The Financial Puzzle: Credit Reports and Scores

There are many reasons consumers choose to open a credit account. Having a credit card for emergencies, or for taking advantage of a sale are a few of them. Wanting a credit card and getting a credit card are two separate matters. Many consumers do not understand credit reports and how they affect credit scores. Forty percent of consumers do not order the free credit reports that are available from www.annualcreditreport.com. Ultimately, credit scores determine whether you can get credit and how much you will pay for it. In this case, what you don’t know can hurt you.

The way creditors make decisions about credit and the rates they charge are based

upon a consumer’s credit worthiness. Loaning money is risky to the lender, because

when the borrower cannot repay, the lender loses the money that has been loaned. Credit

worthiness or consumer risk factors are based upon information reported to a credit

agency.

There are three large credit reporting agencies (CRAs) that gather and compile credit

information from credit providers and suppliers, including banks, credit card issuers,

mortgage companies, and other lenders. The information they compile is often referred

to as a credit report.

Credit Reports

Although credit reports from each of the credit bureaus look different, the information

found in the report is generally the same. The following information is included in

a credit report.

✓ Identifying Information—Information such as your name, address, Social Security number, and date of birth

are used to identify you and match you to your credit history. This information comes

from your creditors and is based upon what you submit to them. Identifying information

is not used in determining your credit score.

✓ Trade Lines—This is a fancy term for your credit accounts. Lenders report on the accounts you

have with them. They report the type of account (bankcard, auto loan, mortgage, etc.),

the date you opened the account, your credit limit/loan amount, the account balance,

the amount of your monthly payment and your payment history.

✓ Credit Inquiries—When you apply for a loan, you authorize the potential lender to check your credit

report. The inquiries section of the report contains a list of everyone who has accessed

your credit report within the last two years. The report will list consumer inquiries,

spurred by your own requests for credit, credit inquiries made by creditors that you

already have accounts with, and promotional inquiries, that result from potential

lenders who request a list of consumers that fit a certain profile so they can be

offered credit.

✓ Public Record and Collection Items—Credit reporting agencies also collect public record information from state county

courts and information on overdue debt from collection agencies. Public record information

includes bankruptcies, foreclosures, suits, wage attachments, liens, and judgments.

Credit Score

Since a lender wants to know what kind of risk they are taking by loaning money, credit

reporting agencies use the information found in your credit report to determine a

mathematical score that indicates how much risk is involved in loaning you money.

The score is referred to as your credit score. Just like grades in school, the higher

the number the better. One score, the VantageScore, even assigns a grade between “A”

and “F” based upon the numeric score.

Each consumer actually has five credit scores, which lenders can use. The credit reporting

agencies, Experian, TransUnion, and Equifax each issue a form of the FICO score while

TransUnion and Experian also issue a VantageScore. FICO scores range from 300 to 850.

A VantageScore ranges from 501 to 990. The information used to determine the score

will vary by credit agencies and so will your score. Your credit scores can change

based on what actions you take in your financial life, for example, take out a car

loan, pay off a credit card, or miss a payment.

A credit score is sometimes called a FICO score because credit bureaus use computer

software developed by the Fair Isaac Company. Your FICO score provides a good guide

in determining whether you will be a good or bad credit risk. Having a high or low

credit score does not determine whether a person will be a good or bad customer. The

FICO score is based on credit data only, and lenders may have other factors they take

into account when determining credit risk.

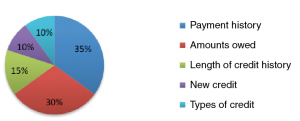

There is no clear-cut formula used for calculating a credit score, but there are five

components that make up the FICO score:

✓ Payment history is 35 percent of your score. This can include number of accounts

paid as agreed, number of accounts paid past due, the type of accounts you have held

in the past (credit cards, mortgages, car loans, etc.) and severity of past due items.

✓ Outstanding balances makes up 30 percent of your credit score. This can include

amounts owed on your accounts, the amounts owed on certain types of accounts, and

also the number of accounts with balances.

✓ Length of credit history makes up 15 percent, which includes length of time the

account has been open and length of time since the account was last used.

✓ New credit and types of credit make up 10 percent each. New credit can include

new accounts opened and recent credit inquiries as well. Types of credit refer to

the traditional versus nontraditional or secured versus unsecured credit in your financial

history, i.e., loans, credit cards, mortgages, etc. are traditional.

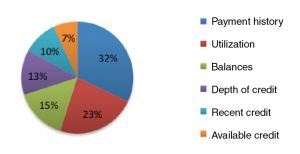

The VantageScore uses six variables to determine the credit score and assigns values to them that are different than those assigned to the FICO score, even though payment history is still the largest determinant of credit score. The variables are highlighted below:

Mistakes on Your Credit Report

Having a common last name like Smith or Jones can lead to mistakes in credit reporting

as well as people living in the same area with the same name. Mistakes in credit reports

do occur. A study conducted by the Policy and Economic Research Council found potential

errors in 19.2 percent of credit reports examined. Once consumers disputed errors

and got the bureaus to fix them, less than 1 percent of these corrected reports led

to meaningful increases in credit scores. What does ‘meaningful increase’ mean? The

errors that were found and corrected were not enough to push the consumer into a better

credit risk tier.

How do you fix a mistake that you find on your credit report? To ensure that mistake

gets corrected as quickly as possible, contact both the credit bureau and creditor

that provided the information to the bureau. Both these parties are responsible for

correcting inaccurate or incomplete information in your report under the Fair Credit

Reporting Act.

Obtaining Your Credit Report

Why would you want to check your credit report? You can check for inaccuracies on

your credit report and guard against identity theft. You have the right to a free

credit report from each of the three credit bureaus once a year. To order your free

credit reports visit www.annualcreditreport.com, call 1-877-322-8228 or complete the Annual Credit Report Request Form found at ftc.gov/credit

and mail it to: Annual Credit Report Request Service, PO Box 105281, Atlanta, GA 30348-5281.

Although your credit report is free, you will not be able to see your credit score

for free. To view your score you must pay a fee.

Beware of bogus websites that want to charge a fee to view your report. Only annualcreditreport.com is authorized to provide your credit report free of charge. Some imposter sites direct

you to another site that will try to sell you something or collect your personal information.

Annualcreditreport.com and the nationwide consumer reporting companies will not send you an email asking

for your personal information. If you get an email, see a pop-up ad, or get a phone

call from someone claiming to be from annualcreditreport.com or any of the three nationwide consumer reporting companies, do not reply or click

on any link in the message. It is probably a scam. Forward any such email to the FTC

at spam@uce.gov.

Regularly checking your credit history is a good financial practice that can help keep you on track. It is important to know your credit standing. Correcting inaccuracies in a report can take some time so it is better to stay on top of things rather than waiting until you get ready to make a major purchase.

References

“My FICO Booklet.” MyFICO.com. Fair Isaac Corporation, 2010-2011. Web. http://www.myfico.com/Downloads/Files/myFICO_UYFS_Booklet.pdf.

Sherman, Lauren. “Forbes.com.” Eight Reasons Why We Overspend. Forbes.com, 05 Feb

2009. Web. http://www.forbes.com/2009/02/05/why-we-overspend-lifestyle_0205_overspend.html.

Brooke Kusch, MS

Family Financial Planning

Sissy R. Osteen, Ph.D., CFP©

Associate Professor and Resource Management Specialist

Related Categories