retention, the questions most of us are asking:

- Will increased heifer retention (at some point in the future) result in even higher prices?

- How long will these prices last?

Good questions. Past cattle cycles indicate the answer to the first is most likely yes. When producers begin to retain more heifers to develop as herd replacements, it results in fewer calves going to market.

The answer to the second questions is this week’s topic. The biological time lag of beef production. The reality of beef production is that what competing animal proteins can accomplish in weeks (broiler production) or months (pork production), will take those of us in the cow-calf sector years to accomplish. The biology of the beef animal is why.

The Time Line

If we selected a high percentage of our spring (2024) born heifer calves to develop as replacements this fall. Next spring (2025), those properly developed replacement heifers would be ready to breed by 14 – 15 months of age. The following spring (2026), those heifers would calve at two years of age. Those calves would be ready to market at weaning in the fall of 2026. Those calves would become yearlings in 2027 and eventually become marketed as finished “A Maturity” finished cattle or beef carcasses six to seven months after entering the feedyard.

Bottomline

As of now there is little evidence of large scale heifer retention across the country. If and when we begin to retain heifers (on a large scale) we are a couple of years away from increasing the cow inventory, and at least 30 months away from increasing the supply of weaned calves, and so on, regarding yearlings and fed cattle. As is always the case in the beef cattle industry, other factors can and will have impact on the market. That being stated, the basic fundamentals of supply and demand favor strong prices for all categories of cattle until cow inventory begins to increase, and that will take some time.

Estimating Feed Intake in Beef Cows, Continued

David Lalman, Oklahoma State University Professor and Harrington Chair,

Extension Beef Cattle Nutrition Specialist

In the September 16, 2024 edition of the Cow-Calf Corner Newsletter, the widely-adopted equation to estimate feed intake in beef cows was discussed. That equation was published in 1996 in Nutrient Requirements of Beef Cattle, Seventh Revised Edition, National Academy of Sciences, Engineering, and Medicine (NASEM, 1996). Another widely used guideline for beef cow feed or forage intake was published by Dr. Chuck Hibberd and Dr. Todd Thrift in 1992 (Table 1).

| Forage quality | Stage of production | Dry matter intake % body weight |

|---|---|---|

| Low quality forage | Dry | 1.8 |

| < 52% TDN | Lactating | 2.2 |

| Average quality forage | Dry | 2.2 |

| 53 to 59% TDN | Lactating | 2.5 |

| High quality forage | Dry | 2.5 |

| > 59% TDN | Lactating | 2.7 |

In her effort to test these guidelines, along with the 1996 equation, Megan Gross used 85 study or treatment means. She restricted this “validation” data set to include studies published that met the following restrictions:

- Data either published or studies conducted between 2003 and 2022.

- Cows had ad-libitum (free choice) access to feed.

- No marker generated data.

- No metabolism or tie stall data.

- Only studies with adequate dietary protein were included.

As a sidenote, 58 of those 85 treatment means were generated by our group at Oklahoma State University.

Like the 1996 NASEM equation, the Hibberd and Thrift guidelines are sensitive to body weight, diet digestibility or energy, and stage of production. Megan discovered that these guidelines consistently overestimated dry-cow feed intake. In fact, the average deviation from the observed values was about 6 pounds per day with slightly better accuracy when diet digestibility was low and slightly poorer accuracy when diet digestibility was high. As a reference, the NASEM 1996 equation had an average deviation from observed values of 5.3 pounds per day in dry cows.

The Hibberd and Thrift guidelines were substantially more accurate in estimating lactating cow feed intake with an average deviation from observed values of about 3.3 pounds of feed or forage per day. That compares to 6.6 pounds average deviation from observed values using the NASEM, 1996 lactating cow equation. Certainly, reasonable estimates of feed intake in lactating beef cows can be obtained using the Hibberd and Thrift guidelines.

The feed intake equation developed using the more recent data is provided below. Intake must first be calculated using metric units (kg), but then can be converted to imperial units (pounds) by dividing kg per day by 0.454.

Dry cows: DMI = SBW0.75 * 0.017 + Diet NEm * 1.18 – 14.38

Lactating cows: DMI = SBW0.75 * 0.017 + Diet NEm * 1.18 – 11.1

Where DMI is dry matter intake, kg per day; SBW0.75 is shrunk body weight raised to 0.75 power; and diet NEm is diet net energy for maintenance, megacalories per kilogram of feed. Shrunk body weight is calculated by multiplying full body weight by 0.96.

Throughout this work, Megan and her graduate committee identified several areas where more data is needed. For example, information to quantify the effects of forage processing, cow body condition, milk yield and milk composition would further improve our ability to accurately estimate feed intake in a group of beef cows.

Save the Date

Livestock & Range Field Day

October 17, 2024

2024-2025 OQBN Market Partners & Sale Schedule

| Market Partner | Location | Sale Date | 45-Day Wean Date | 60-Day Wean Date |

|---|---|---|---|---|

| OKC West Livestock Market | El Reno, OK | November 5, 2024 November 19, 2024 December 10, 2024 January 21, 2025 |

September 21, 2024 October 5, 2024 October 26, 2024 December 7, 2024 |

September 6, 2024 September 20, 2024 October 11, 2024 November 22, 2024 |

| McAlester Union Stockyards | McAlester, OK | November 12, 2024 February 4, 2025 April 8, 2025 |

September 30, 2024 December 21, 2024 February 22, 2025 |

September 13, 2024 December 6, 2024 February 7, 2025 |

| Payne County Stockyards | Perkins, OK | November 13, 2024 | September 29, 2024 | September 14, 2024 |

| Southern Plains Livestock Auction | Blackwell, OK | November 25, 2024 | October 11, 2024 | September 26, 2024 |

| LeFlore County Livestock Auction | Wister, OK | December 7, 2024 | October 23, 2024 | October 8, 2024 |

| Big Iron Auctions | Online OQBN Sale | November 19, 2024 | October 5, 2024 | September 20, 2024 |