Cow-Calf Corner | August 22, 2022

Feedlots Defy Gravity Again

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

Aided and abetted by the drought, feedlots put together another month of large placements in July. July placements were 101.8 percent of last year, despite growing indications that feeder supplies are declining. July 1 estimated feeder supplies outside of feedlots were down 2.7 percent year over year. Drought continues to force cattle to market sooner than planned. Oklahoma auction volumes of feeder cattle for the past six weeks are up 10.9 percent, consistent with the unexpectedly large placements in July.

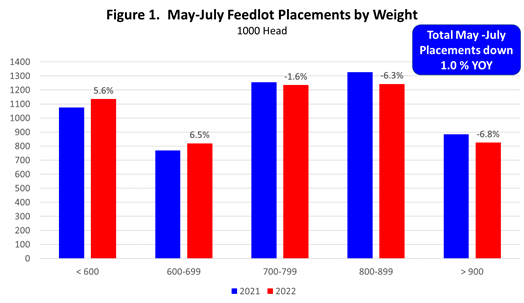

July feedlot placements included a 2.5 percent decrease in feeders weighing over 700 pounds, which was more than offset by a 9.5 percent increase in feeders weighting less than 700 pounds. Figure 1 shows that this is the third month in a row with increased placements of lightweight feeders and decreased placement of heavy feeders. Total feedlot placements in May – July were down 1.0 percent, with placements under 700 pounds up 6.0 percent and placements over 700 pounds down 4.7 percent. These lightweight placements will finish from November into the first quarter of 2023.

In fact, feedlot placements in the past six months, since February, have totaled 10.91 million head, up 0.8 percent year over year, and account for 97.2 percent of the 11.224 million head on-feed inventory on August 1. In those six months, placements weighing under 700 pounds are up 3.5 percent year over year, while placements over 700 pounds are down 0.7 percent. All of this suggests that feedlots are somewhat back-loaded with relatively tighter numbers finishing in the August – October period and recent lightweight placements finishing November and later.

The implications for feeder cattle markets may be even more important. Increased lightweight placements, especially since May, likely includes fall calves marketed right off the cow, early weaned spring calves and summer stockers marketed ahead of schedule. Pasture and range conditions are currently rated at 52 percent poor/very poor, the worst level for this time of year since 2012. It appears that the supply of calves and feeder cattle available this fall will likely be significantly smaller because many cattle have already moved to market.

Feeder cattle prices have been quite strong this summer with heavy feeder prices moving higher by more than seasonal amounts and calf prices moving counter-seasonally higher. In Oklahoma auctions, 750-pound steers reached the highest prices of the year in mid-August and 500-pound steer calves reached the highest level since the seasonal peaks in March. The trend for higher feeder cattle prices may severely diminish or offset seasonal lows for calves this fall.

Retained Ownership – Part 2 How Does a Beef Pricing Grid Work?

Mark Z. Johnson, Oklahoma State University Extension Beef Cattle Breeding Specialist

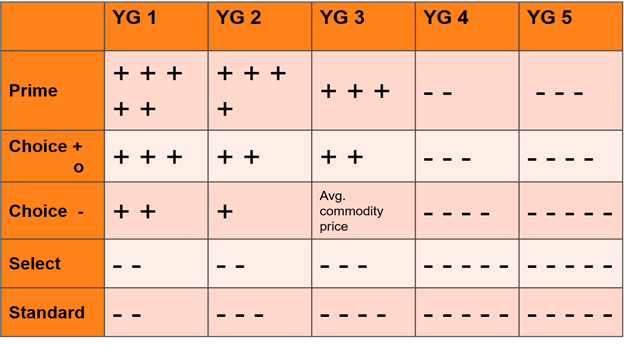

The vast majority of fed cattle are sold with price determined on a carcass value basis. Your pen of live finished cattle are harvested, carcasses are weighed, USDA Yield and Quality Grades are assigned. Optimum combinations of Quality and Yield Grades result in more $ value per pound of carcass weights sold. Price docks occur if carcasses are too light or too heavy. An example grid is shown below. Down the first column are the Quality Grades which indicate the tenderness, juiciness and flavor of cooked beef. Prime is the highest Quality grade, therefore is worth more $/pound than the lower Quality Grades listed below it. Across the top row are the Yield Grades which indicate cutability, or the percentage of close trimmed red meat yield from the beef carcass. Yield Grade 1 indicates the highest level of cutability and is worth more $/pound than the lower Yield Grades following it on that row.

Beef, like nearly all other Ag produced commodities is sold according to standard assumptions about the product. Those being acceptable hot carcass weight (HCW), which typically falls somewhere in the range of 600 – 1,000 lbs. As well, that the typical carcass combines a Yield Grade of 3 with Quality Grade of lower third of Choice. Historically, the biggest value difference occurred between Choice and Select carcasses. Likewise, Quality Grades have been the bigger driver of carcass value than Yield Grades. It’s worth noting the breakout of the Choice Quality Grade into thirds. Most Quality based, premium branded beef products require the upper two-thirds of Choice (or Prime) Quality grade status to meet their specifications. For example, Certified Angus Beef (CAB), a premium branded program has 10 specifications, one of which is a Quality Grade of upper two-thirds of Choice or Prime. Beef Quality and Yield Grades will be discussed in greater detail in parts 3 and 4 of this series on retained ownership.

Characteristics of Beef Pricing Grids

- Better than average combinations of Quality and Yield Grades receive premiums over commodity price. Poorer than average combinations receive discounts.

- Value of the Carcass = HCW x Price per pound (as determined by the grid)

- There are many types of grids designed by packers to stratify and incentivize different types of carcasses; however, there is typically more economic incentive for Quality.

- Prices (premiums, discounts, acceptable HCW) can and do change weekly relative to the supply of fed cattle and consumer demand.

- Knowing the history and genetic potential of your cattle is critical when deciding if retaining ownership and selling on a grid is best for your operation.

Dr Mark Johnson discussed retained ownership on SunUp TV’s Cow-Calf Corner on August 13, 2022.

Manage Shrink when Marketing Weaned Calves this Fall

Paul Beck, Oklahoma State University Extension Beef Nutrition Specialist

When selling calves shrink is a concern because it is a reduction in the sales weight, but abnormal levels of shrink is often used as a health indicator for cattle arriving in receiving facilities at stocker operations, grow yards, and feedlots. Adjustments in price are common to compensate for varying shrinkage and gut fill.

Shrink is often characterized in two categories; fill shrink and tissue shrink. Fill shrink is the loss of excreta from the digestive system. This type of shrink is common in marketing and can be recovered quickly in a few days once cattle are back on feed and water. Tissue shrink is more severe, with shrinkage levels greater than 6%, associated with long periods without feed and water along with other stressors, such as long-distance transport, weaning, rough handling, or heat stress. Tissue shrink may take up to 30 days to recover.

Selling calves directly after weaning leads to some of the highest levels of shrink. Weaning is stressful and calves are often unfamiliar with water and feed locations, so may refuse to eat or drink even when feed and water are offered. Preconditioning programs have been designed to reduce weaning stress’ effect on calves later in production by enhancing the immune system and teaching calves to eat from a feedbunk and drink from a water tank or fountain at the ranch of origin. Preconditioning calves before marketing reduces shrink because the stress of separation from the dam has already occurred and calves are familiarized with handling and feed and water sources. Unweaned calves transported directly to the auction market can have shrinkage of 7 to 10% while preconditioned calves can have 2 to 5% shrinkage.

Dietary interventions can be used to reduce shrink. Steers coming off wheat pasture were transported for 4-hours either directly off pasture or after they were given access to hay and water for 24-hours. Initial shrink after only 30-minute hauls were similar and only around ½% of initial weight. Weight loss of steers moved directly from pasture were much greater than steers fed hay before transport when hauls were 1 to 2 hours. After 4-hours of transit steers directly off wheat lost 37 pounds (5.1% shrink). Steers given access to hay before transport lost 28 pounds (3.85% shrink) over the same haul. This shows that shrink losses were about 1.28% per hour of transport, but providing access to a dry hay before transport decreases shrinkage rates to 0.96% per hour. The reduced shrink was likely due to slower passage rate of feed through the digestive tract and less water loss.

Cattle market surveys have shown that calves that are gaunt or shrunk prior to marketing have $2 to 4/hundredweight premium over cattle with average fill. These premiums are unlikely to cover the lost revenue from the excessive weight loss due to shrink. Calves that were classified as ‘full’ or ‘tanked’ were discounted $4.73 and $11.10/hundredweight, respectively, in a survey of Arkansas feeder cattle markets. These large discounts are reflective of the buyer belief that excessive shrink will occur before cattle reach their final destination. There is value to both the buyer and seller for calves to have a fair weigh up at marketing.