Cow-Calf Corner | April 8, 2024

Beef Trade Update

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

U.S. beef trade continues to evolve in the face of a unique domestic cattle market situation. Beef exports in February were down 1.3 percent year over year with the two-month total thus far in 2024 down 2.6 percent. This follows a 2023 year over year decrease of 14.3 percent from record 2022 beef exports. Beef exports in the first two months of the year are down year over year from most of the top markets; including number one Japan, down 13.5 percent; number two South Korea, down 5.5 percent; and number three China/Hong Kong, down 2.6 percent. Additionally, Canada, the number five market is down 2.0 percent thus far in 2024, along with number six Taiwan, down 7.5 percent year over year. Mexico, which had been the number three market as recently as 2019, is currently the number four market but recovering. Beef exports to Mexico are up 20.7 percent in January-February, following a 12.2 percent year over year increase in 2023.

Beef imports in February were up 23.8 percent year over year and are up 31.9 percent in the first two months of the year. This follows a 9.9 percent year over year increase in beef imports in 2023. Beef imports this year are led by Brazil, who jumps out strongly to fill the "other country" quota early in the year, with shipments moderating after two or three months in the face of the over-quota tariff. Imports from Brazil are up 41.8 percent year over year thus far in 2024. Imports from Australia are up sharply so far this year, with a year over year increase of 111.3 percent, still narrowly the number three country as a beef import source. Canada is the number two import source, slightly ahead of Australia and up 9.0 percent year over year. New Zealand is the number four beef import source and is up 48.6 percent thus far in 2024. Mexico is the fifth largest source of beef imports, down 16.9 percent in January-February after decreasing 12.4 percent year over year in 2023. Uruguay is the number six beef import source and is up 90.9 percent year over year thus far in 2024.

Beef exports continue to face headwinds as beef production decreases and beef prices increase in the U.S. market. A generally strong U.S. dollar adds additional headwinds, making U.S. beef imports more expensive to international customers. At the same time, decreasing domestic beef supplies in the U.S., coupled with higher prices, attracts additional beef imports, with the strong dollar adding additional incentive for beef imports. As is typical, beef imports are heavily dominated by imports of lean processing beef to supplement decreasing supplies of non-fed beef in the U.S. Decreasing lean beef supplies, coupled with strong ground beef demand in the U.S. is pushing 90 percent lean prices (and ground beef prices) to record levels. Fed beef (steer and heifer) production is declining, but the large percentage of yield grade 4 and 5 in feedlot cattle means that the supply of fatty (50 percent lean) trimmings is high relative to lean beef supplies and stimulating strong demand for domestic and imported lean processing beef to increase ground beef production.

Benefits of Estrus Synchronization and Artificial Insemination

Mark Z. Johnson, Oklahoma State University Extension Beef Cattle Breeding Specialist

Regardless of when your calving season occurs, manipulating the reproductive process of your cow herd can result in shorter breeding and calving seasons. Accordingly, more calves born earlier in the calving season result in an older, heavier, more uniform calf crop when you wean. Shortened calving seasons permit improvements in herd health and management such as timing of vaccinations and practices that add to calf value with less labor requirements (or at the very least concentrating labor efforts into a shorter time frame). Cows that are closer to the same stage of gestation can also be fed and grouped accordingly which facilitates a higher level of management.

Estrus synchronization can be used for natural mating or breeding by Artificial Insemination (AI). Synchronization protocols permit us to concentrate the labor needed for heat detection to a few days, and in some cases eliminate the need for heat detection when cows can be bred on a timed basis. Choosing an estrous synchronization protocol which can be used with AI or natural mating can be difficult as a number of synchronization methods are available. Traditional protocols are designed to mimic or control the corpus luteum on the ovary. Newer protocols have been designed to control ovulation and/or the follicular waves that occur on the ovary during the 21-day estrous cycle. Estrus synchronization systems vary in cost, labor required, and effectiveness. Management decisions regarding synchronization should be based on answers to the following questions:

1. Do you have adequate labor and facilities to successfully implement the management practices involved?

Most synchronization protocols will require at least two trips through the chute, plus at least one more if breeding by AI. Heat detection will require labor for several hours, twice a day to observe standing heats. Labor will be required to sort cows.

2. Do you have an AI technician available for the duration of time you will be AI breeding cows?

3. Cost of synchronization protocols can vary significantly. Is the cost justified?

Whatever method you determine best fits your operation, be sure to use the correct synchronization product at the recommended time and follow Beef Quality Assurance practices when administering the product.

4. Have you identified an AI sire(s) offering the genetic potential to increase your profit potential relative to your intended marketing end point or use of calves sired?

Use of AI permits us to get more cows bred to genetically superior sires for traits of economic importance to our operation's production and marketing goals. Synchronization at the onset of breeding season, results in more cows having heats in the first 18 - 25 days of breeding season. Female's return heats will remain synchronized to a degree, which gives a second chance to AI each female in the early part of breeding season. Without any synchronization, herd managers are faced with a 21 days of continual estrus detection and typically only one opportunity for AI in most females.

Bottomline: estrus synchronization can be an important management tool to get cows settled as early in the breeding season as possible and get cows bred to bulls with highest possible genetic value. A defined breeding season is important to permit meaningful record keeping, timely management and profit potential. Maintaining a 60 to 75 day breeding and calving season can be one of the most important management tools for cow calf producers.

Mark Johnson, OSU Extension beef cattle breeding specialist, discusses the benefits of estrus synchronization in cattle herds on SunUpTV from March 25, 2023.

Marketing Bulls as Feeder Calves? The Market will Charge You for It

Kellie Curry Raper, Oklahoma State University Extension Livestock Marketing Specialist

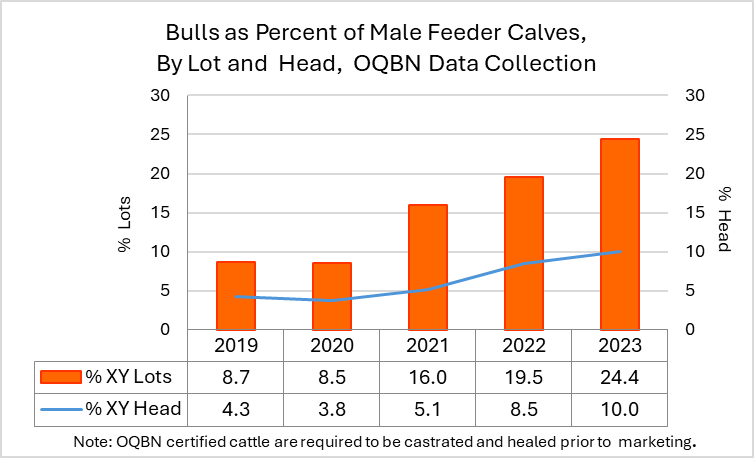

An important aspect of the Oklahoma Quality Beef Network is detailed data collection on OQBN sale dates for both OQBN and non-OQBN cattle. And one thing that data is telling us is that more lots of un-castrated males have come through the sale ring as of late. The charts below illustrate data from the 2019-2023 fall sale seasons and indicates a sharp increase in the number of bulls marketed as feeder calves beginning in 2021. Note that OQBN certified cattle are required to be castrated and healed prior to marketing, so this increase in bulls is coming from non-program cattle.

The numbers in Figure 1 indicate that the share of bulls as a percent of male feeder calves increased - both in terms of number of lots and as measured by head count.

Figure 1. Bulls as Percent of Male Feeder Calves, 2019-2023.

In fact, the proportion of bull lots nearly tripled from 8.7% in 2019 to 24.4% in 2023, while the proportion of bulls as measured by head more than doubled from 4.3% to 10% over the same time period. These numbers reflect an overall increase in the proportion of bulls coming through feeder calf sales.

Research indicates multiple animal performance benefits linked to earlier castration (birth to 3 months), including shorter initial weight loss periods, lower disease susceptibility, and higher post-weaning ADGs. Additionally, the process is less stressful for calves at younger ages when the calves are lighter, posing less risk of harm to both the calf and the producer.

Figure 2 takes a closer look at how the increase in bull lots is distributed across weight classes.

Figure 2. Bulls by Weight as Percent of All Male Feeder Calf Lots, 2019-2023.

The far right segment of each bar represents steers as a proportion of all male feeder calf lots in that year, falling from 91% in 2019 to only 76% in 2023. Note that the bar truncates at 25% to provide a closer look at how the proportion of bulls has changed across weight classes. In 2019, the highest proportion of bull lots in the OQBN data were 4- and 5-weight lots. This holds true as the proportion of bull lots in all weight categories increased in general by 2023. However, the accompanying increase in the other weight classes, including 6- and 7-weights, is substantial.

Perhaps some of the increase in the number of bull feeder calf lots can be explained by weather events. Management protocols may get delayed or discarded because of extended periods of extreme cold stress during calving season, such as in 2021. Drought-induced marketing decisions may prioritize the urgent need to move cattle over implementation of typical management practices. Beyond weather, the enticement of higher feeder calf prices may also play a role in that producers are satisfied with earning revenue substantial enough to be willing to 'take the money and run' rather than taking time to castrate those bull calves. Even so, calves coming to the sale ring as bulls are discounted by buyers. An analysis of recent OQBN data puts that value at $11.25/cwt. That's over $56/head for a 500 pound animal. Whatever the reason, if you are marketing uncastrated bulls as feeder calves, the market will charge you for it.

Rancher's Thursday Webinar: Management of Beef on Dairy Crossbreds in Beef Production

Paul Beck, Oklahoma State University Extension Beef Cattle Nutrition Specialist

The Rancher's Thursday Lunchtime Webinar Series focusing on use of Beef on Dairy crossbreds in beef production started last week with a presentation by Bailey Basiel from Penn State University discussing how sire breeds and selection within a breed affects performance and carcass quality from beef on dairy crosses. The recording of the presentations will be posted on the OSU Beef Extension website.

The series will continue through May 2nd every Thursday at noon from April 11th to May 2nd. This Webinar covers the management of Dairy Beef crossbreds in the beef production system. There will be presentations on research dealing with the effects of sire selection and early life management on finishing performance as well as management and performance of dairy-beef crosses in commercial feeding operations. Experts from across the nation will cover recent research and real-world experiences in managing and marketing these unique animal resources.

A new Rancher’s Thursday Lunchtime Webinar Series will run every Thursday at noon from April 4th to May 2nd. This Webinar will cover the management of Dairy Beef crossbreds in the beef production system. There will be presentations on research dealing with the effects of sire selection and early life management on finishing performance as well as management and performance of dairy-beef crosses in commercial feeding operations. Experts from across the nation will cover recent research and real-world experiences in managing and marketing these unique animal resources.