Does My Town Sell a Lot of (Legal) Weed? Medical Marijuana Dispensary Gap Analysis Across 77 Oklahoma Cities

Introduction and Background

In 2018, Oklahoma became the 30th state to legalize the medical use of marijuana, also known as cannabis or “weed.” State Question 788 passed with 57% percent voter approval, legalizing marijuana while also imposing a 7% excise tax on all sales and designating the Oklahoma Medical Marijuana Authority (OMMA) to regulate the industry (Aston, 2024). At the time, Oklahoma had lighter marijuana regulations than most states, causing the industry to boom in terms of both the number of growers and dispensaries (Romero, 2021). By 2021, it was clear that the industry was growing excessively, with the OMMA only able to inspect less than 40% of licensed businesses (Mangold, 2021). In 2022, the state legislature placed a moratoriumon new applications for grower,processor and dispensary licenses. Nonetheless, a 2023 report found that growers in the state generated 64 times more product than what the state’s 385,000 licensed medical marijuana patients were capable of legally purchasing (Cannabis Public Policy, 2023).

By early 2023, State Question 820 was on the Oklahoma ballot to legalize recreational use of marijuana, leading to high hopes from many within the state’s marijuana industry that it would once again expand. However, each of Oklahoma’s 77 counties voted against Question 820 (Demko, 2023). This, combined with an excessive volume of growers/dispensaries from the early boom, led to a radical shrinkage of the medical marijuana industry in the state: By February 2024, grower licenses were down 34.7% from a year prior while processor licenses were down 21.2%, dispensary licenses were down 13.4% and patient licenses were down 11% (MJBizDaily, 2024).

The Oklahoma medical marijuana industry has been the subject of a significant amount of negative press, including its association with black-market activity, links to organized crime, and potential impacts to local utilities and water districts (Rotella et al., 2024; Bodine, 2021). However, there are also positive aspects, particularly associated with dispensaries. In addition to creating jobs in rural locations where large employers are often scarce, dispensaries collect sales tax revenue. Alternatively, while this tax revenue generation is good for local governments, residents may not want their hometown to become a hotbed for weed sales.

This fact sheet uses a technique known as retail gap analysis to answer the question, “What Oklahoma cities sell the most medical marijuana relative to their local population?” Residents and businesses can use the information presented here to assess to what extent the largest city in their county is attracting outside marijuana consumers. They can also use the data sources and methods outlined to calculate the “weed gap” for other cities across Oklahoma.

Data and Methods

Gap analysis is a technique to identify strengths and weaknesses in a specific geographical area’s retail industry (Shideler and Malone, 2017). This analysis is usually performed at the city level (as opposed to the county) because a shopper’s decision to “go shopping” typically occurs with a specific place in mind.

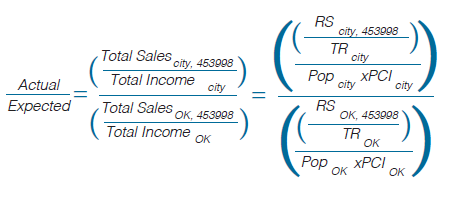

The “gap” is a simple ratio between the actual and expected percentage of income captured by a city for a particular retail category (see equation below). This calculation is also known as retail surplus – when actual is more than expected – or retail leakage (vice versa). Instances of retail surplus are indicative of a strong sector that is drawing in customers from outside the city.

Medical marijuana dispensaries use a specific North American Industry Classification

System (NAICS) 6-digit code in Oklahoma: 453998. All sales tax collected for this

code are reported to the Oklahoma Tax Commission, which captures (and makes public)

this information for each city in the state.

The actual percentage of income captured by a retail category is calculated by the total amount of sales for that category divided by total income in the city. These, in turn, are calculated using the retail sales tax collected for that NAICS code by the city and the city sales tax rate (numerator) and the total city population and per-capita income (denominator).

Similarly, the expected percentage of income captured is the state-level amount of sales for the good divided by the total income in the state. It is the “typical” percentage of income spent on this good across all of Oklahoma.

The Gap Analysis Formula and Online Data Sources

The result of these calculations is a gap, or number that reveals how much spending

on a product is occurring in a specific town compared to what is expected. A gap of

1 indicates that sales from medical marijuana dispensaries are exactly what would

be expected for the city’s population and income. A gap of 2 means that actual sales

are twice what would be expected (i.e. a surplus of sales), while a gap of 0.5 would

reveal a significant leakage – that is, sales are only half of what is expected.

Figure 1. Gap analysis formula.

Variables and online data sources used in Gap Analysis

RS city, 453998 : Tax Collections at the city level from Medical Marijuana Dispensaries (NAICS 453998), June 2023 year-to-date

TR city : Tax Rate at the city level, June 2023 (ranges from 0.02 to 0.05)

RS OK, 453 9 9 8 : Tax Collections at the state level from Medical Marijuana Dispensaries (NAICS 453998), June 2023 year-to-date

TR OK: Tax Rate at the state level, June 2023 (0.045)

Available from: OK Tax Commission Public Reports

- “View Public Reports” -> “Tax by NAICS Report”

Pop city : City’s Population, 2022

Pop OK : State’s Population, 2022

PCI city : City’s Per Capita Income, 2018-2022 Estimate

PCI OK : State’s Per Capita Income, 2018-2022 Estimate

Available from: Census Website

Gap Analysis for 77 Oklahoma Cities

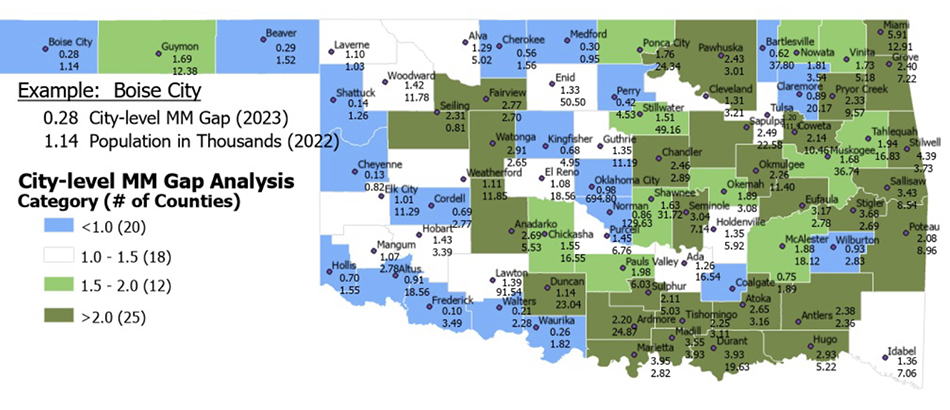

Figure 1 displays city-level gap coefficients for the largest city in each Oklahoma county, using the most recent data available (2022 Census data and tax data for the fiscal year ending June 2023). The city population is also listed. The county containing each city displays a color corresponding to four levels of city gap coefficients, ranging from the highest (over 2.0) to the lowest (less than 1.0).

Table 1 provides data and gap analysis comparisons for cities with similar populations.

Figure 2. City-level MM gap analysis category map of Oklahoma.

Discussion

Given that marijuana is illegal for both medical and recreational use in Kansas and Texas, a pattern of higher gaps in cities near those borders was expected. While there are some high gap coefficients in certain Northern and Southern border cities, like Miami near Missouri and Kansas or Marietta, Madill and Durant near Texas, the most surprising gaps were found on Oklahoma’s eastern border. In these border states (Arkansas and Missouri), medical marijuana is legal. Gaps over 2 were found in every city analyzed along the eastern (mostly Arkansas) border except Idabel. This raises the question, “Why would Arkansas residents be shopping for medical marijuana in Oklahoma, perhaps even more than Texas residents?”

According to the Oklahoma Medical Marijuana Authority, Oklahoma has medical marijuana card reciprocity with Arkansas, meaning Arkansas cardholders can easily obtain a 30-day temporary license by simply paying $100 and displaying their Arkansas card. This makes legal medical marijuana in Oklahoma accessible for many Arkansans, but the question remains: Why would they travel further to buy cannabis in Oklahoma when they have dispensaries in-state?

The answer to this lies in a comparison of the available supply of medical marijuana across the two states. Arkansas is much more heavily regulated than Oklahoma, with only 33 dispensaries and eight growers across the entire state (Arkansas Department of Finance and Administration, 2024). This stands in stark contrast to the 3,875 growers and 2,145 dispensaries in Oklahoma (Oklahoma Medical Marijuana Authority, 2024). As one might expect, anonymous advice exchanged between Arkansans on online forums (Reddit forum ARMMJ, 2023) is clear: Leave the marijuana oligopoly of Arkansas and shop in Oklahoma, where a perfectly competitive market provides weed that’s both cheaper and higher quality.

U.S. Highway 412 and Interstate 40 are two of the major crossings between Arkansas and Oklahoma. Running a gap analysis on the first city into Oklahoma along each of these highways (West Siloam Springs, population 1,040; and Roland, population 3,633) returns gaps of 36.81 and 12.02 respectively. Though they aren’t the largest cities in their counties, and gaps in small towns tend to appear more extreme due to their population, these incredibly high numbers seem to validate the theory that Arkansas residents are making sizeable contributions to medical marijuana sales in the state of Oklahoma.

While the east side of Oklahoma has large medical marijuana gap coefficients, the western half has small ones. Beaver and Boise City in the panhandle are selling just over a quarter of what their populations should in theory demand. Shattuck, Cheyenne and Frederick are even lower, having the lowest gap coefficients in the state from the cities we analyzed. This may be due to different perceptions of medical marijuana in agricultural-dominant locations, or simply because of the smaller number of dispensaries in these more rural areas.

Table 1 demonstrates that city size also has an impact on marijuana sales: Apart from outliers Seiling and Laverne, all the cities we analyzed with populations less than 2,000 had gaps far below 1. Many medium-sized cities (2,000 – 17,000) seem to have higher gap coefficients, but of Oklahoma’s three largest cities, Tulsa has a gap of 1.20 followed by Norman and Oklahoma City with gaps of 0.86 and 0.98 respectively. Larger cities tend to have gaps closer to one given that their sales are divided by a very high total income, but it is likely that other cities in the Oklahoma City and Tulsa metro areas are competing for marijuana sales.

Limitations and Conclusion

While it is interesting to observe trends across the state of Oklahoma through the lens of gap analysis, there are some limitations on the usefulness of the data. The gap analysis performed here does not consider marijuana sales outside a county’s largest city. Through our analysis of the largest cities, we have accounted for 61.7% of all legal medical marijuana sales in the state. Similar gaps for other cities across the state can be calculated using the formulas and publicly available data sources detailed above.

It is also worth noting that NAICS 453998 is formally for “All Other Miscellaneous Retail Stores (excluding Tobacco).” While dominated by medical marijuana dispensaries in Oklahoma, it is possible that other NAICS 453998 establishments might exist in a community – for example, candle shops or hot tub stores. If so, the reported sales from those establishments would be included in the gap analysis reported here (and the medical marijuana gap number reported would be overstated). Unfortunately, it is not possible to isolate dispensaries given the current tax reporting system. A more complete listing of other businesses included in NAICS 453998 can be found in the U.S. Census Bureau reference at the end of this report.

Finally, not all marijuana sold is sold legally and therefore able to be measured: A 2023 study by Cannabis Public Policy Consulting estimated that only 38% of medical marijuana consumed by Oklahoma residents is bought through regulated sources, which would appear in the Oklahoma Tax Commission data used. Nonetheless, the data and patterns discussed here clearly show the impact of being located next to states where the industry is either nonexistent or much more heavily regulated.

Table 1. Medical Marijuana Gap Analysis for the Largest Town in each Oklahoma County, by Population (2023).

| County | Largest City | Population (2022) | Per-Capita Income | Tax rate | Marijuana Sales | Retail Sales | Marijuana Sales as % of Retail | Gap |

|---|---|---|---|---|---|---|---|---|

| Population <1,999 | ||||||||

| Dewey | Seiling | 806 | $28,610 | 4.00% | $414,565 | $16,439,527 | 2.52% | 2.310 |

| Roger Mills | Cheyenne | 817 | $26,302 | 3.00% | $22,263 | $5,583,239 | 0.40% | 0.133 |

| Grant | Medford | 949 | $29,468 | 4.00% | $64,454 | $5,172,840 | 1.25% | 0.296 |

| Harper | Laverne | 1,035 | $22,316 | 3.25% | $197,297 | $9,168,338 | 2.15% | 1.098 |

| Cimarron | Boise City* | 1,140 | $23,567 | 3.00% | $59,067 | $10,289,390 | 0.57% | 0.282 |

| Ellis | Shattuck | 1,262 | $24,888 | 4.00% | $33,618 | $11,662,750 | 0.29% | 0.138 |

| Beaver | Beaver* | 1,524 | $25,628 | 3.00% | $89,372 | $8,884,383 | 1.01% | 0.294 |

| Harmon | Hollis | 1,552 | $24,444 | 3.00% | $207,014 | $7,822,876 | 2.65% | 0.701 |

| Alfalfa | Cherokee* | 1,556 | $31,403 | 3.25% | $211,533 | $12,196,505 | 1.73% | 0.556 |

| Jefferson | Waurika | 1,824 | $20,303 | 3.00% | $74,696 | $9,511,109 | 0.79% | 0.259 |

| Coal | Coalgate | 1,886 | $24,377 | 3.00% | $268,693 | $14,582,744 | 1.84% | 0.751 |

| 2,000-2,999 | ||||||||

| Cotton | Walters | 2,281 | $25,175 | 3.00% | $95,054 | $11,655,205 | 0.82% | 0.213 |

| Pushmataha | Antlers | 2,361 | $18,216 | 3.50% | $795,312 | $30,043,773 | 2.65% | 2.376 |

| Blaine | Watonga* | 2,651 | $15,818 | 5.00% | $950,768 | $28,645,208 | 3.32% | 2.913 |

| Haskell | Stigler | 2,687 | $20,707 | 3.50% | $1,594,444 | $56,430,264 | 2.83% | 3.682 |

| Major | Fairview | 2,703 | $27,623 | 4.00% | $1,609,040 | $25,792,179 | 6.24% | 2.769 |

| Washita | New Cordell | 2,769 | $26,477 | 4.00% | $393,779 | $18,684,992 | 2.11% | 0.690 |

| Greer | Mangum | 2,775 | $19,313 | 3.00% | $444,101 | $11,368,726 | 3.91% | 1.065 |

| McIntosh | Eufaula | 2,776 | $21,048 | 3.50% | $1,439,844 | $45,660,260 | 3.15% | 3.166 |

| Love | Marietta | 2,820 | $21,180 | 3.00% | $1,833,735 | $21,369,277 | 8.58% | 3.945 |

| Latimer | Wilburton | 2,828 | $20,123 | 3.50% | $411,528 | $27,002,777 | 1.52% | 0.929 |

| Lincoln | Chandler | 2,886 | $26,264 | 4.00% | $1,452,847 | $71,421,265 | 2.03% | 2.463 |

| 3,000-4,999 | ||||||||

| Osage | Pawhuska | 3,009 | $24,792 | 4.00% | $1,412,542 | $32,194,975 | 4.39% | 2.433 |

| Okfuskee | Okemah | 3,078 | $18,309 | 3.50% | $830,719 | $25,307,813 | 3.28% | 1.894 |

| Johnston | Tishomingo | 3,110 | $17,996 | 3.00% | $978,961 | $25,497,166 | 3.84% | 2.248 |

| Atoka | Atoka* | 3,160 | $26,230 | 4.00% | $1,710,248 | $76,881,236 | 2.22% | 2.651 |

| Pawnee | Cleveland | 3,213 | $26,957 | 3.50% | $884,880 | $54,275,213 | 1.63% | 1.313 |

| Kiowa | Hobart | 3,386 | $17,313 | 4.00% | $650,679 | $23,922,114 | 2.72% | 1.426 |

| Tillman | Frederick | 3,486 | $21,161 | 3.50% | $56,812 | $13,019,992 | 0.44% | 0.099 |

| Nowata | Nowata | 3,543 | $24,444 | 3.00% | $1,216,817 | $22,221,787 | 5.48% | 1.805 |

| Adair | Stilwell* | 3,732 | $16,644 | 3.75% | $2,120,262 | $59,300,571 | 3.58% | 4.386 |

| Marshall | Madill | 3,929 | $27,342 | 3.00% | $2,968,051 | $87,471,232 | 3.39% | 3.550 |

| Noble | Perry | 4,526 | $29,817 | 4.25% | $445,262 | $33,034,800 | 1.35% | 0.424 |

| Kingfisher | Kingfisher | 4,947 | $30,498 | 3.50% | $803,575 | $75,719,640 | 1.06% | 0.684 |

| 5,000-6,999 | ||||||||

| Woods | Alva | 5,020 | $28,218 | 4.25% | $1,418,611 | $61,248,986 | 2.32% | 1.287 |

| Murray | Sulphur | 5,025 | $30,745 | 3.00% | $2,532,088 | $78,556,571 | 3.22% | 2.106 |

| Craig | Vinita | 5,180 | $21,408 | 3.00% | $1,493,904 | $85,642,979 | 1.74% | 1.731 |

| Choctaw | Hugo | 5,221 | $19,063 | 3.50% | $2,268,141 | $81,112,425 | 2.80% | 2.928 |

| Caddo | Anadarko | 5,531 | $21,494 | 3.50% | $2,490,935 | $55,573,754 | 4.48% | 2.692 |

| Hughes | Holdenville | 5,916 | $16,965 | 5.00% | $1,050,448 | $36,707,802 | 2.86% | 1.345 |

| County | Largest City | Population (2022) | Per-Capita Income | Tax rate | Marijuana Sales | Retail Sales | Marijuana Sales as % of Retail | Gap |

|---|---|---|---|---|---|---|---|---|

| Garvin | Pauls Valley | 6,026 | $26,358 | 4.50% | $2,448,565 | $107,902,766 | 2.27% | 1.981 |

| McClain | Purcell | 6,762 | $31,821 | 5.00% | $2,434,448 | $100,530,034 | 2.42% | 1.454 |

| 7,000-9,999 | ||||||||

| McCurtain | Idabel | 7,056 | $19,358 | 4.00% | $1,443,063 | $104,042,711 | 1.39% | 1.358 |

| Seminole | Seminole | 7,141 | $19,919 | 4.00% | $3,368,468 | $111,250,428 | 3.03% | 3.043 |

| Delaware | Grove | 7,215 | $38,198 | 3.40% | $5,145,690 | $205,177,989 | 2.51% | 2.399 |

| Sequoyah | Sallisaw | 8,540 | $21,330 | 4.00% | $4,868,354 | $124,418,034 | 3.91% | 3.434 |

| LeFlore | Poteau | 8,959 | $22,682 | 3.00% | $3,289,679 | $157,980,508 | 2.08% | 2.080 |

| Mayes | Pryor Creek | 9,566 | $26,092 | 4.00% | $4,524,628 | $170,802,711 | 2.65% | 2.329 |

| 10,000-16,999 | ||||||||

| Wagoner | Coweta | 10,456 | $28,435 | 4.00% | $4,942,801 | $122,214,894 | 4.04% | 2.136 |

| Logan | Guthrie | 11,191 | $27,297 | 3.75% | $3,208,857 | $144,244,976 | 2.22% | 1.350 |

| Beckham | Elk City | 11,290 | $28,994 | 4.50% | $2,580,848 | $190,773,697 | 1.35% | 1.013 |

| Okmulgee | Okmulgee | 11,402 | $23,834 | 4.00% | $4,786,190 | $132,243,902 | 3.62% | 2.263 |

| Woodward | Woodward | 11,789 | $32,191 | 4.00% | $4,195,502 | $202,141,089 | 2.08% | 1.421 |

| Custer | Weatherford | 11,859 | $28,841 | 4.50% | $2,958,917 | $176,545,770 | 1.68% | 1.112 |

| Texas | Guymon | 12,378 | $22,005 | 4.00% | $3,590,910 | $128,615,113 | 2.79% | 1.694 |

| Ottawa | Miami | 12,913 | $22,385 | 3.65% | $13,301,693 | $146,726,267 | 9.07% | 5.913 |

| Pontotoc | Ada | 16,542 | $27,159 | 4.00% | $4,414,838 | $294,793,302 | 1.50% | 1.263 |

| Grady | Chickasha | 16,549 | $31,688 | 3.75% | $6,343,585 | $211,370,185 | 3.00% | 1.554 |

| Cherokee | Tahlequah | 16,828 | $26,948 | 3.25% | $6,862,219 | $258,830,028 | 2.65% | 1.944 |

| 17,000-29,999 | ||||||||

| Pittsburg | McAlester | 18,108 | $26,239 | 4.00% | $6,960,732 | $290,185,801 | 2.40% | 1.882 |

| Jackson | Altus | 18,556 | $29,702 | 4.13% | $3,917,458 | $190,594,772 | 2.06% | 0.913 |

| Canadian | El Reno | 18,560 | $24,660 | 4.00% | $3,851,775 | $144,586,479 | 2.66% | 1.081 |

| Bryan | Durant | 19,628 | $28,129 | 4.38% | $16,865,298 | $305,040,069 | 5.53% | 3.925 |

| Rogers | Claremore | 20,174 | $29,048 | 3.00% | $4,067,338 | $323,155,069 | 1.26% | 0.892 |

| Creek | Sapulpa | 22,580 | $31,330 | 4.00% | $13,704,250 | $249,621,868 | 5.49% | 2.489 |

| Stephens | Duncan | 23,045 | $30,634 | 3.50% | $6,274,678 | $274,849,211 | 2.28% | 1.142 |

| Kay | Ponca City | 24,340 | $29,976 | 3.83% | $9,981,553 | $280,870,633 | 3.55% | 1.758 |

| Carter | Ardmore | 24,869 | $28,997 | 3.75% | $12,319,490 | $446,798,351 | 2.76% | 2.195 |

| 30,000-99,999 | ||||||||

| Pottawatomie | Shawnee | 31,720 | $26,577 | 3.63% | $10,716,034 | $454,237,211 | 2.36% | 1.633 |

| Muskogee | Muskogee | 36,738 | $25,227 | 4.00% | $12,148,584 | $412,214,057 | 2.95% | 1.684 |

| Washington | Bartlesville | 37,795 | $34,131 | 3.40% | $6,265,877 | $398,673,411 | 1.57% | 0.624 |

| Payne | Stillwater | 49,160 | $24,801 | 4.00% | $14,323,316 | $589,882,758 | 2.43% | 1.510 |

| Garfield | Enid | 50,499 | $30,253 | 4.25% | $15,778,935 | $540,863,422 | 2.92% | 1.327 |

| Comanche | Lawton | 91,542 | $27,221 | 4.13% | $26,973,606 | $823,839,291 | 3.27% | 1.391 |

| 100,000+ | ||||||||

| Cleveland | Norman | 129,627 | $35,650 | 4.13% | $30,910,590 | $1,343,978,286 | 2.30% | 0.859 |

| Tulsa | Tulsa | 411,867 | $36,490 | 3.65% | $140,406,752 | $4,956,032,622 | 2.83% | 1.200 |

| Oklahoma | Oklahoma City | 694,800 | $35,954 | 4.13% | $191,058,770 | $6,986,434,271 | 2.73% | 0.983 |

| Oklahoma State Total | 4,019,271 | $33,630 | 4.50% | $1,051,957,571 | $35,562,403,417 | 2.96% |

References

Arkansas Department of Finance and Administration. (2024).

Arkansas Medical Marijuana Dispensary Locations

Aston, Alexia. (2024).

Is weed legal in Oklahoma? What to know about medical marijuana laws, licenses

The Oklahoman.

Bodine, Seth. (2021). “As Marijuana Industry in Oklahoma Booms, Rural Utilities Feel Growing Pains.” KOSU. Available online: https://www.kosu.org/local-news/2021-09-28/asmarijuana-industry-in-oklahoma-booms-rural-utilities-feelgrowing-pains

Cannabis Public Policy. (2023). “An Empirical Assessment of Oklahoma’s Medical Marijuana Market.” Prepared for the Oklahoma Medical Marijuana Authority. Available online: https://oklahoma.gov/omma/about/publications/supply-anddemand-study.html

Mangold, Barry. (2021).

Oklahoma Medical Marijuana Authority Undergoing A ‘Hard Reset,’ New Director Says

News on 6.

Demko, Paul. (2023).

People just can’t pay their bills’: Oklahoma’s wild marijuana market is about to shrivel

Politico.

Oklahoma Medical Marijuana Authority. (2024). Current Licensing Report

Reddit Forum ARMMJ. (December 1, 2023).

Arkansas weed is too expensive. We need to have better options like Oklahoma

Romero, Simon. (2021). “How Oklahoma Became a Marijuana Boom State.” New York Times.

Available online: https://www.nytimes.com/2021/12/29/us/oklahomamarijuana-

boom.html

Rotella, Sebastian, Berg, Kirsten, Yalch, Garrett, and Adcock, Clifton. (2024). “Gangsters,

Money and Murder: How Chinese Organized Crime is Dominating America’s

Illegal Marijuana Market.” ProPublica. Available online:

https://www.propublica.orgarticle/chinese-organized-crimeus-marijuana-market

Shideler, Dave and Malone, Trey. (2017). “Measuring Community Retail Activity.” Oklahoma Cooperative Extension Service Fact Sheet AGEC-1049. Available online: https://extension.okstate.edu/fact-sheets/measuring-communityretail-activity.html

U.S. Census Bureau. (2020).

North American Industry Classification Definitions: 453998

Zimmer, Rylee, Hilburn, Sidany, Van Leuven, Andrew, and Whitacre, Brian. (2023).

Medical Marijuana Dispensary Locations Across Oklahoma

Oklahoma State University Agricultural Economics Department Report.