Cow-Calf Corner | October 21, 2024

Beef Production and Fall Beef Demand

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

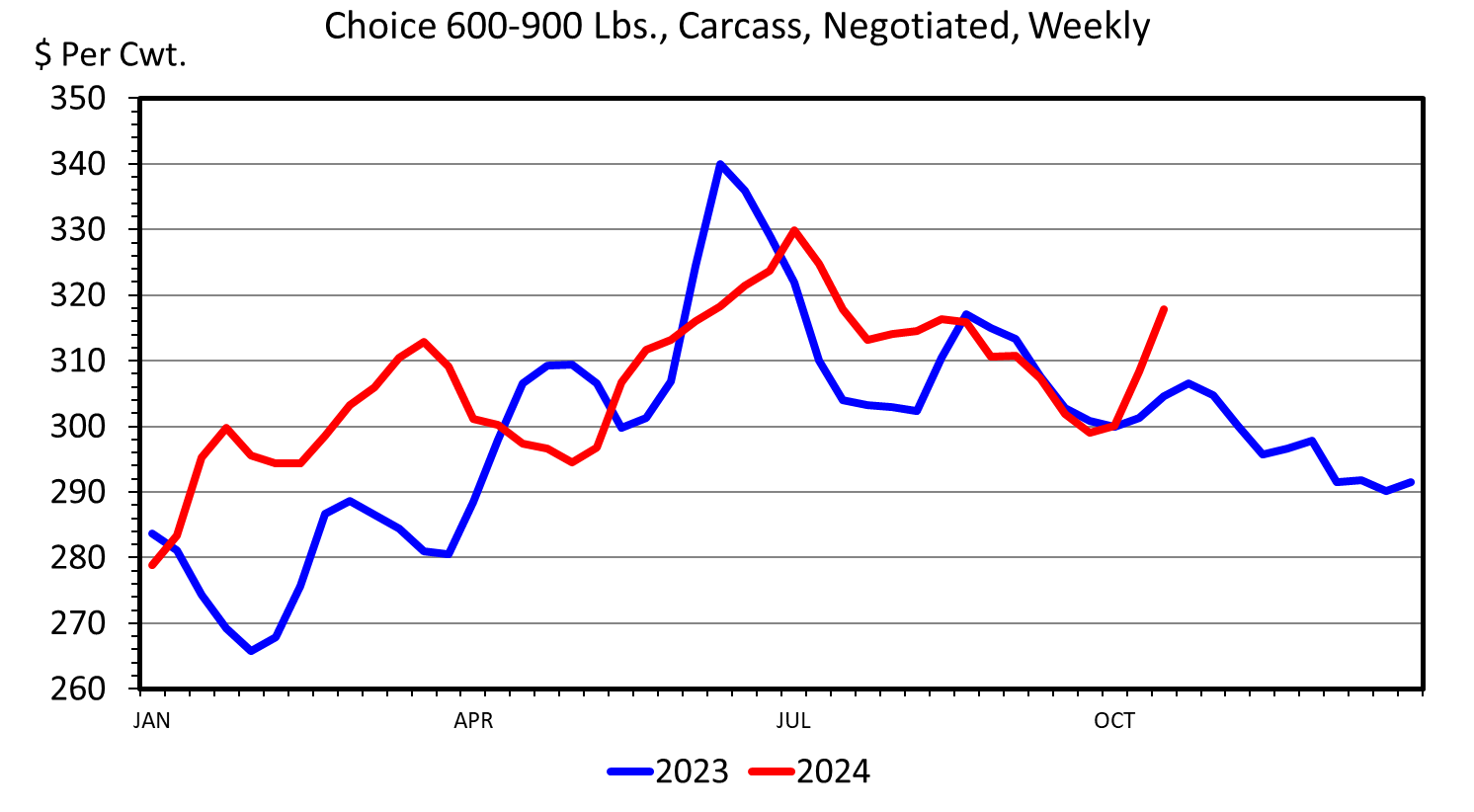

As of October 18, the daily Choice boxed beef price was $320.65/cwt., up from a recent low of $296.37/cwt on September 26 and the highest price since July 15. The weekly Choice boxed beef price is also at the highest level since July and has averaged 2.2 percent higher year over year and a record high for the year-to-date (Figure 1). Numerous wholesale cuts have moved higher recently including chuck arm roast (IMPS 114E), chuck roll (116A), chuck mock tender (116B), and chuck flap (116G). Wholesale round cuts have also moved higher including round knuckle (167A), top inside round (169A), bottom (gooseneck) round (170), outside round (171B), and eye of round (171C). Middle meat prices from the loin and rib have also increased including bottom sirloin flap (185A), sirloin tri-tip (185D), loin strip (180), and tenderloin (189A). Likewise, wholesale ribeye prices (112A) have increased recently and are showing an early seasonal demand for the holidays.

Figure 1. Boxed Beef Cutout Value

Thus far in 2024, steer slaughter is unchanged from one year ago. Heifer slaughter is down 1.6 percent year over year. Total fed slaughter is down 0.7 percent compared to last year, less than earlier expected. For the year-to-date, steer carcasses have averaged 25.5 pounds heavier than last year, and heifer carcasses are averaging 22.6 pounds heavier than one year ago. The result of stronger than expected fed slaughter and heavier carcass weights has been an increase in fed beef production of 1.9 percent year over year thus far in 2024. In fact, for the last 16 weeks, fed beef production has been 3.7 percent larger year over year. The increase in boxed beef prices is perhaps even more surprising in the face of increased fed beef production. Higher prices and increased quantities suggest that beef demand continues to be very robust.

In contrast to fed beef production, nonfed beef production is sharply lower this year, down 12.8 percent year over year. Total cow slaughter is down 15.3 percent, consisting of a 13.8 percent year over year decrease in dairy cow slaughter and a 16.8 percent decrease in beef cow slaughter so far this year. Bull slaughter is also down 8.1 percent compared to last year. Tighter supplies of lean trimmings have kept processing beef prices higher this year and the demand for lean has increased demand for lean carcass cuts. For example, the current wholesale price of 90 percent lean trimmings is higher than wholesale prices for top inside round, bottom (gooseneck) round, and outside round.

In the fall, summer grilling demand gives way to seasonally stronger demand for roasts, crock pot cooking and increased middle meat demand in restaurants. Wholesale ground beef prices have moderated recently as hamburger grilling demand slows but prices remain well above year ago levels. Total beef production is down a scant 0.7 percent so far this year and may end the year equal to year ago levels. Despite this, wholesale and retail beef prices are higher thus far in 2024.

Estimating Hay Needs

Mark Z. Johnson, Oklahoma State University Extension Beef Cattle Breeding Specialist

Some basic rules of thumb to follow when determining the hay supplies you will need to sustain your cow herd over the next few months.

- Determine your average mature cow size. This can be done by weighing your 4 – 7 year old cows and calculating the average weight. From mature cow size, we can approximate the amount of forage dry matter cows will need to consume per year or per day. For example: a 1,000 pound cow will consume about 26 pounds of forage dry matter per day. A 1,400 pound cow will consume about 36.4 pounds of forage dry matter per day.

- Determine your cow inventory

- Estimate the amount of time you expect to be feeding cows.

From this information you can calculate the total amount of hay needed. For example: 100 cows weighing 1,400 pounds will consume about 3640 pounds of hay per day. We should take into account that a certain amount of the hay fed will be wasted and there will be a certain amount of spoilage of each bale fed that won’t be consumed. With this in mind we will add another 10% to the daily total to bump it up to about 4000 pounds (2 tons) per day.

Remember the amount of hay wasted or spoiled could be higher. If we are feeding hay from last year expect a higher percentage spoiled in each bale.

If we are expecting to feed hay from mid-October to mid-May, that is approximately 200 days of hay feeding. 4000 pounds of hay needed per day x 200 days equals a total of 800,000 pounds (400 ton) of forage dry matter that cows will consume over this time. If we are feeding or buying large rounds with an average weight of 1,250 pounds that equates to 640 (800,000 divided by 1,250) big bales needed to sustain the 100 cows.

If possible, purchase hay by the ton. It leads to less error in securing the amount of hay you will need to purchase or have on inventory. If buying hay by the bale is your only option, make sure to weigh enough of the bales to have an accurate representation of bale weight. Also, take into account the amount of spoilage of each bale. One of the upsides of hay baled this summer (and the drought we are dealing with now) is less spoilage of warm season grass hay baled in the summer of 2024.

Other factors such as weather, stage of gestation or lactating versus dry cows will obviously impact nutritional requirements of cows from day to day. Provide hay and other nutritional supplementation accordingly.

Cull Cows – Should They Stay or Should They Go? And When Should They Go?

Kellie Curry Raper, Oklahoma State University Cooperative Extension State Livestock Marketing Specialist

In Financial Opportunities of Cull Cow Marketing (Cow-Calf Corner - 9/23/24), Mark Johnson discussed the cull cow market, the importance of cull cow revenue to cow-calf operations, and the potential of adding value based on seasonal patterns in cull cow prices. As Dr. Johnson discussed, cull cow prices tend to bottom in the fall and peak in the spring, presenting a range of opportunities. Let’s take a deeper dive into the culling decision along with post-culling management and marketing with a focus on spring-calving herds.

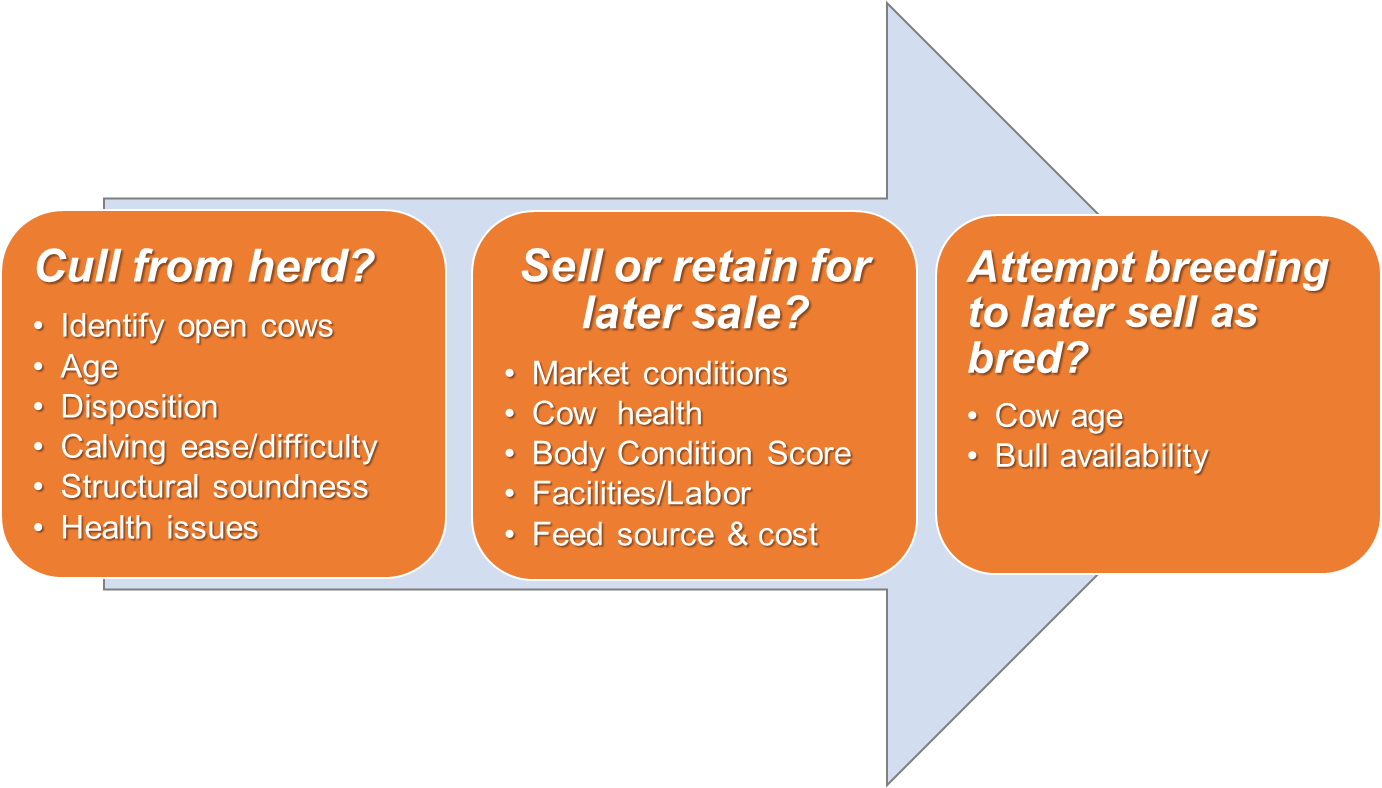

Cow-calf producers with spring calving herds typically wean calves in late summer or early fall and subsequently make decisions about culling cows from the herd. The culling decision is based on many factors related to fertility, productivity, management ease, and health, as described in Figure 1.

Figure 1. Multidimensional Decisions in Beef Cow Culling and Marketing (Source: K. Raper)

Alongside that culling decision is the marketing decision – the decision to market cull cows immediately or retain them on the farm for marketing at a later date (Raper and Biermacher, 2017). Many factors influence this decision, including individual cow health, cash flow needs, on-farm resources for retention and feeding, current market conditions versus market expectations, and time. If a cull cow is not healthy enough or structurally sound enough to stay in your herd, she likely needs to go on the trailer for immediate marketing, as the risk of carrying her for 4 more months outweighs the opportunity for added revenue. If a cull cow carries too much body condition, she should also join those on the trailer, as adding or maintaining weight will likely be more costly than any revenue gained from the seasonal price upswing. On the other hand, if a cull cow is sound, reasonably healthy and not over-conditioned, AND if you have the resources to do so, there are multiple retention strategies with the potential for increasing cull cow salvage values in a profitable way. These strategies focus on taking advantage of the typical spring upswing in cull cow prices without spending all of the revenue gain on feed intake cost.

This article will focus on feeding strategies and leave the conversation about selling culls as bred cows for later.

In the previously referenced studies, 162 cull cows over a three-year period were assigned either to a native pasture or to a low-cost dry-lot retention program. Market value and retention costs were assessed at October culling and again at one-month intervals from November through March and used to calculate net returns. Net returns from cull cow retention measure the difference in revenue at culling and revenue when marketing at a later date, less the associated retention and feed costs, written as:

Net Returns = Revenue at Marketing – Retention & Feed Costs – Revenue if sold at Culling

Cows retained in the dry-lot setting had higher weight gain, on average, than cows retained on native pasture, but cumulative feed costs also increased at a much faster pace, even with the low-cost strategy. Cows with BCS≤6 (thin and medium) were profitably retained in the native pasture system, regardless of the retention period, with net returns ranging from $20/head in November to $70/head in March. Many of these cows actually lost some weight during the retention period, but the seasonal price upswing ‘outweighed” the lost weight. However, in the low-cost dry lot system, only the 4-month retention period was profitable for thin and medium cows, with net returns of $20/head and $10/head, respectively, as feed costs consumed most of what would be gained from the seasonal price upswing. Net returns for cows with BCS>6 were negative across the board in the dry lot system, with minimal profitability in the pasture system as well.

So…as my family says in dominoes, get rid of your big ‘uns! And then carefully consider how to manage and market the rest.

Raper, Kellie Curry, Jon T. Biermacher, and Zakou Amadou. Marketing Cull Beef Cows: Does Body Condition Score Matter?, Oklahoma Cooperative Extension Service, Fact Sheet AGEC-627, March 2017.

Raper, Kellie Curry and Jon T. Biermacher. Beef Cull Cow Management and Marketing Alternatives, Oklahoma Cooperative Extension Service, Fact Sheet AGEC-629, March 2017.

2024-2025 OQBN Market Partners & Sale Schedule

| Market Partner | Location | Sale Date | 45-Day Wean Date | 60-Day Wean Date |

|---|---|---|---|---|

| OKC West Livestock Market | El Reno, OK | November 5, 2024 November 19, 2024 December 10, 2024 January 21, 2025 |

September 21, 2024 October 5, 2024 October 26, 2024 December 7, 2024 |

September 6, 2024 September 20, 2024 October 11, 2024 November 22, 2024 |

| McAlester Union Stockyards | McAlester, OK | November 12, 2024 February 4, 2025 April 8, 2025 |

September 30, 2024 December 21, 2024 February 22, 2025 |

September 13, 2024 December 6, 2024 February 7, 2025 |

| Payne County Stockyards | Perkins, OK | November 13, 2024 | September 29, 2024 | September 14, 2024 |

| Southern Plains Livestock Auction | Blackwell, OK | November 25, 2024 | October 11, 2024 | September 26, 2024 |

| LeFlore County Livestock Auction | Wister, OK | December 7, 2024 | October 23, 2024 | October 8, 2024 |

| Big Iron Auctions | Online OQBN Sale | November 19, 2024 | October 5, 2024 | September 20, 2024 |