Cow-Calf Corner | May 1, 2023

Global Beef Market Outlook

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

The latest Livestock and Poultry: World Markets and Trade report issued by the USDA Foreign Agricultural Service in April provides updates and forecasts of beef, pork, and chicken meat production, consumption, exports, and imports for the major countries in each market.

Global beef production is projected to increase slightly in 2023 with decreased production in the U.S., the largest beef producing country, but continued growth in beef production in Brazil, the number two beef producer as well as number three China. Beef production is projected to be steady to slightly lower in the European Union (E.U.), the number four beef producer, along with India (number five), Argentina (number six) and Canada (number nine). Increases are also forecast for Mexico (number seven) and Australia (number eight).

Total beef consumption is forecast to decrease in the U.S., the largest beef consuming nation. China/Hong Kong is the second largest beef consuming region with continued growth in beef consumption projected in 2023. Brazil and the E.U. are the third and fourth largest beef consuming countries, both expected to have slight growth in beef consumption this year. The top four beef consuming nations are projected to account for 65 percent of global beef consumption. India is the number five beef consuming country, followed by Argentina and Mexico.

Total beef exports are projected to increase just slightly in 2023. Brazil is the largest beef exporting country with exports forecast to increase slightly in 2023. U.S. beef exports are expected to decrease slightly with declining beef production, dropping the U.S. from second to third place as a beef exporting country behind India. Australia continues to recover and rebuild its beef industry with beef exports increasing and putting Australia just behind the U.S. as the number four beef exporter. These top four beef exporting countries account for 61 percent of global beef exports. Behind the top four beef exporters, the next tier of beef exporting countries includes Argentina, New Zealand, the E.U., Canada, Uruguay, Paraguay, and Mexico.

The combined China/Hong Kong market is by far the largest beef importing region in recent years with total imports more than double the beef imports into the U.S., the second largest beef importing country. These top two markets account for 51 percent of global beef imports. Imports of beef into China/HK are forecast to be steady this year after growing rapidly in the past six years. U.S. beef imports are projected to increase in 2023 as declining beef production will reduce beef supplies, especially supplies of processing beef for the ground beef market. Other major beef importers include Japan, South Korea, the E.U., United Kingdom and Chile.

Global macroeconomic concerns continue to keep beef markets nervous. Slowdowns in some markets, notably China, have had some impact and, yet, global beef markets continue to be resilient and demonstrate continued, albeit rather slow, growth.

Derrell Peel discussed potential record high prices for cattle on SUNUPTV from April 15, 2023.

Grass Fever and Spring Checklist

Mark Z. Johnson, Oklahoma State University Extension Beef Cattle Breeding Specialist

Much of Oklahoma has received a good rain this week. Soft, slow and 1 - 3 inches of quantity over much of the state. I am extremely bullish on the future of the cattle business. Low cow inventories are, and will continue to add value to all ages and classes of beef cattle. The key to capitalizing on the future value of cattle is run your operation as a business. Managing your operation like a business means making sound, prudent financial decisions regarding your cattle inventories, pasture management, herd health and the purchase of inputs like feed. At this time of year it is easy for me to catch "grass fever" as the pastures green up. I immediately want more inventory and look forward to not rolling out hay and supplemental feed on as daily basis. At this time of year I am forced to remind myself: "not so fast."

If you find yourself in the same situation, take a deep breath, remember you are operating a business, and review the following checklist:

- Have my bulls undergone a Breeding Soundness Exam?

- Have I given pre-breeding vaccinations and dewormed my cow herd? Are my replacement heifers of adequate age and target weight to breed up quick and early ahead of my mature cow herd? Are my cows and bulls in adequate Body Condition for the onset of breeding season? Based on that answer, Do I need to continue with supplemental feed? Have I made a plan for weed control, fertilizer, deferred grazing and proper pasture management to insure my drought stressed grazing system gets ahead of grazing pressure? Do I have semen and supplies needed if I intend to synchronize estrus and Artificially Inseminate my cowherd? What is my hay and feed plan for next winter?

- Do I have ample bull power on hand to get cows covered early in the breeding season?

Bottom line: This is the time of year when it is easy to get excited about the cattle business. It is also time to be planning for the future and keep your business poised for economic sustainability.

Mark Johnson, OSU Extension beef cattle breeding specialist, previews the upcoming Blueprint for the Future Cattlemen's Conference on SUNUPTV from April 15, 2023.

Calving Season - Does It Matter?

Kellie Curry Raper, Oklahoma State University Extension Livestock Economist

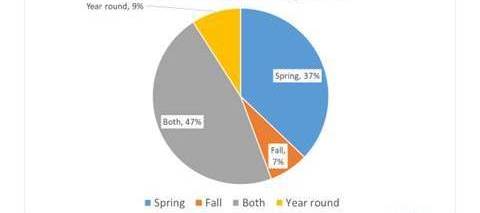

Among cow-calf producers, breeding season for the herd varies from a 30-day window to year-round. The chart below reflects calving season decisions reported by producers through the Oklahoma Beef Management and Marketing Survey in 2017. When producers were asked, 91% reported a defined calving season, with nearly half reporting both a fall and spring season.

Figure 1: Calving Season- Self identified, Oklahoma Producers' Self Identified

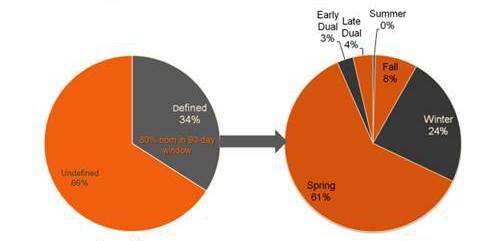

However, when compared to the same producers' percentages of calf crop born by month, only 34% had a defined calving season, defined as 80% of calves born in a 90-day window, or 80% of calves born across two distinct 90-day windows, i.e. dual seasons. This result is similar to the 2017 National Animal Health Monitoring System data, where 58.7% of operations had no set season.

Figure 2: Calving Seasons - Oklahoma. Overall (left), Defined (right).

Does a defined calving season - and thus a defined breeding season - matter? Let's take a look.

Year-round calving - Why shouldn't the bull be on continuous duty? If you want to keep cows on an annual calving cycle, they should be rebred within 80 days after calving. If the bull is a constant presence, females with reproductive issues that should be culled may take longer to detect. And the longer those issues take to detect, the more likely a cow misses a calving season - and the producer has cost associated with the cow, but no revenue to show for it. A defined breeding season highlights any breeding issues more quickly, allowing producers to select cows over time that return the highest value. It also facilitates more focused attention on bred cows and heifers as calving season starts, because there are fewer surprises as to the timing of births.

That's only one piece of the puzzle. Here are a couple more.

Impact on Cost per Cow - Though Ramsey et al's (2005) study of standardized performance data from 394 ranches in Texas, Oklahoma, and New Mexico is more than 15 years old now, we can still learn from it. Note that breeding season length in their study ranged from extremely short (less than one month) to 365 days, that is, year-round presence of the bull. In the ranches represented, each additional day in the breeding season decreased average pounds of calf weaned per cow per year by 0.16 pounds and increased the annual cost of producing 100 pounds of weaned calf by 4.7 cents. A year-round breeding season (365 days) would result in 45.82 fewer pounds of calf per cow per year on average than a 75-day breeding season. In 2004, cost per hundredweight of weaned calf was $13.63 higher for producers with year-round breeding seasons compared to those with 75-day breeding seasons. Producer price indices for September 2004 and September 2022 indicate those costs can be multiplied by 1.5 to get today's cost, estimated at $20.45 per hundredweight, or an additional cost of $112.48 for a 500-pound weaned calf.

Impact on Calf Value -What does breeding season have to do with calf value? A relatively narrow calving window facilitates recommended calf management practices, such as vaccinations, extended weaning, and other health management practices because calves are in a narrower age range and ready for practice implementation at the same time. This also facilitates marketing larger lots of uniform calves at sale time. This has value, even in small increments. Increasing lot size from a one-head lot to a five-head lot increased calf value on average by approximately $17/head in Oklahoma auctions with an increase of approximately $25/head for a ten-head lot over a one-head lot (Mallory, et al. 2016). This suggests that even small producers can benefit from a strategic calving season.

The Takeaway:

If you haven't recently contemplated how your breeding and calving seasons contribute to the value of your cattle operation, take some time to consider whether there are incentives to change it. If you want hard data, track cost and value for your own operation and compare it to alternative scenarios. Decision making on the ranch is a continuous feedback loop - and it's never out of season!

References

Mallory, S., E.A. DeVuyst, K.C. Raper, D. Peel, and G. Mourer. "Effect of Location Variables on Feeder Calf Basis at Oklahoma Auctions." Journal of Agricultural and Resource Economics 41(2016):393-405.

Ramsey, R., D. Doye, C. Ward, J. McGrann, L. Falconer, and S. Bevers. "Factors Affecting Beef Cow-Herd Costs, Production, and Profits." Journal of Agricultural and Applied Economics 37(2005):91-99.