Cow-Calf Corner | October 17, 2022

Mexican Beef and Cattle Industry Development Continues

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

USDA’s Foreign Agricultural Service recently released the latest Livestock and Poultry: World Markets and Trade report. The report provides estimates for production, consumption and trade for beef, pork and chicken for major countries. The article focuses on the Mexican beef and cattle industry.

Mexico continues to develop as a major beef exporting country. In recent years, Mexican beef production has continued to grow while total domestic consumption has been relatively stable leading to growing beef exports from the country. Current USDA projections for 2023 have Mexico as the number ten beef exporting country in the world. Over 80 percent of Mexican beef exports go to the U.S. although other global markets are receiving larger amounts of Mexican beef in recent years. Beef imports from Mexico have accounted for 18.9 percent of total U.S. beef imports and, 2021, Mexico was the second largest source of U.S. beef imports, accounting for a record 20.2 percent share of the total.

Mexico continues to be a significant beef importer with total beef imports relatively steady in the last decade. However, the current level of Mexican beef imports is about half of the peak levels in the previous decade. The majority of Mexican beef imports originate in the U.S. Beef exports from the U.S. to Mexico were relatively steady in the decade prior to the pandemic albeit at levels significantly lower compared to the peak levels in the 2000s. However, U.S. beef exports to Mexico decreased the past two years, with 2021 down 30 percent from 2018. Mexico has dropped from being the number three market for U.S. beef exports to number five behind Japan, South Korea, China/Hong Kong and Canada.

In the 1990s and early 2000s, Mexican beef imports were a matter of supplementing the total supply of beef to meet demand in the country. As domestic production and exports have developed, Mexico has been a net exporter of beef since 2015. Mexican beef exports and imports are now more a matter of specific product flows in and out to match domestic demand and increased value opportunities in global markets, similar to the economic role of beef trade in the U.S. and Canada. Mexico is the largest source of imported beef cuts that are marketed directly to consumers in the U.S.

Historically, Mexico had a comparative advantage in cow-calf production with many of the feeder cattle exported to the U.S. for growing, finishing and processing. For the past twenty years, the U.S. has imported roughly 1.2 million head of cattle from Mexico annually. In 2021, lower cattle imports, combined with increased cattle exports to Mexico, resulted in the lowest net cattle imports since 2016. Thus far in 2022, reduced cattle imports and increased cattle exports has reduced net cattle imports sharply and is projected to lead to annual net cattle imports of roughly 700,000 head, the lowest total since 2008. It is unclear if the current reduction in net cattle flows from Mexico to the U.S. is a short-term or long-term change. Short-term production conditions, e.g. droughts, does not appear to be the explanation although cattle number do change year to year. The change may be more long-term in nature as the continued development of beef production and net exports in Mexico may be a reason for fewer cattle exports in the coming years. Mexico continues to develop the finishing and processing infrastructure to retain more cattle in the country for value-added production. Time will tell how beef and cattle flows in Mexico continue to develop.

Preparing for Financial Opportunity – Turning Calves into Yearlings

Mark Z. Johnson, Oklahoma State University Extension Beef Cattle Breeding Specialist

To reiterate some points I made in my article last week. Cattle producers need to act as business managers and assess inventories of all resources (cows, calves, silage, feed grains and potential for winter grazing) to determine the best course of action to maximize their profit potential. This should include considering how feed resources are best used and various marketing endpoints to maximize returns and capture the greatest possible value. If you have calves on inventory and no wheat pasture to graze, this week we address the financial opportunity of turning those calves into yearlings without winter grass.

Consider the following:

- Drought has resulted in low cattle inventories. The laws of supply and demand dictate that the future value of cattle will increase. Feedlot placement data shows more light weight calves going on feed. At the time of this writing, the futures board looks promising for yearlings in the spring of 2023. The futures contract for March is at $179/cwt and May is at $185/cwt.

- This week the USDA Oklahoma Cattle Auction Summary tells us that 476 pound, Medium and Large frame, Muscle Score 1 steer calves traded at an average of $184.07/cwt. This translates to a total value per head of $876.

- A few weeks ago, my colleague, Dr. Dave Lalman put together a ration of roughly 1/3 Dry Distillers Grains, 1/3 rolled Corn and 1/3 chopped Wheat Hay. At August prices, this ration could be limit fed at a rate of 13.5 pounds/day (as is) to 500 pound growing calves resulting in an ADG of just over 2 pounds/day at a cost of gain (COG) of $0.83/pound.

- I will use more conservative figures (2 pound ADG and $0.85 COG) to work through the

following calculations:

- Limit feeding for 180 days until next May resulting in 360 pounds of gain at a cost of $306 per head resulting in an 836 pound yearling.

- This feed cost added to the current $876 value of the steer equals $1,182. To account for opportunity cost, financing, and potential death loss, I am raising this value by 10% resulting in a breakeven value of $1,300.

- Using the current futures board price of $1.85 for May predicts a value of (836 x $1.85) $1,546.

I encourage producers to check on current prices of feedstuffs in your area. Take inventory of your hay, silage, feed grains and potential for winter grazing. Manage your business, do the math, consult with a nutritionist and arrive at your own estimation of the cost of gain. For example, if we raise the COG to $1.30 in the example above, the breakeven goes to $1479.

Also consider feeding management, as limit feeding requires skills and facilities such as:

- Adequate bunk space to permit all calves to eat at the same time.

- Pens small enough so that all calves come to the bunk to eat at feeding time.

- A scale or method of weighing out the daily feed.

- Roughage feeds available for calves while working up to a high concentrate, limit fed diet.

- Time constraints and feeding skills of the manager. This limit feeding program works best when calves are fed at the same time each day.

- Business management skill to assess the economic limitations and opportunities.

- A plan for the use of or marketing of cattle following the limit growing program.

Resources:

Woods County Drought Meeting. Stretching Forage Presentation. David Lalman. August, 2022.

Oklahoma Cooperative Extension Service Fact Sheet: ANSI 3025

USDA Oklahoma Weekly Auction Summary. AMS Livestock, Poultry & Grain Market News Oklahoma Dept. of Ag Mrkt News. October 7, 2022

Opportunities for Growing Cattle on Self-Fed Rations

Paul Beck, Oklahoma State University State Extension Beef Nutrition Specialist

We are faced with conditions where it will likely be very valuable to buy or retain calves this fall to sell as feeders next spring. Lack of wheat pasture and cost of hay and feed have priced most of our normal production systems out of the market. Some other options that should be considered include using low quality products from grain, cotton, or peanut processing as roughage replacements in self-fed rations. Products like cotton gin trash, peanut hulls, or rice mill feed may be locally available or have the potential to be shipped in at a low enough price for these to be viable options for growing calves or wintering beef cows. Rice mill feed is a blend of 67% ground rice hulls and 33% rice bran from the rice milling industry. Gin trash is made up of cotton leaves, seed, immature bolls, stems, and lint from the cotton ginning process. Peanut hulls are the shell of the peanuts removed during processing. All of these are high in fiber and can be extremely variable in composition and nutrient profile.

| Feedstuff | Rice Mill Feed | Gin Trash | Peanut Hulls |

|---|---|---|---|

| Dry Matter, % | 96.4 | 93.1 | 92.0 |

| % of dry matter | |||

| Neutral Detergent Fiber | 54.3 | 69.2 | 88.7 |

| Acid Detergent Fiber | 40.1 | 60.8 | 79.1 |

| Crude Protein | 6.7 | 12.4 | 5.4 |

Adapted from Stacey and Rankins, 2004; and Kennedy and Rankins, 2008.

Self-feeding rations composed of rice mill feed and corn or rice mill feed and soybean hulls along with free-choice hay offered separately showed some promising results for growing calves. Research from Alabama in 2004 showed that growing steers fed a blend of 60% rice mill feed and 40% corn gained over 2.2 pounds per day and consumed nearly 22 pounds of feed and 3 pounds of hay per day. These dry matter intakes were over 3.3% of their bodyweight. As corn replaced more rice mill feed gains and intake of feed increased but hay intake decreased. Feed efficiency in this system were from 8.3 to 11.1 total pounds of feed and hay per pound of gain for the 40/60 rice mill feed/corn and 60/40 rice mill feed/corn blend, respectively. When soybean hulls were used as the energy source in similar rations, steers fed 70% rice mill feed and 30% soybean hulls consumed over 26 pounds of the feed and 4 pounds of hay on a dry matter basis, this equated to over 4.5% of bodyweight in daily dry matter consumption. Steers on the 70% rice mill feed diet gained 2.2 pounds per day, and as more soybean hulls replaced rice mill bed feed intake and average daily gains increased but hay intake decreased.

Similar research from Alabama in 2008 used peanut hulls and cotton gin trash as roughage replacements in self-fed rations. These diets included either 45% peanut hulls or cotton gin trash along with cracked corn at 55% or with 47% cracked corn and 8% cottonseed meal. The peanut hull/cracked corn diet was slightly deficient in protein which impacted both intake and performance, but steers still had daily fed and hay consumption rates over 3.3% of body weight and gained 1.9 pounds per day. Steers fed the peanut hull diet containing added protein from cottonseed meal consumed feed and hay at 3.7% of bodyweight and gained 2.25 pounds per day. Steers fed the gin trash diets consumed over 4% of their bodyweight daily and gained over 2.5 pounds per day.

- We normally do not expect growing steers consume over 2.5 to 3% of their bodyweight, but intakes over 3.3 to 4% of bodyweight are often observed in self-fed byproduct-based diets.

- Feeding a palatable moderate quality hay is essential for rumen health especially for the ground byproduct-based diets.

- These feeding systems have potential for use in cows, but the high intake of these diets can be cost prohibitive. So, a higher inclusion rate (60 to 80%) of rice mill feed, gin trash, peanut hulls, or other byproducts should be considered. Also, self-feeding should be time limited or physical barriers to limit access be put in place (such as lowering the door on the self-feeder) to limit intake.

- These feeding programs are most efficient and cost effective if on farm feed mixing and delivery can be implemented and truckload lots of bulk commodities can be sourced and stored on-farm.

- Contact your local Cooperative Extension office for assistance in developing and managing feeding programs to fit your operation.

Weather Related Sales of Livestock Tax Rules

JC Hobbs, Associate Extension Specialist, Department of Agricultural Economics

Over the past several months I have received many calls from livestock producers wanting information concerning the application of the Weather Related Sales of Livestock Rules provided by the IRS.

Last week, the IRS released Notice 2022-43: Extension of Replacement Period for Livestock Sold on Account of Drought. It reports that livestock producers in all 77 Oklahoma counties qualify for the 4 year extended period for replacing breeding, dairy, and draft animals that were sold in excess of normal beginning September 1, 2021 and during 2022. The beginning of the replacement is the first 12 month drought free period (September 1 to August 31). Producers electing to replace animals will have until December 31 of the fourth year. More detailed information can be found by using Google and searching for IRS Notice 2022-43.

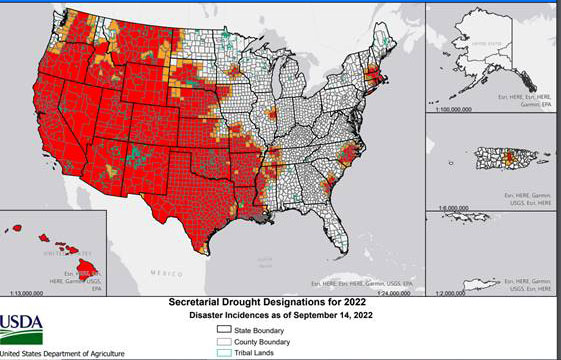

In addition, the Secretary of Agriculture federal disaster declarations for this year allow livestock producers to postpone reporting the gain from sales of any livestock in excess of normal for 2022 to be reported on their 2024 income tax return. The following map provides proof of the declarations by county from the secretary. More detailed information can be found by using Google and searching for USDA Secretary of Agriculture Drought Disaster Designations

In both scenarios, the treatment only applies to the number of animals sold in excess of normal annual sales.