Ag Insights October 2024

Tuesday, October 1, 2024

Winter Annual Grassy Weed Management Practices

Josh Bushong, Area Extension Agronomist

Weeds can have a substantial economic impact on growing wheat from either direct competition with the crop or price implications of dockage and foreign material at the elevator. Weeds also can impact a field for years to come. Fall herbicide applications have proven to save the most yield. Management options depend on the which weeds are present and whether or not you are growing conventional wheat or one of the two herbicide-tolerant trait systems.

Grassy weeds such as feral rye, Italian ryegrass, and rescuegrass are prime examples where fall applications might be warranted mainly due to how difficult it is to manage them, especially in conventional wheat. Cheat, other bromes, and jointed goatgrass issues will depend on how much actually came up this fall.

The two herbicide-tolerant trait systems are Clearfield, which uses the Beyond herbicide, and CoAXium, which uses the Aggressor AX herbicide. For both systems the herbicide applications need to be applied when both weeds and the wheat are actively growing to ensure adequate weed control and crop safety. Under an ideal growing season, both systems will provide better weed control when sequential fall and spring applications are made. If the wheat continues to have drought stress and the weeds are remaining small this fall, I would defer to focusing just on a spring herbicide application.

Italian ryegrass continues to gain more acreage year after year. Most of the past decade populations have been centered along the highway 81 corridor, but now I’m seeing it further west from Altus to Watonga. Heavy reliance on Axial, a Group 1 type herbicide, has resulted in intensified selection of herbicide resistance. Dr. Misha Manuchehri, previous OSU Small Grains Extension Weeds Scientist, has confirmed Group 1 resistance in Kingfisher, Caddo, Grady, Comanche, and Cotton counties.

Widespread Acetolactate Synthase (ALS), Group 2, herbicide resistance was confirmed in 2008 around the time when PowerFlex was hitting the market. Our best recommendation now relies on delayed preemergent herbicides such as Zidua, Anthem Flex, and Axiom (not to be confused with CoAXium).

True cheat is an old enemy of wheat. ALS products such as Outrider (previously named Maverick) and Olympus have been excellent products to keep cheat managed. Unfortunately, these days are numbered. ALS herbicide resistant cheat was first confirmed in Kay county in 2010. Strong suspicions of resistance are continuing to be reported throughout north central Oklahoma.

The herbicide chemical families of Sulfonyurea (SU) and Imidazolinone (Imi) both belong

to the ALS herbicide group (same site of action). As such, what we’ve observed is

that once cheat becomes resistance to SU products the Imi products, like the herbicide

Beyond, will also likely have resistance.

Meaning that if the SU herbicides are not controlling the cheat, using Beyond in a Clearfield production system will not work either.

Feral rye was plentiful in all too many wheat fields last year. The Clearfield Plus

system has shown improvement with the addition of Metholated Seed Oil (MSO) adjuvants.

It’s not perfect by any means but can still be a viable option to greatly reduce rye

if applied correctly. Sequential applications of 4oz/a of Beyond tank-mixed with MSO

and a nitrogen source applied in the fall and spring also has shown more consistent

results. Applications made prior to the rye reaching the tillering stage usually results

in better efficacy and the second application in early spring helps reduce any escapes

and late emerged rye.

Integrated weed management is using all the tools in our toolbox. We are currently

in a time when it takes every management practice to produce clean wheat. Many cultural

practices, as mentioned earlier, and continuing to rotate crops and herbicide sites

of action will always be the foundation. Using new tools and traits greatly helps

but can’t be solely relied upon for the future of your farming operation.

Contact your local OSU Extension Educator to discuss weed management options for your

operation.

Direct Impact of Eastern Redcedar Part 1

Dana Zook, NW OK Area Livestock Specialist

In many areas of the state, the Eastern Redcedar tree has been present in the landscape for a long time and it can be easy to overlook its true impact on rangelands. One day you are driving along and notice the trees seem much bigger than in the past. Don’t feel alone, it’s happened to me! This species can thrive in many different soil types and under a variety of weather conditions and it seems that no landscape is immune. Some might not feel like the cedar tree is an issue but research tells the true story. Read on to gain insight into a few areas of agriculture where the Eastern Redcedar has made its mark.

Reduced Forage Production

As Eastern Redcedar trees grow, they shade out forage plants that are used for wildlife and livestock production. Areas dominated by the Eastern Redcedar may see reductions in rangeland carrying capacity (stocking rate). This might be hard to initially identify but evidence of this could be detected by increased feed costs or earlier need for supplementation compared to the past.

Recently, Oklahoma State University Natural Resources Extension published an infographic

documenting the change in Eastern Redcedar Tree Cover from 1950 to 1985. The impact

is astonishing. In that time, the amount of land taken up by this species statewide

went from 1.5 million acres to 3.5 million acres (140% increase). In Northwest Oklahoma,

the increase went from 92,750 acres to a staggering 697,350 acres (652% increase).

If we simply say that 1 acre of native grass produces 1,000 pounds of forage that

would be a substantial loss for livestock production. There is no denying the spread

of the Eastern Redcedar has reduced forage production. You can view the post @Oklahomalands

on Facebook.

Water Use by Eastern Redcedar

Water is becoming one of our most limited resources, especially in Western Oklahoma. While both water availability and water quality are reduced in some areas, the Eastern Redcedar quietly but efficiently encroaches our grasslands. Is there a relationship here? According to the OSU Factsheet L-439 “Water Use by Eastern Redcedar”, a single Eastern Redcedar uses up to 21 gallons of water each day, all year long. Water use by this species will vary depending on soil type and research shows it can adapt to drier conditions but also increase water uptake in areas where the water table is closer to the surface.

Precipitation will also be less available in areas where the Eastern Redcedar tree

has dominated the landscape. When it rains, a portion of the precipitation will be

caught in the canopy of the tree and litter layer on the ground and is eventually

lost through Evaporation and Transpiration. In areas where rainfall is so desperately

needed, Eastern Redcedar trees reduce the amount of water that could enter the soil,

would be available for natural stream flow, and could replenish groundwater supplies.

Who knew that one type of tree could have so much impact? Stay tuned next month for more information about this invasive tree. For assistance identifying the impact of Eastern Redcedar on rangelands or evaluating supplemental need for livestock, contact your local OSU Extension office.

Winter Supplement Season is on Deck

Scott Clawson, Area Ag Economics Specialist

Like it or not, the winter feeding season for the beef cowherd will be here before we know it. In Oklahoma, from the first frost until the time we file our taxes we devote a tremendous amount of resources to our cows. Those resources can range from hay that was grown and baled earlier this year to the cash we will spend on winter supplement. It is simply an expensive time of year on the ranch. As a result, it is time to take a deeper dive into what is happening in our commodity markets by looking at the most recent World Agriculture Supply and Demand Estimates (WASDE). The newest WASDE was released on August 12th and provided a forecast on multiple crops including corn and soybeans.

The WASDE highlight on corn was the increase in the per acre yield to an incredible 183.1 bushels, which is a record high. Even with a reduction in planted acres and lower stocks to start the year, the yield was enough to overcome those obstacles and push the expected total production to 15.1 billion bushels. CME corn futures have been softer over the past several months as supply pressure is building in the market and pushing prices lower. This does not only impact corn itself, but also the byproducts tied to corn. Dried Distiller’s Grains (DDGs) are a versatile feed ingredient in the cowherd and a staple in many commodity blends. The price of corn and DDGs are highly correlated (R=0.824) which means the prices tend to move up and down together (Langemeier, 2022).

The soybean market was the recipient of a bearish WASDE report. US soybean production is estimated at 4.6 billion bushels. This is the result of a per acre yield of 53.2 bushels and 86.3 million acres planted. The projected 2024/25 ending stocks estimated at 560 million bushels has pressured both cash and futures prices downward in recent months. Along with this, soybean meal prices were pegged at $320/ton for 2024/25.

Crop markets (corn and soybeans) are on the opposite side of the market dynamics from beef cows. Both crops are dealing with large supply expectations pressuring prices downward while the beef supply is tight and supporting prices. From a cattleman’s perspective, these trends should lead to softer feed prices as booking season comes around this fall compared to this time last year. Don’t forget that the cheaper a ration is per ton, does not mean it is the cheapest to feed. Cheaper feeds may require a higher feeding rate per day to meet the cow’s nutritional requirement. Compare supplements by the cost per cow per day to make decisions. The next WASDE report is right around the corner, we will see if the bearish results continue. For more assistance with your winter supplement program, contact your local OSU Extension Educator.

Sources

U.S. Department of Agriculture (USDA). World Agricultural Supply and Demand Estimates. August 12, 2024. Internet site: https://www.usda.gov/oce/commodity/wasde/wasde0824.pdf (Accessed August 21,2024).

Langemeier, M. "Explaining Fluctuations in DDG Prices." farmdoc daily (12):82, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 3, 2022.

Discussing the Cull Cow Market

Scott Clawson, Area Ag Economics Specialist

Fall is catching up to us fast. This time of year, we rightfully spend significant time discussing the calf market, but the cull cow market can create opportunities as well.

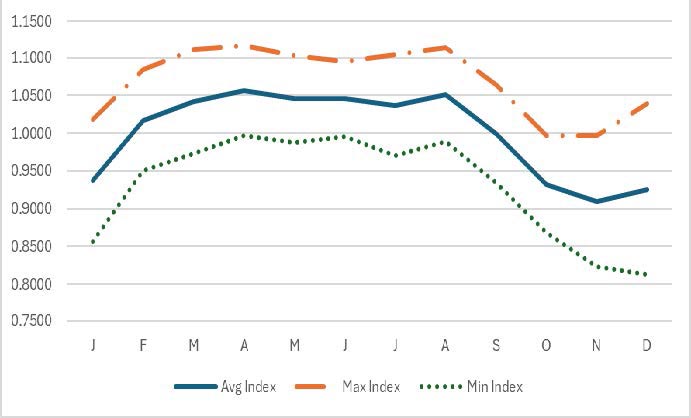

What normally happens in the cull cow market?

Cull cows exhibit seasonality just like we see in other commodity markets. The normal pattern suggests our highest annual prices will be in the spring and the lowest in the fall. Logically, this fits with most of our spring calving cow herds. The fall is a convenient time to make culling decisions. We will wean a calf, preg check, identify our “problems”, and take them to town. This leads to a saturation of the marketplace when demand is usually softer. Then the tables generally turn in the spring as cull prices push higher.

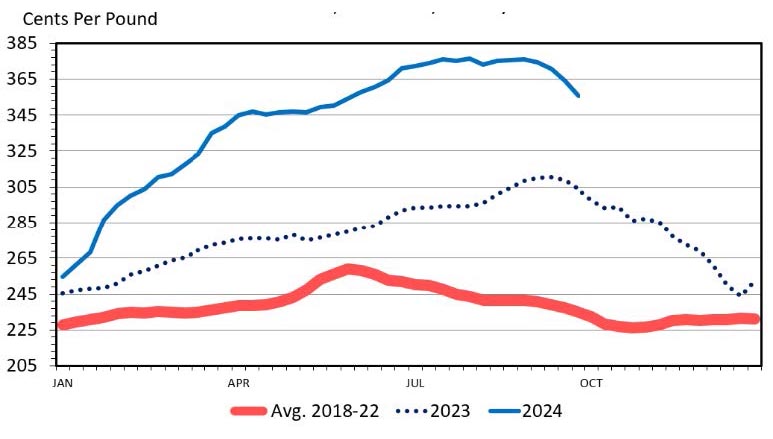

What has happened so far in 2024?

Cull cow prices, along with cull bull prices, have been sensational in 2024. The first half of 2024 saw very few days in the red, building on the 2023 prices that were stronger than normal. Lurking behind these sale barn prices has been the market’s need for 90% lean, a primary component of ground beef. Since the start of the year, the trajectory of cull cow values has followed hand in hand value of 90% lean. The strength of this market is likely due to both consumer demand and the fact that cow slaughter has been lower in 2024 by roughly 650,000 head through August.

What to expect through the fall?

September’s retreat in cull cow values along with 90% lean pulling back from record prices implies that some seasonal pressure will exist this fall. The biological factors and convenience of culling spring calving cows in the fall is still present. Seasonality calculations suggest a fall average price in the range of $107-109/cwt. with the market providing some additional quality premiums and/or discounts. Concern over forage conditions has also reemerged. The Drought Severity and Coverage Index (DSCI) has progressed from 71 at the start of the year to 171 at the time of this writing for Oklahoma. DSCI is a drought measurement index via the US Drought Monitor. This may result in additional culling or at least discourage retention. There is another side of the coin where rebuilt hay inventories and largely cheaper feed ingredients will be invested into those cull cows to be marketed in a typically stronger spring market.

If you have cows to cull, keep an eye on what the 90% lean market is doing as it is providing support for the market. Additionally, weigh the opportunity to winter those culls until the spring. For more information on adding value to cull cows or setting up a winter-feeding plan for the cow herd.

Table 1. 2000-2023 OK Cull Cow Seasonal Price Index data via USDA, LMIC, calculations by author

Table 2. Wholesale Boneless Beef Prices, Fresh, 90% Lean, Weekly. Data Source: USDA-AMS, Livestock Marketing Information Center, M-P-24 09/27/24

Table 3. 2024 Oklahoma Averaged Cull Cow Price, plus seasonal est. data via USDA, LMIC, calculations by author

Extension Experience – Insights into Oklahoma Agriculture

The Extension Experience podcast is brought to you by Josh Bushong and Dana Zook. Biweekly episodes provide perspectives on Agriculture topics and offer insight from our experience working with OSU Extension Educators and producers across Oklahoma.

The Extension Experience podcast is available on Spotify and Apple Podcast platforms.

You can also access the episodes on our blog.

You can also find and share our podcast from our Facebook page!

We hope you consider listening to the Extension Experience.