Cow-Calf Corner | April 12, 2021

Update on Beef Export Markets

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

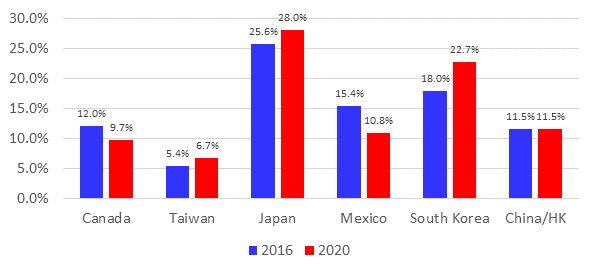

Beef exports have evolved significantly in recent years in a very dynamic environment of global politics and trade policies; direct and indirect impacts of animal disease outbreaks; and growing beef preferences and consumption. Compared to five years ago, total beef exports in 2020 were up by 15.6 percent over 2016. Total U.S. beef exports dropped 4.2 percent year over year in 2019 from the all-time peak level in 2018 with decreased exports to most major export destinations. The COVID-19 pandemic significantly disrupted global beef trade in 2020. Total beef exports dropped a further 2.3 percent year over year in 2020 as a result of the pandemic. Thus far in 2021, the two-month total of beef exports for January and February is down 1.1 percent year over year. However, total annual beef exports for 2021 are forecast to increase modestly over last year. Figure 1 shows the market share of beef exports to major destinations in 2016 and 2020.

Figure 1. U.S Beef Exports Market Share, 5-Year Change.

Japan has been the largest U.S. beef export market since 2013 (and was for many years prior to 2004) with the 2020 market share at 28 percent of total exports. Beef exports to Japan grew at an average rate of 9.7 percent annually from 2016 to 2020 with peak exports in 2018 and a decrease in 2019 before rebounding modestly in 2020, despite pandemic disruptions. In the first two months of 2021, beef exports to Japan are down 11.5 percent year over year.

South Korea has been the fastest and most consistently growing major U.S. beef export market in recent years. South Korea became the second largest beef export market in 2016, moving ahead of both Canada and Mexico. Beef exports to South Korea have increased by an average of 17.4 percent in the last five years, pushing the country to a nearly 23 percent market share in 2020, just behind Japan. In fact, in the first two months of 2021, beef exports to South Korea are up 15.1 percent year over year pushing South Korea just ahead of Japan as the number one beef export market so far this year.

The combined China/Hong Kong market is the third largest U.S. beef export market. Though the data is reported separately, it is important to look at the net total since the two really represent a single market. Reported separately, Hong Kong has been a major export market for U.S. for more than a decade. However, it has been recognized for a number of years that some of the exports to Hong Kong were ultimately transshipped into China. It was expected that, as exports to China began to grow, some of the increase would likely offset decreased exports to Hong Kong. Exports to China began at a very slow pace following access in 2017. Only in 2020 did beef exports to China jump sharply and, as expected, exports to Hong Kong have decreased. The market share of beef exports to China/HK was 11.5 percent in 2020; the same as in 2016. However, in 2020, the total included 35 percent exports to China with the balance to Hong Kong; compared to 2016 when 100 percent of the exports were to Hong Kong. In the first two months of 2021, the China portion of the China/HK market is up 998 percent year over year while Hong Kong is down 18.3 percent with the China portion making up 67 percent of the two-month total. Total exports to China/HK in January and February 2021 are up 115 percent year over year.

Mexico is currently the third largest U.S. beef export market. Mexico’s economy has taken a serious hit since the last federal election and, combined with the pandemic impacts the past year, resulted in a 24.7 percent year over year decrease in beef exports in 2020. As recently as 2019, Mexico was the number two beef export market with a 14 percent market share. Recovery of beef exports to Mexico is likely to be slow with limited chances for improvement in 2021.

Beef exports to Canada have decreased an average of 2.3 percent annually in the last five years dropping the country to the number five beef export market currently. The market share of beef exports to Canada has declined from 12 percent to less than 10 percent (Figure 1) from 2016 to 2020. In the first two months of 2021, beef exports to Canada are down 7.5 percent year over year and the country has an 8.9 percent share of total exports thus far in the year.

Beef exports to Taiwan have increased an average of 13.5 percent annually since 2016, increasing the country’s market share to 6.7 percent in 2020 (Figure 1). However, total beef exports to Taiwan were essentially unchanged in 2020 compared to the previous year and are down 23.8 percent in the first two months of 2021.

Bull Management before the Breeding Season

Parker Henley, Oklahoma State University Extension Livestock Specialist

A significant portion of reproductive failures in cow-calf enterprises are due to the fertility of the herd bull. With turnout just around the corner, it’s time to focus on your bull battery. Most spring calving cow-calf operations are 30-60 days from the start of the breeding season. There are two major considerations to keep in mind during this pre-turnout period:

- have a veterinarian conduct a breeding soundness exam (BSE) on all potential herd sires,

- monitor body condition score and slowly transition the newly purchased young bulls to a grazing setting.

Bull breeding soundness is one of the most economically important traits for cow-calf producers. Thus, a BSE is recommended to measure a bull’s potential to achieve satisfactory conception rates. The BSE should include examination of the reproductive anatomy, scrotal measurement, sperm motility, sperm morphology (physical characteristics), locomotion, eyesight and body condition score. A bull that passes the BSE appears to be sound for breeding purposes as best as science can determine at that point in time. Bulls should have a BSE 6-8 weeks prior to turn out. If a bull fails the BSE, this allows producers to have enough time to replace the animal with a sound bull for the breeding season.

Each year cow-calf operations purchase yearling bulls to replace sub-fertile bulls or poor genetics. Many seedstock producers develop bulls on grain-based, high energy diets prior to sale. Because bulls are typically managed to maximize gain and achieve physical characteristics appealing to buyers at a sale, they have the potential to be over-conditioned upon purchase. Bull buyers should consider gradually transitioning their newly purchased bulls to a lower energy, forage-based grazing system over the 30-60 days before they turn him out on cows. This period can allow the bull to shed excess fat and reach an optimum body condition for the breeding season. These bulls should be kept in a large enough pen or pasture so they can get daily exercise. When multiple bulls are used in a single pasture, they should be exposed to each other prior to turnout to minimize bull interactions once they join the cowherd. In conclusion, it’s never too early to plan for your next breeding season.

To view Dr. Johnson’s discussion on Maternal EPDs on Sunup TV Cow-Calf Corner from April 10, 2021.

Total Quality Management

A Foundational Approach of the Beef Quality Assurance Program

Bob LeValley Oklahoma Beef Quality Assurance Coordinator

One aspect of “quality” is providing products that meet or exceed expectations and established requirements. Established product requirements in the beef industry may differ somewhat from one segment of the industry to the next, but there are some common expectations fundamental to each.

The commercial cow/calf operator sells weaned calves, cull cows and bulls. Weaned calves should possess performance, health and potential carcass characteristics that satisfy stocker operators and cattle feeders, while meeting food safety requirements. Culled breeding stock must meet the food safety and carcass characteristic requirement of market cow and market bull processors.

As products of stocker operations, feeder cattle should meet the requirements of cattle feeders for performance, health, potential carcass characteristics and food safety. Fed cattle must meet the expectations of beef processors for health, carcass attributes and food safety. Commodity beef products must meet requirements of beef purveyors for fat cover, marbling, carcass size, safety, and lack of defects such as injection site blemishes, dark cutters, etc. Beef sold to the consumer, must meet expectations for both food safety and eating satisfaction. The common theme is that quality in the beef industry includes and goes well beyond food safety. Animal performance, health, carcass characteristics and eating satisfaction, are often the result of various and cumulative management decisions, many of which go all the way back to the cow/calf operation.

The Beef Quality Assurance program focuses on many of the “quality” factors that producers will influence in each production segment of the industry. By doing so, it helps to assure consumers that cattle shipped from a beef production unit are healthy, wholesome, and safe. To become a BQA certified producer, complete the on-line certification program at www.BQA.org or contact your OSU Extension educator, or the Oklahoma Beef Council for information on an in-person certification program near you.