Price Premiums from the Oklahoma Quality Beef Network – 2001-2003

The Oklahoma Quality Beef Network (OQBN) is a program, which began in 2001, and is sponsored by the Oklahoma Cattlemen’s Association. OQBN is a process verification and certification program for preconditioning calves. Preconditioning programs are designed to reduce stress from shipping calves at weaning, improve calves’ immune system, and boost performance in post-weaning production phases (stocker production and cattle feeding) and carcass performance (higher grading carcasses with fewer defects).

Visit http://osuextra.okstate.edu/ for information on preconditioning, and also visit the Oklahoma Cattlemen’s Association Web site at http://www.okcattlemen.org/OQBN%20Home.htm for specific information on several aspects of the OQBN program.

One frequently asked question regarding preconditioning and the OQBN in particular is whether or not buyers pay a premium for OQBN calves. This extension fact sheet reports on research at OSU to estimate price premiums for the first thee years of the OQBN program (Ratcliff).

Three-Year Summary

Table 1 provides a summary of OQBN sales since the first sale in 2001. Sales were held primarily from October to December each of the three years (2001 to 2003). Number of sales per year has changed little. However, the number of OQBN sale lots and number of head declined in 2002 and again in 2003 compared with the first year. Livestock markets sponsoring OQBN sales included the following locations: Apache, El Reno, Enid, Holdenville, Idabel, Tulsa, Woodward, and Welch.

In 2003, the third year of the program, 221 OQBN sale lots were sold in eight fall sales throughout Oklahoma. Sales totaled 4,169 head of calves sold, an average of 18.9 head per sale lot.

Table 1. Three-year summary of sale data, 2001-2003.

| 2001 | 2002 | 2003 | |

|---|---|---|---|

| Number of sales | 7 | 7 | 8 |

| Total number of lots | 1,224 | 1,121 | 855 |

| Total number of head | 13,824 | 11,215 | 11,258 |

| OQBN Certified | |||

| Number of lots | 400 | 326 | 221 |

| Total number of head | 6,999 | 5,214 | 4,169 |

| Average lot size (head) | 17.5 | 16.0 | 18.9 |

| Non-certified | |||

| Number of lots | 824 | 795 | 634 |

| Total number of head | 6,825 | 6,001 | 7,089 |

| Average lot size (head) | 8.3 | 7.5 | 11.2 |

Estimated Premiums: Traditional Method

At each of the OQBN sales, Oklahoma Cooperative Extension Service educators and specialists collected specific data on the calves sold. Data collected consisted of lot size, average weight, sex, breed or breed group, muscle score, frame size, condition or fleshiness, horn or polled status, uniformity, health, and how the calves had been managed regarding weaning and vaccinations. Data were collected on the OQBN certified calves sold and a large number of calves sold at the same sales that were not managed in accordance with the OQBN protocol.

Considerable previous research has estimated the value of various cattle attributes with market data, including research in Oklahoma (Smith et al.). Most of these studies were reviewed in a recent article (Avent, Ward, and Lalman) along with a discussion of those traits that are typically affected by a preconditioning program. Cattle characteristics affected by preconditioning programs include sale weight, sex (castration of bull calves), horns (dehorning if calves are horned), condition, and health. In some OQBN sales, calves are sorted into larger, more uniform sale lots, thus uniformity and sale lot size may also be affected.

The first method of estimating price premiums (if any) for calves following the OQBN management protocol followed the method traditionally used in many previous studies. The variation in sale prices for calves was explained by sale lot size and the series of cattle characteristics (described above), along with the manner in which calves were handled regarding weaning and vaccinations.

The focus of this research was on the price premium (if any) buyers paid for calves managed according to the OQBN preconditioning protocol. Before presenting results, some preliminary comments are necessary. First, only results for the management variables are presented in this fact sheet. Results for most cattle characteristic variables and lot size variables were generally consistent with previous research though differences were found, not unexpectedly, from one sale to another. Selected additional results will be presented later. In the tables, livestock markets and locations are not identified. This research was not intended to compare one market with another though some market effects are discussed later also. Thus, caution must be exercised in drawing conclusions about sale location from these tables. For example, sale location A in 2001 is not necessarily the same as location A in 2002 or 2003. The same applies to all other sale locations.

Results of the first method for estimating the OQBN premium at each sale are presented in Table 2. Numbers represent the premium paid for OQBN certified calves. Numbers with a negative sign mean OQBN-managed calves sold as a discount to calves sold in that respective management group. Zeros mean there was no significant difference for that respective management group vs. OQBN-managed calves. All results in Table 2 are after accounting for sale lot size and calf traits that affect prices paid by buyers for calves (weight, muscle score, frame size, etc.).

Several points can be made about the results presented in Table 2.

- In many cases, buyers did not distinguish between calves managed under the OQBN protocol and calves managed in some other manner. This is evidenced by the many zeroes found in the table.

- In nearly all cases where a significant difference was found, OQBN calves received a premium. Only a few numbers with negative signs can be seen in Table 2, meaning few OQBN-managed calves were discounted relative to other management groups.

- Premiums varied widely within and between sales from a low of $1.87/cwt. (location A in 2002) to a high of $13.73/cwt (location G in 2003). Reasons for the wide variation are not explained by the data collected for this research.

- There were more consistent premiums when OQBN calves were compared with calves not weaned and where there was no information about vaccinations (denoted in Table 2 as Vaccinations unknown, not weaned).

- For the comparison group just mentioned (Vaccinations unknown, not weaned), the average annual OQBN premium increased each year, from $1.51/cwt., to $3.95/cwt., to $5.89/cwt. over the three years. Estimated annual average OQBN premiums compared with other management groups varied from year to year.

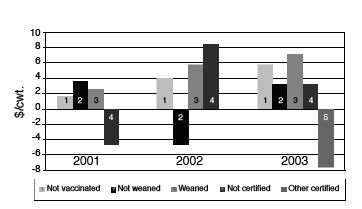

Figure 1 shows the average annual premium for OQBN-managed calves versus the other management groups. Most premiums increased in 2002 and 2003 compared with the first year but the number of observations for any one group and year was small in several cases. In each year, there was at least one sale in which another management group received a premium compared to OQBN calves. These appear to be unique to a given sale, not indicative of a trend or recurring pattern, and not easily explained by the data collected for this analysis.

Figure 1. Estimated OQBN premium by management level for 2001-2003

Table 2A. OQBN premium ($/cwt.) by management group and sale, 2001.

| 2001 Sale Location | |||||||

|---|---|---|---|---|---|---|---|

| Management Group | A | B | C | D | E | F | Average |

| Vaccinations unknown, not weaned | NA | NA | NA | 2.08 | -3.42 | 5.88 | 1.51 |

| Vaccinated, not weaned | 0 | 3.56 | NA | 0 | NA | NA | 3.56 |

| Weaned, vaccinations unknown | 0 | NA | 2.66 | 0 | NA | NA | 2.66 |

| Vaccinated, weaned, not certified | 0 | NA | 0 | -4.54 | NA | 0 | -4.54 |

| Other certified | NA | NA | 0 | NA | NA | NA | 0 |

| Weighted average | 1.04 |

Table 2B. OQBN premium ($/cwt.) by management group and sale, 2002.

| 2002 Sale Location | ||||||||

|---|---|---|---|---|---|---|---|---|

| Management Group | A | B | C | D | E | F | G | Average |

| Vaccinations unknown, not weaned | 1.87 | 0 | 0 | 0 | 3.63 | 4.44 | 10.59 | 3.95 |

| Vaccinated, not weaned | -4.48 | NA | 0 | NA | 0 | 0 | NA | -4.48 |

| Weaned, vaccinations unknown | 0 | NA | 0 | NA | 0 | 0 | 5.85 | 5.85 |

| Vaccinated, weaned, not certified | 3.15 | NA | 0 | NA | 0 | 0 | 13.75 | 8.44 |

| Other certified | NA | NA | 0 | NA | 0 | NA | NA | 0 |

| Weighted average | 4.85 |

Table 2C. OQBN premium ($/cwt.) by management group and sale, 2003.

| 2003 Sale Location | ||||||||

|---|---|---|---|---|---|---|---|---|

| Management Group | A | B | C | D | E | F | G | Average |

| Vaccinations unknown, not weaned | 4.54 | 9.57 | 7.5 | 0 | 7.46 | 2.76 | 3.49 | 5.89 |

| Vaccinated, not weaned | 3.31 | NA | NA | NA | NA | NA | NA | 3.31 |

| Weaned, vaccinations unknown | 0 | 5.81 | 8.9 | 0 | 0 | 0 | 0 | 7.35 |

| Vaccinated, weaned, not certified | 0 | NA | 10.07 | 0 | -3.34 | 0 | NA | 3.36 |

| Other certified | 0 | NA | 0 | -7.57 | NA | NA | NA | -7.57 |

| Weighted average | 4.38 |

Notes: NA means there were no observations in this management group at this sale. 0.00 means no significant difference. No sign before the number means there was a premium for OQBN certified calves of this amount. A ‘-’ means there was a discount for OQBN certified calves of this amount.

Estimated Premiums: Alternative Method

As mentioned above, preconditioning programs affect certain calf characteristics. These are briefly summarized below (Avent, Ward, and Lalman).

- Weight– Preconditioning results in marketing heavier calves compared with marketing calves at weaning. The sale price effect of weight alone will likely be lower prices for heavier calves compared with marketing lighter calves at weaning.

- Sex – OQBN and most preconditioning programs require castrating bull calves. The price effect is to market steer calves, which typically receive a higher price than bull calves.

- Horns – OQBN and most preconditioning programs require dehorning calves. Normally, polled or dehorned calves bring higher prices than do horned calves.

- Condition – Typically, preconditioning improves the condition or fleshiness of calves due to the high nutritional program during the preconditioning phase. Some preconditioned calves may appear too fleshy and may be discounted by buyers.

- Health – Preconditioned calves are expected to be healthier, less stressed, and have a stronger immune system than calves sold at weaning. Healthy calves normally receive a price premium compared with calves that appear sick or unhealthy.

- Uniformity – OQBN and many preconditioning programs do not include sorting as part of their protocol. However, in those cases where sorting occurs, sale lot uniformity may be increased. Buyers sometimes pay higher prices for uniform sale lots.

- Lot Size – OQBN and many preconditioning programs do not include commingling calves as part of their protocol. In those cases where commingling occurs, the result is typically larger sale lots. Research consistently indicates buyers prefer larger sale lots through their willingness to pay higher prices for larger lots.

Thus, each of the above factors can affect the sale price for calves. An alternative method for estimating price premiums compared sale lots that met specific criteria to those that did not. The criteria for the OQBN group was selling 10 head or more of calves managed under the OQBN protocol, meaning there were no bulls, no calves with visible horns, all calves were healthy, and calves were sold in uniform lots.

Results for the second method of estimating the OQBN premium at each sale are presented in Table 3. Numbers represent the premium paid for calves sold in the management group with the specific OQBN criteria compared to all other sale lots managed in some other manner. Zeros again mean there was no significant difference for lots with the specific OQBN criteria and lots with calves managed in some other manner. All results in Table 3 are after accounting for calf traits that affect prices paid by buyers for calves (weight, muscle score, frame size, etc.).

Again, key points can be made about results presented in Table 3.

- Calves managed under the stated OQBN criteria earned a premium in all but one sale.

- Premiums for the OQBN group varied widely, from a low of $2.32/cwt. (location C in 2002) to a high of $13.04/cwt. (location A in 2003).

- Premiums with this method are larger than with the first method. Note that the larger premiums are due in part to the price effect from selling calves in larger sale lots (10 head or more) along with meeting the OQBN certification specifications.

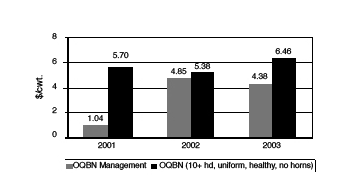

Figure 2 compares the annual average premiums for each of the two methods for each year of the OQBN program. As noted, the second method showed larger premiums. The simple average premium over the three years for method one was $3.42/cwt. compared with $5.85/cwt. for method two. Readers should note that the second method requires following the OQBN protocol and marketing calves in uniform lots of 10 head or more.

Figure 2. Estimated OQBN premium by two methods for 2001-2003

Table 3A. Premiums ($/cwt.) for specifically defined OQBN lots by sale, 2001.

| 2001 Sale Location | |||||||

|---|---|---|---|---|---|---|---|

| A | B | C | D | E | F | Average | |

| Management Group | |||||||

| OBQN certified, 10 hd or more, healthy uniform, no horns | 0.00 | 5.27 | 3.48 | 8.42 | 3.60 | 7.70 | 5.70 |

| Not certified | Base | Base | Base | Base | Base | Base | Base |

Table 3B. Premiums ($/cwt.) for specifically defined OQBN lots by sale, 2002.

| 2002 Sale Location | ||||||||

|---|---|---|---|---|---|---|---|---|

| A | B | C | D | E | F | G | Average | |

| Management Group | ||||||||

| OBQN certified, 10 hd or more, healthy uniform, no horns | 6.66 | 5.57 | 2.32 | 5.33 | 10.22 | 7.56 | 7.45 | 5.38 |

| Not certified | Base | Base | Base | Base | Base | Base | Base | Base |

Table 3C. Premiums ($/cwt.) for specifically defined OQBN lots by sale, 2003.

| 2003 Sale Location | ||||||||

|---|---|---|---|---|---|---|---|---|

| A | B | C | D | E | F | G | Average | |

| Management Group | ||||||||

| OBQN certified, 10 hd or more, healthy uniform, no horns | 13.04 | 2.99 | 9.11 | 2.85 | 5.00 | 9.46 | 2.77 | 6.46 |

| Not certified | Base | Base | Base | Base | Base | Base | Base | Base |

Notes: NA means there were no observations in this management group at this sale. 0.00 means no significant difference. No sign before the number means there was a premium for OQBN certified calves of this amount.

Livestock Market Effects

Managers of livestock markets sponsoring OQBN sales managed them somewhat differently. In most but not all sales, the sale began with the normal consignments of livestock at that specific sale location. Then the sale was stopped and it was announced the next segment of the sale would be OQBN calves. After all OQBN lots were sold, the sale resumed with the normal run of remaining livestock. Calves were commingled into uniform sale lots in some sales but as a general rule commingling was not done. Some livestock market managers more actively promoted the OQBN sale at their market than others. As a result, sale volume of OQBN calves varied widely from sale to sale.

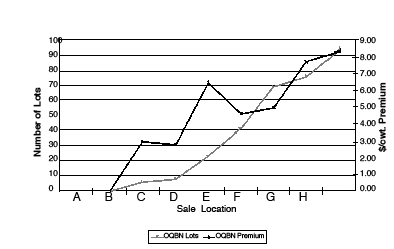

Evidence from data collected for the first three years of the OQBN program suggests livestock market managers can influence the extent of the premium paid for OQBN-managed calves via the volume of OQBN-certified calves sold at that sale. Consider Figure 3, which plots the three-year (2001-2003) volume of OQBN sale lots (read from the left axis) at eight sale locations and the average premium received at those sales based on method two (read from the right axis). OQBN sale lot volume is plotted for the eight sale locations from lowest to highest. Then the average premium estimated for each corresponding sale is plotted on the other line. There appears to be a direct relationship between volume of OQBN sale lots and the size of the premium buyers paid for OQBN-managed calves sold in sale lots of 10 head or more.

Figure 3. Relationship between number of specifically defined ) OQBN sale lots and the estimated OQBN premium for 2001-2003

Comparison with Previous Research

How do estimated premiums for calves sold through the OQBN program compare with previous research estimating preconditioning calf premiums? Estimates here are compared with another OSU study and a continuing estimate of premiums from a satellite auction.

In the OSU study, two sets of livestock market data were used to estimate the market value buyers placed on preconditioning programs (Avent). Both data sets were on feeder cattle at the Joplin Regional Stockyards. One set of data included regular and special preconditioned calf sales from December 1997 to March 2001. For this data, preconditioned calves received a premium of $2.59/cwt. when compared to non-preconditioned calves over the four-year period. The second set of data was from two preconditioned calf sales and one regular feeder cattle sale on three consecutive days in December 2000. For the second set of data, more detail was available on each sale lot, much like the OQBN data, than for the first set of data. The premium price for the preconditioning program most similar to the OQBN protocol was $3.36/cwt. compared with the regular weekly auction.

A series of price premium estimates have been conducted annually for preconditioned calves marketed through Superior Livestock Auction for the past nine years, 1995 to 2003 (King and Seeger 2004a). Two significant trends have emerged from the data. First, the percentage of sale lots that correspond closely to the OQBN protocol has increased significantly from 3% in 1995 to 22% in 2003. Second, the premium for these preconditioned lots has increased also. Premiums were estimated in a model similar to the “traditional” approach taken in the OSU study reported in this fact sheet, thus accounting for many factors that affect feeder cattle prices (lot size, weight, breed, fleshiness, frame score, etc.). The price premium estimated in 1995 was $2.47/cwt. but has steadily increased to $6.69/cwt. in the most recent year, 2003. It might be noted that no effort was made to adjust the price premium for the change in feeder calf prices over the nine-year period.

King and Seeger (2004b) also estimated the price premium for preconditioned calves sold at the Joplin Regional Stockyards from November 2003 to March 2004. Again, for the preconditioning program most nearly corresponding to the OQBN protocol, the price premium estimated was $5.33/cwt.

Average OQBN premiums estimated by the traditional method were similar to but slightly lower than those estimated in other studies compared here. One reason may have to do with reputation and experience. Preconditioning sales in other studies began earlier and have continued longer than those in Oklahoma. Also in other studies, all data came from a single sale site. As noted above, how a livestock market manager promotes and manages the sale appears to make a significant difference in the volume and premium for OQBN-certified calves. Sale lots in the Superior Livestock Auction were much larger (a minimum of truckload size) than in sales throughout Oklahoma. This may have affected the premium for preconditioned calves, even though King and Seeger accounted for differences in lot size in the Superior Livestock sales.

Research has shown that building a positive reputation takes time. Buyers must go through a twofold learning process if they have not been accustomed to purchasing preconditioned calves. First, buyers need to have confidence in the OQBN certification process. Sellers and those certifying the calves must manage the calves and attest to managing the calves in accordance with the OQBN protocol. Specifications must be followed to the letter or the integrity of the entire program suffers. Second, buyers may not understand initially and must learn the added value of having preconditioned calves in a stocker program or in the feedlot. Healthy, high performing calves are more valuable to stocker operators and feedlot managers than less healthy, lower performing calves.

Thus, building confidence and the buyer learning process takes time. The more buyers who have good experiences with OQBN-certified calves and the more trust they have in the certification process, the more competitive bidding will be among buyers. The combined result is an increased likelihood, but no guarantee, of higher premiums for OQBN calves in the future.

Summary and Conclusions

Preconditioning programs are not new but preconditioning appears to be a growth area in the beef industry. Preconditioned calves typically are healthier, have a stronger immune system, and are more valuable to feeder cattle buyers than are non-preconditioned calves. The question is how much more valuable?

Key findings from OSU research were:

- The market value of calves preconditioned according to the Oklahoma Quality Beef Network (OQBN) specifications varied widely within and between OQBN sales during the first three years of the program.

- Price premiums for OQBN certified calves varied according to the method used to estimate the premium. However, in the second method reported here, the premium is not technically for preconditioning alone.

- The price premium at any given sale is positively related to the volume of OQBN sale lots at that sale and how the livestock market is managed.

One last point needs to be stressed. Emphasis in this fact sheet has been on the price premium for preconditioned calves. The premium is important. However, as discussed in extension fact sheet F-583, “Economic Value of Preconditioning Feeder Calves,” there is much more to the economics of preconditioning than the price premium. Preconditioning programs can be profitable for cow-calf producers, but usually not from the price premium alone. Several factors contribute to enhanced returns from preconditioning (selling added weight, marketing into a seasonally upward trending market, marketing steers rather than bulls, marketing dehorned rather than horned calves, marketing in larger and more uniform sale lots, and marketing healthier calves). These added benefits must be weighed against the added costs of preconditioning (for feed, animal health supplies, and labor) and a couple of potentially offsetting market factors, that selling added weight means lower prices in absolute terms (not adjusted for the positive benefits from preconditioning) and that preconditioning may increase fleshiness which may be discounted by buyers.

Positive net returns for preconditioning are not guaranteed. However, following the OQBN protocol appears to increase the likelihood of returns from preconditioning exceeding the costs of preconditioning based on the first three years of the OQBN program.

References

Avent, R. Keith. “Market Value, Feedlot Performance, and Profitability of a Preconditioned Calf.” Unpublished Master of Science thesis, Oklahoma State University, August 2002.

Avent, R. Keith, Clement E. Ward, and David L. Lalman. “Market Valuation of Preconditioning Feeder Calves.” Journal of Agricultural and Applied Economics 36,1(April 2004):173-83.

King, Michael E. and Jon T. Seeger. “Nine-Year Trends at Superior Livestock Auction Confirm Higher Prices Go to Calves in Value-Added Health Programs.” Technical Bulletin, SV-2004-02, Pfizer Animal Health, New York, NY, June 2004a.

King, Michael E. and Jon T. Seeger. “Joplin Regional Stockyards Study: Calves in Value-Added Health Programs Receive Premium Prices.” Technical Bulletin, SV-2004-04 Pfizer Animal Health, New York, NY, June 2004b.

Ratcliff, Chandra D. “Oklahoma Quality Beef Network: Price Premiums from a Preconditioning Program.” Unpublished Master of Science thesis, Oklahoma State University, July 2004.

Smith, S. C., D. R. Gill, C. Bess III, B. Carter, B. Gardner, Z. Prawl, T. Stovall, and J. Wagner. “Effect of Selected Characteristics on the Sale Price of Feeder Cattle in Eastern Oklahoma.” Oklahoma Cooperative Extension Service. Fact Sheet E-955, Stillwater, OK, 2000.

Clement E. Ward

Extension Livestock Marketing Specialist

Chandra D. Ratcliff

Graduate Research Assistant

David L. Lalman

Extension Beef Cattle Specialist