Ag Insights November 2025

Saturday, November 1, 2025

Winter Grassy Weed Management

Josh Bushong, Area Extension Agronomist

Weeds continue to have the most economic impact on wheat grown for grain, compared

to the other pests commonly found in the crop. They directly impact the crop due to

competition and will also cause implications at harvest with weight deductions, with

dockage, and with price reductions with foreign material. Weeds also can impact a

field for years to come. Fall herbicide applications have been proven to save the

most yield. Management options depend on which weeds are present and, whether or not

you are growing conventional wheat or one of the two herbicide-tolerant trait systems.

Weeds continue to have the most economic impact on wheat grown for grain, compared

to the other pests commonly found in the crop. They directly impact the crop due to

competition and will also cause implications at harvest with weight deductions, with

dockage, and with price reductions with foreign material. Weeds also can impact a

field for years to come. Fall herbicide applications have been proven to save the

most yield. Management options depend on which weeds are present and, whether or not

you are growing conventional wheat or one of the two herbicide-tolerant trait systems.

Grassy weeds such as feral rye, ryegrass, jointed goatgrass, and rescuegrass are prime examples where fall applications might be warranted mainly due to how difficult it is to manage them especially in conventional wheat or with the herbicide-tolerant wheats. Cheat, other bromes, and jointed goatgrass issues will depend on how much actually came up this fall.

The two herbicide-tolerant trait systems are Clearfield, which uses the Beyond herbicide,

and CoAXium, which uses the Aggressor AX herbicide. For both systems the herbicide

applications need to be applied when both weeds and the wheat are actively growing

to ensure adequate weed control and crop safety. Under an ideal growing season, both

systems will provide better weed control when sequential fall and spring applications

are made. If the wheat continues to have drought stress and the weeds remain small

this fall, I would defer to focusing just on a spring herbicide application.

The two herbicide-tolerant trait systems are Clearfield, which uses the Beyond herbicide,

and CoAXium, which uses the Aggressor AX herbicide. For both systems the herbicide

applications need to be applied when both weeds and the wheat are actively growing

to ensure adequate weed control and crop safety. Under an ideal growing season, both

systems will provide better weed control when sequential fall and spring applications

are made. If the wheat continues to have drought stress and the weeds remain small

this fall, I would defer to focusing just on a spring herbicide application.

Italian ryegrass continues to gain more acreage year after year. Most of the past decade populations have been centered along the highway 81 corridor, but now I’m seeing it further west from Altus to Watonga. Heavy reliance on Axial, a Group 1 type herbicide, has resulted in intensified selection of herbicide resistance. Dr. Misha Manuchehri, previous OSU Small Grains Extension Weeds Scientist, has confirmed Group 1 resistance in Kingfisher, Caddo, Grady, Comanche, and Cotton counties.

Widespread Acetolactate Synthase (ALS), Group 2, herbicide resistance was confirmed in 2008 around the time when PowerFlex was hitting the market. Our best recommendation now relies on delayed pre-emergent herbicides such as Zidua, Anthem Flex, and Axiom (not to be confused with CoAXium).

True cheat is an old enemy of wheat. ALS products such as Outrider (previously named

Maverick) and Olympus have been excellent products to keep cheat managed. Unfortunately,

these days are numbered. ALS herbicide resistant cheat was first confirmed in Kay

county in 2010. Strong suspicion of resistance is continuing to be reported throughout

north central Oklahoma.

True cheat is an old enemy of wheat. ALS products such as Outrider (previously named

Maverick) and Olympus have been excellent products to keep cheat managed. Unfortunately,

these days are numbered. ALS herbicide resistant cheat was first confirmed in Kay

county in 2010. Strong suspicion of resistance is continuing to be reported throughout

north central Oklahoma.

Dr. Liberty Galvin and her research team collected weed samples from about 80 fields throughout the wheat belt in Oklahoma in 2024. They conducted herbicide screening for quizalofop (Group 1), imazamox (Group 2), and glyphostate (Group 9) herbicides on both ryegrass and cheat. Unfortunately, her team confirmed that there are ryegrass populations resistant to all three herbicide groups. Some of the cheat populations tested had resistance to either Group 2 or 9, with none of them showing resistance to Group 1 herbicides.

The herbicide chemical families of Sulfonyurea (SU) and Imidazolinone (Imi) both belong to the ALS herbicide group 2 (same site of action). As such, what we’ve observed is that once cheat becomes resistance to SU products the Imi products, like the herbicide Beyond, will also likely have resistance. Meaning that if the SU herbicides are not controlling the cheat, using Beyond in a Clearfield production system will not work either.

Feral rye was plentiful in all too many wheat fields last year. The Clearfield Plus system has shown improvement with the addition of Methylated Seed Oil (MSO) adjuvants. It’s not perfect by any means, but can still be a viable option to greatly reduce rye if applied correctly. Sequential applications of 4oz/a of Beyond tank-mixed with MSO and a nitrogen source applied in the fall and spring also has shown more consistent results. Applications made prior to the rye reaching the tillering stage usually results in better efficacy and the second application in early spring helps reduce any escapes and late emerged rye.

Integrated weed management uses all the tools in our toolbox. We are currently at a time when it takes every management practice to produce clean wheat. Many cultural practices, as mentioned earlier, and continuing to rotate crops and herbicide sites of action will always be the foundation. Using new tools and traits greatly helps but can’t be solely relied upon for the future of your farming operation.

Contact your local OSU Extension Educator to discuss weed management options for your operation.

Fall Weaning Management

Dana Zook, NW OK Area Livestock Specialist

Processing and weaning plans are underway for spring calving herds. I don’t have to

tell you that the value of these calves are very high. Producers would benefit from

some plans to minimize stress and maintain health. Research has proven that low stress

cattle handling and proper vaccination helps calves perform as stockers and in the

feedyard. Read on for some insight on best management during weaning.

Processing and weaning plans are underway for spring calving herds. I don’t have to

tell you that the value of these calves are very high. Producers would benefit from

some plans to minimize stress and maintain health. Research has proven that low stress

cattle handling and proper vaccination helps calves perform as stockers and in the

feedyard. Read on for some insight on best management during weaning.

Vaccinations & Management

The Oklahoma Quality Beef Network (OQBN) provides a research proven guide for management and vaccination of newly weaned calves. The OQBN program requires that cattle are raised from the ranch of origin, weaned a minimum of 45 days, and are bunk trained. Bull calves must be castrated, and all calves must be dehorned. All calves should be healed from these procedures and appear in good health on sale day.

The OQBN vaccination guide for this program include two rounds of a Clostridial vaccine (Blackleg), two rounds of a 5-way Respiratory vaccine, and 1 round of a Mannheimia haemolytica vaccine (Shipping Fever). All vaccines should be given according to label instructions and be complete three weeks prior to sale.

In addition to vaccination, the weaning environment makes a big difference in the health status of calves. Initially putting calves in a familiar pen or trap with some shade will help smooth the weaning transition. With current temperatures above normal, ensure that newly weaned calves are not put into a hot, dusty dry lot. Consider the guide above but I encourage producers to work with a veterinarian to develop a weaning plan targeted to your operation. If you don’t have a vet, there is no better time than the present!

Calf Nutrition Should Not be an After-Thought

Weaning nutrition is one of the most important times to pay attention to detail. Producers should be prepared to provide calves with familiar feeds that are palatable and provide a greater concentration of nutrition to compensate for low intake. Some producers may choose to feed a small amount of range cubes on good grass. Other producers may elect to use a complete ration. Despite the choice, feeds and forages for newly weaned calves should be highly palatable. In a ration high energy/high fiber-based commodities such alfalfa, soybean hulls, and wheat midds are appropriate. Whole corn is also a good partner with these feeds and is often locally available. Start calves on a palatable ration at 1% of body weight and increase slowly over several weeks.

Retaining Calves? Consider Insurance

Recently a producer told me he just can’t bear to sell his calves at 600 pounds; he would rather put some gain on them and sell in the Spring. I totally understand this sentiment. There are a variety of situations that keep producers from selling early (taxes, wheat pasture, forage stocks). If you have the same feeling as the producer above, I encourage you to consider Livestock Risk Protection (LRP) to insure calves at a value that retains your profit. Also, death loss is a reality. In this market, the loss of one calf at a value of $2000 is a real hit to the budget. In reality, it seems like the prices of calves will stay high, but markets are a funny thing and can fluctuate with the news cycle. It would be unfortunate to be caught in a dip in the market and miss out on some immense profit.

With that, Happy Fall! May all your calf-working be peaceful, your vaccinations be well placed and luck be in your favor! If you have any questions about vaccinations, nutrition, or LRP, please contact your local county OSU Extension office – we are happy to help you!

Cotton Outlook

Alberto Amador, West Area Ag Economics Specialist

Fall has arrived, bringing with it the cotton harvest season. Interestingly, I realized

that throughout the year, in my previous columns, I’ve discussed the context of the

principal commodities but not cotton. U.S. growers play an important role in global

cotton trade, ranking as the world’s second largest exporter in 2023.

Fall has arrived, bringing with it the cotton harvest season. Interestingly, I realized

that throughout the year, in my previous columns, I’ve discussed the context of the

principal commodities but not cotton. U.S. growers play an important role in global

cotton trade, ranking as the world’s second largest exporter in 2023.

However, this year the outlook is different. According to the latest US forecast, harvested acreage is down by 0.44 million acres and yield also decreased by 25 pounds per acre. Consequently, the expected production decreased by 8%, moving from 14.41 to 13.22 million 480-pound bales. Despite this reduction, the total demand (exports and domestic consumption) has not changed much. It’s slightly higher (0.21 million 480-pound bales) thanks to larger beginning stocks.

The global forecast shows an increase of 1 million bales from last month, bringing total production to 117 million bales. The trade forecast also rises, with higher imports from Mexico, Turkey and Vietnam offsetting the decline in India and China due to higher production there. The global imports expectation is projected at 43.7 million bales. Regarding exports, the projection increased 0.1 million getting them as the same level of imports with following contributions from major exporters: Brazil 14.3 million bales, U.S. 12 million bales, Australia 5.1million bales, and India 1.3 million bales.

The growth in production is mainly driven by higher output expectation in China. In 2024/25, the two largest producers, China and India, accounted for 47% (56 million bales) of global cotton. Although China has been the largest producer in recent years, it’s the fourth largest importer only behind Bangladesh, Vietnam, and Pakistan.

Due to competitive global cotton prices, in 2023 China significantly increased its imports. Therefore, during the last marketing year China reduced imports while increased production. Although the latest forecast shows a slight growth in imports, it appears the same strategy will continue this year to avoid increasing stocks. These actions pressure global price downward by limiting demand. A similar scenario occurred in the period 2012-2014, when China’s large stockpile from 2011 weighed on the global market, pushing U.S. price down into the 80-90 cents per pound range.

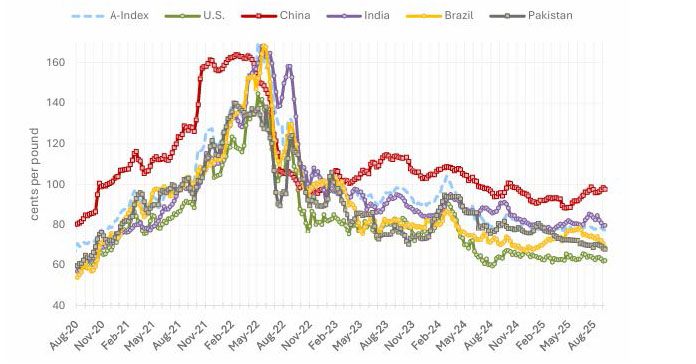

The U.S. cotton price has remained competitive over the past year. The current price is slightly higher than a year ago but still below the levels of the previous two years. In September the price was 62.7 cents per pound. According to USDA, the U.S season-average price for 2025-26 is projected at 64 cents per pound while cotton futures on the Intercontinental Exchange (ICE) are trading at 66 cents per pound.

I highly recommend staying tuned to local cash prices and China’s market behavior regarding cotton, as I mentioned before China is the largest US cotton export market followed by Pakistan, Vietnam, Turkey, Bangladesh, Mexico, India among others. As always, I encourage you to reach out to your local OSU extension office with any questions or concerns regarding cotton or any commodity.

| Date | A-Index | U.S. | China | India | Brazil | Pakistan |

|---|---|---|---|---|---|---|

| August 8 | 77.8 | 62.6 | 95.8 | 82.5 | 73.2 | 69.8 |

| September 10 | 77.9 | 62.7 | 97.4 | 79.9 | 68.6 | 68.1 |

| Change | 0.1 | 0.1 | 1.6 | -2.6 | -4.6 | -1.7 |

Weekly Cotton Prices

Beef Quality Assurance: A Commitment to Cattle, Consumers, and the Future

Barry Whitworth, DVM

Senior Extension Specialist/BQA State Coordinator, Department of Animal & Food Services,

Ferguson College of Agriculture, Oklahoma State University

According to one survey, Beef Quality Assurance (BQA) is the most successful rancher

educational program in the United States. In Oklahoma, BQA is a joint effort of the

Oklahoma Beef Council, Oklahoma State University Cooperative Extension Service, and

the OSU Department of Animal and Food Sciences. This Beef Checkoff-funded program

helps cattle producers raise healthy cattle while providing consumers with a healthy,

safe, wholesome product.

According to one survey, Beef Quality Assurance (BQA) is the most successful rancher

educational program in the United States. In Oklahoma, BQA is a joint effort of the

Oklahoma Beef Council, Oklahoma State University Cooperative Extension Service, and

the OSU Department of Animal and Food Sciences. This Beef Checkoff-funded program

helps cattle producers raise healthy cattle while providing consumers with a healthy,

safe, wholesome product.

BQA is a voluntary certification program that provides cattle producers with science-based guidelines for animal husbandry, herd health, and food safety. Launched in the 1980s, BQA helps producers adopt best management practices that reduce residues, prevent defects in carcasses, and improve the overall quality of beef. This not only benefits producers but also builds consumer confidence.

The objectives of BQA are to provide hands on training to help cattle producers meet BQA expectations as well as realize the benefits of being BQA certified. BQA emphasizes record keeping that meets or exceeds government guidelines. BQA participants are provided with technical assistance from BQA staff, veterinarians, extension specialists, and others. Lastly, BQA provides a foundation for responsible cattle management.

To improve beef quality, BQA applies principles from the Hazard Analysis Critical Control Points (HACCP) program. This system helps producers identify key control points in beef production where management practices can prevent problems before they occur. Preventing issues at the source not only protects consumers but also makes economic sense for producers.

The BQA program addresses a wide range of management practices such as cattle care, herd health, biosecurity, nutrition, record keeping, transportation, environmental stewardship, worker safety, and emergency action planning. Emphasizing these results in better outcomes for cattle as well as producers. To find other areas where improvement should be made, BQA relies on the National Beef Quality Audits (NBQA). These audits are conducted roughly every five years on feeder steers and heifers and cull cows and bulls. The audits can be viewed at the Beef Quality Assurance website.

Beef cattle producers have different options for certification. The option of certification depends on what phase of the beef cattle production cycle producers identify with. One certification program is related to cow/calf production for those who breed and sell calves. Another program deals with stocker/backgrounder operations for those that raise and sell feeder cattle, and lastly, feeder operators can be feedyard certified. Even those individuals that haul cattle can be BQA certified in transportation.

BQA training can be done online at bqa.org or in-person trainings occur across the state of Oklahoma throughout the year. For in-person training, producers should contact their local Oklahoma State University Cooperative County Extension office for more information.

BQA certifications are valid for three years from the date of the original certification. To renew a certification, a producer must obtain three hours of continuing educational (CE) courses before their BQA certification expires. CE courses are available at bqa.org or can be obtained through OSU Extension programs.

BQA certification demonstrates to consumers that beef cattle are raised with care, respect, and responsibility. By following BQA guidelines, producers can improve herd health, reduce losses, and increase consumer demand for beef. In short, BQA is both good business and the right thing to do.

For more information about BQA, cattle producers should visit the BQA website at www.bqa.org or contact their local Oklahoma State University Cooperative County Extension office.

References

Klopatek, S. C., Cantwell, A. M., Roche, L., Stackhouse-Lawson, K., & Oltjen, J. W. (2022). Beef Quality Assurance national rancher survey: program participation, best management practices, and motivations for joining future sustainability programs. Translational animal science, 6(3), txac094.

Economic Considerations for Stockers

Alberto Amador, West Area Ag Economics Specialist

In recent days, the cattle industry and beef prices have been trending topics. Record high prices have placed beef markets under public scrutiny. Recently, President Trump commented on the beef price situation, suggesting that strategic actions were being taken to control prices and benefit consumers’ pockets. Simultaneously, an increase in beef imports from Argentina was announced. Both actions have impacted perception and market. As a result, since October 16, live cattle future prices have declined. The Feeder cattle index fell by $6/cwt, while feeder futures for March and April dropped $14.92 and $15.25, respectively. Additionally, December Live Cattle Future declined $7.98/cwt over the same period.

Despite these actions, cattle prices remain high compared to last year. Because the main cause of sky-high prices is a tight supply. According to the latest national inventory report published last July, the total inventory cattle in the nation is at its lowest level since 1965. The continuous decline in calf-crop over recent years, along with the closure of the Mexican border (though with only a minor impact) have impacted the supply of calves.

In medium and long-term, I don’t see that neither an increase in Argentina’s beef imports nor a reopening of the Mexican border for live cattle imports will cause a significant impact on the beef/cattle prices. Therefore, a meaningful change in supply will only occur once herd expansion begins across the country. However, herd rebuilding depends on multiple factors such as input costs, drought, and forage availability. Moreover, because of the longer reproductive cycle of beef cows compared to other livestock species, any supply response from herd expansion will take time to materialize, I’d say within the next 2 to 4 years.

With a slow herd expansion process and robust beef demand through this period of high prices, cattle and beef prices are expected to remain elevated. For this reason, grazing or running stockers continues to be an attractive option for many producers. However, recent shifts and events in beef industry have provided a clearer view of the risks involved in this business. If you are planning to run stockers this fall or are already doing so, you’ll be interested in continuing reading, as I’ll mention important aspects to consider.

To begin with, let’s consider the value of gain (VOG) per pound. This metric represents how much each additional pound gained per animal is worth in the market. Because prices vary by weight, heavier weights usually bring a lower price per pound. In other words, it represents the potential income generated from adding weight. However, to determine the actual profit, it’s necessary to subtract the production costs. Table 1 shows the VOG under different scenarios with October 3rd prices, illustrating the potential revenue from selling heavier cattle. Most values are above $1.5 per pound, a good level compared with previous years, but some VOGs exceed $2 per pound for gains of 200 pounds or more. Analyzing this metric helps producers determine goals, adjust budgets, and design an efficient business plan.

Another important aspect which helps manage price volatility is Livestock Risk Protection (LRP). This risk management program provides a price floor in case market prices decline, as has occurred recently. LRP comes with a premium cost, which depends on the coverage level selected. When someone signs an LRP contract, they agree on a fixed expected ending price, coverage level, and coverage period. The expected ending price is based on the CME Feeder Cattle Index which is a weekly moving average of feeder cattle prices in 12 states and changes constantly. For example, the expected ending price on October 9 was $359/cwt for contract selling before May, while on October 16 has risen to $375/cwt for the same coverage period. Assuming a coverage level of 97% and a basis of +$6 in March, the price floors for each contract are $342/cwt and $358/cwt respectively (coverage price + basis – premium costs).

I consider LRP an excellent risk management tool, though its value depends on individual’s risk tolerance, whether they are willing to carry risk or prefer protection. I highly recommend including LRP in a business plan, setting the price floor at least at the level of production costs.

| End Wt. (lbs.) | Avg. Price ($/cwt) | Value per Head ($/hd.) | VOG 400 lb. Beg. Wt. ($/lb.) | VOG 450 lb. Beg. Wt. ($/lb.) | VOG 500 lb. Beg. Wt. ($/lb.) | VOG 550 lb. Beg. Wt. ($/lb.) | VOG 600 lb. Beg. Wt. ($/lb.) |

|---|---|---|---|---|---|---|---|

| 400 | 530.57 | 2,122 | |||||

| 450 | 488.44 | 2,198 | 1.51 | ||||

| 500 | 455.21 | 2,276 | 1.54 | 1.56 | |||

| 550 | 432.55 | 2,379 | 1.71 | 1.81 | 2.06 | ||

| 600 | 411.6 | 2,470 | 1.74 | 1.81 | 1.94 | 1.81 | |

| 650 | 386.26 | 2,511 | 1.55 | 1.56 | 1.56 | 1.32 | 0.82 |

| 700 | 377.6 | 2,643 | 1.74 | 1.78 | 1.84 | 1.76 | 1.74 |

| 750 | 374.47 | 2,809 | 1.96 | 2.04 | 2.13 | 2.15 | 2.26 |

| 800 | 368.42 | 2,947 | 2.06 | 2.14 | 2.24 | 2.27 | 2.39 |

| 850 | 359.41 | 3,055 | 2.07 | 2.14 | 2.23 | 2.25 | 2.34 |

| 900 | 347.57 | 3,128 | 2.01 | 2.07 | 2.13 | 2.14 | 2.20 |