Reality Check program helps teens develop financial skills

Tuesday, September 6, 2022

Media Contact: Trisha Gedon | Sr. Communications Specialist | 405-744-3625 | trisha.gedon@okstate.edu

Oklahoma teens get a reality check on adulting in an interactive, hands-on financial literacy program offered by Oklahoma State University Extension.

Reality Check helps teens understand fiscal responsibility by providing real-life scenarios in which they make financial decisions on matters regarding rent/mortgage, utilities, insurance and entertainment.

Ron Cox, OSU Extension marriage and family specialist, recently hosted a group of teens on the OSU campus for the United We Can! program, which is geared toward increasing parental involvement in school, youth academic achievement and self-sufficiency and curbing negative behaviors. Part of their campus experience was participating in the Reality Check program.

“Reality Check gives the students a space in life with a set salary, and they must establish a budget based on their assigned income,” Cox said. “They have to consider expenses, such as housing, food, utilities, transportation, insurance, etc. Along with those general expenses, there’s also a category called chance, which represents those times when you get sick and go to the hospital, have an unexpected home repair or perhaps get an unexpected bonus at work. It’s all about living within your means, and sometimes, kids don’t get those lessons at home.”

Reality Check helps kids understand the value of a dollar and budgeting while developing necessary tools to understand what it’s like to be a financially responsible adult.

Brenda Miller, OSU Extension northeast district family and consumer sciences program specialist, said the goals of Reality Check are to give students a glimpse of their future in a fun way, help teens become aware of basic financial planning skills, goal setting, decision making and career planning, and clarify the need for young people to examine their attitudes about their futures and career expectations.

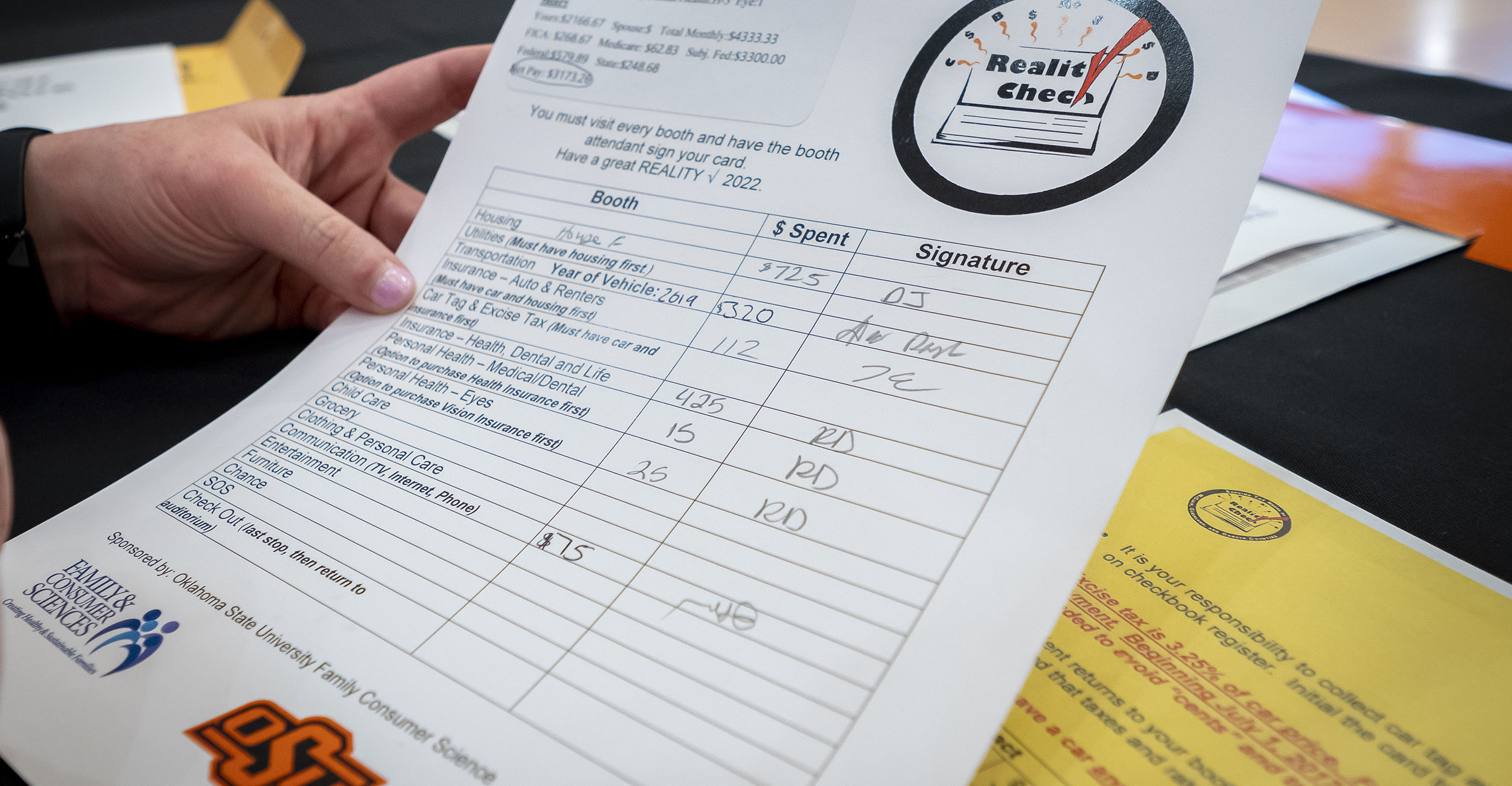

“Participants are given a worksheet indicating an occupation and a lifestyle status a 25-year-old person may experience,” Miller said. “They are assigned a job, such as a mechanic, banker or teacher, along with a salary and corresponding payroll deductions. They may be single, living with a roommate, married, have a stay-at-home spouse or X number of children. These are all possible situations they will face in a few years.”

Participants start at the bank booth to create a bank account and decide if they want to open a savings account. They visit approximately 20 other booths to complete a monthly budget. Depending on how much money they have, the students may need to adjust their housing or car expenditures in order to meet their budget.

Miller said it’s interesting to observe how the students react when they see the salaries they’ve been assigned.

“While $35,000 sounds like a lot of money to many teenagers, once they start paying their bills, they learn quickly they can’t afford that fancy sports car or eating out five times a week,” she said. “They may also discover they’re going to have to choose a less expensive housing option.”

Ruby Escalera, a student at East Central Middle School in Tulsa, said her experience with Reality Check will help her learn priorities as an adult.

“It made me realize I need to have a job with a higher income than what I was assigned,” she said. “My husband in this scenario didn’t work, so I was responsible for all the bills.”

Milton Ahamilton said he enjoyed the simulation of adult life.

“I was assigned a character who was an EMT, and we just went through all the responsibilities – car insurance, medical, housing, groceries, utilities — everyday stuff for adults,” Ahamilton said. “We had to figure out what things were going to cost according to our salary. I didn’t realize there was so much stuff to account for. This made me realize it’s extremely hard to be an adult.”

Cox said it can be hard for teens to get a firm grasp on finances, but OSU Extension programs like Reality Check can give kids a leg up on adult life.

“This program helps kids see what parents go through to take care of them,” he said. “It gives them a whole new perspective and hopefully a whole new understanding.”

For additional information about bringing Reality Check to a local school, contact the nearest OSU Extension county office. Learn more about United We Can! and the student experience of Reality Check on this segment of OSU Agriculture’s SUNUP television show.