Cow-Calf Corner | November 11, 2024

Beef Export and Import Update

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

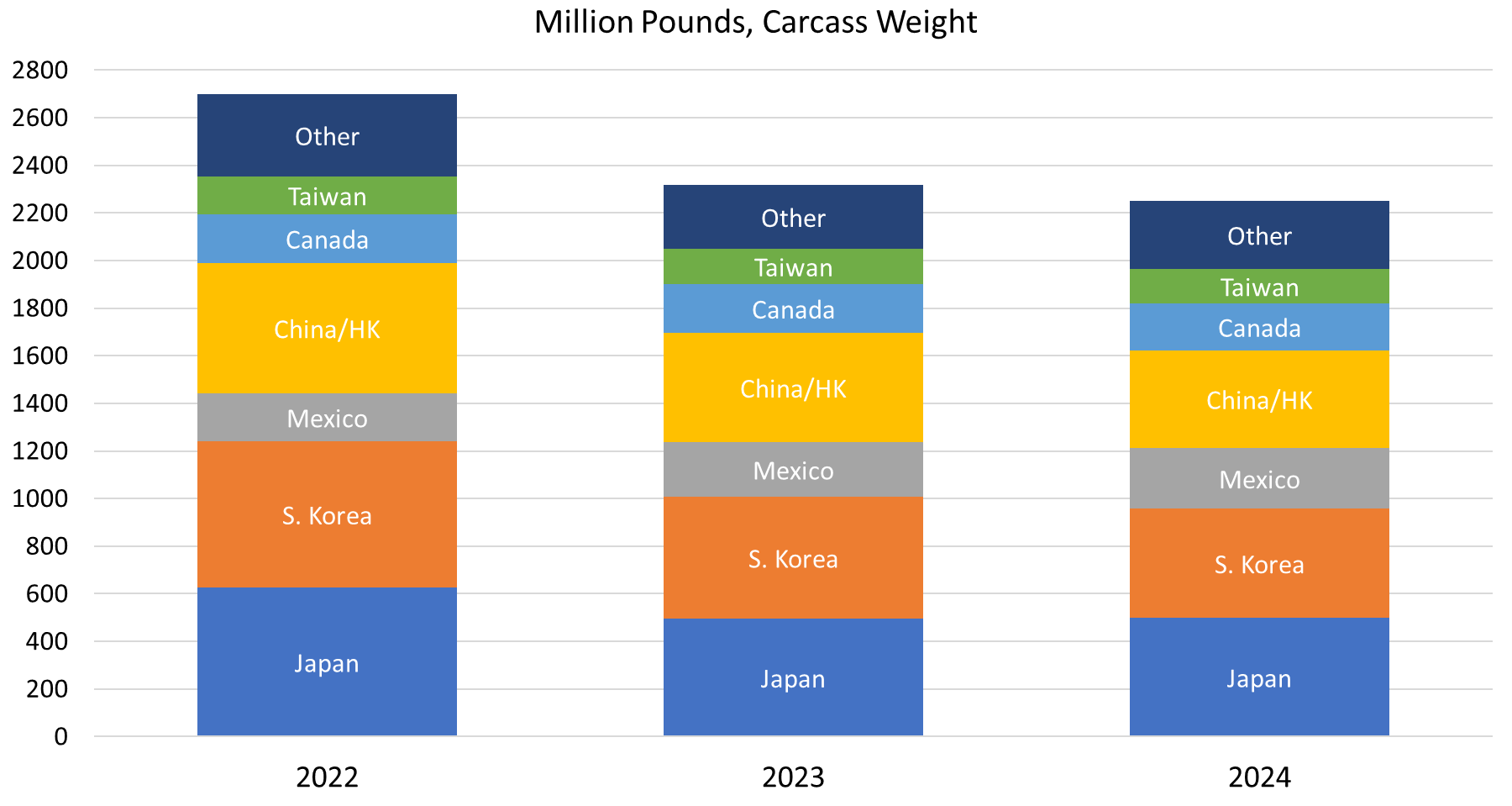

Total beef exports increased 3.6 percent year over year in September, bringing the total for the first nine months of the year to just 2.9 percent below last year (Figure 1). Japan is the number one export market, up 8.4 percent in September and up 0.6 percent year over year thus far in 2024. Number two South Korea was up 5.9 percent in September but remains down 10.3 percent for the first nine months of the year. China/Hong Kong is the number three export destination, down 12.3 percent in September and down 10.2 percent year over year for the January-September period. Beef exports to fourth-ranked Mexico were up 11.2 percent in September and are up 10.9 percent year over year for the first nine months of the year. Canada is the number five export market and was down 16.6 percent year over year in September and down 5.5 percent for the year to date. Beef exports to number six Taiwan were up 35.9 percent year over year in September, bringing the year-to-date total just 0.7 percent below one year ago.

Figure 1. U.S. Beef Exports, January-September 2022-2024

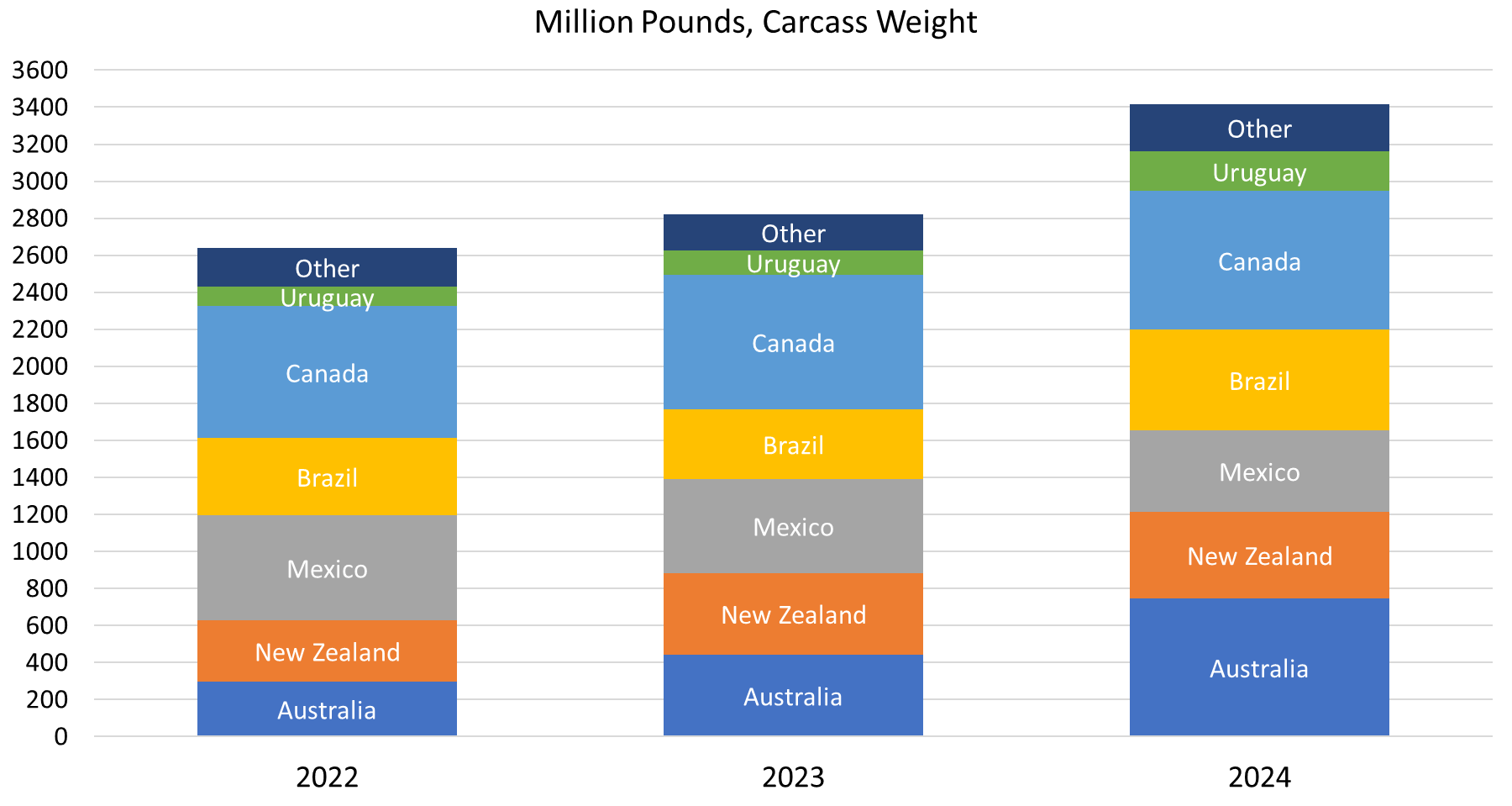

Total beef imports remain significantly stronger in 2024, up 23.0 percent year over year in September and up 21.1 percent thus far in 2024 (Figure 2). Canada remains the number one beef import source, just fractionally higher than Australia. Beef imports from Canada were down 0.7 percent year over year in September but remain up by 2.7 percent over last year. Imports from Australia have jumped sharply in 2024, up 60.0 percent in September and up 68.4 percent for the year to date compared to one year ago.

Figure 2. U.S. Beef Imports, January-September 2022-2024

Brazil has also grown sharply as a source of U.S. beef imports, up 87.4 percent in September and up 44.9 percent for the January-September period. Brazil is the number three beef import source in 2024, up from number five last year. The number four beef import market is New Zealand, with September imports down 20.0 percent from one year ago but up 6.2 percent year over year for the first nine months of the year. Mexico is the number five beef import source, down from third place last year, with September imports up 6.2 percent year over year, but down 13.4 percent for the year to date. Uruguay is the sixth largest beef import source and was up 11.2 percent in September and is up 64.8 percent year over year thus far in 2024.

Cow Inventory and Culling Rates

Mark Z. Johnson, Oklahoma State University Extension Beef Cattle Breeding Specialist

Approximately 70% of the U.S. cowherd calves in the spring. As referenced in previous Cow-calf Corner articles, the fall months, when we wean spring born calves and pregnancy check our cowherd, is usually the time we see the majority of cull cows going to market. Accordingly, the fall and winter months during the last quarter of the year are typically the lowest prices for cull cows.

Overall in 2024, the rate of cow slaughter is down. While cow slaughter has picked up somewhat since August (as expected), it remains sharply lower than recent years. Cull cow prices have seen their typical break as we have moved through the fall. However, cull cow prices remain well above 2023 levels and record high for the fourth quarter. As compared to recent years, reduced cow slaughter has supported cull cow values even through seasonal fall markets. Tight slaughter cow supplies and strong prices are expected to be the pattern through the winter months and into 2025.

From a cow inventory standpoint, the lower rate of cow culling/cow slaughter this year has not been enough to overcome the tight supply of bred heifers at the start of 2024. As a result, the U.S. beef cow inventory is most likely to be smaller to at the beginning of 2025.

Reference

CattleFax Update November 1, 2024

Enhancing Reproductive Success in the Cow-Calf Herd

Rosslyn Biggs, DVM, OSU College of Veterinary Medicine, State Beef Cattle Extension Specialist

Reproductive management is at the foundation of a successful cow-calf herd. However, enhanced reproductive technologies are not readily incorporated as seen in the results of the 2017 USDA National Animal Health Monitoring System Beef Cow-calf study. Results of this study indicated, of heifers bred for calving in 2017, 76.8 percent were bred only by bulls, and 15.1 percent were bred by a combination of artificial insemination and bull breeding. Of cows bred for calving in 2017, 92.9 percent were bred only by bulls, and 5.5 percent were bred by a combination of artificial insemination and bull breeding. Estrus synchronization was utilized in only 7.3 percent of all operations.

As producers approach breeding season, plans should be developed to fit the needs of the operation in coordination with veterinary input. Breeding soundness evaluations and pregnancy detections should be standard in all breeding herds. Reproductive technologies when used appropriately improve herd health, efficiency, genetics, and overall profitability. Enhanced reproductive protocols can be utilized for operations incorporating artificial insemination as well as exclusively bull bred herds.

Estrus synchronization involves manipulating the estrous cycle of heifers and cows so that a large group of females come into heat at the same time. Various hormone-based protocols are used to achieve estrus synchronization, making it easier to manage breeding and improve pregnancy rates.

By synchronizing estrus, producers can breed multiple cows simultaneously, potentially reducing the time and labor required for heat detection and insemination. Although this technique is most often used in conjunction with artificial insemination to maximize reproductive efficiency, advantages can also be seen in bull-bred herds. Estrus synchronization allows for more precise timing of calving.

Artificial insemination (AI) is one of the most widely used reproductive technologies in the beef industry. AI allows producers to access superior genetics enabling them to improve a variety of traits in the resulting calf crop. Moreover, AI reduces the need for keeping a large number of bulls on-site, thereby lowering bull maintenance costs, decreasing disease transmission, and improving animal and human safety.

Great resources exist for producers seeking to integrate or improve their reproductive strategies. Notable examples are those provided by the Beef Reproduction Task Force. The task force offers a variety of free resources including webinars, synchronization protocols, and decision tools such as the Estrus Synchronization Planner and AI Cowculator. More information on these resources can be found at Beef Reproduction Task Force.

2024-2025 OQBN Market Partners & Sale Schedule

| Market Partner | Location | Sale Date | 45-Day Wean Date | 60-Day Wean Date |

|---|---|---|---|---|

| OKC West Livestock Market | El Reno, OK | November 5, 2024 November 19, 2024 December 10, 2024 January 21, 2025 |

September 21, 2024 October 5, 2024 October 26, 2024 December 7, 2024 |

September 6, 2024 September 20, 2024 October 11, 2024 November 22, 2024 |

| McAlester Union Stockyards | McAlester, OK | November 12, 2024 February 4, 2025 April 8, 2025 |

September 28, 2024 December 21, 2024 February 22, 2025 |

September 13, 2024 December 6, 2024 February 7, 2025 |

| Payne County Stockyards | Perkins, OK | November 13, 2024 | September 29, 2024 | September 14, 2024 |

| Southern Plains Livestock Auction | Blackwell, OK | November 25, 2024 | October 11, 2024 | September 26, 2024 |

| LeFlore County Livestock Auction | Wister, OK | December 7, 2024 December 14, 2024 |

October 23, 2024 October 30, 2024 |

October 8, 2024 October 15, 2024 |

| Big Iron Auctions | Online OQBN Sale | November 19, 2024 | October 5, 2024 | September 20, 2024 |